Filed by First Majestic Silver Corp. Pursuant to Rule 425 under the

Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Gatos Silver, Inc. (Commission File No. 001-39649) 121 Mining Investment a Corporate Update November 14, 2024 TSX | AG NYSE |

AG FSE | FMV

CAUTIONARY DISCLAIMER Certain statements contained herein regarding First

Majestic Silver Corp. (the “Company”) and its operations constitute discussed in the section entitled Description of the Business - Risk Factors in the Company’s Annual Information Form for the “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of year ended December 31, 2023, available on www.sedarplus.ca, and as an exhibit to its most recently filed Form 40-F on file with the

Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such the United States Securities and Exchange Commission in Washington, D.C., which is available on EDGAR at sections and other applicable

laws and “forward-looking information” under applicable Canadian securities laws (collectively, www.sec.gov/edgar or on First Majestic’s website. Although the Company has attempted to identify important factors that

“forward-looking statements”). These statements relate to future events or the future performance, business prospects or could cause actual results to differ materially from those contained in forward-looking statements, there may be

other factors opportunities for First Majestic that are based on forecasts of future results, estimates of amounts not yet determinable and that cause results not to be as anticipated, estimated or intended. The Company believes that the

expectations reflected in assumptions of management of First Majestic made in good faith in light of management’s experience and perceptions of these forward-looking statements are reasonable, however there can be no assurance that such

statements will prove to be historical trends, current conditions and expected future developments. Forward-looking statements include, but are not accurate, as actual results and future events could differ materially from those anticipated in such

statements. Accordingly, limited to, statements with respect to: closing of the transaction (the “Transaction”) with Gatos Silver, Inc. (“Gatos”) and the readers should not place undue reliance on forward-looking statements.

These statements speak only as of the date hereof. terms and timing related thereto, expected free cash flow from Gatos, expected value creation for shareholders, the future The Company does not undertake to update any forward-looking statements

that are incorporated by reference herein, except price of silver and other metals, the global supply and market for precious metals, revenue, the estimation of mineral reserves in accordance with applicable securities laws. and resources, the

realization of mineral reserve estimates, the timing and amount of estimated future production, life of mine The Company notes that changes in climate conditions could adversely affect the business and operations through shifting estimates, recovery

rates, costs of production (including cash costs and all-in sustaining costs), capital expenditures, margin weather patterns, environmental incidents, and extreme weather events. This can include changes in snow and precipitation estimates, costs

and timing of the development of new deposits, exploration programs, the timing and payment of dividends, levels, extreme temperatures, changing sea levels and other weather events which can result in frozen conditions, flooding, timing and possible

outcomes of pending litigation and tax claims, the market for the Company’s shares and the Company’s droughts, or fires. Such conditions could directly or indirectly impact our operations by affecting the safety of our staff and the ESG

score performance. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. communities in which we operate, disrupting safe access to sites, damaging facilities and equipment, disrupting energy and

Consequently, guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon guidance water supply, creating labor and material shortages and can cause supply chain interruptions. There is no assurance that the and

forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they Company will be able to successfully anticipate, respond to or manage risks associated with severe climate conditions. Any are placed

will occur. such disruptions could have an adverse effect on the Company’s operations, production, and financial results. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as plans ,

expects or does not expect , is expected , budget , scheduled , estimates , forecasts , intends , anticipates or does not Certain Technical Information anticipate , or believes , or variations of such words and phrases or state that certain actions,

events or results may , could , Scientific and technical information regarding Gatos, its direct and indirect subsidiaries and affiliates and their respective would , might or will be taken , occur or be achieved . Actual results may vary from

forward-looking statements. Forward- businesses and properties are derived from disclosure documents publicly filed by Gatos including Gatos’ Annual Report on looking statements are subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, Form 10-K for the year ended December 31, 2023, filed with the SEC on February 20, 2024, as amended by Amendment No. 1 to level of activity, performance or achievements of the Company to be materially

different from those expressed or implied by such annual report filed with the SEC on May 6, 2024, at www.sec.gov/edgar. (the “Gatos Annual Report”) and the technical such forward looking statements, including but not limited to:

satisfaction and waiver of all applicable closing conditions for report entitled “Mineral Resource and Mineral Reserve Update, Los Gatos Joint Venture, Chihuahua Mexico” dated October 20, the Transaction on a timely basis or at all

including, without limitation, receipt of all necessary shareholder, stock exchange and 2023 (the “Gatos Technical Report”), each of which are available on EDGAR at www.sec.gov/edgar or on SEDAR+ at regulatory approvals or consents and

lack of material changes with respect to the Company and Gatos and their respective www.sedarplus.com. The Gatos Technical Report was reviewed on behalf of the Company by Gonzalo Mercado, P.Geo. Internal businesses; the timing of the closing of the

Transaction and the failure of the Transaction to close for any reason; the outcome QP for the Company. To the best of the Company’s knowledge, information and belief as of the date hereof there is no new of any legal proceedings;

unanticipated difficulties or expenditures relating to the Transaction; risks relating to the value of the material scientific and technical information that would make disclosure of the mineral resources or reserves inaccurate or consideration to

be issued in connection with the Transaction; the diversion of management time on pending Transaction- misleading. The Company is not affirming or adopting any statements or reports attributed to Gatos (including prior mineral related issues; risks

related to the integration of acquisitions; risks related to international operations; risks related to joint reserve and resource declaration) in this presentation or made by Gatos outside of this presentation. venture operations; fluctuations in

security markets; the duration and effects of the COVID-19, and any other pandemics on operations and workforce, and the effects on global economies and society; general economic conditions including inflation Non-GAAP Financial Measures risks;

actual results of current exploration activities; actual results of current reclamation activities; reclamation expenses; This presentation includes reference to certain financial measures which are not standardized measures under the

Company’s conclusions of economic evaluations; changes in project parameters as plans continue to be refined; commodity prices; future financial reporting framework. These measures include all-in sustaining costs (or “AISC”) per

silver equivalent ounce, cash costs demand for and prices of metals; possible variations in ore reserves, grade or recovery rates; actual performance and possible per silver equivalent ounce and free cash flow. The Company believes that these

measures, together with measures failure of plant, equipment or processes to operate as anticipated; availability of sufficient water for operating purposes; determined in accordance with IFRS, provide investors with an improved ability to evaluate

the underlying performance of the accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in Company. These measures are widely used in the mining industry as a benchmark for

performance but do not have any the completion of development or construction activities, changes in national and local government, legislation, taxation, standardized meaning prescribed under IFRS, and therefore they may not be comparable to

similar measures disclosed by controls, regulations and political or economic developments; operating or technical difficulties in connection with mining or other companies. The data is intended to provide additional information and should not be

considered in isolation or as a development activities; risks and hazards associated with the business of mineral exploration, development and mining substitute for measures of performance prepared in accordance with IFRS. For a complete description

of how the Company (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); calculates such measures and a reconciliation of certain measures to GAAP terms please see

“Non-GAAP Measures” in the risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom the Company Company’s most recent management discussion and analysis filed on SEDAR+ at

www.sedarplus.ca and EDGAR at does business; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations that www.sec.gov/edgar. Information regarding such measures with respect to Gatos, its direct

and indirect subsidiaries and may impose restrictions on mining, including those currently enacted in Mexico; employee relations; relationships with and affiliates and their respective businesses and properties are derived from disclosure documents

publicly filed by Gatos claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and including the Gatos Annual Report. For a complete description of how Gatos calculates such measures

with respect to the Los labour; the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses, Gatos mine and a reconciliation of certain measures to US GAAP terms, please see “Non-GAAP

Measures” in the Gatos Annual permits and approvals from government authorities; diminishing quantities or grades of mineral reserves as properties are Report. The Company is not affirming or adopting any statements or reports attributed to

Gatos regarding such measures in mined; the Company’s title to properties, changes in climate conditions and extreme weather events, as well as those factors this presentation or made by Gatos outside of this presentation. 2 TSX | AG NYSE | AG

FSE | FMV

CAUTIONARY DISCLAIMER Important Information for Investors and Shareholders

about the Transaction and Where to Find It This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities of First

Majestic or Gatos or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities of First Majestic or Gatos in any jurisdiction in contravention of applicable law. This presentation

may be deemed to be soliciting material relating to the transaction. In connection with the proposed transaction between First Majestic and Gatos pursuant to the Definitive Agreement and subject to future developments, First Majestic will file with

the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 that is expected to include a Proxy Statement of Gatos that will also constitute a Prospectus of First Majestic (the “Proxy

Statement/Prospectus”) and other documents. First Majestic will also file a management proxy circular in connection with the transaction with applicable Canadian securities regulatory authorities. This presentation is not a substitute for any

registration statement, proxy statement, prospectus or other document First Majestic or Gatos may file with the SEC or Canadian securities regulatory authorities in connection with the pending Transaction. Gatos plans to mail to the Gatos

stockholders the definitive Proxy Statement/Prospectus in connection with the transaction and First Majestic will deliver its proxy circular to First Majestic shareholders. INVESTORS AND SECURITY HOLDERS OF GATOS AND FIRST MAJESTIC ARE URGED TO READ

THE PROXY STATEMENT/PROSPECTUS AND MANAGEMENT PROXY CIRCULAR, RESPECTIVELY, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC OR CANADIAN SECURITIES REGULATORY AUTHORITIES CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME

AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FIRST MAJESTIC, GATOS, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able

to obtain free copies of the Proxy Statement/Prospectus (when available), the filings with the SEC that will be incorporated by reference into the Proxy Statement/Prospectus and other documents filed with the SEC by First Majestic and Gatos

containing important information about First Majestic or Gatos and the Transaction through the website maintained by the SEC at www.sec.gov. Investors will also be able to obtain free copies of the management proxy circular and other documents filed

with Canadian securities regulatory authorities by First Majestic, through the website maintained by the Canadian Securities Administrators at www.sedarplus.com. In addition, investors and security holders will be able to obtain free copies of the

documents filed by First Majestic with the SEC and Canadian securities regulatory authorities on First Majestic’s website at www.firstmajestic.com or by contacting First Majestic’s investor relations team. Copies of the documents filed

with the SEC by Gatos will be available free of charge on Gatos’s website or by contacting Gatos’ investor relations team. Participants in the Merger Solicitation First Majestic, Gatos and certain of their respective directors, executive

officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of

the shareholders of First Majestic and the stockholders of Gatos in connection with the transaction, including a description of their respective direct or indirect interests, by security holdings or otherwise, will be included in the Proxy

Statement/Prospectus described above and other relevant documents when it is filed with the SEC and Canadian securities regulatory authorities in connection with the transaction. Additional information regarding First Majestic’s directors and

executive officers is also included in First Majestic’s Notice of Annual Meeting of Shareholders and 2024 Proxy Statement, which was filed with the SEC and Canadian securities regulatory authorities on April 15, 2024, and information regarding

Gatos’s directors and executive officers is also included in Gatos’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 20, 2024, as amended by Amendment No. 1 to such annual report filed with

the SEC on May 6, 2024 and Gatos’ 2024 Proxy Statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2024. These documents are available free of charge as described above. 3 TSX | AG NYSE | AG FSE |

FMV

Mine Production Mined Silver Production Vs. Silver Demand Silver is

critical due to its unique properties, Current silver to gold 1300 making substitution mine supply ratio 7:1 nearly impossible 1100 900 82% of forecasted annual Silver is the single silver supply is sourced most electrically from mining, 18% is 700

conductive metal sourced from recycling 500 Forecasted annual 2024F demand by usages: 300 silver consumption is 61% industrial fabrication ~1,219M ounces 17% coins & bars compared to annual Source: Metals Focus 17% jewelry 100 mine production of

~ 5% silverware 2014 2016 2018 2020 2022 2024F 824M ounces Mine Production Recycling Silver Demand Source: Metals Focus 4 TSX | AG NYSE | AG FSE | FMV Silver Moz Silver

ABOUT THE COMPANY Multi Leverage Asset Goal to Silver Producer ~50% of

revenue from Three doré-producing Become the World’s Largest Silver (50% Gold) underground mines in Mexico Primary Silver Producer North Bullion American Producer Assets First Mint >245,000 Ha of mining Own and produce .999+ claims in

two premier bullion at our minting mining jurisdictions – facility, First Mint, LLC Mexico and Nevada 5 TSX | AG NYSE | AG FSE | FMV

Sustainalytics • ESG Risk Rating improved by 39% year over year. High

• As of Q3 2024 our score of 30.6 is in the top 40% industry performance. Medium S&P Global Low • 2024 Corporate Sustainability Assessment ESG Negligible score improved to 37, well above the Metals & Mining industry average of

29. 37 ISS ESG 31 • As of Q3 2024, both our environment and social 25 scores are in the top 50% of mining industry performance. 20 17 • We achieved placement in the best 10% for the environment sub-topic of “waste and

toxicity,” the social sub-topic of “Product Safety, Quality, and Brand,” and the governance sub-topic of Industry Average “Shareholder Rights.” 2020 2021 2022 2023 2024 6 TSX | AG NYSE | AG FSE | FMV Sustainalytics

S&P Global Measure of performance Measure of risk

FIRST MAJESTIC SILVER ANNOUNCES AGREEMENT TO ACQUIRE GATOS SILVER IN

ALL-SHARE DEAL WORTH ~US$970M • The transaction value is based on the fixed exchange ratio of 2.550 First Majestic Shares per Gatos Share (US$13.49 per share at time of announcement) implying total equity value for Gatos of ~US$970M •

The transaction has been approved by the Board of Directors of First Majestic and Gatos • The Electrum Group LLC has entered into a voting support agreement, representing approximately 32% of Gatos Shares, and will own approximately 12% of the

pro forma entity • The transaction is anticipated to close in January 2025 and is subject to: • The approval of at least 50%+1 of First Majestic shareholder votes cast and 50%+1 of outstanding Gatos Shares • Receipt of any required

regulatory approvals, including clearance from Mexican anti-trust authorities 7 TSX | AG NYSE | AG FSE | FMV

TRANSACTION HIGHLIGHTS Consolidates three world-class, producing silver

mining districts in Mexico under one banner 1 • Cerro Los Gatos (CLG), San Dimas and Santa Elena collectively provide the foundation of a diversified, intermediate primary silver producer Enhances production profile with strong margins 2 (1)

• Combined annual production of 30-32 Moz AgEq, including 15-16 Moz Ag at all-in sustaining costs of US$18.00-US$20.00/oz AgEq Bolsters free cash flow generation 3 (2) • Gatos expected to immediately contribute annual free cash flow of

~US$70M to the combined entity Leverages a highly experienced combined team with a strong track record of value creation in Mexico 4 • Over 20 years of experience operating in Mexico, with an emphasis on socially responsible mining, community

engagement and value creation Maintains peer-leading exposure to silver 5 (3) • Over 50% of pro forma revenue derived from silver compared to an average of ~30% for intermediate silver producing peers Creates a 350,000 ha highly prospective

land package which has yielded a history of exploration success 6 • Cerro Los Gatos contributes 103,000 ha of unencumbered and underexplored land with significant new discovery potential Results in a larger company with a strengthened balance

sheet, leading trading liquidity and improved capital markets profile 7 • Pro forma market cap approaching US$3B, average daily trading liquidity of ~US$49M, and well-positioned to deliver increased shareholder value Realizes meaningful

synergies 8• Corporate cost savings, supply chain and procurement efficiencies, cross-pollination of expertise, and acceleration/optimization of internal projects and exploration programs all expected to deliver meaningful value creation for

all shareholders Source: Capital IQ, Corporate disclosure (1) Based on First Majestic and Gatos 2024 production guidance, adjusted for First Majestic metal price assumptions and shown on an attributable basis. All-in-sustaining costs or

“AISC” are non-GAAP (2) measures. For further information regarding such measures please refer to each companies’ respective separate public disclosure. Based on analyst consensus estimates for 2024. Free cash flow is a non- 8 (3)

GAAP measure. For further information regarding such measure please refer to each companies’ respective separate public disclosure. Based on mid-point of silver production guidance divided by silver TSX | AG NYSE | AG FSE | FMV equivalent

production guidance.

THREE WORLD-CLASS SILVER Producing Assets Cerro Los Gatos (70%) Ag Au Zn Pb

Cu Chihuahua, Mexico MINING DISTRICTS WITH A (1)(2) 2024E Production: 13.5 – 15.0 Moz AgEq MASSIVE 350,000-HECTARE (2) 2024E AISC: US$14.00 – $16.00 / oz AgEq LAND PACKAGE La Encantada Ag Coahuila, Mexico 2024E Production: 2.4 –

2.5 Moz AgEq 2024E AISC: US$26.17 – $27.18 / oz AgEq Del Toro Ag Zacatecas, Mexico Care & Maintenance British Columbia, Canada Durango Santa Elena Ag Au Sonora, Mexico 2024E Production: 9.2 – 9.6 Moz AgEq 2024E AISC: US$15.25 –

$15.64 / oz AgEq Mexico City First Mint Facility Ag Au San Dimas Nevada, USA Durango, Mexico 2024E Production: 9.8 – 10.4 Moz AgEq Ag San Martin Jerritt Canyon Au 2024E AISC: US$18.69 – $19.45 / oz AgEq Jalisco, Mexico Nevada, USA Care

& Maintenance Care & Maintenance Source: Corporate disclosure 9 TSX | AG NYSE | AG FSE | FMV (1) (2) Cerro Los Gatos production shown on a 100% basis. Cerro Los Gatos production and AISC estimates based on 2024 guidance

A TIER 1 SILVER MINE WITH ROBUST EXPLORATION UPSIDE Asset Key Stats

OWNERSHIP▪ 70% Gatos | 30% Dowa Metals & Mining MINE TYPE▪ Underground (1) SILVER PURITY▪ 64% THROUGHPUT▪ Ramping up to +3,500 tpd ▪ 7 years based on currently defined Reserves with MINE LIFE significant

opportunities to extend mine life (2) 2024 GUIDANCE PRODUCTION▪ 13.5 – 15.0 Moz AgEq (8.4 – 9.2 Moz Ag) 2024 GUIDANCE AISC▪ US$14.00 - $16.00/oz AgEq PRODUCES▪ High Ag-bearing Pb and Zn Concentrates • CLG is a

sizeable, low-cost producing silver asset with robust exploration and development potential, operating since 2019 Production Stats (Actual – 100% Basis) • Key position in an established silver district FULL YEAR Q1 2024 Q2 2024 •

Over 103,000 hectares of mineral rights in Chihuahua State, 2023 representing a highly prospective and under-explored district with numerous silver-zinc-lead epithermal mineralized zones AG PRODUCTION (MOZ) 9.2 Moz 2.4 Moz 2.3 Moz • 70% owned

district, with modern, mechanized underground AGEQ PRODUCTION (MOZ) 14.3 Moz 3.7 Moz 3.9 Moz operation AISC (US$/OZ) $15.51 $14.36 $15.26 • Strong JV partner, Japan’s Dowa Metals & Mining Co., Ltd (30%) 10 Source: Corporate

disclosure TSX | AG NYSE | AG FSE | FMV (1) (2) Calculated as 2023 Ag production as a % of 2023 AgEq production. Shown on a 100% basis

LARGE SCALE, LOW-COST AND HIGH-MARGIN CLG is One of the Largest Primary

Silver Mines Globally Comparative Advantages of CLG 2023A AgEq Production (Moz) 2023A Ag Production (Moz) ▪ High-grade primary silver deposit with substantial by-products 23.5 23.3 23.0 21.7 ▪ Deposit geometry and vein width allows for

19.1 efficient, mechanized mining methods 14.4 14.3 ▪ Modern, well-capitalized mine, mill and 12.8 11.9 surface facilities 10.3 9.6 ▪ Proven operating team that continues to 16.8 13.3 12.8 optimize the asset and elevate targets 12.1 9.7

9.7 9.2 6.6 6.4 5.7 1.2▪ Attractive AISC versus comparable primary silver operations Saucito Juanicipio Fresnillo Greens Creek San Julian Palmarejo CLG San Dimas Pirquitas Las Chispas Santa Elena (Fresnillo) (56% Fresnillo (Fresnillo) (Hecla)

(Fresnillo) (Coeur) (70% Gatos / (First Majestic) (SSR) (SilverCrest) (First Majestic) ▪ Stable free cash flow generation / 44% MAG) 30% Dowa) ▪ Significant asset upside and district potential CLG is One of the Lowest-Cost Silver Mines

Currently in Operation (1) (1) 2023 By-Product AISC (US$/oz Ag) 2023 Co-Product AISC (US$/oz AgEq) Peer High $25 Peer High $25 $20 $20 $15 $15 $10 $10 $15.51 Peer Peer $14.73 $11.33 $5 $5 $8.42 Average Average -- -- (2) (3) 4 Peers Gatos Gatos 3

Peers Gatos Gatos (H1'24) (H1'24) Source: Capital IQ, Corporate disclosure (1) (2) 11 Peer AISC figures are based on full-year 2023 reporting; peer costs include both silver and gold operations to reflect the cost base of the operating portfolios.

Peers reporting on a by-product AISC TSX | AG NYSE | AG FSE | FMV (3) basis include Hecla, Coeur, MAG and Endeavour Silver. Peers reporting on a co-product AISC basis include First Majestic (pre-transaction), Fresnillo, and SilverCrest

(1) (3) % of Revenue from Silver (2024E) Gross Margins (H1 2024A) Sector

Top of peer set on leading silver gross margins purity (2) (4) Silver and Silver-Equivalent Production (2024E) Free Cash Flow (2025E) Ag Production (Moz) AgEq Production (Moz) Up-tiers on Significant FCF silver generation production Source: Capital

IQ, Corporate disclosure (1) (2) (3) 12 Mid-point of silver production guidance divided by silver equivalent production guidance. Based on latest management guidance. Calculated as Cost of Sales as a % of Revenue from respective TSX | AG NYSE | AG

FSE | FMV (4) peer income statements, before depreciation. Based on analyst consensus

2024E Operational Guidance Mill Throughput: 2,650 tpd 9.2M – 9.6M

AgEq oz Production: (1.3M – 1.4M Ag oz + 94K - 99K Au oz ) AISC: $15.25 – $15.64 Produces: 100% Doré QUARTER END Full Year 2023 Q3 2024 Q2 2024 Q3 2023 Silver production (oz) 376,203 376,947 374,941 1,176,591 • Continued

strong metallurgical recoveries due to the operational optimization of the new dual circuit plant Silver eqv. production (oz) 2,685,375 2,580,497 2,669,411 9,571,792 • Exploration drilling focused in the search of a new mineralized Silver

grade (g/t) 68 69 75 64 vein Gold grade (g/t) 3.50 3.52 4.09 3.77 • Upgraded the LNG facility to 24MW (from 12MW) to power the Ermitaño mine and dual-circuit processing plant Cash costs / oz ($US) $11.96 $12.25 $11.72 $11.87 •

Certified ISO 9001 Assay Lab on site, increasing reliability as well All-in Sustaining cost / oz ($US) $14.38 $15.07 $14.68 $14.83 as reducing costs and allowing for faster assay turnaround times 13 TSX | AG NYSE | AG FSE | FMV

DRILLING FOCUSED ON TESTING CONTINUITY, EXTENT & GRADE OF

NAVIDAD’S MINERALIZATION IN H2 2024 Ermitaño-Navidad Ermitaño-Splay Ermitaño-Luna Ermitaño-Central W E Mined YE 2023 The Navidad Vein System: New High-Grade Gold and Silver Discovery EW-23-364 8.15 g/t Au and 427 g/t Ag

(July 2024) over 4.78 m (1079 AgEq) OPEN EW-24-368 54.93 g/t Au and 399 g/t Ag EW-24-370 EW-24-367 over 1.82 m (4794 AgEq) (No vein) 10.13 g/t Au and 86 g/t Ag over 4.42 m (896 AgEq) EW-23-366 1.4 g/t Au and 124 g/t Ag EW-24-371 EW-24-374 over 2.85

m (236 AgEq) EW-24-372 EW-24-373 EW-23-360 EW-23-359 3.48 g/t Au and 74 g/t Ag 3.27 g/t Au and 39 g/t Ag over 2.39 m (353 AgEq) over 2.46 m (301 AgEq) • See Appendix Tables on Slide 32 for select Ermitaño-Navidad significant intercept

details 14 TSX | AG NYSE | AG FSE | FMV

2024E Operational Guidance Mill Throughput: 2,300 tpd 9.8M – 10.4M

AgEq oz Production: (5.2M – 5.5M Ag oz + 56K – 59K Au oz) AISC: $18.69 – $19.45 Produces: 100% Doré QUARTER END Full Year 2023 Q3 2024 Q2 2024 Q3 2023 Silver production (oz) 1,046,340 1,141,906 1,548,203 6,355,308 • Over

50% of the power requirements provided by environmentally clean, low-cost hydroelectric power Silver eqv. production (oz) 2,110,905 2,114,072 3,010,458 12,789,920 • Focused on improvements in dilution control from long hole Silver grade (g/t)

188 210 237 240 stoping and cut and fill in order to increase head grades • 2024 exploration budget is the largest since asset Gold grade (g/t) 2.12 2.15 2.71 2.85 acquisition. The focus is on the West Block“, where several Cash costs /

oz ($US) $16.50 $16.66 $14.07 $12.51 of the districts most prominent producers are trending in this direction All-in Sustaining cost / oz ($US) $21.44 $21.78 $17.76 $16.48 15 TSX | AG NYSE | AG FSE | FMV

2024E Operational Guidance Mill Throughput: 2,715 tpd Production: 2.4M

– 2.5M Ag oz AISC: $26.17 – $27.18 Produces: 100% Doré QUARTER END Full Year 2023 Q3 2024 Q2 2024 Q3 2023 Silver production (oz) 545,031 585,329 565,724 2,718,856 • Natural gas generators currently supplying 90% of power

requirements Silver eqv. production (oz) 550,042 589,060 573,458 2,745,622 • Optimizing costs and improving efficiencies Silver grade (g/t) 110 129 109 121 • Ramping up throughput at the mill to budgeted rates in Cash costs / oz ($US)

$25.24 $23.69 $25.63 $20.05 Q4 2024 All-in Sustaining cost / oz ($US) $30.10 $27.87 $29.86 $24.28 16 TSX | AG NYSE | AG FSE | FMV

• Located in Elko County, Nevada, U.S.A. • Underground mining

operations temporarily suspended in March 2023 • Focused on new regional discoveries across the large 30,821- hectare (119 square mile) land package; ~$10M 2024 exploration budget • Current known Measured & Indicated resources of

1.83M oz contained (10,918K tonnes @ 5.2 g/t Au) & Inferred resources of 1.91M oz contained (12,427K tonnes @ 4.8 g/t Au) • Processing facility contains one of only three Roasters in the State of Nevada • Analyzing the optimization

of bulk mining and cost-effective mining methods • Continuing modernization of the open-air processing plant to better withstand severe weather conditions 17 TSX | AG NYSE | AG FSE | FMV

FIRST, WE MINE. THEN WE MINT. • Located in Nevada, U.S.A. •

Commenced producing bullion in Q1 2024 • Production led by industry veterans with over 20 years of experience working at two of the largest mints in North America • High efficiency production allows the mint to produce over 10% of the

Company’s production from our Mexican operations • Eliminating the middleman by vertically integrating the minting process and controlling the supply chain while capitalizing on the strong investment demand for physical silver and above

average premiums • State-of-the-art machines require less electricity and release no gas emissions compared to the traditional minting processes • Installed and commissioned new coin press equipment in Q3 2024 to expand product range 18

TSX | AG NYSE | AG FSE | FMV

• Closing and integrating Gatos Silver into the First Majestic

portfolio • Ongoing exploration activities, mine plan optimization and processing plant improvements planned at Jerritt Canyon • Continued improvements in metallurgical recoveries through implementation of fine grinding and other R&D

• Over 210,000 m of exploration planned in 2024 - West, Central & Sinaloa blocks, Los Hernandez, Ermitaño, Navidad & Jerritt Canyon • Santa Elena’s new high-grade discovery, Navidad (July 30, 2024): • EW-24-364:

8.2 g/t Au and 427 g/t Ag over 4.78 m Santa Elena’s 24MW LNG Power Plant • EW-24-370: 10.1 g/t Au and 86 g/t Ag over 4.42 m • Higher Silver Prices!! 19 TSX | AG NYSE | AG FSE | FMV

Available Liquidity • $258.3M cash on hand, including $154.7M Cash

and Cash Equivalents plus $103.9M of Restricted Cash • Total Working Capital of $238.2M inclusive of $64.0M of Marketable Securities, including: • 5% interest in Metalla Royalty & Streaming • 45% interest in Sierra Madre Gold

& Silver Revolving • 36% interest in Silver Storm Mining Working Credit Available • Revolving Credit Facility of $175.0M ($139.6M undrawn) Capital Facility Liquidity • Senior Convertible Debenture @ 0.375% in the amount of

$174.3M (Undrawn) $230.0M $377.9M $139.6M Marketable Securities $64.0M The above liquidity is exclusive of • All amounts shown are in US dollars $103.9 million in restricted cash • As of 09/30/24 20 TSX | AG NYSE | AG FSE |

FMV

Capital Structure Research Coverage Bank of Montreal Scotiabank Market

Capitalization: $2.39B USD / $3.33B CDN Cormark Securities Shares Outstanding (09/30/2024): 302M (FD 312M) Toronto Dominion 3M Avg. Daily Volume (NYSE & TSX): 9.2M Shares; ~$55M daily liquidity H.C. Wainwright National Bank Financial Share

Price: $7.94 USD / $11.07 CDN TheGoldAdvisor.com 52 Week Low/High: $4.17 / $8.42 | $5.67 CDN / $11.58 CDN • As of 10/29/24 unless stated otherwise *All amounts are in U.S. dollars unless stated otherwise. 2% Top Shareholders % S/O Van Eck

(GDXJ & GDX) 9.6% The Vanguard Group 3.6% 39% Mirae Asset Global Investments 2.6% 59% BlackRock Asset Management 1.9% Tidal Investments LLC 1.9% Dimensional Fund Advisors 1.6% Keith Neumeyer (President & CEO) 1.4% Citadel Advisors 1.0% KBC

Group NV 0.7% State Street Global Advisors 0.7% Institutional Retail Insiders Management • As of 10/29/24 21 TSX | AG NYSE | AG FSE | FMV

Under the Company’s dividend policy, the quarterly dividend per

common share is targeted to equal approximately 1% of the Company’s revenues. The Q3 2024 cash dividend of $0.0048 per share will be paid to holders of record of First Majestic as of the close of business on November 15, 2024, and will be paid

out on or about November 29, 2024. 22 TSX | AG NYSE | AG FSE | FMV

121 Mining Investment London, UK November 14-15, 2024 First Majestic

Silver Corp. 1800 - 925 West Georgia Street Vancouver, British Columbia, Canada V6C3L2 Email: info@firstmajestic.com Tel: 604.688.3033 Fax: 604.639.8873 North American Toll-Free: 1.866.529.2807 Bullion Sales Email: customersupport@firstmajestic.com

Email: customersupport@firstmint.com

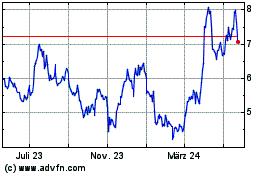

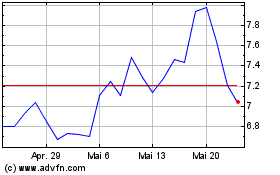

First Majestic Silver (NYSE:AG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

First Majestic Silver (NYSE:AG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024