0000007789FALSE00000077892023-10-192023-10-190000007789exch:XNYS2023-10-192023-10-190000007789exch:XNYSus-gaap:SeriesEPreferredStockMember2023-10-192023-10-190000007789us-gaap:SeriesFPreferredStockMemberexch:XNYS2023-10-192023-10-190000007789exch:XNYSasb:TwoThousandTwentyThreeSubordinatedDebtMember2023-10-192023-10-19

| | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549 |

| FORM | 8-K |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 |

| | | | | |

| Date of Report (Date of earliest event reported) | October 19, 2023 |

| | |

| Associated Banc-Corp |

| (Exact name of registrant as specified in its chapter) |

| | | | | | | | |

| Wisconsin | 001-31343 | 39-1098068 |

(State or other jurisdiction of incorporation)

| (Commission File Number)

| (IRS Employer Identification No.)

|

| | | | | | | | | | | |

| 433 Main Street | Green Bay | Wisconsin | 54301 |

| (Address of principal executive offices) | (Zip code) |

| | | | | | | | |

| Registrant’s telephone number, including area code | 920 | 491-7500 |

| | | | | |

| |

| (Former name or former address, if changed since last report) |

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | ASB | New York Stock Exchange |

| Depositary Shrs, each representing 1/40th intrst in a shr of 5.875% Non-Cum. Perp Pref Stock, Srs E | ASB PrE | New York Stock Exchange |

| Depositary Shrs, each representing 1/40th intrst in a shr of 5.625% Non-Cum. Perp Pref Stock, Srs F | ASB PrF | New York Stock Exchange |

| 6.625% Fixed-Rate Reset Subordinated Notes due 2033 | ASBA | New York Stock Exchange |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

☐ | Emerging growth company |

☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| | |

| Item 2.02 Results of Operations and Financial Condition. |

| |

On October 19, 2023, Associated Banc-Corp announced its earnings for the quarter ended September 30, 2023. A copy of the registrant’s press release containing this information and the slide presentation discussed on the conference call for investors and analysts on October 19, 2023, are being furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Report on Form 8-K and are incorporated herein by reference.

|

| |

| Item 9.01 Financial Statements and Exhibits. |

| |

(d) Exhibits. |

| |

The following exhibits are furnished as part of this Report on Form 8-K: |

|

|

|

| | | | | | | | |

| SIGNATURES |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

| | Associated Banc-Corp |

| | (Registrant) |

| | |

| | |

| Date: October 19, 2023 | By: /s/ Derek S. Meyer |

| | Derek S. Meyer |

| | Chief Financial Officer |

| | | | | |

| NEWS RELEASE Investor Contact: Ben McCarville, Vice President, Director of Investor Relations 920-491-7059 Media Contact: Jennifer Kaminski, Vice President, Public Relations Senior Manager 920-491-7576 |

Associated Banc-Corp Reports Third Quarter 2023 Net Income Available to Common Equity of $80 Million, or $0.53 per Common Share

Results driven by balance sheet growth and continued progress against the Company's strategic initiatives

GREEN BAY, Wis. -- October 19, 2023 -- Associated Banc-Corp (NYSE: ASB) ("Associated" or "Company") today reported net income available to common equity ("earnings") of $80 million, or $0.53 per common share, for the quarter ended September 30, 2023. These amounts compare to earnings of $84 million, or $0.56 per common share, for the quarter ended June 30, 2023 and earnings of $93 million, or $0.62 per common share, for the quarter ended September 30, 2022.

"We continued to see steady improvements in customer acquisition, retention and satisfaction scores during the quarter, enabling us to grow core customer deposits by over $500 million and decrease our reliance on non-customer funding sources," said President and CEO Andy Harmening. "Our strategic initiatives have also enabled us to deliver another quarter of balanced, high-quality loan growth. While we feel well positioned today, we recognize that the banking environment continues to evolve, and we look forward to sharing more details about the second phase of our strategic plan later this quarter.”

Third Quarter 2023 Highlights (all comparisons to the second quarter of 2023)

•Total period end commercial loans increased $68 million to $18.5 billion

•Total period end consumer loans increased $276 million to $11.7 billion

•Total period end deposits increased $109 million to $32.1 billion

•Quarterly net interest margin decreased 9 basis points to 2.71%

•Noninterest income increased $1 million to $67 million

•Noninterest expense increased $6 million to $196 million

•Provision for credit losses on loans remained flat at $22 million

•Net income available to common equity decreased $4 million to $80 million

Loans

Third quarter 2023 average total loans of $29.9 billion were up 2%, or $446 million, from the prior quarter and were up 10%, or $2.8 billion, from the same period last year. With respect to third quarter 2023 average balances by loan category:

•Commercial and business lending increased $86 million from the prior quarter and increased $793 million from the same period last year to $11.0 billion.

•Commercial real estate lending increased $17 million from the prior quarter and increased $545 million from the same period last year to $7.3 billion.

•Consumer lending increased $343 million from the prior quarter and increased $1.5 billion from the same period last year to $11.6 billion.

Third quarter 2023 period end total loans of $30.2 billion were up 1%, or $344 million, from the prior quarter and were up 9%, or $2.4 billion, from the same period last year. With respect to third quarter 2023 period end balances by loan category:

•Commercial and business lending increased $40 million from the prior quarter and increased $582 million from the same period last year to $11.2 billion.

•Commercial real estate lending increased $28 million from the prior quarter and increased $450 million from the same period last year to $7.3 billion.

•Consumer lending increased $276 million from the prior quarter and increased $1.3 billion from the same period last year to $11.7 billion.

In 2023, we now expect full-year total loan growth of 5% to 6%.

Deposits

Third quarter 2023 average deposits of $32.0 billion were up 2%, or $721 million, from the prior quarter and were up 11%, or $3.1 billion, from the same period last year. With respect to third quarter 2023 average balances by deposit category:

•Noninterest-bearing demand deposits decreased $351 million from the prior quarter and decreased $1.8 billion from the same period last year to $6.3 billion.

•Savings increased $65 million from the prior quarter and increased $79 million from the same period last year to $4.8 billion.

•Interest-bearing demand deposits increased $315 million from the prior quarter and increased $392 million from the same period last year to $7.0 billion.

•Money market deposits decreased $450 million from the prior quarter and decreased $1.0 billion from the same period last year to $6.3 billion.

•Total time deposits increased $970 million from the prior quarter and increased $4.7 billion from the same period last year to $6.0 billion.

•Network transaction deposits increased $172 million from the prior quarter and increased $766 million from the same period last year to $1.6 billion.

Third quarter 2023 period end deposits of $32.1 billion were up $109 million from the prior quarter and were up 10%, or $2.9 billion, from the same period last year. With respect to third quarter 2023 period end balances by deposit category:

•Noninterest-bearing demand deposits decreased $143 million from the prior quarter and decreased $1.8 billion from the same period last year to $6.4 billion.

•Savings increased $59 million from the prior quarter and increased $128 million from the same period last year to $4.8 billion.

•Interest-bearing demand deposits increased $490 million from the prior quarter and increased $406 million from the same period last year to $7.5 billion.

•Money market deposits decreased $253 million from the prior quarter and decreased $641 million from the same period last year to $7.3 billion.

•Total time deposits decreased $45 million from the prior quarter and increased $4.8 billion from the same period last year to $6.1 billion.

•Network transaction deposits (included in money market and interest-bearing deposits) increased $49 million from the prior quarter and increased $785 million from the same period last year to $1.6 billion.

We continue to expect total core customer deposits (which excludes network transaction deposits and brokered CDs) to decrease by 3% in 2023 on a period end basis, with 2% growth in the second half of the year.

Net Interest Income and Net Interest Margin

Third quarter 2023 net interest income of $254 million decreased $4 million, or 1%, from the prior quarter and decreased $10 million, or 4%, from the same period last year. The net interest margin decreased to 2.71%, reflecting a 9 basis point decrease from the prior quarter and a 42 basis point decrease from the same period last year.

•The average yield on total loans for the third quarter of 2023 increased 19 basis points from the prior quarter and increased 190 basis points from the same period last year to 5.96%.

•The average cost of total interest-bearing liabilities for the third quarter of 2023 increased 30 basis points from the prior quarter and increased 255 basis points from the same period last year to 3.36%.

•The net free funds benefit for the third quarter of 2023 increased three basis points from the prior quarter and increased 49 basis points compared to the same period last year to 0.71%.

We now expect total net interest income growth of 8% to 10% in 2023.

Noninterest Income

Third quarter 2023 total noninterest income of $67 million increased $1 million, or 2%, from the prior quarter and decreased $4 million, or 6%, from the same period last year. With respect to third quarter 2023 noninterest income line items:

•Mortgage banking, net was $7 million for the third quarter, down $1 million from the prior quarter and up $4 million from the same period last year.

•Service charges and deposit account fees increased slightly from the prior quarter and decreased $2 million from the same period last year.

•Capital markets, net increased slightly from the prior quarter and decreased $2 million from the same period last year.

•Asset gains (losses) increased $1 million from the prior quarter and increased $1 million from the same period last year.

We continue to expect total noninterest income to compress by 8% to 10% in 2023.

Noninterest Expense

Third quarter 2023 total noninterest expense of $196 million increased $6 million, or 3%, from the prior quarter and increased slightly from the same period last year as we continued to invest in our strategic initiatives. With respect to third quarter 2023 noninterest expense line items:

•Personnel expense increased $3 million from the prior quarter and decreased $1 million from the same period last year.

•Technology expense increased $2 million from the prior quarter and increased $3 million from the same period last year.

•Occupancy expense increased $1 million from the prior quarter and increased slightly from the same period last year.

We continue to expect total noninterest expense growth of 3% to 4% in 2023, excluding any nonrecurring items incurred in the fourth quarter.

Taxes

The third quarter 2023 tax expense was $19 million compared to $24 million of tax expense in the prior quarter and $26 million of tax expense in the same period last year. The effective tax rate for the third quarter of 2023 was 18.9% compared to an effective tax rate of 21.3% in the prior quarter and an effective tax rate of 21.4% in the same period last year.

We continue to expect the 2023 effective tax rate to be between 20% and 21%, assuming no change in the statutory corporate tax rate.

Credit

The third quarter 2023 provision for credit losses on loans was $22 million, compared to a provision of $22 million in the prior quarter and a provision of $17 million in the same period last year. With respect to third quarter 2023 credit quality:

•Nonaccrual loans of $169 million were up $37 million from the prior quarter and up $52 million from the same period last year. The nonaccrual loans to total loans ratio was 0.56% in the third quarter, up from 0.44% in the prior quarter and up from 0.42% in the same period last year.

•Third quarter 2023 net charge offs of $18 million were up compared to net charge offs of $11 million in the prior quarter and were up compared to net charge offs of $2 million in the same period last year.

•The allowance for credit losses on loans (ACLL) of $381 million was up $4 million compared to the prior quarter and up $48 million compared to the same period last year. The ACLL to total loans ratio was 1.26% in the third quarter, flat with the prior quarter and up from 1.20% in the same period last year.

In 2023, we expect to adjust provision to reflect changes to risk grades, economic conditions, loan volumes, and other indications of credit quality.

Capital

The Company’s capital position remains strong, with a CET1 capital ratio of 9.55% at September 30, 2023. The Company’s capital ratios continue to be in excess of the Basel III “well-capitalized” regulatory benchmarks on a fully phased in basis.

THIRD QUARTER 2023 EARNINGS RELEASE CONFERENCE CALL

The Company will host a conference call for investors and analysts at 4:00 p.m. Central Time (CT) today, October 19, 2023. Interested parties can access the live webcast of the call through the Investor Relations section of the Company's website, http://investor.associatedbank.com. Parties may also dial into the call at 877-407-8037 (domestic) or 201-689-8037 (international) and request the Associated Banc-Corp third quarter 2023 earnings call. The third quarter 2023 financial tables with an accompanying slide presentation will be available on the Company's website just prior to the call. An audio archive of the webcast will be available on the Company's website approximately fifteen minutes after the call is over.

ABOUT ASSOCIATED BANC-CORP

Associated Banc-Corp (NYSE: ASB) has total assets of $42 billion and is the largest bank holding company based in Wisconsin. Headquartered in Green Bay, Wisconsin, Associated is a leading Midwest banking franchise, offering a full range of financial products and services from more than 200 banking locations serving more than 100 communities throughout Wisconsin, Illinois and Minnesota. The Company also operates loan production offices in Indiana, Michigan, Missouri, New York, Ohio and Texas. Associated Bank, N.A. is an Equal Housing Lender, Equal Opportunity Lender and Member FDIC. More information about Associated Banc-Corp is available at www.associatedbank.com.

FORWARD-LOOKING STATEMENTS

Statements made in this document which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target," “outlook,” "project," "guidance," or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference.

NON-GAAP FINANCIAL MEASURES

This press release and related materials may contain references to measures which are not defined in generally accepted accounting principles (“GAAP”). Information concerning these non-GAAP financial measures can be found in the financial tables. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide a greater understanding of ongoing operations and enhance comparability of results with prior periods.

# # #

| | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Consolidated Balance Sheets (Unaudited) | | | | | | | |

| ($ in thousands) | September 30, 2023 | June 30, 2023 | Seql Qtr $ Change | March 31, 2023 | December 31, 2022 | September 30, 2022 | Comp Qtr $ Change |

| Assets | | | | | | | |

| Cash and due from banks | $ | 388,694 | | $ | 407,620 | | $ | (18,926) | | $ | 311,269 | | $ | 436,952 | | $ | 386,231 | | $ | 2,463 | |

| Interest-bearing deposits in other financial institutions | 323,130 | | 190,881 | | 132,249 | | 511,116 | | 156,693 | | 112,173 | | 210,957 | |

| Federal funds sold and securities purchased under agreements to resell | 965 | | 31,160 | | (30,195) | | 455 | | 27,810 | | 4,015 | | (3,050) | |

| Investment securities available for sale, at fair value | 3,491,679 | | 3,504,777 | | (13,098) | | 3,381,607 | | 2,742,025 | | 2,487,312 | | 1,004,367 | |

| Investment securities held to maturity, net, at amortized cost | 3,900,415 | | 3,938,877 | | (38,462) | | 3,967,058 | | 3,960,398 | | 3,951,491 | | (51,076) | |

| Equity securities | 35,937 | | 30,883 | | 5,054 | | 30,514 | | 25,216 | | 24,879 | | 11,058 | |

| Federal Home Loan Bank and Federal Reserve Bank stocks, at cost | 268,698 | | 271,637 | | (2,939) | | 331,420 | | 295,496 | | 279,334 | | (10,636) | |

| Residential loans held for sale | 54,790 | | 38,083 | | 16,707 | | 35,742 | | 20,383 | | 51,134 | | 3,656 | |

| Commercial loans held for sale | — | | 15,000 | | (15,000) | | 33,490 | | — | | — | | — | |

| Loans | 30,193,187 | | 29,848,904 | | 344,283 | | 29,207,072 | | 28,799,569 | | 27,817,280 | | 2,375,907 | |

| Allowance for loan losses | (345,795) | | (338,750) | | (7,045) | | (326,432) | | (312,720) | | (292,904) | | (52,891) | |

| Loans, net | 29,847,392 | | 29,510,153 | | 337,239 | | 28,880,640 | | 28,486,849 | | 27,524,376 | | 2,323,016 | |

| Tax credit and other investments | 256,905 | | 263,583 | | (6,678) | | 269,269 | | 276,773 | | 275,247 | | (18,342) | |

| Premises and equipment, net | 373,017 | | 374,866 | | (1,849) | | 375,540 | | 376,906 | | 379,462 | | (6,445) | |

| Bank and corporate owned life insurance | 679,775 | | 678,578 | | 1,197 | | 677,328 | | 676,530 | | 677,129 | | 2,646 | |

| Goodwill | 1,104,992 | | 1,104,992 | | — | | 1,104,992 | | 1,104,992 | | 1,104,992 | | — | |

| Other intangible assets, net | 42,674 | | 44,877 | | (2,203) | | 47,079 | | 49,282 | | 51,485 | | (8,811) | |

| Mortgage servicing rights, net | 89,131 | | 80,449 | | 8,682 | | 74,479 | | 77,351 | | 78,352 | | 10,779 | |

| | | | | | | |

| Interest receivable | 171,119 | | 159,185 | | 11,934 | | 152,404 | | 144,449 | | 115,782 | | 55,337 | |

| Other assets | 608,068 | | 573,870 | | 34,198 | | 518,115 | | 547,621 | | 546,214 | | 61,854 | |

| Total assets | $ | 41,637,381 | | $ | 41,219,473 | | $ | 417,908 | | $ | 40,702,519 | | $ | 39,405,727 | | $ | 38,049,607 | | $ | 3,587,774 | |

| Liabilities and stockholders’ equity | | | | | | | |

| Noninterest-bearing demand deposits | $ | 6,422,994 | | $ | 6,565,666 | | $ | (142,672) | | $ | 7,328,689 | | $ | 7,760,811 | | $ | 8,224,579 | | $ | (1,801,585) | |

| Interest-bearing deposits | 25,700,332 | | 25,448,743 | | 251,589 | | 23,003,134 | | 21,875,343 | | 20,974,003 | | 4,726,329 | |

| Total deposits | 32,123,326 | | 32,014,409 | | 108,917 | | 30,331,824 | | 29,636,154 | | 29,198,581 | | 2,924,745 | |

| Federal funds purchased and securities sold under agreements to repurchase | 451,644 | | 325,927 | | 125,717 | | 208,398 | | 585,139 | | 276,674 | | 174,970 | |

| Commercial paper | — | | 15,327 | | (15,327) | | 18,210 | | 20,798 | | 7,687 | | (7,687) | |

| | | | | | | |

| FHLB advances | 3,733,041 | | 3,630,747 | | 102,294 | | 4,986,138 | | 4,319,861 | | 3,777,478 | | (44,437) | |

| Other long-term funding | 529,459 | | 534,273 | | (4,814) | | 544,103 | | 248,071 | | 249,484 | | 279,975 | |

| Allowance for unfunded commitments | 34,776 | | 38,276 | | (3,500) | | 39,776 | | 38,776 | | 39,776 | | (5,000) | |

| Accrued expenses and other liabilities | 637,491 | | 537,640 | | 99,851 | | 448,407 | | 541,438 | | 545,976 | | 91,515 | |

| Total liabilities | 37,509,738 | | 37,096,599 | | 413,139 | | 36,576,856 | | 35,390,237 | | 34,095,656 | | 3,414,082 | |

| Stockholders’ equity | | | | | | | |

| Preferred equity | 194,112 | | 194,112 | | — | | 194,112 | | 194,112 | | 194,112 | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Common equity | 3,933,531 | | 3,928,762 | | 4,769 | | 3,931,551 | | 3,821,378 | | 3,759,840 | | 173,691 | |

| Total stockholders’ equity | 4,127,643 | | 4,122,874 | | 4,769 | | 4,125,663 | | 4,015,490 | | 3,953,952 | | 173,691 | |

| Total liabilities and stockholders’ equity | $ | 41,637,381 | | $ | 41,219,473 | | $ | 417,908 | | $ | 40,702,519 | | $ | 39,405,727 | | $ | 38,049,607 | | $ | 3,587,774 | |

Numbers may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Consolidated Statements of Income (Unaudited) | Comp Qtr | YTD | YTD | Comp YTD |

| ($ in thousands, except per share data) | 3Q23 | 3Q22 | $ Change | % Change | Sep 2023 | Sep 2022 | $ Change | % Change |

| Interest income | | | | | | | | |

| Interest and fees on loans | $ | 447,912 | | $ | 275,666 | | $ | 172,246 | | 62 | % | $ | 1,262,538 | | $ | 643,239 | | $ | 619,299 | | 96 | % |

| Interest and dividends on investment securities | | | | | | | | |

| Taxable | 38,210 | | 19,221 | | 18,989 | | 99 | % | 104,197 | | 54,009 | | 50,188 | | 93 | % |

| Tax-exempt | 15,941 | | 16,538 | | (597) | | (4) | % | 47,960 | | 49,025 | | (1,065) | | (2) | % |

| Other interest | 6,575 | | 3,284 | | 3,291 | | 100 | % | 17,990 | | 7,696 | | 10,294 | | 134 | % |

| Total interest income | 508,637 | | 314,708 | | 193,929 | | 62 | % | 1,432,685 | | 753,969 | | 678,716 | | 90 | % |

| Interest expense | | | | | | | | |

| Interest on deposits | 193,131 | | 26,000 | | 167,131 | | N/M | 464,749 | | 37,590 | | 427,159 | | N/M |

| Interest on federal funds purchased and securities sold under agreements to repurchase | 3,100 | | 756 | | 2,344 | | N/M | 8,504 | | 1,200 | | 7,304 | | N/M |

| Interest on other short-term funding | — | | 1 | | (1) | | (100) | % | 1 | | 2 | | (1) | | (50) | % |

| Interest on FHLB Advances | 48,143 | | 20,792 | | 27,351 | | 132 | % | 147,365 | | 38,663 | | 108,702 | | N/M |

| Interest on long-term funding | 10,019 | | 2,722 | | 7,297 | | N/M | 25,895 | | 8,182 | | 17,713 | | N/M |

| Total interest expense | 254,394 | | 50,270 | | 204,124 | | N/M | 646,514 | | 85,637 | | 560,877 | | N/M |

| Net interest income | 254,244 | | 264,439 | | (10,195) | | (4) | % | 786,171 | | 668,332 | | 117,839 | | 18 | % |

| Provision for credit losses | 21,943 | | 16,998 | | 4,945 | | 29 | % | 62,014 | | 13,006 | | 49,008 | | N/M |

| Net interest income after provision for credit losses | 232,301 | | 247,440 | | (15,139) | | (6) | % | 724,157 | | 655,326 | | 68,831 | | 11 | % |

| Noninterest income | | | | | | | | |

| Wealth management fees | 20,828 | | 19,984 | | 844 | | 4 | % | 61,499 | | 63,719 | | (2,220) | | (3) | % |

| Service charges and deposit account fees | 12,864 | | 15,029 | | (2,165) | | (14) | % | 38,230 | | 48,392 | | (10,162) | | (21) | % |

| Card-based fees | 11,510 | | 11,479 | | 31 | | — | % | 33,492 | | 32,847 | | 645 | | 2 | % |

| Other fee-based revenue | 4,509 | | 4,487 | | 22 | | — | % | 13,249 | | 12,613 | | 636 | | 5 | % |

Capital markets, net | 5,368 | | 7,675 | | (2,307) | | (30) | % | 15,544 | | 24,331 | | (8,787) | | (36) | % |

| Mortgage banking, net | 6,501 | | 2,098 | | 4,403 | | N/M | 17,814 | | 16,635 | | 1,179 | | 7 | % |

| Bank and corporate owned life insurance | 2,047 | | 1,827 | | 220 | | 12 | % | 6,882 | | 8,004 | | (1,122) | | (14) | % |

| Asset gains (losses), net | 625 | | 18 | | 607 | | N/M | 590 | | 1,883 | | (1,293) | | (69) | % |

| Investment securities gains (losses), net | (11) | | 5,664 | | (5,675) | | N/M | 55 | | 5,676 | | (5,621) | | (99) | % |

| | | | | | | | |

Other | 2,339 | | 2,527 | | (188) | | (7) | % | 6,841 | | 6,613 | | 228 | | 3 | % |

| Total noninterest income | 66,579 | | 70,788 | | (4,209) | | (6) | % | 194,195 | | 220,713 | | (26,518) | | (12) | % |

| Noninterest expense | | | | | | | | |

| Personnel | 117,159 | | 118,243 | | (1,084) | | (1) | % | 347,669 | | 335,720 | | 11,949 | | 4 | % |

| Technology | 26,172 | | 22,694 | | 3,478 | | 15 | % | 73,990 | | 65,401 | | 8,589 | | 13 | % |

| Occupancy | 14,125 | | 13,717 | | 408 | | 3 | % | 42,775 | | 43,948 | | (1,173) | | (3) | % |

| Business development and advertising | 7,100 | | 6,778 | | 322 | | 5 | % | 20,054 | | 17,388 | | 2,666 | | 15 | % |

| Equipment | 5,016 | | 4,921 | | 95 | | 2 | % | 14,921 | | 14,841 | | 80 | | 1 | % |

| Legal and professional | 4,461 | | 4,159 | | 302 | | 7 | % | 13,149 | | 14,118 | | (969) | | (7) | % |

| Loan and foreclosure costs | 2,049 | | 1,631 | | 418 | | 26 | % | 4,822 | | 5,121 | | (299) | | (6) | % |

| FDIC assessment | 9,150 | | 5,800 | | 3,350 | | 58 | % | 25,575 | | 16,300 | | 9,275 | | 57 | % |

| Other intangible amortization | 2,203 | | 2,203 | | — | | — | % | 6,608 | | 6,608 | | — | | — | % |

| | | | | | | | |

| Other | 8,771 | | 15,645 | | (6,874) | | (44) | % | 24,726 | | 31,057 | | (6,331) | | (20) | % |

| Total noninterest expense | 196,205 | | 195,791 | | 414 | | — | % | 574,291 | | 550,503 | | 23,788 | | 4 | % |

| Income before income taxes | 102,674 | | 122,438 | | (19,764) | | (16) | % | 344,061 | | 325,536 | | 18,525 | | 6 | % |

| Income tax expense | 19,426 | | 26,163 | | (6,737) | | (26) | % | 70,299 | | 68,176 | | 2,123 | | 3 | % |

| Net income | 83,248 | | 96,275 | | (13,027) | | (14) | % | 273,762 | | 257,360 | | 16,402 | | 6 | % |

| Preferred stock dividends | 2,875 | | 2,875 | | — | | — | % | 8,625 | | 8,625 | | — | | — | % |

| Net income available to common equity | $ | 80,373 | | $ | 93,400 | | $ | (13,027) | | (14) | % | $ | 265,137 | | $ | 248,735 | | $ | 16,402 | | 7 | % |

| Earnings per common share | | | | | | | | |

| Basic | $ | 0.53 | | $ | 0.62 | | $ | (0.09) | | (15) | % | $ | 1.76 | | $ | 1.66 | | $ | 0.10 | | 6 | % |

| Diluted | $ | 0.53 | | $ | 0.62 | | $ | (0.09) | | (15) | % | $ | 1.75 | | $ | 1.65 | | $ | 0.10 | | 6 | % |

| Average common shares outstanding | | | | | | | | |

| Basic | 150,035 | | 149,321 | | 714 | | — | % | 149,929 | | 149,063 | | 866 | | 1 | % |

| Diluted | 151,014 | | 150,262 | | 752 | | 1 | % | 150,971 | | 150,205 | | 766 | | 1 | % |

| | | | | | | | |

N/M = Not meaningful

Numbers may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Consolidated Statements of Income (Unaudited) - Quarterly Trend |

| ($ in thousands, except per share data) | | | Seql Qtr | | | | Comp Qtr |

| 3Q23 | 2Q23 | $ Change | % Change | 1Q23 | 4Q22 | 3Q22 | $ Change | % Change |

| Interest income | | | | | | | | | |

| Interest and fees on loans | $ | 447,912 | | $ | 423,307 | | $ | 24,605 | | 6 | % | $ | 391,320 | | $ | 349,403 | | $ | 275,666 | | $ | 172,246 | | 62 | % |

| Interest and dividends on investment securities | | | | | | | | | |

| Taxable | 38,210 | | 35,845 | | 2,365 | | 7 | % | 30,142 | | 21,435 | | 19,221 | | 18,989 | | 99 | % |

| Tax-exempt | 15,941 | | 15,994 | | (53) | | — | % | 16,025 | | 16,666 | | 16,538 | | (597) | | (4) | % |

| Other interest | 6,575 | | 6,086 | | 489 | | 8 | % | 5,329 | | 3,779 | | 3,284 | | 3,291 | | 100 | % |

| Total interest income | 508,637 | | 481,231 | | 27,406 | | 6 | % | 442,817 | | 391,283 | | 314,708 | | 193,929 | | 62 | % |

| Interest expense | | | | | | | | | |

| Interest on deposits | 193,131 | | 162,196 | | 30,935 | | 19 | % | 109,422 | | 60,719 | | 26,000 | | 167,131 | | N/M |

| Interest on federal funds purchased and securities sold under agreements to repurchase | 3,100 | | 2,261 | | 839 | | 37 | % | 3,143 | | 2,280 | | 756 | | 2,344 | | N/M |

| Interest on other short-term funding | — | | — | | — | | N/M | — | | — | | 1 | | (1) | | (100) | % |

| Interest on FHLB advances | 48,143 | | 49,261 | | (1,118) | | (2) | % | 49,960 | | 36,824 | | 20,792 | | 27,351 | | 132 | % |

| Interest on long-term funding | 10,019 | | 9,596 | | 423 | | 4 | % | 6,281 | | 2,470 | | 2,722 | | 7,297 | | N/M |

| Total interest expense | 254,394 | | 223,314 | | 31,080 | | 14 | % | 168,807 | | 102,294 | | 50,270 | | 204,124 | | N/M |

| Net interest income | 254,244 | | 257,917 | | (3,673) | | (1) | % | 274,010 | | 288,989 | | 264,439 | | (10,195) | | (4) | % |

| Provision for credit losses | 21,943 | | 22,100 | | (157) | | (1) | % | 17,971 | | 19,992 | | 16,998 | | 4,945 | | 29 | % |

| Net interest income after provision for credit losses | 232,301 | | 235,817 | | (3,516) | | (1) | % | 256,039 | | 268,997 | | 247,440 | | (15,139) | | (6) | % |

| Noninterest income | | | | | | | | | |

| Wealth management fees | 20,828 | | 20,483 | | 345 | | 2 | % | 20,189 | | 20,403 | | 19,984 | | 844 | | 4 | % |

| Service charges and deposit account fees | 12,864 | | 12,372 | | 492 | | 4 | % | 12,994 | | 13,918 | | 15,029 | | (2,165) | | (14) | % |

| Card-based fees | 11,510 | | 11,396 | | 114 | | 1 | % | 10,586 | | 11,167 | | 11,479 | | 31 | | — | % |

| Other fee-based revenue | 4,509 | | 4,465 | | 44 | | 1 | % | 4,276 | | 3,290 | | 4,487 | | 22 | | — | % |

| Capital markets, net | 5,368 | | 5,093 | | 275 | | 5 | % | 5,083 | | 5,586 | | 7,675 | | (2,307) | | (30) | % |

| Mortgage banking, net | 6,501 | | 7,768 | | (1,267) | | (16) | % | 3,545 | | 2,238 | | 2,098 | | 4,403 | | N/M |

| Bank and corporate owned life insurance | 2,047 | | 2,172 | | (125) | | (6) | % | 2,664 | | 3,427 | | 1,827 | | 220 | | 12 | % |

| | | | | | | | | |

| Asset gains (losses), net | 625 | | (299) | | 924 | | N/M | 263 | | (545) | | 18 | | 607 | | N/M |

| Investment securities gains (losses), net | (11) | | 14 | | (25) | | N/M | 51 | | (1,930) | | 5,664 | | (5,675) | | N/M |

| | | | | | | | | |

| Other | 2,339 | | 2,080 | | 259 | | 12 | % | 2,422 | | 4,102 | | 2,527 | | (188) | | (7) | % |

| Total noninterest income | 66,579 | | 65,543 | | 1,036 | | 2 | % | 62,073 | | 61,657 | | 70,788 | | (4,209) | | (6) | % |

| Noninterest expense | | | | | | | | | |

| Personnel | 117,159 | | 114,089 | | 3,070 | | 3 | % | 116,420 | | 118,381 | | 118,243 | | (1,084) | | (1) | % |

| Technology | 26,172 | | 24,220 | | 1,952 | | 8 | % | 23,598 | | 25,299 | | 22,694 | | 3,478 | | 15 | % |

| Occupancy | 14,125 | | 13,587 | | 538 | | 4 | % | 15,063 | | 15,846 | | 13,717 | | 408 | | 3 | % |

| Business development and advertising | 7,100 | | 7,106 | | (6) | | — | % | 5,849 | | 8,136 | | 6,778 | | 322 | | 5 | % |

| Equipment | 5,016 | | 4,975 | | 41 | | 1 | % | 4,930 | | 4,791 | | 4,921 | | 95 | | 2 | % |

| Legal and professional | 4,461 | | 4,831 | | (370) | | (8) | % | 3,857 | | 4,132 | | 4,159 | | 302 | | 7 | % |

| Loan and foreclosure costs | 2,049 | | 1,635 | | 414 | | 25 | % | 1,138 | | 804 | | 1,631 | | 418 | | 26 | % |

| FDIC assessment | 9,150 | | 9,550 | | (400) | | (4) | % | 6,875 | | 6,350 | | 5,800 | | 3,350 | | 58 | % |

| Other intangible amortization | 2,203 | | 2,203 | | — | | — | % | 2,203 | | 2,203 | | 2,203 | | — | | — | % |

| | | | | | | | | |

| Other | 8,771 | | 8,476 | | 295 | | 3 | % | 7,479 | | 10,618 | | 15,645 | | (6,874) | | (44) | % |

| Total noninterest expense | 196,205 | | 190,673 | | 5,532 | | 3 | % | 187,412 | | 196,560 | | 195,791 | | 414 | | — | % |

| Income before income taxes | 102,674 | | 110,687 | | (8,013) | | (7) | % | 130,700 | | 134,094 | | 122,438 | | (19,764) | | (16) | % |

| Income tax expense | 19,426 | | 23,533 | | (4,107) | | (17) | % | 27,340 | | 25,332 | | 26,163 | | (6,737) | | (26) | % |

| Net income | 83,248 | | 87,154 | | (3,906) | | (4) | % | 103,360 | | 108,762 | | 96,275 | | (13,027) | | (14) | % |

| Preferred stock dividends | 2,875 | | 2,875 | | — | | — | % | 2,875 | | 2,875 | | 2,875 | | — | | — | % |

| Net income available to common equity | $ | 80,373 | | $ | 84,279 | | $ | (3,906) | | (5) | % | $ | 100,485 | | $ | 105,887 | | $ | 93,400 | | $ | (13,027) | | (14) | % |

| Earnings per common share | | | | | | | | | |

| Basic | $ | 0.53 | | $ | 0.56 | | $ | (0.03) | | (5) | % | $ | 0.67 | | $ | 0.70 | | $ | 0.62 | | $ | (0.09) | | (15) | % |

| Diluted | $ | 0.53 | | $ | 0.56 | | $ | (0.03) | | (5) | % | $ | 0.66 | | $ | 0.70 | | $ | 0.62 | | $ | (0.09) | | (15) | % |

| Average common shares outstanding | | | | | | | | | |

| Basic | 150,035 | | 149,986 | | 49 | | — | % | 149,763 | | 149,454 | | 149,321 | | 714 | | — | % |

| Diluted | 151,014 | | 150,870 | | 144 | | — | % | 151,128 | | 150,886 | | 150,262 | | 752 | | 1 | % |

|

N/M = Not meaningful

Numbers may not sum due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Selected Quarterly Information | | | | | | | |

| ($ in millions except per share data; shares repurchased and outstanding in thousands) | YTD

Sep 2023 | YTD

Sep 2022 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 |

| Per common share data | | | | | | | |

| Dividends | $ | 0.63 | | $ | 0.60 | | $ | 0.21 | | $ | 0.21 | | $ | 0.21 | | $ | 0.21 | | $ | 0.20 | |

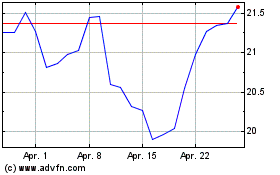

| Market value: | | | | | | | |

| High | 24.18 | | 25.71 | | 19.21 | | 18.45 | | 24.18 | | 25.13 | | 21.87 | |

| Low | 14.48 | | 17.63 | | 16.22 | | 14.48 | | 17.66 | | 20.54 | | 17.63 | |

| Close | | | 17.11 | | 16.23 | | 17.98 | | 23.09 | | 20.08 | |

| Book value / share | | | 26.06 | | 26.03 | | 26.06 | | 25.40 | | 25.01 | |

| Tangible book value / share | | | 18.46 | | 18.41 | | 18.42 | | 17.73 | | 17.32 | |

| Performance ratios (annualized) | | | | | | | |

| Return on average assets | 0.91 | % | 0.95 | % | 0.80 | % | 0.86 | % | 1.06 | % | 1.12 | % | 1.02 | % |

| Noninterest expense / average assets | 1.90 | % | 2.04 | % | 1.90 | % | 1.89 | % | 1.92 | % | 2.03 | % | 2.08 | % |

| Effective tax rate | 20.43 | % | 20.94 | % | 18.92 | % | 21.26 | % | 20.92 | % | 18.89 | % | 21.37 | % |

Dividend payout ratio(a) | 35.80 | % | 36.14 | % | 39.62 | % | 37.50 | % | 31.34 | % | 30.00 | % | 32.26 | % |

| Net interest margin | 2.86 | % | 2.77 | % | 2.71 | % | 2.80 | % | 3.07 | % | 3.31 | % | 3.13 | % |

| Selected trend information | | | | | | | |

Average full time equivalent employees(b) | 4,222 | | 4,101 | | 4,220 | | 4,227 | | 4,219 | | 4,169 | | 4,182 | |

| Branch count | | | 202 | | 202 | | 202 | | 202 | | 215 | |

Assets under management, at market value(c) | | | $ | 12,543 | | $ | 12,995 | | $ | 12,412 | | $ | 11,843 | | $ | 11,142 | |

| Mortgage loans originated for sale during period | $ | 283 | | $ | 536 | | $ | 115 | | $ | 99 | | $ | 69 | | $ | 64 | | $ | 132 | |

| Mortgage loan settlements during period | $ | 255 | | $ | 620 | | $ | 103 | | $ | 97 | | $ | 55 | | $ | 95 | | $ | 120 | |

| | | | | | | |

| Mortgage portfolio serviced for others | | | $ | 6,452 | | $ | 6,525 | | $ | 6,612 | | $ | 6,712 | | $ | 6,800 | |

| Mortgage servicing rights, net / mortgage portfolio serviced for others | | | 1.38 | % | 1.23 | % | 1.13 | % | 1.15 | % | 1.15 | % |

| | | | | | | |

| Shares outstanding, end of period | | | 150,951 | | 150,919 | | 150,886 | | 150,444 | | 150,328 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Selected quarterly ratios | | | | | | | |

| Loans / deposits | | | 93.99 | % | 93.24 | % | 96.29 | % | 97.18 | % | 95.27 | % |

| Stockholders’ equity / assets | | | 9.91 | % | 10.00 | % | 10.14 | % | 10.19 | % | 10.39 | % |

Risk-based capital(d)(e) | | | | | | | |

| Total risk-weighted assets | | | $ | 33,497 | | $ | 33,146 | | $ | 32,648 | | $ | 32,472 | | $ | 31,406 | |

| Common equity Tier 1 | | | $ | 3,197 | | $ | 3,143 | | $ | 3,086 | | $ | 3,036 | | $ | 2,956 | |

| Common equity Tier 1 capital ratio | | | 9.55 | % | 9.48 | % | 9.45 | % | 9.35 | % | 9.41 | % |

| Tier 1 capital ratio | | | 10.12 | % | 10.07 | % | 10.05 | % | 9.95 | % | 10.03 | % |

| Total capital ratio | | | 12.25 | % | 12.22 | % | 12.22 | % | 11.33 | % | 11.41 | % |

| Tier 1 leverage ratio | | | 8.42 | % | 8.40 | % | 8.46 | % | 8.59 | % | 8.66 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

N/M = Not meaningful

Numbers may not sum due to rounding.

(a)Ratio is based upon basic earnings per common share.

(b)Average full time equivalent employees without overtime.

(c)Excludes assets held in brokerage accounts.

(d)The Federal Reserve establishes regulatory capital requirements, including well-capitalized standards for the Corporation. The regulatory capital requirements effective for the Corporation follow Basel III, subject to certain transition provisions.

(e)September 30, 2023 data is estimated.

| | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Selected Asset Quality Information | | | | | |

| ($ in thousands) | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr %

Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change |

| Allowance for loan losses | | | | | | | |

| Balance at beginning of period | $ | 338,750 | | $ | 326,432 | | 4 | % | $ | 312,720 | | $ | 292,904 | | $ | 280,771 | | 21 | % |

| Provision for loan losses | 25,500 | | 23,500 | | 9 | % | 17,000 | | 21,000 | | 14,000 | | 82 | % |

| Charge offs | (20,535) | | (14,855) | | 38 | % | (5,501) | | (2,982) | | (3,346) | | N/M |

| Recoveries | 2,079 | | 3,674 | | (43) | % | 2,212 | | 1,798 | | 1,478 | | 41 | % |

| Net (charge offs) recoveries | (18,455) | | (11,181) | | 65 | % | (3,289) | | (1,183) | | (1,867) | | N/M |

| Balance at end of period | $ | 345,795 | | $ | 338,750 | | 2 | % | $ | 326,432 | | $ | 312,720 | | $ | 292,904 | | 18 | % |

| Allowance for unfunded commitments | | | | | | | |

| Balance at beginning of period | $ | 38,276 | | $ | 39,776 | | (4) | % | $ | 38,776 | | $ | 39,776 | | $ | 36,776 | | 4 | % |

| Provision for unfunded commitments | (3,500) | | (1,500) | | 133 | % | 1,000 | | (1,000) | | 3,000 | | N/M |

| Balance at end of period | $ | 34,776 | | $ | 38,276 | | (9) | % | $ | 39,776 | | $ | 38,776 | | $ | 39,776 | | (13) | % |

| Allowance for credit losses on loans (ACLL) | $ | 380,571 | | $ | 377,027 | | 1 | % | $ | 366,208 | | $ | 351,496 | | $ | 332,680 | | 14 | % |

| Provision for credit losses on loans | $ | 22,000 | | $ | 22,000 | | — | % | $ | 18,000 | | $ | 20,000 | | $ | 17,000 | | 29 | % |

| ($ in thousands) | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr % Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change |

| Net (charge offs) recoveries | | | | | | | |

| | | | | | | |

| | | | | | | |

| Commercial and industrial | $ | (16,558) | | $ | (11,177) | | 48 | % | $ | (1,759) | | $ | 278 | | $ | (897) | | N/M |

| Commercial real estate—owner occupied | 2 | | 3 | | (33) | % | 3 | | 3 | | 3 | | (33) | % |

| Commercial and business lending | (16,556) | | (11,174) | | 48 | % | (1,756) | | 281 | | (894) | | N/M |

| Commercial real estate—investor | 272 | | 2,276 | | (88) | % | — | | — | | — | | N/M |

| Real estate construction | 18 | | (18) | | N/M | 18 | | 16 | | 9 | | 100 | % |

| Commercial real estate lending | 290 | | 2,257 | | (87) | % | 18 | | 16 | | 9 | | N/M |

| Total commercial | (16,266) | | (8,917) | | 82 | % | (1,738) | | 297 | | (885) | | N/M |

| Residential mortgage | (22) | | (283) | | (92) | % | (53) | | (125) | | (42) | | (48) | % |

| Auto finance | (1,269) | | (1,048) | | 21 | % | (957) | | (768) | | (165) | | N/M |

| Home equity | 128 | | 183 | | (30) | % | 340 | | 123 | | (101) | | N/M |

| Other consumer | (1,027) | | (1,117) | | (8) | % | (881) | | (711) | | (675) | | 52 | % |

| Total consumer | (2,189) | | (2,264) | | (3) | % | (1,550) | | (1,480) | | (983) | | 123 | % |

| Total net (charge offs) recoveries | $ | (18,455) | | $ | (11,181) | | 65 | % | $ | (3,289) | | $ | (1,183) | | $ | (1,867) | | N/M |

| | | | | | | |

| (In basis points) | Sep 30, 2023 | Jun 30, 2023 | | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | |

| Net (charge offs) recoveries to average loans (annualized) | | | | | | | |

| | | | | | | |

| | | | | | | |

| Commercial and industrial | (66) | | (46) | | | (7) | | 1 | | (4) | | |

| Commercial real estate—owner occupied | — | | — | | | — | | — | | — | | |

| Commercial and business lending | (60) | | (41) | | | (7) | | 1 | | (3) | | |

| Commercial real estate—investor | 2 | | 18 | | | — | | — | | — | | |

| Real estate construction | — | | — | | | — | | — | | — | | |

| Commercial real estate lending | 2 | | 12 | | | — | | — | | — | | |

| Total commercial | (35) | | (20) | | | (4) | | 1 | | (2) | | |

| Residential mortgage | — | | (1) | | | — | | (1) | | — | | |

| Auto finance | (27) | | (25) | | | (26) | | (24) | | (7) | | |

| Home equity | 8 | | 12 | | | 22 | | 8 | | (7) | | |

| Other consumer | (148) | | (163) | | | (125) | | (95) | | (89) | | |

| Total consumer | (7) | | (8) | | | (6) | | (6) | | (4) | | |

| Total net (charge offs) recoveries | (25) | | (15) | | | (5) | | (2) | | (3) | | |

| | | | | | | |

| ($ in thousands) | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr %

Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change |

| Credit quality | | | | | | | |

| Nonaccrual loans | $ | 168,558 | | $ | 131,278 | | 28 | % | $ | 117,569 | | $ | 111,467 | | $ | 116,406 | | 45 | % |

| Other real estate owned (OREO) | 8,452 | | 7,575 | | 12 | % | 15,184 | | 14,784 | | 16,373 | | (48) | % |

| | | | | | | |

| Repossessed assets | $ | 658 | | $ | 348 | | 89 | % | $ | 92 | | $ | 215 | | $ | 299 | | 120 | % |

| Total nonperforming assets | $ | 177,668 | | $ | 139,201 | | 28 | % | $ | 132,845 | | $ | 126,466 | | $ | 133,078 | | 34 | % |

| | | | | | | |

| Loans 90 or more days past due and still accruing | $ | 2,156 | | $ | 1,726 | | 25 | % | $ | 1,703 | | $ | 1,728 | | $ | 1,417 | | 52 | % |

| | | | | | | |

| Allowance for credit losses on loans to total loans | 1.26 | % | 1.26 | % | | 1.25 | % | 1.22 | % | 1.20 | % | |

| | | | | | | |

| Allowance for credit losses on loans to nonaccrual loans | 225.78 | % | 287.20 | % | | 311.48 | % | 315.34 | % | 285.79 | % | |

| Nonaccrual loans to total loans | 0.56 | % | 0.44 | % | | 0.40 | % | 0.39 | % | 0.42 | % | |

| Nonperforming assets to total loans plus OREO and repossessed assets | 0.59 | % | 0.47 | % | | 0.45 | % | 0.44 | % | 0.48 | % | |

| Nonperforming assets to total assets | 0.43 | % | 0.34 | % | | 0.33 | % | 0.32 | % | 0.35 | % | |

| Annualized year-to-date net charge offs (recoveries) to year-to-date average loans | 0.15 | % | 0.10 | % | | 0.05 | % | — | % | — | % | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

N/M = Not meaningful

| | | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Selected Asset Quality Information (continued) | |

| (In thousands) | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr %

Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change | |

| Nonaccrual loans | | | | | | | | |

| Commercial and industrial | $ | 74,812 | | $ | 34,907 | | 114 | % | $ | 22,735 | | $ | 14,329 | | $ | 15,576 | | N/M | |

| Commercial real estate—owner occupied | 3,936 | | 1,444 | | 173 | % | 1,478 | | — | | — | | N/M | |

| Commercial and business lending | 78,748 | | 36,352 | | 117 | % | 24,213 | | 14,329 | | 15,576 | | N/M | |

| Commercial real estate—investor | 10,882 | | 22,068 | | (51) | % | 25,122 | | 29,380 | | 37,479 | | (71) | % | |

| Real estate construction | 103 | | 125 | | (18) | % | 178 | | 105 | | 141 | | (27) | % | |

| Commercial real estate lending | 10,985 | | 22,193 | | (51) | % | 25,300 | | 29,485 | | 37,620 | | (71) | % | |

| Total commercial | 89,732 | | 58,544 | | 53 | % | 49,513 | | 43,814 | | 53,196 | | 69 | % | |

| Residential mortgage | 66,153 | | 61,718 | | 7 | % | 58,274 | | 58,480 | | 55,485 | | 19 | % | |

| Auto finance | 4,533 | | 3,065 | | 48 | % | 2,436 | | 1,490 | | 302 | | N/M | |

| Home equity | 7,917 | | 7,788 | | 2 | % | 7,246 | | 7,487 | | 7,325 | | 8 | % | |

| Other consumer | 222 | | 163 | | 36 | % | 100 | | 197 | | 98 | | 127 | % | |

| Total consumer | 78,826 | | 72,733 | | 8 | % | 68,056 | | 67,654 | | 63,210 | | 25 | % | |

| Total nonaccrual loans | $ | 168,558 | | $ | 131,278 | | 28 | % | $ | 117,569 | | $ | 111,467 | | $ | 116,406 | | 45 | % | |

| | | | | | | | |

| Sep 30, 2023 | Jun 30, 2023 | Seql Qtr %

Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change | |

Restructured loans (accruing)(a) | | | | | | | | |

| Commercial and industrial | $ | 234 | | $ | 168 | | 39 | % | $ | 47 | | $ | 12,453 | | $ | 14,829 | | N/A | |

| Commercial real estate—owner occupied | — | | — | | N/M | — | | 316 | | 369 | | N/A | |

| Commercial and business lending | 234 | | 168 | | 39 | % | 47 | | 12,769 | | 15,198 | | N/A | |

| Commercial real estate—investor | — | | — | | N/M | — | | 128 | | 733 | | N/A | |

| Real estate construction | — | | — | | N/M | — | | 195 | | 165 | | N/A | |

| Commercial real estate lending | — | | — | | N/M | — | | 324 | | 898 | | N/A | |

| Total commercial | 234 | | 168 | | 39 | % | 47 | | 13,093 | | 16,097 | | N/A | |

| Residential mortgage | 207 | | 126 | | 64 | % | 126 | | 16,829 | | 16,169 | | N/A | |

| Auto finance | 169 | | 80 | | 111 | % | 61 | | — | | — | | N/A | |

| Home equity | 236 | | 78 | | N/M | 31 | | 2,148 | | 2,103 | | N/A | |

| Other consumer | 1,243 | | 988 | | 26 | % | 498 | | 798 | | 764 | | N/A | |

| Total consumer | 1,855 | | 1,271 | | 46 | % | 716 | | 19,775 | | 19,036 | | N/A | |

| Total restructured loans (accruing) | $ | 2,089 | | $ | 1,439 | | 45 | % | $ | 763 | | $ | 32,868 | | $ | 35,132 | | N/A | |

| Nonaccrual restructured loans (included in nonaccrual loans) | $ | 961 | | $ | 796 | | 21 | % | $ | 341 | | $ | 20,127 | | $ | 21,650 | | N/A | |

| Sep 30, 2023 | Jun 30, 2023 | Seql Qtr %

Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change | |

| Accruing loans 30-89 days past due | | | | | | | | |

| Commercial and industrial | $ | 1,507 | | $ | 12,005 | | (87) | % | $ | 4,239 | | $ | 6,283 | | $ | 1,861 | | (19) | % | |

| Commercial real estate—owner occupied | 1,877 | | 1,484 | | 26 | % | 2,955 | | 230 | | — | | N/M | |

| Commercial and business lending | 3,384 | | 13,489 | | (75) | % | 7,195 | | 6,512 | | 1,861 | | 82 | % | |

| Commercial real estate—investor | 10,121 | | — | | N/M | — | | 1,067 | | — | | N/M | |

| Real estate construction | 10 | | 76 | | (87) | % | — | | 39 | | 43 | | (77) | % | |

| Commercial real estate lending | 10,131 | | 76 | | N/M | — | | 1,105 | | 43 | | N/M | |

| Total commercial | 13,515 | | 13,565 | | — | % | 7,195 | | 7,618 | | 1,904 | | N/M | |

| Residential mortgage | 11,652 | | 8,961 | | 30 | % | 7,626 | | 9,874 | | 6,517 | | 79 | % | |

| Auto finance | 16,688 | | 11,429 | | 46 | % | 8,640 | | 9,408 | | 6,206 | | 169 | % | |

| Home equity | 3,687 | | 4,030 | | (9) | % | 4,113 | | 5,607 | | 4,234 | | (13) | % | |

| Other consumer | 1,880 | | 2,025 | | (7) | % | 1,723 | | 1,610 | | 1,592 | | 18 | % | |

| Total consumer | 33,908 | | 26,444 | | 28 | % | 22,102 | | 26,499 | | 18,549 | | 83 | % | |

| Total accruing loans 30-89 days past due | $ | 47,422 | | $ | 40,008 | | 19 | % | $ | 29,297 | | $ | 34,117 | | $ | 20,452 | | 132 | % | |

| | | | | | | | |

| Sep 30, 2023 | Jun 30, 2023 | Seql Qtr %

Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr %

Change | |

| Potential problem loans | | | | | | | | |

| | | | | | | | |

| Commercial and industrial | $ | 207,237 | | $ | 205,228 | | 1 | % | $ | 135,047 | | $ | 136,549 | | $ | 108,556 | | 91 | % | |

| Commercial real estate—owner occupied | 27,792 | | 29,396 | | (5) | % | 32,077 | | 34,422 | | 28,287 | | (2) | % | |

| Commercial and business lending | 235,029 | | 234,624 | | — | % | 167,124 | | 170,971 | | 136,843 | | 72 | % | |

| Commercial real estate—investor | 148,840 | | 106,662 | | 40 | % | 89,653 | | 92,535 | | 117,982 | | 26 | % | |

| Real estate construction | — | | — | | N/M | — | | 970 | | — | | N/M | |

| Commercial real estate lending | 148,840 | | 106,662 | | 40 | % | 89,653 | | 93,505 | | 117,982 | | 26 | % | |

| Total commercial | 383,869 | | 341,286 | | 12 | % | 256,776 | | 264,476 | | 254,825 | | 51 | % | |

| Residential mortgage | 1,247 | | 1,646 | | (24) | % | 1,684 | | 1,978 | | 2,845 | | (56) | % | |

| | | | | | | | |

| Home equity | 236 | | 240 | | (2) | % | 244 | | 197 | | 185 | | 28 | % | |

| | | | | | | | |

| Total consumer | 1,483 | | 1,886 | | (21) | % | 1,928 | | 2,175 | | 3,030 | | (51) | % | |

| Total potential problem loans | $ | 385,352 | | $ | 343,173 | | 12 | % | $ | 258,704 | | $ | 266,651 | | $ | 257,855 | | 49 | % | |

| | | | | | | | |

N/M = Not meaningful

Numbers may not sum due to rounding.

(a) On January 1, 2023, the Corporation adopted ASU 2022-02. Under this update, troubled debt restructurings were eliminated and replaced with a modified loan classification. As a result, amounts reported for 2023 periods will not be comparable to amounts reported for 2022 periods.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Net Interest Income Analysis - Fully Tax-Equivalent Basis - Sequential and Comparable Quarter | | | |

| Three Months Ended |

| | September 30, 2023 | June 30, 2023 | September 30, 2022 |

| ($ in thousands) | Average

Balance | Interest

Income /Expense | Average

Yield /Rate | Average

Balance | Interest

Income /Expense | Average

Yield /Rate | Average

Balance | Interest

Income /Expense | Average

Yield /Rate |

| Assets | | | | | | | | | |

| Earning assets | | | | | | | | | |

Loans (a) (b) (c) | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Commercial and business lending | $ | 10,985,584 | | $ | 194,956 | | 7.04 | % | $ | 10,899,337 | | $ | 184,080 | | 6.77 | % | $ | 10,192,463 | | $ | 110,215 | | 4.29 | % |

| Commercial real estate lending | 7,312,645 | | 134,370 | | 7.29 | % | 7,295,367 | | 127,967 | | 7.04 | % | 6,768,054 | | 78,887 | | 4.62 | % |

| Total commercial | 18,298,229 | | 329,326 | | 7.14 | % | 18,194,703 | | 312,047 | | 6.88 | % | 16,960,517 | | 189,101 | | 4.42 | % |

| Residential mortgage | 8,807,157 | | 74,643 | | 3.39 | % | 8,701,496 | | 72,056 | | 3.31 | % | 8,223,531 | | 64,069 | | 3.12 | % |

| Auto finance | 1,884,540 | | 24,074 | | 5.07 | % | 1,654,523 | | 19,701 | | 4.78 | % | 969,918 | | 9,170 | | 3.75 | % |

| Other retail | 894,685 | | 20,534 | | 9.15 | % | 887,574 | | 20,135 | | 9.08 | % | 901,738 | | 13,868 | | 6.13 | % |

| Total loans | 29,884,611 | | 448,577 | | 5.96 | % | 29,438,297 | | 423,939 | | 5.77 | % | 27,055,703 | | 276,209 | | 4.06 | % |

| Investment securities | | | | | | | | | |

| Taxable | 5,407,299 | | 38,210 | | 2.83 | % | 5,304,381 | | 35,845 | | 2.70 | % | 4,328,586 | | 19,221 | | 1.78 | % |

Tax-exempt(a) | 2,300,488 | | 20,085 | | 3.49 | % | 2,314,825 | | 20,152 | | 3.48 | % | 2,435,957 | | 20,838 | | 3.42 | % |

| Other short-term investments | 483,211 | | 6,575 | | 5.40 | % | 511,487 | | 6,086 | | 4.77 | % | 378,528 | | 3,284 | | 3.45 | % |

| Investments and other | 8,190,998 | | 64,870 | | 3.16 | % | 8,130,693 | | 62,083 | | 3.05 | % | 7,143,071 | | 43,342 | | 2.42 | % |

| Total earning assets | 38,075,608 | | $ | 513,447 | | 5.36 | % | 37,568,991 | | $ | 486,022 | | 5.18 | % | 34,198,774 | | $ | 319,551 | | 3.72 | % |

| Other assets, net | 3,000,371 | | | | 2,989,321 | | | | 3,073,005 | | | |

| Total assets | $ | 41,075,980 | | | | $ | 40,558,311 | | | | $ | 37,271,779 | | | |

| Liabilities and stockholders' equity | | | | | | | | | |

| Interest-bearing liabilities | | | | | | | | | |

| Interest-bearing deposits | | | | | | | | | |

| Savings | $ | 4,814,499 | | $ | 18,592 | | 1.53 | % | $ | 4,749,808 | | $ | 15,160 | | 1.28 | % | $ | 4,735,285 | | $ | 516 | | 0.04 | % |

| Interest-bearing demand | 6,979,071 | | 41,980 | | 2.39 | % | 6,663,775 | | 34,961 | | 2.10 | % | 6,587,404 | | 10,306 | | 0.62 | % |

| Money market | 6,294,083 | | 45,034 | | 2.84 | % | 6,743,810 | | 43,529 | | 2.59 | % | 7,328,165 | | 9,474 | | 0.51 | % |

| Network transaction deposits | 1,639,619 | | 22,008 | | 5.33 | % | 1,468,006 | | 18,426 | | 5.03 | % | 873,168 | | 4,716 | | 2.14 | % |

| Time deposits | 5,955,741 | | 65,517 | | 4.36 | % | 4,985,949 | | 50,119 | | 4.03 | % | 1,230,859 | | 989 | | 0.32 | % |

| Total interest-bearing deposits | 25,683,013 | | 193,131 | | 2.98 | % | 24,611,348 | | 162,196 | | 2.64 | % | 20,754,882 | | 26,000 | | 0.50 | % |

| Federal funds purchased and securities sold under agreements to repurchase | 320,518 | | 3,100 | | 3.84 | % | 285,754 | | 2,261 | | 3.17 | % | 380,674 | | 756 | | 0.79 | % |

| Commercial paper | 5,041 | | — | | 0.01 | % | 12,179 | | — | | 0.01 | % | 18,308 | | 1 | | 0.01 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| FHLB advances | 3,460,827 | | 48,143 | | 5.52 | % | 3,796,106 | | 49,261 | | 5.20 | % | 3,283,328 | | 20,792 | | 2.51 | % |

| Long-term funding | 533,744 | | 10,019 | | 7.51 | % | 543,003 | | 9,596 | | 7.07 | % | 249,838 | | 2,722 | | 4.36 | % |

| Total short and long-term funding | 4,320,130 | | 61,263 | | 5.63 | % | 4,637,042 | | 61,118 | | 5.28 | % | 3,932,149 | | 24,270 | | 2.45 | % |

| Total interest-bearing liabilities | 30,003,143 | | $ | 254,394 | | 3.36 | % | 29,248,389 | | $ | 223,314 | | 3.06 | % | 24,687,031 | | $ | 50,270 | | 0.81 | % |

| Noninterest-bearing demand deposits | 6,318,781 | | | | 6,669,787 | | | | 8,119,475 | | | |

| Other liabilities | 622,004 | | | | 511,074 | | | | 480,672 | | | |

| Stockholders’ equity | 4,132,052 | | | | 4,129,061 | | | | 3,984,602 | | | |

| Total liabilities and stockholders’ equity | $ | 41,075,980 | | | | $ | 40,558,311 | | | | $ | 37,271,779 | | | |

| Interest rate spread | | | 2.00 | % | | | 2.12 | % | | | 2.91 | % |

| Net free funds | | | 0.71 | % | | | 0.68 | % | | | 0.22 | % |

| Fully tax-equivalent net interest income and net interest margin ("NIM") | | $ | 259,053 | | 2.71 | % | | $ | 262,708 | | 2.80 | % | | $ | 269,281 | | 3.13 | % |

| Fully tax-equivalent adjustment | | 4,810 | | | | 4,791 | | | | 4,843 | | |

| Net interest income | | $ | 254,244 | | | | $ | 257,917 | | | | $ | 264,439 | | |

Numbers may not sum due to rounding.

(a)The yield on tax-exempt loans and securities is computed on a fully tax-equivalent basis using a tax rate of 21% and is net of the effects of certain disallowed interest deductions.

(b)Nonaccrual loans and loans held for sale have been included in the average balances.

(c)Interest income includes amortization of net deferred loan origination costs and net accreted purchase loan discount.

| | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Net Interest Income Analysis - Fully Tax-Equivalent Basis - Year Over Year |

| Nine Months Ended September 30, |

| | 2023 | 2022 |

| ($ in thousands) | Average

Balance | Interest

Income /Expense | Average

Yield / Rate | Average

Balance | Interest

Income /Expense | Average

Yield / Rate |

| Assets | | | | | | |

| Earning assets | | | | | | |

Loans (a) (b) (c) | | | | | | |

| | | | | | |

| | | | | | |

| Commercial and business lending | $ | 10,835,003 | | $ | 546,210 | | 6.74 | % | $ | 9,623,927 | | $ | 236,971 | | 3.29 | % |

| Commercial real estate lending | 7,286,627 | | 381,425 | | 7.00 | % | 6,438,335 | | 176,006 | | 3.65 | % |

| Total commercial | 18,121,629 | | 927,634 | | 6.84 | % | 16,062,262 | | 412,977 | | 3.44 | % |

Residential mortgage | 8,698,542 | | 217,410 | | 3.33 | % | 7,920,382 | | 177,906 | | 2.99 | % |

| Auto finance | 1,677,838 | | 60,233 | | 4.80 | % | 657,150 | | 17,837 | | 3.63 | % |

| Other retail | 895,371 | | 59,163 | | 8.82 | % | 888,241 | | 35,900 | | 5.40 | % |

| Total loans | 29,393,380 | | 1,264,441 | | 5.75 | % | 25,528,036 | | 644,621 | | 3.37 | % |

| Investment securities | | | | | | |

| Taxable | 5,209,845 | | 104,197 | | 2.67 | % | 4,371,244 | | 54,009 | | 1.65 | % |

Tax-exempt (a) | 2,314,838 | | 60,429 | | 3.48 | % | 2,416,064 | | 61,771 | | 3.41 | % |

| Other short-term investments | 495,883 | | 17,990 | | 4.85 | % | 625,748 | | 7,696 | | 1.64 | % |

| Investments and other | 8,020,566 | | 182,616 | | 3.03 | % | 7,413,056 | | 123,477 | | 2.22 | % |

| Total earning assets | 37,413,946 | | $ | 1,447,057 | | 5.17 | % | 32,941,092 | | $ | 768,098 | | 3.11 | % |

| Other assets, net | 3,005,220 | | | | 3,134,678 | | | |

| Total assets | $ | 40,419,166 | | | | $ | 36,075,770 | | | |

| Liabilities and stockholders' equity | | | | | | |

| Interest-bearing liabilities | | | | | | |

| Interest-bearing deposits | | | | | | |

| Savings | $ | 4,743,526 | | $ | 43,611 | | 1.23 | % | $ | 4,650,105 | | $ | 1,427 | | 0.04 | % |

| Interest-bearing demand | 6,819,714 | | 106,860 | | 2.09 | % | 6,573,680 | | 14,307 | | 0.29 | % |

| Money market | 6,853,545 | | 130,201 | | 2.54 | % | 7,090,960 | | 12,642 | | 0.24 | % |

| Network transaction deposits | 1,420,042 | | 53,259 | | 5.01 | % | 795,059 | | 6,460 | | 1.09 | % |

| Time deposits | 4,447,813 | | 130,818 | | 3.93 | % | 1,266,116 | | 2,754 | | 0.29 | % |

| Total interest-bearing deposits | 24,284,640 | | 464,749 | | 2.56 | % | 20,375,920 | | 37,590 | | 0.25 | % |

| Federal funds purchased and securities sold under agreements to repurchase | 344,950 | | 8,504 | | 3.30 | % | 376,687 | | 1,200 | | 0.43 | % |

| Commercial paper | 11,475 | | 1 | | 0.01 | % | 23,106 | | 2 | | 0.01 | % |

| | | | | | |

| | | | | | |

| FHLB advances | 3,834,247 | | 147,365 | | 5.14 | % | 2,445,486 | | 38,663 | | 2.11 | % |

| Long-term funding | 495,434 | | 25,895 | | 6.97 | % | 249,759 | | 8,182 | | 4.37 | % |

| Total short and long-term funding | 4,686,106 | | 181,765 | | 5.18 | % | 3,095,039 | | 48,047 | | 2.07 | % |

| Total interest-bearing liabilities | 28,970,746 | | $ | 646,514 | | 2.98 | % | 23,470,959 | | $ | 85,637 | | 0.49 | % |

| Noninterest-bearing demand deposits | 6,772,521 | | | | 8,189,067 | | | |

| Other liabilities | 567,938 | | | | 446,249 | | | |

| Stockholders’ equity | 4,107,961 | | | | 3,969,495 | | | |

| Total liabilities and stockholders’ equity | $ | 40,419,166 | | | | $ | 36,075,770 | | | |

| Interest rate spread | | | 2.19 | % | | | 2.62 | % |

| Net free funds | | | 0.67 | % | | | 0.15 | % |

| Fully tax-equivalent net interest income and net interest margin ("NIM") | | $ | 800,543 | | 2.86 | % | | $ | 682,461 | | 2.77 | % |

| Fully tax-equivalent adjustment | | 14,372 | | | | 14,129 | | |

| Net interest income | | $ | 786,171 | | | | $ | 668,332 | | |

Numbers may not sum due to rounding.

(a)The yield on tax-exempt loans and securities is computed on a fully tax-equivalent basis using a tax rate of 21% and is net of the effects of certain disallowed interest deductions.

(b)Nonaccrual loans and loans held for sale have been included in the average balances.

(c)Interest income includes amortization of net deferred loan origination costs and net accreted purchase loan discount.

| | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Loan and Deposit Composition | | | | | | | |

| ($ in thousands) | | | | | | | |

| Period end loan composition | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr % Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr % Change |

| | | | | | | |

| Commercial and industrial | $ | 10,099,068 | | $ | 10,055,487 | | — | % | $ | 9,869,781 | | $ | 9,759,454 | | $ | 9,571,925 | | 6 | % |

| Commercial real estate—owner occupied | 1,054,969 | | 1,058,237 | | — | % | 1,050,236 | | 991,722 | | 999,786 | | 6 | % |

| Commercial and business lending | 11,154,037 | | 11,113,724 | | — | % | 10,920,017 | | 10,751,176 | | 10,571,711 | | 6 | % |

| Commercial real estate—investor | 5,218,980 | | 5,312,928 | | (2) | % | 5,094,249 | | 5,080,344 | | 5,064,289 | | 3 | % |

| Real estate construction | 2,130,719 | | 2,009,060 | | 6 | % | 2,147,070 | | 2,155,222 | | 1,835,159 | | 16 | % |

| Commercial real estate lending | 7,349,699 | | 7,321,988 | | — | % | 7,241,318 | | 7,235,565 | | 6,899,449 | | 7 | % |

| Total commercial | 18,503,736 | | 18,435,711 | | — | % | 18,161,335 | | 17,986,742 | | 17,471,159 | | 6 | % |

| Residential mortgage | 8,782,645 | | 8,746,345 | | — | % | 8,605,164 | | 8,511,550 | | 8,314,902 | | 6 | % |

| Auto finance | 2,007,164 | | 1,777,974 | | 13 | % | 1,551,538 | | 1,382,073 | | 1,117,136 | | 80 | % |

| | | | | | | |

| | | | | | | |

| Home equity | 623,650 | | 615,506 | | 1 | % | 609,787 | | 624,353 | | 612,608 | | 2 | % |

| Other consumer | 275,993 | | 273,367 | | 1 | % | 279,248 | | 294,851 | | 301,475 | | (8) | % |

| Total consumer | 11,689,451 | | 11,413,193 | | 2 | % | 11,045,737 | | 10,812,828 | | 10,346,121 | | 13 | % |

| Total loans | $ | 30,193,187 | | $ | 29,848,904 | | 1 | % | $ | 29,207,072 | | $ | 28,799,569 | | $ | 27,817,280 | | 9 | % |

| | | | | | | |

| | | | | | | |

| Period end deposit and customer funding composition | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr % Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr % Change |

| Noninterest-bearing demand | $ | 6,422,994 | | $ | 6,565,666 | | (2) | % | $ | 7,328,689 | | $ | 7,760,811 | | $ | 8,224,579 | | (22) | % |

| Savings | 4,836,735 | | 4,777,415 | | 1 | % | 4,730,472 | | 4,604,848 | | 4,708,720 | | 3 | % |

| Interest-bearing demand | 7,528,154 | | 7,037,959 | | 7 | % | 6,977,121 | | 7,100,727 | | 7,122,218 | | 6 | % |

| Money market | 7,268,506 | | 7,521,930 | | (3) | % | 8,357,625 | | 8,239,610 | | 7,909,232 | | (8) | % |

| Brokered CDs | 3,351,399 | | 3,818,325 | | (12) | % | 1,185,565 | | 541,916 | | — | | N/M |

| Other time deposits | 2,715,538 | | 2,293,114 | | 18 | % | 1,752,351 | | 1,388,242 | | 1,233,833 | | 120 | % |

| Total deposits | 32,123,326 | | 32,014,409 | | — | % | 30,331,824 | | 29,636,154 | | 29,198,581 | | 10 | % |

Other customer funding(a) | 151,644 | | 170,873 | | (11) | % | 226,258 | | 261,767 | | 283,856 | | (47) | % |

| Total deposits and other customer funding | $ | 32,274,971 | | $ | 32,185,282 | | — | % | $ | 30,558,081 | | $ | 29,897,921 | | $ | 29,482,437 | | 9 | % |

Network transaction deposits(b) | $ | 1,649,389 | | $ | 1,600,619 | | 3 | % | $ | 1,273,420 | | $ | 979,003 | | $ | 864,086 | | 91 | % |

| | | | | | | |

| | | | | | | |

Net deposits and other customer funding(c) | $ | 27,274,183 | | $ | 26,766,338 | | 2 | % | $ | 28,099,096 | | $ | 28,377,001 | | $ | 28,618,351 | | (5) | % |

| | | | | | | |

| Quarter average loan composition | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr % Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr % Change |

| | | | | | | |

| Commercial and industrial | $ | 9,927,271 | | $ | 9,831,956 | | 1 | % | $ | 9,600,838 | | $ | 9,528,180 | | $ | 9,221,970 | | 8 | % |

| Commercial real estate—owner occupied | 1,058,313 | | 1,067,381 | | (1) | % | 1,015,187 | | 1,001,805 | | 970,493 | | 9 | % |

| Commercial and business lending | 10,985,584 | | 10,899,337 | | 1 | % | 10,616,026 | | 10,529,984 | | 10,192,463 | | 8 | % |

| Commercial real estate—investor | 5,205,626 | | 5,206,430 | | — | % | 5,093,122 | | 5,048,419 | | 4,891,530 | | 6 | % |

| Real estate construction | 2,107,018 | | 2,088,937 | | 1 | % | 2,158,072 | | 2,013,986 | | 1,876,524 | | 12 | % |

| Commercial real estate lending | 7,312,645 | | 7,295,367 | | — | % | 7,251,193 | | 7,062,405 | | 6,768,054 | | 8 | % |

| Total commercial | 18,298,229 | | 18,194,703 | | 1 | % | 17,867,219 | | 17,592,389 | | 16,960,517 | | 8 | % |

| Residential mortgage | 8,807,157 | | 8,701,496 | | 1 | % | 8,584,528 | | 8,443,661 | | 8,223,531 | | 7 | % |

| Auto finance | 1,884,540 | | 1,654,523 | | 14 | % | 1,490,115 | | 1,244,436 | | 969,918 | | 94 | % |

| | | | | | | |

| | | | | | | |

| Home equity | 619,423 | | 612,045 | | 1 | % | 618,724 | | 619,044 | | 601,821 | | 3 | % |

| Other consumer | 275,262 | | 275,530 | | — | % | 285,232 | | 295,804 | | 299,917 | | (8) | % |

| Total consumer | 11,586,382 | | 11,243,594 | | 3 | % | 10,978,599 | | 10,602,945 | | 10,095,186 | | 15 | % |

Total loans(d) | $ | 29,884,611 | | $ | 29,438,297 | | 2 | % | $ | 28,845,818 | | $ | 28,195,334 | | $ | 27,055,703 | | 10 | % |

| | | | | | | |

| Quarter average deposit composition | Sep 30, 2023 | Jun 30, 2023 | Seql Qtr % Change | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2022 | Comp Qtr % Change |

| Noninterest-bearing demand | $ | 6,318,781 | | $ | 6,669,787 | | (5) | % | $ | 7,340,219 | | $ | 8,088,435 | | $ | 8,119,475 | | (22) | % |

| Savings | 4,814,499 | | 4,749,808 | | 1 | % | 4,664,624 | | 4,660,696 | | 4,735,285 | | 2 | % |

| Interest-bearing demand | 6,979,071 | | 6,663,775 | | 5 | % | 6,814,487 | | 6,831,213 | | 6,587,404 | | 6 | % |

| Money market | 6,294,083 | | 6,743,810 | | (7) | % | 7,536,393 | | 7,382,793 | | 7,328,165 | | (14) | % |

| Network transaction deposits | 1,639,619 | | 1,468,006 | | 12 | % | 1,147,089 | | 901,168 | | 873,168 | | 88 | % |

| Brokered CDs | 3,428,711 | | 3,001,775 | | 14 | % | 810,889 | | 190,406 | | 734 | | N/M |

| Other time deposits | 2,527,030 | | 1,984,174 | | 27 | % | 1,551,371 | | 1,272,797 | | 1,230,126 | | 105 | % |

| Total deposits | 32,001,794 | | 31,281,134 | | 2 | % | 29,865,072 | | 29,327,509 | | 28,874,357 | | 11 | % |

Other customer funding(a) | 164,289 | | 196,051 | | (16) | % | 245,349 | | 306,122 | | 326,324 | | (50) | % |

| Total deposits and other customer funding | $ | 32,166,082 | | $ | 31,477,186 | | 2 | % | $ | 30,110,421 | | $ | 29,633,631 | | $ | 29,200,680 | | 10 | % |

Net deposits and other customer funding(c) | $ | 27,097,752 | | $ | 27,007,405 | | — | % | $ | 28,152,443 | | $ | 28,542,056 | | $ | 28,326,779 | | (4) | % |

N/M = Not meaningful

Numbers may not sum due to rounding.

(a) Includes repurchase agreements and commercial paper.

(b) Included above in interest-bearing demand and money market.

(c) Total deposits and other customer funding, excluding brokered CDs and network transaction deposits.

(d) Nonaccrual loans and loans held for sale have been included in the average balances.

| | | | | | | | | | | | | | | | | | | | | | | |

Associated Banc-Corp

Non-GAAP Financial Measures Reconciliation | YTD | YTD | | | | | |

| ($ in millions, except per share data) | Sep 2023 | Sep 2022 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 |

Selected equity and performance ratios(a)(b)(c) | | | | | | | |

| Tangible common equity / tangible assets | | | 6.88 | % | 6.94 | % | 7.03 | % | 6.97 | % | 7.06 | % |

| Return on average equity | 8.91 | % | 8.67 | % | 7.99 | % | 8.47 | % | 10.32 | % | 10.81 | % | 9.59 | % |

| Return on average tangible common equity | 13.07 | % | 12.96 | % | 11.67 | % | 12.38 | % | 15.26 | % | 16.15 | % | 14.32 | % |

| Return on average common equity Tier 1 | 11.41 | % | 11.60 | % | 10.08 | % | 10.88 | % | 13.38 | % | 14.04 | % | 12.69 | % |

| Return on average tangible assets | 0.95 | % | 1.00 | % | 0.84 | % | 0.90 | % | 1.11 | % | 1.18 | % | 1.08 | % |

| Average stockholders' equity / average assets | 10.16 | % | 11.00 | % | 10.06 | % | 10.18 | % | 10.26 | % | 10.40 | % | 10.69 | % |

Tangible common equity reconciliation(a) | | | | | | | |

| Common equity | | | $ | 3,934 | | $ | 3,929 | | $ | 3,932 | | $ | 3,821 | | $ | 3,760 | |

| Goodwill and other intangible assets, net | | | (1,148) | | (1,150) | | (1,152) | | (1,154) | | (1,156) | |

| Tangible common equity | | | $ | 2,786 | | $ | 2,779 | | $ | 2,779 | | $ | 2,667 | | $ | 2,603 | |

| | | | | | | |

| | | | | | | |

Tangible assets reconciliation(a) | | | | | | | |

| Total assets | | | $ | 41,637 | | $ | 41,219 | | $ | 40,703 | | $ | 39,406 | | $ | 38,050 | |

| Goodwill and other intangible assets, net | | | (1,148) | | (1,150) | | (1,152) | | (1,154) | | (1,156) | |

| Tangible assets | | | $ | 40,490 | | $ | 40,070 | | $ | 39,550 | | $ | 38,251 | | $ | 36,893 | |

Average tangible common equity and average common equity Tier 1 reconciliation(a) | | | | | | | |

| Common equity | $ | 3,914 | | $ | 3,776 | | $ | 3,938 | | $ | 3,935 | | $ | 3,868 | | $ | 3,798 | | $ | 3,791 | |

| Goodwill and other intangible assets, net | (1,151) | | (1,160) | | (1,149) | | (1,151) | | (1,153) | | (1,155) | | (1,158) | |

| Tangible common equity | 2,763 | | 2,616 | | 2,789 | | 2,784 | | 2,715 | | 2,642 | | 2,634 | |

| Modified CECL transitional amount | 45 | | 67 | | 45 | | 45 | | 45 | | 67 | | 67 | |

| Accumulated other comprehensive loss | 271 | | 147 | | 302 | | 252 | | 259 | | 254 | | 190 | |

| Deferred tax assets, net | 28 | | 36 | | 28 | | 28 | | 28 | | 29 | | 30 | |

| Average common equity Tier 1 | $ | 3,107 | | $ | 2,867 | | $ | 3,164 | | $ | 3,108 | | $ | 3,047 | | $ | 2,993 | | $ | 2,921 | |

Average tangible assets reconciliation(a) | | | | | | | |

| Total assets | $ | 40,419 | | $ | 36,076 | | $ | 41,076 | | $ | 40,558 | | $ | 39,607 | | $ | 38,385 | | $ | 37,272 | |

| Goodwill and other intangible assets, net | (1,151) | | (1,160) | | (1,149) | | (1,151) | | (1,153) | | (1,155) | | (1,158) | |

| Tangible assets | $ | 39,268 | | $ | 34,916 | | $ | 39,927 | | $ | 39,407 | | $ | 38,454 | | $ | 37,230 | | $ | 36,114 | |

Adjusted net income reconciliation(b) | | | | | | | |

| Net income | $ | 274 | | $ | 257 | | $ | 83 | | $ | 87 | | $ | 103 | | $ | 109 | | $ | 96 | |

| Other intangible amortization, net of tax | 5 | | 5 | | 2 | | 2 | | 2 | | 2 | | 2 | |

| Adjusted net income | $ | 279 | | $ | 262 | | $ | 85 | | $ | 89 | | $ | 105 | | $ | 110 | | $ | 98 | |

Adjusted net income available to common equity reconciliation(b) | | | | | | | |

| Net income available to common equity | $ | 265 | | $ | 249 | | $ | 80 | | $ | 84 | | $ | 100 | | $ | 106 | | $ | 93 | |

| Other intangible amortization, net of tax | 5 | | 5 | | 2 | | 2 | | 2 | | 2 | | 2 | |

| Adjusted net income available to common equity | $ | 270 | | $ | 254 | | $ | 82 | | $ | 86 | | $ | 102 | | $ | 108 | | $ | 95 | |

Selected trend information(d) | | | | | | | |

| Wealth management fees | $ | 61 | | $ | 64 | | $ | 21 | | $ | 20 | | $ | 20 | | $ | 20 | | $ | 20 | |

| Service charges and deposit account fees | 38 | | 48 | | 13 | | 12 | | 13 | | 14 | | 15 | |

| Card-based fees | 33 | | 33 | | 12 | | 11 | | 11 | | 11 | | 11 | |

| Other fee-based revenue | 13 | | 13 | | 5 | | 4 | | 4 | | 3 | | 4 | |

| Fee-based revenue | 146 | | 158 | | 50 | | 49 | | 48 | | 49 | | 51 | |

| Other | 48 | | 63 | | 17 | | 17 | | 14 | | 13 | | 20 | |

| Total noninterest income | $ | 194 | | $ | 221 | | $ | 67 | | $ | 66 | | $ | 62 | | $ | 62 | | $ | 71 | |

Pre-tax pre-provision income(e) | | | | | | | |

| Income before income taxes | $ | 344 | | $ | 326 | | $ | 103 | | $ | 111 | | $ | 131 | | $ | 134 | | $ | 122 | |

| Provision for credit losses | 62 | | 13 | | 22 | | 22 | | 18 | | 20 | | 17 | |

| Pre-tax pre-provision income | $ | 406 | | $ | 339 | | $ | 125 | | $ | 133 | | $ | 149 | | $ | 154 | | $ | 139 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Efficiency ratio reconciliation(f) | | | | | | | |

| Federal Reserve efficiency ratio | 58.17 | % | 62.32 | % | 60.06 | % | 58.49 | % | 56.07 | % | 55.47 | % | 60.32 | % |

| Fully tax-equivalent adjustment | (0.84) | % | (0.98) | % | (0.89) | % | (0.85) | % | (0.79) | % | (0.77) | % | (0.87) | % |

| Other intangible amortization | (0.67) | % | (0.75) | % | (0.69) | % | (0.68) | % | (0.66) | % | (0.62) | % | (0.67) | % |

| Fully tax-equivalent efficiency ratio | 56.67 | % | 60.60 | % | 58.50 | % | 56.96 | % | 54.64 | % | 54.08 | % | 58.79 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Numbers may not sum due to rounding.

(a)Tangible common equity and tangible assets exclude goodwill and other intangible assets, net.

(b)Adjusted net income and adjusted net income available to common equity, which are used in the calculation of return on average tangible assets and return on average tangible common equity, respectively, add back other intangible amortization, net of tax.

(c)These capital measurements are used by management, regulators, investors, and analysts to assess, monitor, and compare the quality and composition of our capital with the capital of other financial services companies.

(d)These financial measures have been included as they provide meaningful supplemental information to assess trends in the Corporation’s results of operations.

(e)Management believes this measure is meaningful because it reflects adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations, and enhance comparability of results with prior periods.