Regulatory News:

As announced on February 18, 2014 as part of the proposed key

transactions for the development and growth of the Group, PSA

Peugeot Citroën (Paris:UG) announces the launch of “Accelerate”,

the first Group-wide employee share offering.

This plan will be offered in 14 countries worldwide (including

major European countries as well as Brazil and China) and covers

approximately 100,000 Group employees. The goal of the offering is

to involve employees in the company’s corporate turnaround project,

“Back in the race”, as a complementary step to the capital increase

which took place in the first half of 2014.

The offering concerns a maximum of 3,500,000 newly-issued

shares. The settlement-delivery of shares should occur on January

29, 2015. The main terms and conditions of this offering are

described below.

Issuer

Peugeot S.A. (the Company)Compartment A – NYSE Euronext Paris

(France)Common share ISIN code: FR0000121501 UG

Scope of the Transaction - Offered Securities

The 21st resolution of the General Shareholders’ Meeting of

April 25, 2014 authorized the Management Board to increase the

share capital of the company of up to a maximum amount of 3,500,000

shares in connection with this offering.

In accordance with this authorization, the Management Board,

with the approval of the Supervisory Board, decided, on May 22,

2014, on the principle of the plan within the maximum limit of

3,500,000 shares, approved the main features of the offering and

delegated to the Chairman of the Management Board the powers

required for its implementation.

According to the projected time line, the Chairman of the

Management Board, acting on the delegation granted to him by the

Management Board, will decide on the final terms and conditions of

the offer on December 17, 2014, notably the dates of the

revocation/subscription period and the subscription price of the

new shares to be issued to employees. The subscription price will

be equal to 80% of the “Reference Price.”

In accordance with the provisions of Article L. 3332-19 of the

French Labor Code, the Reference Price is equal to the average of

the Peugeot S.A. share price as listed on compartment A of NYSE

Euronext Paris during the twenty (20) trading days preceding the

decision of the Chairman of the Management Board setting the

subscription price.

The reservation period will be open from October 31 to November

17, 2014.

The revocation/subscription period will be opened from December

17 until December 21, 2014, after the subscription price has been

communicated to the employees. During this period, the employees

will be able to revoke their request to subscribe that was

submitted during the reservation period.

The new shares will be entirely assimilated into the existing

common shares comprising the Company’s share capital. The Company’s

capital increase under this offering is scheduled for January 29,

2015.

Conditions of the Subscription

• Beneficiaries of the share offering reserved for

employees: the beneficiaries of the offering are employees of

the Group who are members of the Group Savings Plan (Plan d’Epargne

d’Entreprise du Groupe, or PEG) and/or the International Group

Savings Plan (Plan International d’Epargne Salariale, or PIES)

regardless of the nature of their employment contract (fixed or

indefinite term length, full or part-time employment) and that are

able to justify a three-month seniority by the end of the

subscription period, i.e., December 21, 2014, and persons eligible

in accordance with applicable legislation.

• Terms and conditions of the subscription: the shares

will either be subscribed to directly or through a French

collective employee shareholding plan (Fonds Commun de Placement

d’Entreprise, or FCPE), in accordance with applicable regulatory

and/or tax legislation in the various countries of residence of the

capital increase beneficiaries.

• Subscription formula: employees will be able to

subscribe to Peugeot S.A. shares within the framework of a

“classic” subscription formula (“Accelerate Classic”) and/or

in a “secured” subscription formula (“Accelerate Secure”)

(which allows the employee to benefit from a guarantee on their

investment). Employees will benefit from a matching contribution

provided by the Group as described in the employee documentation

relating to the offering that will be supplied to them. The

matching contribution will consist of the delivery of treasury

shares.

• Lock-up period applicable to the Peugeot S.A. shares or to

the corresponding FCPE units: the subscribers to the offer will

hold either the shares subscribed to directly, or the corresponding

units of the FCPEs, during a five-year period, except in the event

of an authorized early-exit situation.

• Exercising voting rights attached to the shares: when

shares are subscribed to, then held, via the intermediary of a

FCPE, voting rights attached to these shares will be exercised by

the relevant FCPE Supervisory Board; when shares are subscribed to

directly by employees, voting rights will be exercised individually

by the relevant employees.

Hedging Transactions

The implementation of the secure subscription formula may lead

the financial institution structuring the offer to undertake

hedging transactions over the course of the offering.

Listing

The request to list the newly-issued Peugeot S.A. shares to

trading on the same line of the compartment A of NYSE Euronext

Paris (ISIN code: FR0000121501 UG) as the existing shares will be

made as soon as possible following the completion of the capital

increase scheduled to take place on January 29, 2015.

Special Note Regarding the International Offering

This press release does not constitute an offer to sell or a

solicitation to subscribe to Peugeot S.A. shares. The offering of

Peugeot S.A. shares reserved for employees will be conducted only

in countries where such an offering has been registered with or

notified to the competent local authorities and/or following the

approval of a prospectus by the competent local authorities or in

consideration of an exemption of the requirement to prepare a

prospectus or to proceed to a registration or notification of the

offering.

More generally, the offering will only be conducted in countries

where all required filing procedures and/or notifications have been

completed and the necessary authorizations have been obtained.

Employee Contact

For all questions regarding this offering, the beneficiaries may

address their Human Resources contact person and/or any other

person specified in the employee documentation.

About PSA Peugeot CitroënWith its three world-renowned

brands, Peugeot, Citroën and DS, PSA Peugeot Citroën sold 2.8

million vehicles worldwide in 2013, of which 42% outside Europe.

The second largest carmaker in Europe, PSA Peugeot Citroën recorded

sales and revenue of €54 billion in 2013. The Group is the European

leader in low-carbon vehicles, with average emissions of 115.9

grams of CO2 per km in 2013. PSA Peugeot Citroën has sales

operations in 160 countries. It is also involved in financing

activities (Banque PSA Finance) and automotive equipment

(Faurecia).For more information, please visit

psa-peugeot-citroen.com.

Communications Division - 75 avenue de la

Grande-Armée - 75116 Paris, France+33 1 40 66 42 00 –

psa-peugeot-citroen.com – @PSA_news

PSA Peugeot CitroënMedia relationsJean-Baptiste

Thomas, +33 (0) 1 40 66 47

59jean-baptiste.thomas@mpsa.comorPierre-Olivier Salmon, +33 (0) 1

40 66 49 94pierreolivier.salmon@mpsa.comorCaroline

Brugier-Corbière, +33 (0) 1 40 66 58

54caroline.brugier-corbiere@mpsa.comorInvestor

relationsCarole Dupont-Pietri, +33 (0) 1 40 66 42

59carole.dupont-pietri@mpsa.comorAnne-Laure Desclèves, +33 (0) 1 40

66 43 65annelaure.descleves@mpsa.comorKarine Douet, +33 (0) 1 40 66

57 45karine.douet@mpsa.com

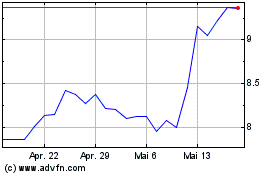

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

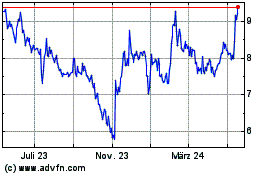

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024