BBVA Raises Bid for Turkey's Garanti

25 April 2022 - 8:21AM

Dow Jones News

By Joshua Kirby

Banco Bilbao Vizcaya Argentaria SA said Monday that it is

raising its voluntary takeover bid for the shares in Turkey's

Turkiye Garanti Bankasi SA it doesn't already own.

The Spanish bank said it is increasing the offer to 15 Turkish

lira ($1.02) a share, from TRY12.20 previously. This would take the

maximum amount payable to TRY31.6 billion, about $2.14 billion.

The last day of the acceptance period will now be May 18, it

said.

Assuming all Garanti shareholders accept the offer, BBVA expects

a hit of about 34 basis points to its common equity Tier 1 fully

loaded ratio, which measures its capital strength.

BBVA said in November it would buy out a remaining 50.15% stake

in the Turkish lender. The bid was valued at roughly $2.58 billion

at the time, more than the valuation in dollars of the new,

increased bid.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

April 25, 2022 02:06 ET (06:06 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

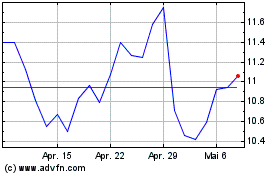

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

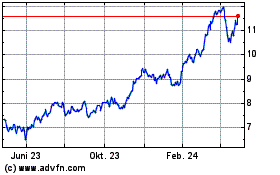

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024