AptarGroup, Inc. (NYSE:ATR), a global leader in drug and

consumer product dosing, dispensing and protection technologies,

today reported strong third quarter results due to solid

operational performance and margin improvement across the company.

Results were driven by growth in proprietary drug delivery systems,

as well as increased demand for closure technologies. Reported

sales and core sales increased by 2%, as currency and acquisition

effects did not impact the quarter. Aptar reported net income of

$100 million for the quarter, a 19% increase from the prior

year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241024363414/en/

Photo: Aptar

“Aptar delivered another strong quarter driven by our Pharma and

Closures segments. We saw increased demand for our proprietary drug

delivery systems, active material science solutions and closure

technologies, especially for food applications. The Beauty segment

saw growth in the personal care and home care markets, but it was

not enough to offset tough comparisons from tooling and fragrance

dispensing solutions from the prior year period. All three segments

continued to demonstrate solid operational performance and margin

improvement. We are proud of the strong results and progress we

have made for the first nine months of the year and are positioned

to achieve double-digit adjusted EPS growth for the full year,”

said Stephan B. Tanda, Aptar President and CEO.

Third Quarter 2024 Highlights

- Reported and core sales increased 2%

- Reported earnings per share increased 17% to $1.48 and

adjusted earnings per share increased 6% to $1.49

- Reported net income of $100 million increased 19% and

adjusted EBITDA increased 8% from the prior year to $208 million,

delivering an adjusted EBITDA margin of 23%, which is at the high

end of the long-term target range

- Pharma segment delivered reported sales growth of 8% and

core sales growth of 7% with continued demand for proprietary drug

delivery systems, which grew double digits in the quarter

- Closures segment achieved a solid quarter, with sales and

margins within its long-term target ranges

- Earlier this month, closed the previously announced joint

venture transaction in China, following regulatory approvals,

strengthening dispensing technology footprint

First Nine Months 2024 Highlights

- Double-digit earnings per share growth over the prior year

period

- Net cash provided by operations increased to $465 million

compared to $356 million in the prior year period

- Free cash flow increased to $255 million compared to $124

million in the prior year

Third Quarter Results

For the quarter ended September 30, 2024, reported sales

increased 2% to $909 million compared to $893 million in the prior

year. Core sales, which were not impacted by currency exchange

rates and acquisitions, increased 2%.

Third Quarter Segment Sales

Analysis

(Change Over Prior

Year)

Aptar

Pharma

Aptar

Beauty

Aptar

Closures

Total

AptarGroup

Reported Sales Growth

8%

(7)%

3%

2%

Currency Effects (1)

(1)%

1%

1%

0%

Acquisitions

0%

0%

0%

0%

Core Sales Growth

7%

(6)%

4%

2%

(1) - Currency effects are approximated by

translating last year's amounts at this year's foreign exchange

rates.

Aptar Pharma’s reported sales increased 8% from the prior year

quarter and core sales were up 7%. The segment’s strong performance

was driven by continued demand for proprietary drug delivery

systems, which grew double digits in the quarter after growing

double digits in the prior year period. Growth in the third quarter

was driven by allergy, emergency medicine and central nervous

system therapeutics, as well as growing royalty revenues, boosting

margins to 36%, which is at the top end of the long-term range. The

Active Material Science division also grew double digits, with

demand increasing across a number of end markets.

Aptar Beauty’s reported sales decreased 7%, and including

currency effects core sales were down 6% compared to the prior year

quarter. Approximately 4% of the decline in core sales can be

attributed to lower tooling sales, with less favorable product mix

contributing the remaining 2% of the decline. While revenue

increased from the personal care and home care markets, this

increase could not offset the challenging comparisons from prestige

fragrance sales in the prior year period. Sales in North America

improved progressively, while the Chinese beauty market remains

soft. Margins were up year over year for Beauty, with improved

operational performance and cost management remaining important

points of focus for the segment.

Aptar Closures’ reported sales increased 3% from the prior year

quarter and the segment’s core sales increased 4%. The increase in

core sales was driven mainly by demand for closures in the food end

market. Closures delivered a solid quarter and was within its

long-term target ranges for both core sales and adjusted EBITDA

margins. The segment’s margins increased by nearly 200 basis points

over the prior year quarter, due to increased plant utilization and

ongoing cost containment efforts.

Aptar reported third quarter earnings per share of $1.48, an

increase of 17%, compared to $1.26 during the same period a year

ago. Third quarter adjusted earnings per share, excluding

restructuring charges and the unrealized gains or losses on an

equity investment, were $1.49, an increase of 6%, compared to $1.40

in the prior year, including comparable exchange rates. The third

quarter had an effective tax rate of 24% compared to the prior year

period effective tax rate of 23%.

Year-To-Date Results

For the nine months ended September 30, 2024, reported sales

increased 3% to $2.73 billion compared to $2.65 billion in the

prior year. Core sales, which were not impacted by currency

exchange rates and acquisitions, also increased 3%.

Nine Months Year-To-Date

Segment Sales Analysis

(Change Over Prior

Year)

Aptar

Pharma

Aptar

Beauty

Aptar

Closures

Total

AptarGroup

Total Reported Sales Growth

9%

(3)%

1%

3%

Currency Effects (1)

0%

0%

1%

0%

Acquisitions

0%

0%

0%

0%

Core Sales Growth

9%

(3)%

2%

3%

(1) - Currency effects are approximated by

translating last year's amounts at this year's foreign exchange

rates.

For the nine months ended September 30, 2024, Aptar’s reported

earnings per share were $4.05, an increase of 22%, compared to

$3.32 reported a year ago. Current year adjusted earnings per

share, excluding restructuring charges, acquisition costs, and the

unrealized gains or losses on an equity investment, were $4.12 and

increased 15% from prior year adjusted earnings per share of $3.58,

including comparable exchange rates. The current year had an

effective tax rate of 23% comparable to the prior year period

effective tax rate of 25%.

Outlook

Regarding Aptar’s outlook, Tanda stated, “Looking to the fourth

quarter, we anticipate a solid finish to a strong year. The top

line is expected to grow in the fourth quarter, even with some

customers having indicated seasonal inventory right-sizing in the

beauty and cough & cold end markets. Our pharma business should

finish full year 2024 within its core sales long-term target range

of 7-11%, driven by demand for allergy medication, emergency

medicine and central nervous system therapies. The segment will

deliver solid, double-digit adjusted EBITDA growth in 2024 due in

part to sales of higher value products and royalties. Our Closures

segment has returned to growth and we expect a strong finish to

2024, with healthy adjusted EBITDA margin improvements over the

prior year. Beauty is battling a tough macro environment but

continues to focus on the bottom line. Innovation, cost mitigation,

improved operational leverage and accelerating efficiencies remain

key priorities for our teams.”

Aptar currently expects earnings per share for the fourth

quarter of 2024, excluding any restructuring expenses, changes in

the fair value of equity investments and acquisition costs, to be

in the range of $1.22 to $1.30. This guidance is based on an

effective tax rate range of 20% to 22% with a comparable adjusted

prior year effective tax rate of 24%. The earnings per share

guidance range is based on spot rates at the end of September for

all currencies. Based on the fourth quarter guidance, full year

adjusted EPS would be in the range of $5.34 to $5.42, a

double-digit increase over full year 2023.

Share Repurchase Authorization and Cash Dividend

As previously reported, Aptar’s Board of Directors authorized

the repurchase of $500 million of the Company’s common stock. This

new authorization replaces all previous authorizations. Aptar may

repurchase shares through the open market, privately negotiated

transactions or other programs, subject to market conditions. The

Board also approved the quarterly cash dividend of $0.45 per share.

The payment date is November 14, 2024, to stockholders of record as

of October 24, 2024. During the third quarter, Aptar repurchased 95

thousand shares for approximately $14 million.

Open Conference Call

There will be a conference call held on Friday, October 25, 2024

at 8:00 a.m. Central Time to discuss the company’s third quarter

results for 2024. The call will last approximately one hour.

Interested parties are invited to listen to a live webcast by

visiting the Investor Relations website at investors.aptar.com.

Replay of the conference call can also be accessed for a limited

time on the Investor Relations page of the website.

About Aptar

Aptar is a global leader in drug and consumer product dosing,

dispensing and protection technologies. Aptar serves a number of

attractive end markets including pharmaceutical, beauty, food,

beverage, personal care and home care. Using market expertise,

proprietary design, engineering and science to create innovative

solutions for many of the world’s leading brands, Aptar in turn

makes a meaningful difference in the lives, looks, health and homes

of millions of patients and consumers around the world. Aptar is

headquartered in Crystal Lake, Illinois and has more than 13,000

dedicated employees in 20 countries. For more information, visit

www.aptar.com.

Presentation of Non-GAAP Information

This press release refers to certain non-GAAP financial

measures, including current year adjusted earnings per share and

adjusted EBITDA, which exclude the impact of restructuring

initiatives, acquisition-related costs, certain purchase accounting

adjustments related to acquisitions and investments and net

unrealized investment gains and losses related to observable market

price changes on equity securities. Core sales and adjusted

earnings per share also neutralize the impact of foreign currency

translation effects when comparing current results to the prior

year. Adjusted EBITDA is defined as earnings before net interest,

taxes, depreciation, amortization, restructuring initiatives,

acquisition-related costs, net unrealized investment gains and

losses related to observable market price changes on equity

securities and other special items. Adjusted EBITDA margin is

adjusted EBITDA divided by reported net sales. Non-GAAP financial

measures may not be comparable to similarly titled non-GAAP

financial measures provided by other companies. Aptar’s management

believes these non-GAAP financial measures provide useful

information to our investors because they allow for a better period

over period comparison of operating results by removing the impact

of items that, in management’s view, do not reflect Aptar’s core

operating performance. These non-GAAP financial measures also

provide investors with certain information used by Aptar’s

management when making financial and operational decisions. Free

cash flow is calculated as cash provided by operating activities

less capital expenditures plus proceeds from government grants

related to capital expenditures. We use free cash flow to measure

cash flow generated by operations that is available for dividends,

share repurchases, acquisitions and debt repayment. We believe that

it is meaningful to investors in evaluating our financial

performance and measuring our ability to generate cash internally

to fund our initiatives. These non-GAAP financial measures should

not be considered in isolation or as a substitute for GAAP

financial results but should be read in conjunction with the

unaudited condensed consolidated statements of income and other

information presented herein. A reconciliation of non-GAAP

financial measures to the most directly comparable GAAP measures is

included in the accompanying tables. Our outlook is provided on a

non-GAAP basis because certain reconciling items are dependent on

future events that either cannot be controlled, such as exchange

rates and changes in the fair value of equity investments, or

reliably predicted because they are not part of the company's

routine activities, such as restructuring and acquisition

costs.

This press release contains forward-looking statements,

including certain statements set forth under the “Outlook” section

of this press release. Words such as “expects,” “anticipates,”

“believes,” “estimates,” “future,” “potential,” “continues” and

other similar expressions or future or conditional verbs such as

“will,” “should,” “would” and “could” are intended to identify such

forward-looking statements. Forward-looking statements are made

pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 and are based on our beliefs as well as assumptions

made by and information currently available to us. Accordingly, our

actual results or other events may differ materially from those

expressed or implied in such forward-looking statements due to

known or unknown risks and uncertainties that exist in our

operations and business environment including, but not limited to:

geopolitical conflicts worldwide including the invasion of Ukraine

by the Russian military and the recent events in the Middle East

and the resulting indirect impact on demand from our customers

selling their products into these countries, as well as rising

input costs and certain supply chain disruptions; the availability

of raw materials and components (particularly from sole sourced

suppliers for some of our Pharma solutions) as well as the

financial viability of these suppliers; lower demand and asset

utilization due to an economic recession either globally or in key

markets we operate within; economic conditions worldwide, including

inflationary conditions and potential deflationary conditions in

other regions we rely on for growth; the execution of our fixed

cost reduction initiatives, including our optimization initiative;

fluctuations in the cost of materials, components, transportation

cost as a result of supply chain disruptions and labor shortages,

and other input costs (particularly resin, metal, anodization costs

and energy costs); significant fluctuations in foreign currency

exchange rates or our effective tax rate; the impact of tax reform

legislation, changes in tax rates and other tax-related events or

transactions that could impact our effective tax rate; financial

conditions of customers and suppliers; consolidations within our

customer or supplier bases; changes in customer and/or consumer

spending levels; loss of one or more key accounts; our ability to

successfully implement facility expansions and new facility

projects; our ability to offset inflationary impacts with cost

containment, productivity initiatives and price increases; changes

in capital availability or cost, including rising interest rates;

volatility of global credit markets; our ability to identify

potential new acquisitions and to successfully acquire and

integrate such operations, including the successful integration of

the businesses we have acquired, including contingent consideration

valuation; our ability to build out acquired businesses and

integrate the product/service offerings of the acquired entities

into our existing product/service portfolio; direct or indirect

consequences of acts of war, terrorism or social unrest;

cybersecurity threats against our systems and/or service providers

that could impact our networks and reporting systems; the impact of

natural disasters and other weather-related occurrences; fiscal and

monetary policies and other regulations; changes, difficulties or

failures in complying with government regulation, including FDA or

similar foreign governmental authorities; changing regulations or

market conditions regarding environmental sustainability; work

stoppages due to labor disputes; competition, including

technological advances; our ability to protect and defend our

intellectual property rights, as well as litigation involving

intellectual property rights; the outcome of any legal proceeding

that has been or may be instituted against us and others; our

ability to meet future cash flow estimates to support our goodwill

impairment testing; the demand for existing and new products; the

success of our customers’ products, particularly in the

pharmaceutical industry; our ability to manage worldwide customer

launches of complex technical products, particularly in developing

markets; difficulties in product development and uncertainties

related to the timing or outcome of product development;

significant product liability claims; and other risks associated

with our operations. For additional information on these and other

risks and uncertainties, please see our filings with the Securities

and Exchange Commission, including the discussion under “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our Form 10-K and Form

10-Qs. We undertake no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

AptarGroup, Inc. Condensed

Consolidated Financial Statements (Unaudited) (In Thousands,

Except Per Share Data) Consolidated Statements of

Income

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net Sales

$

909,291

$

892,997

$

2,734,802

$

2,648,970

Cost of Sales (exclusive of depreciation

and amortization shown below)

558,511

566,691

1,708,707

1,697,824

Selling, Research & Development and

Administrative

141,604

138,137

443,714

427,488

Depreciation and Amortization

67,015

62,686

196,332

184,212

Restructuring Initiatives

3,864

6,161

9,659

19,628

Operating Income

138,297

119,322

376,390

319,818

Other Income (Expense):

Interest Expense

(12,290

)

(9,984

)

(32,526

)

(29,900

)

Interest Income

3,022

946

9,022

2,266

Net Investment Gain (Loss)

1,043

(1,240

)

1,495

1,839

Equity in Results of Affiliates

(77

)

1,002

(168

)

1,514

Miscellaneous Income (Expense), net

1,136

3

(518

)

(1,341

)

Income before Income Taxes

131,131

110,049

353,695

294,196

Provision for Income Taxes

31,209

25,751

80,382

72,265

Net Income

$

99,922

$

84,298

$

273,313

$

221,931

Net Loss (Gain) Attributable to

Noncontrolling Interests

117

(2

)

284

201

Net Income Attributable to AptarGroup,

Inc.

$

100,039

$

84,296

$

273,597

$

222,132

Net Income Attributable to AptarGroup,

Inc. per Common Share:

Basic

$

1.51

$

1.28

$

4.13

$

3.39

Diluted

$

1.48

$

1.26

$

4.05

$

3.32

Average Numbers of Shares Outstanding:

Basic

66,445

65,707

66,274

65,550

Diluted

67,716

67,035

67,574

66,865

AptarGroup, Inc. Condensed

Consolidated Financial Statements (Unaudited) (continued) ($ In

Thousands) Consolidated Balance Sheets

September 30,

024

December 31,

2023

ASSETS

Cash and Equivalents

$

325,524

$

223,643

Short-term Investments

2,387

—

Accounts and Notes Receivable, Net

698,989

677,822

Inventories

488,540

513,053

Prepaid and Other

150,164

134,761

Total Current Assets

1,665,604

1,549,279

Property, Plant and Equipment, Net

1,505,209

1,478,063

Goodwill

968,293

963,418

Other Assets

486,109

461,130

Total Assets

$

4,625,215

$

4,451,890

LIABILITIES AND STOCKHOLDERS’ EQUITY

Short-Term Obligations

$

253,112

$

458,220

Accounts Payable, Accrued and Other

Liabilities

773,540

793,089

Total Current Liabilities

1,026,652

1,251,309

Long-Term Obligations

822,731

681,188

Deferred Liabilities and Other

222,191

198,095

Total Liabilities

2,071,574

2,130,592

AptarGroup, Inc. Stockholders' Equity

2,539,009

2,306,824

Noncontrolling Interests in

Subsidiaries

14,632

14,474

Total Stockholders' Equity

2,553,641

2,321,298

Total Liabilities and Stockholders'

Equity

$

4,625,215

$

4,451,890

AptarGroup, Inc.

Reconciliation of Adjusted EBIT and Adjusted EBITDA to Net Income

(Unaudited) ($ In Thousands)

Three Months Ended

September 30, 2024

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate

& Other

Net Interest

Net Sales

$

909,291

$

420,594

$

302,859

$

185,838

$

—

$

—

Reported net income

$

99,922

Reported income taxes

31,209

Reported income before income

taxes

131,131

120,243

17,839

18,042

(15,725

)

(9,268

)

Adjustments:

Restructuring initiatives

3,864

564

1,962

877

461

Curtailment gain related to restructuring

initiatives

(1,851

)

—

—

(1,851

)

—

Net investment gain

(1,043

)

—

—

—

(1,043

)

Adjusted earnings before income taxes

132,101

120,807

19,801

17,068

(16,307

)

(9,268

)

Interest expense

12,290

12,290

Interest income

(3,022

)

(3,022

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

141,369

120,807

19,801

17,068

(16,307

)

—

Depreciation and amortization

67,015

30,787

20,420

14,912

896

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

208,384

$

151,594

$

40,221

$

31,980

$

(15,411

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

11.0

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

22.9

%

36.0

%

13.3

%

17.2

%

Three Months Ended

September 30, 2023

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate

& Other

Net Interest

Net Sales

$

892,997

$

389,188

$

323,980

$

179,829

$

—

$

—

Reported net income

$

84,298

Reported income taxes

25,751

Reported income before income

taxes

110,049

108,113

17,415

11,647

(18,088

)

(9,038

)

Adjustments:

Restructuring initiatives

6,161

92

2,880

3,098

91

Net investment loss

1,240

—

—

—

1,240

Realized gain on investments included in

net investment loss above

4,188

—

—

—

4,188

Adjusted earnings before income taxes

121,638

108,205

20,295

14,745

(12,569

)

(9,038

)

Interest expense

9,984

9,984

Interest income

(946

)

(946

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

130,676

108,205

20,295

14,745

(12,569

)

—

Depreciation and amortization

62,686

28,139

20,775

12,862

910

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

193,362

$

136,344

$

41,070

$

27,607

$

(11,659

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

9.4

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

21.7

%

35.0

%

12.7

%

15.4

%

AptarGroup, Inc.

Reconciliation of Adjusted EBIT and Adjusted EBITDA to Net Income

(Unaudited) ($ In Thousands)

Nine Months Ended

September 30, 2024

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate

& Other

Net Interest

Net Sales

$

2,734,802

$

1,242,420

$

951,666

$

540,716

$

—

$

—

Reported net income

$

273,313

Reported income taxes

80,382

Reported income before income

taxes

353,695

335,409

57,808

42,883

(58,901

)

(23,504

)

Adjustments:

Restructuring initiatives

9,659

653

5,871

2,530

605

Curtailment gain related to restructuring

initiatives

(1,851

)

—

—

(1,851

)

—

Net investment gain

(1,495

)

—

—

—

(1,495

)

Transaction costs related to

acquisitions

140

—

140

—

—

Adjusted earnings before income taxes

360,148

336,062

63,819

43,562

(59,791

)

(23,504

)

Interest expense

32,526

32,526

Interest income

(9,022

)

(9,022

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

383,652

336,062

63,819

43,562

(59,791

)

—

Depreciation and amortization

196,332

89,198

62,174

42,697

2,263

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

579,984

$

425,260

$

125,993

$

86,259

$

(57,528

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

10.0

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

21.2

%

34.2

%

13.2

%

16.0

%

Nine Months Ended

September 30, 2023

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate

& Other

Net Interest

Net Sales

$

2,648,970

$

1,135,934

$

979,956

$

533,080

$

—

$

—

Reported net income

$

221,931

Reported income taxes

72,265

Reported income before income

taxes

294,196

288,603

46,643

39,174

(52,590

)

(27,634

)

Adjustments:

Restructuring initiatives

19,628

1,657

12,650

4,060

1,261

Net investment gain

(1,839

)

—

—

—

(1,839

)

Realized gain on investments included in

net investment gain above

4,188

—

—

—

4,188

Transaction costs related to

acquisitions

255

—

199

56

—

Adjusted earnings before income taxes

316,428

290,260

59,492

43,290

(48,980

)

(27,634

)

Interest expense

29,900

29,900

Interest income

(2,266

)

(2,266

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

344,062

290,260

59,492

43,290

(48,980

)

—

Depreciation and amortization

184,212

81,248

61,883

38,097

2,984

—

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

528,274

$

371,508

$

121,375

$

81,387

$

(45,996

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

8.4

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

19.9

%

32.7

%

12.4

%

15.3

%

AptarGroup, Inc.

Reconciliation of Adjusted Earnings Per Diluted Share

(Unaudited) (In Thousands, Except Per Share Data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Income before Income Taxes

$

131,131

$

110,049

$

353,695

$

294,196

Adjustments:

Restructuring initiatives

3,864

6,161

9,659

19,628

Curtailment gain related to restructuring

initiatives

(1,851

)

—

(1,851

)

—

Net investment (gain) loss

(1,043

)

1,240

(1,495

)

(1,839

)

Realized gain on investments included in

net investment (gain) loss above

—

4,188

—

4,188

Transaction costs related to

acquisitions

—

—

140

255

Foreign currency effects (1)

1,261

1,491

Adjusted Earnings before Income Taxes

$

132,101

$

122,899

$

360,148

$

317,919

Provision for Income Taxes

$

31,209

$

25,751

$

80,382

$

72,265

Adjustments:

Restructuring initiatives

1,013

1,611

2,471

5,170

Curtailment gain related to restructuring

initiatives

(478

)

—

(478

)

—

Net investment (gain) loss

(255

)

304

(366

)

(450

)

Realized gain on investments included in

net investment (gain) loss above

—

1,026

—

1,026

Transaction costs related to

acquisitions

—

—

35

65

Foreign currency effects (1)

295

366

Adjusted Provision for Income Taxes

$

31,489

$

28,987

$

82,044

$

78,442

Net Loss (Income) Attributable to

Noncontrolling Interests

$

117

$

(2

)

$

284

$

201

Net Income Attributable to AptarGroup,

Inc.

$

100,039

$

84,296

$

273,597

$

222,132

Adjustments:

Restructuring initiatives

2,851

4,550

7,188

14,458

Curtailment gain related to restructuring

initiatives

(1,373

)

—

(1,373

)

—

Net investment (gain) loss

(788

)

936

(1,129

)

(1,389

)

Realized gain on investments included in

net investment (gain) loss above

—

3,162

—

3,162

Transaction costs related to

acquisitions

—

—

105

190

Foreign currency effects (1)

966

1,125

Adjusted Net Income Attributable to

AptarGroup, Inc.

$

100,729

$

93,910

$

278,388

$

239,678

Average Number of Diluted Shares

Outstanding

67,716

67,035

67,574

66,865

Net Income Attributable to AptarGroup,

Inc. Per Diluted Share

$

1.48

$

1.26

$

4.05

$

3.32

Adjustments:

Restructuring initiatives

0.04

0.07

0.11

0.22

Curtailment gain related to restructuring

initiatives

(0.02

)

—

(0.02

)

—

Net investment (gain) loss

(0.01

)

0.01

(0.02

)

(0.02

)

Realized gain on investments included in

net investment (gain) loss above

—

0.05

—

0.05

Transaction costs related to

acquisitions

—

—

—

—

Foreign currency effects (1)

0.01

0.01

Adjusted Net Income Attributable to

AptarGroup, Inc. Per Diluted Share

$

1.49

$

1.40

$

4.12

$

3.58

(1) Foreign currency effects are

approximations of the adjustment necessary to state the prior year

earnings and earnings per share using current period foreign

currency exchange rates.

AptarGroup, Inc.

Reconciliation of Free Cash Flow to Net Cash Provided by Operations

(Unaudited) (In Thousands)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net Cash Provided by Operations

$

229,262

$

173,401

$

465,174

$

355,602

Capital Expenditures

(66,550

)

(76,187

)

(210,416

)

(231,199

)

Free Cash Flow

$

162,712

$

97,214

$

254,758

$

124,403

AptarGroup, Inc.

Reconciliation of Adjusted Earnings Per Diluted Share

(Unaudited) (In Thousands, Except Per Share Data)

Three Months Ending

December 31,

Expected 2024

2023

Income before Income Taxes

$

80,629

Adjustments:

Restructuring initiatives

25,376

Net investment loss

426

Transaction costs related to

acquisitions

225

Foreign currency effects (1)

2,206

Adjusted Earnings before Income Taxes

$

108,862

Provision for Income Taxes

$

18,384

Adjustments:

Restructuring initiatives

6,769

Net investment loss

104

Transaction costs related to

acquisitions

56

Foreign currency effects (1)

503

Adjusted Provision for Income Taxes

$

25,816

Net Loss Attributable to Noncontrolling

Interests

$

110

Net Income Attributable to AptarGroup,

Inc.

$

62,355

Adjustments:

Restructuring initiatives

18,607

Net investment loss

322

Transaction costs related to

acquisitions

169

Foreign currency effects (1)

1,703

Adjusted Net Income Attributable to

AptarGroup, Inc.

$

83,156

Average Number of Diluted Shares

Outstanding

67,131

Net Income Attributable to AptarGroup,

Inc. Per Diluted Share (3)

$

0.93

Adjustments:

Restructuring initiatives

0.28

Net investment loss

—

Transaction costs related to

acquisitions

—

Foreign currency effects (1)

0.03

Adjusted Net Income Attributable to

AptarGroup, Inc. Per Diluted Share (2)

$1.22 - $1.30

$

1.24

(1) Foreign currency effects are

approximations of the adjustment necessary to state the prior year

earnings and earnings per share using spot rates as of September

30, 2024 for all applicable foreign currency exchange rates.

(2) AptarGroup’s expected earnings per

share range for the fourth quarter of 2024, excluding any

restructuring expenses, acquisition costs and changes in fair value

of equity investments, is based on an effective tax rate range of

20% to 22%. This tax rate range compares to our fourth quarter of

2023 effective tax rate of 23% on reported earnings per share and

24% on adjusted earnings per share.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024363414/en/

Investor Relations Contact:

Mary Skafidas mary.skafidas@aptar.com 815-479-5530

Media Contact: Katie Reardon

katie.reardon@aptar.com 815-479-5671

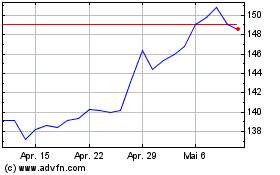

AptarGroup (NYSE:ATR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

AptarGroup (NYSE:ATR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024