Brown-Forman Misses Estimate - Analyst Blog

31 August 2011 - 1:29PM

Zacks

Brown-Forman Corp.(BF.B) recorded fiscal 2012

first-quarter earnings of 81 cents a share compared with 76 cents a

share in the year-ago quarter. However, earnings missed the Zacks

Consensus Estimate of 83 cents a share. The robust increase in

quarterly earnings was primarily driven by strong top-line growth

and strong volume growth.

Quarterly Details

Brown-Forman's net sales recorded a growth of 13.0% to $840.3

million from $744.9 million in the prior-year quarter. The growth

was primarily attributable to solid performance in Germany, Turkey,

the U.K., Russia, and Brazil more than offset declines in Poland,

Spain, and Australia. Total Revenue beat the Zacks Consensus

Estimate of $769 million.

During the quarter, Brown-Forman's gross profit grew 11.0% from

the prior-year quarter to $378.8 million, while gross margin

decreased 90 basis points (bps) year over year to 50.0%.

Advertising expense fell 19.0% year over year to $76.3 million.

Selling, general and administrative expenses inched up 5.0% year

over year to $139.0 million. Conversely, Brown-Forman's operating

profit surged 8% from the prior-year quarter to $185.9 million,

while operating margin contracted 100 times to 22.0% from the

prior-year period.

Balance Sheet & Cash Flow

Brown-Forman ended the quarter with cash and cash equivalents of

$552.5 million and long-term debt of $505.1 million compared with

$567.1 million and $504.5 million in the prior-year quarter,

respectively.

In the quarter, Brown-Forman generated $64 million of cash from

operations and deployed $46.4 million for dividend payout, and $6.2

million on capital expenditures. The company repurchased up to

$15.0 million of Class A and Class B shares, out of $250.0 million

share repurchase program which expires on November 30, 2011.

Dividend

During the quarter, Brown-Forman paid a regular quarterly cash

dividend of 32 cents a share on Class A and Class B common

stock.

Guidance and Zacks Consensus

Moving forward, Brown-Forman anticipates moderate improvement in

global economic conditions and customer trends in fiscal 2012.

Accordingly, the company has delivered its earnings guidance in the

range of $3.45 to $3.85 per share.

Brown-Forman, which competes with Constellation Brands

Inc. (STZ) and Diageo plc (DEO),

currently holds a Zacks #2 Rank, implying a short-term Buy rating

on the stock. Besides, the company retains a long-term 'Outperform'

recommendation on the stock

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

Zacks Investment Research

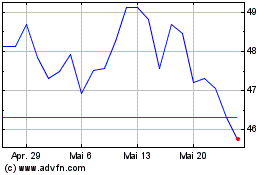

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024