UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM SD

Specialized Disclosure Report

Tesla, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34756 |

|

91-2197729 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1 Tesla Road

Austin, Texas 78725

(Address of principal executive offices, including

zip code)

Brandon Ehrhart

General Counsel and Corporate Secretary

(512) 516-8177

(Name and telephone number, including area code,

of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which

this form is being filed, and provide the period to which the information in this form applies:

x

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31,

2023.

¨

Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended .

Section 1 – Conflict Minerals Disclosure

| Item 1.01 | Conflict Minerals Disclosure and Report |

A copy of Tesla, Inc.’s Conflict Minerals Report for the

year ended December 31, 2023 is provided as Exhibit 1.01 hereto and is publicly available online at https://www.tesla.com/about/legal.

A copy of Tesla, Inc.’s Conflict Minerals Report for the

year ended December 31, 2023 is attached hereto as Exhibit 1.01.

Section 2 – Resource Extraction Issuer Disclosure

| Item 2.01 | Resource Extraction Issuer Disclosure and Report |

Not applicable.

Section 3 – Exhibits

Exhibit 1.01 – Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| |

|

TESLA, INC. |

| |

|

|

| |

By: |

/s/ Brandon Ehrhart |

| |

|

Brandon Ehrhart

General Counsel and Corporate Secretary |

Date: May 31, 2024

Exhibit 1.01

Tesla Conflict Minerals Report

(This report has been filed with

the U.S. Securities and Exchange Commission to comply with the reporting period for the calendar year ended December 31, 2023.)

Tesla’s Mission

The goal of Tesla is to accelerate the world’s transition to

sustainable energy.

Overview of Tesla

We design, develop, manufacture, sell and lease high-performance fully

electric vehicles and energy generation and storage systems, and offer services related to our products. We generally sell our products

directly to customers, and continue to grow our customer-facing infrastructure through a global network of vehicle service centers, Mobile

Service, body shops, Supercharger stations and Destination Chargers to accelerate the widespread adoption of our products. We emphasize

performance, attractive styling and the safety of our users and workforce in the design and manufacture of our products and are continuing

to develop full self-driving technology for improved safety. We also strive to lower the cost of ownership for our customers through continuous

efforts to reduce manufacturing costs and by offering financial and other services tailored to our products. Our mission is to accelerate

the world’s transition to sustainable energy. We believe that this mission, along with our engineering expertise, vertically integrated

business model and focus on user experience differentiate us from other companies.

Introduction

Tesla is committed to sourcing only

responsibly produced materials. This means having safe and humane working conditions in our supply chain and ensuring that workers

are treated with respect and dignity. In addition to the Tesla Supplier Code of Conduct

(“Code”), our Global Human Rights and Responsible Sourcing policies (“Policies”) outline our

expectations for all suppliers and partners with whom we work, as well as our commitment to respect human rights and responsible

sourcing. We follow all applicable U.S. and foreign legal requirements and require our supply base to do the same. Our

contractual agreements with suppliers reinforce these requirements and establish expectations of adherence to Tesla’s Code and

Policies. We ask our suppliers to provide us with evidence that their operations address these social, environmental and

sustainability issues, and that their sourcing is done in a responsible manner.

Tesla’s supply chain has a unique hybrid of traditional automotive

and high-tech industry suppliers from around the world. Most of our Tier 1 suppliers (i.e., directly sourced suppliers) do not purchase

raw materials directly from mining/refining parties and instead obtain them from their upstream suppliers and sub-suppliers. Therefore,

reliably determining the origin of all of our suppliers’ products is a challenging task, but the due diligence practices outlined

below provide additional information and transparency that help us and our suppliers adhere to the responsible sourcing principles of

our Code and Policies.

Our Tier 1 automobile parts suppliers are required to register and

complete the domestic and international material compliance requirements in the automotive industry standard International Material Data

System (“IMDS”) to meet European Union and other international materials and environmental related regulations. This

requirement is also mandated for all suppliers who supply their products or raw materials to us as part of our production part approval

process.

Tesla’s Responsible Supply Chain

All of Tesla’s supply chain partners are subject to our Code.

This Code is the foundation for ensuring social and environmental responsibility and ethical conduct throughout our supply chain, no matter

the industry, region or materials. Tesla continues to identify and do business with organizations that conduct their business with principles

that are consistent with our Code.

Tesla, along with our partners and independent third parties, conducts

audits to observe these principles in action. If there is a reasonable basis to believe a supplier is in violation of our Code, Tesla

works with the supplier to remediate and will transition away from that relationship unless the violation is remediated in a satisfactory

manner.

In addition to our Code, Tesla’s Global Human Rights Policy formalizes

our commitment to uphold, respect and embed human rights and the values they represent throughout our business as we accelerate the world’s

transition to sustainable energy. The ethical treatment of all people and regard for human rights is core to our mission of a sustainable

future for all. The policy is applicable to both our own operations and our supply chain, and includes the communities impacted by our

operations and our supply chain.

Next, our Responsible Sourcing Policy helps to ensure that

all companies or individuals involved in a supply chain producing goods and services for Tesla, whether directly and indirectly, conduct

their worldwide operations in a responsible manner, consistent with Tesla’s mission. Tesla's suppliers are required to use reasonable

efforts to ensure that the products they supply to Tesla do not contribute to armed conflict, human rights abuses or environmental degradation,

regardless of sourcing location. For all materials used in Tesla products, Tesla requires its suppliers to establish policies, due diligence

frameworks and management systems consistent with the OECD Due Diligence Guidance for Responsible Business Conduct, and the OECD Due Diligence

Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

This report details our due diligence efforts to understand

the origin of the conflict minerals used in our products and the company’s efforts to eliminate from our value chain any benefits

our sourcing of these materials may give to armed groups in the Democratic Republic of the Congo and its adjoining countries (“DRC

region”) or other conflict-affected and high-risk areas (“CAHRAs”). The SEC currently defines “conflict

minerals,” also known as “3TG,” as:

| (i) | columbite-tantalite (tantalum); |

| (iv) | wolframite (tungsten); and |

| (v) | any derivatives of the above. |

When sourcing 3TG materials, Tesla expects suppliers to share our

goal and implement steps to create a responsible supply chain. In 2023, we established more rigorous requirements for suppliers

using 3TG materials and worked collaboratively with the Tesla teams that own supplier business relationships to address potential

compliance concerns. We require sourcing (directly and upstream) from smelters or refiners (“SoRs”) that have been

validated as responsible sources by the Responsible Minerals Initiative’s (“RMI”) Responsible Minerals

Assurance Process (“RMAP”) or an equivalent program, and therefore represented in the RMAP Conformant List. In addition,

regardless of RMAP status, if Tesla concludes that an SoR presents a high risk of non-compliance with Tesla's Code and Policies,

Tesla may within Tesla’s sole discretion prohibit it from being used in Tesla's supply chain. We expect suppliers to

communicate and extend Tesla’s requirements to their own suppliers. When we discover suppliers with non-conformant or

high-risk SoRs, Tesla requires these suppliers to transition to a fully conformant, lower risk supply chain without delay. Suppliers

may be requested to provide evidence of changes to their supply chain to prove the removal of non-conformant SoRs.

Tesla recognizes the importance of continuing to source from potentially

high-risk contexts, including for example, the DRC region or other CAHRAs; practicing risk mitigation is a preferred path to an embargo

or termination of sourcing due to the importance of material production to livelihoods in those areas.

The sharing of sourcing information is critical to our efforts to source

responsibly, and all Tesla suppliers are required to provide information upon request on their sourcing, due diligence efforts and findings

for all materials. For more information, please see Tesla’s Responsible Sourcing Policy.

In-Scope Products

As a company at the intersection of technology, transportation (electric

vehicles) and energy (solar and storage), some products manufactured by Tesla contain some portion of 3TG.

Automotive Suppliers

We use the IMDS to help determine which automotive suppliers to include

in our 3TG minerals due diligence inquiries. Utilizing the IMDS database, we review our entire Tier 1 supplier base to determine which

suppliers are likely to supply products with 3TG. To best address the use of 3TG within our supply chain, we engage with suppliers who

have a likelihood of using the covered materials in the products supplied to us in our Reasonable Country of Origin Inquiry (“RCOI").

Non-Automotive Suppliers

In an effort to include all possible relevant sources of 3TG in our

due diligence, Tesla also requests Tier 1 suppliers in our solar and energy supply chains to complete CMRTs and includes them in the RCOI

with our automotive suppliers.

Reasonable Country of Origin Inquiry

Due to Tesla’s downstream position in our supply chain, several

tiers removed from 3TG SoRs, Tesla’s efforts to understand the origin of raw materials rely on the cooperation of our Tier 1 and

other upstream suppliers. In 2023, more than 586 Tier 1 suppliers were selected to take part in our RCOI process, including automotive,

solar and energy suppliers. As Tesla’s supply network expands, we will continue to inform suppliers on our responsible sourcing

requirements as outlined in our Code and Policies, as well as on the need to conduct due diligence efforts and share information on the

sourcing of 3TG.

For the 2023 reporting year, we sent in-scope suppliers a formal communication

of our expectations and utilized the RMI CMRT process to gather information from our Tier 1 suppliers. We expect our suppliers to: review

and adhere to Tesla’s Code and Policies; complete the Tesla-specific CMRT request; remove high-risk and non-conformant SoRs from the supply

chain; establish and document due diligence frameworks consistent with the OECD Due Diligence Guidance; source from SoRs that participate

in RMAP or another OECD-aligned independent assessment program; implement due diligence practices (including recommendation to become

a member of the RMI, participate in the Minerals Grievance Platform, utilize resources such as the CMRT Completion Guide available in

English, Chinese, German and Japanese) and extend and communicate these expectations to upstream suppliers. In addition, Tesla engaged

a reputable third-party service provider with experience in responsible sourcing of minerals data collection to assist with the engagement

and training of suppliers, collection of CMRTs, validation of responses, SoR identification and risk assessment. Using a combination of

outreach via e-mail and phone, our in-scope Tier 1 suppliers were contacted multiple times throughout the year.

We aim to achieve a high response rate (percentage of Tier 1 suppliers

that provide a complete CMRT for the current reporting year), as this will give us the best opportunity to identify opportunities for

improvement. We also strive to obtain information that is most relevant to the supply chains of the parts and products supplied to Tesla.

During the 2023 reporting year, we focused on collecting Tesla product-specific information from our Tier 1 suppliers. The aim of this

change in process from prior years is to encourage Tier 1 suppliers to submit information only relevant to the parts supplied to Tesla,

rather than information relevant to their company as a whole. We saw more suppliers comply with this expectation, increasing our response

rate of acceptable submissions by 6% from the 2022 reporting year. Despite Tesla’s requests for only product- specific CMRT submissions,

the information submitted by some Tier 1 suppliers is likely broader than just SoRs relevant to Tesla, due to the high volume of SoRs

reported for any given supply chain, and thus, is likely over-reporting for the facilities relevant to Tesla. Given the fungible nature

of the materials subject to this disclosure, as well as the complex and long supply chains for products that contain these materials,

it is difficult for suppliers to identify the specific raw material suppliers that are ultimately a source of material for Tesla products.

We continue to work to educate suppliers on our expectations to provide information relevant to Tesla and seek efforts to improve the

transparency and due diligence process.

Industry Collaboration

We recognize the importance of working with industry peers and organizations

and believe that a consolidated effort is the most efficient method to determine the reasonable country of origin. The RMI is one of the

most utilized and respected resources for companies addressing issues related to the responsible sourcing of minerals in supply chains.

Tesla collaborates with the RMI and its member companies to address challenges and emerging issues in the area of responsible minerals

sourcing, including through participation in RMI workgroups to listen, learn, partner and co-design shared solutions. In 2023, a member

of Tesla’s Responsible Sourcing team served as Co-Chair (with RMI) of the RMI’s Gold Team Working Group, a workgroup aiming

to increase the uptake of responsible sourcing practices in the gold supply chain. Tesla also participated in the Smelter Engagement Team

and the Due Diligence Practices Team.

In 2023, we met with representatives from the RMI, peer companies in

the automotive and technology sectors and civil society stakeholders to discuss opportunities to continually improve the industry’s

approach to responsible 3TG sourcing. We provided feedback to the RMI and other OECD-aligned, independent assessment programs (such as

London Bullion Market Association’s Responsible Gold Programme) on opportunities to strengthen the industry’s audit protocol,

upstream due diligence and collective industry tools. We also attended industry forums including the 2023 RMI conference and the 2023

OECD Forum on Responsible Mineral Supply Chains.

The information in Annex I is based on RMI’s RCOI data as of

March 29, 2024 and Tesla’s 2023 supplier CMRT responses received. Based on this information, the countries of origin of the

3TG contained in our products may include the countries listed below in Annex I. This information may be underinclusive to the extent

any of our suppliers have not provided complete information regarding the countries of origin in their or their sub-suppliers’ supply

chains. At the same time, this list may be overinclusive due to the RMI’s database including countries from the supply chains of

all of its participants and not just Tesla. Annex II lists the smelters and refiners that may be in Tesla’s or our suppliers’

supply chains with respect to 3TG contained in our products, and this information is based on the 2023 supplier CMRT responses received.

Like the RCOI data, this SoR list may be under or overinclusive due to the nature of how information is collected and distributed. Additional

details of how this information is compiled and its connection to Tesla can be found in the sections for each of the Annexes below.

Description of Due Diligence

Our 3TG responsible sourcing of minerals processes and policies are

designed to conform in all material respects with the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected

and High-Risk Areas (“OECD Guidance”).

Step 1: Establish Strong Company Management Systems

As noted above, Tesla has a Global Human Rights Policy (https://www.tesla.com/legal/additional-resources#global-human-rights-policy)

and Responsible Sourcing Policy (https://www.tesla.com/legal/additional-resources#responsible-sourcing-policies), both of

which were updated in 2023, as well as the Tesla Supplier Code of Conduct (https://www.tesla.com/legal/additional-resources#supplier-code-of-conduct).

These policies are publicly available through our website.

The Responsible Sourcing Policy is applicable for all materials and

all sourcing regardless of sourcing location, and therefore constitutes our policy for 3TG. We updated our Responsible Sourcing Policy

to clarify that we expect suppliers to source from SoRs that have engaged in the RMAP and set similar expectations with their suppliers.

The RMAP standards are developed to meet the requirements of the OECD Guidance, the Regulation (EU) 2017/821 of the European Parliament

and the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act. We also clarify in the Responsible Sourcing Policy that Tesla

recognizes the importance of continuing to source from potentially high-risk countries, including for example, the Democratic Republic

of the Congo or other Conflict-Affected and High-Risk Areas; practicing risk mitigation is preferable to an embargo or termination of

sourcing due to the importance of material production to livelihoods in those areas.

The Tesla Integrity Line is one of Tesla’s grievance mechanisms

that can be used to report concerns, especially those relating to Tesla’s policies against illegal conduct, unethical behavior or

human rights violations including those related to the sourcing of minerals. In 2023, we expanded access to this third-party managed helpline

to allow external stakeholders, rights holders and rights defenders to raise potential concerns. We also updated The Global Human Rights

Policy to refer to our Integrity Line and clarify that we expect our suppliers and their respective suppliers to implement an effective

grievance management system for their operations, reaching suppliers’ workers and their legitimate representatives.

In instances where stakeholders prefer mechanisms outside of those

operated by Tesla, other external grievance mechanisms are available such as the Responsible Business Alliance’s Grievance Mechanism,

the RMI Grievance Mechanism (previously the Responsible Minerals Initiative’s Minerals Grievance Platform), and the non-judicial

grievance mechanism operated by the Organization for Economic Cooperation and Development—the OECD National Contact Points for Responsible

Business Conduct. These grievance mechanisms options are linked within our Global Human Rights Policy.

Our supplier manuals also address our policies on responsible

sourcing of minerals and state our expectation that all Tesla suppliers are accountable for performing due diligence on their

mineral supply chains in accordance with OECD Guidance. Our standard contractual terms with suppliers also include our expectation

that all Tesla suppliers are accountable for performing minerals due diligence aligned with OECD Guidance, including to conform to

any applicable internationally accepted assurance programs such as RMAP. In 2023, we strengthened our standard language in new

supplier contracts related to supply chain traceability and the removal of high-risk entities in the supply chain.

In 2023, we trained employees within Tesla’s Supply Chain Organization

on the topic of responsible sourcing of minerals and supplier engagement related to 3TG sourcing. We also trained new hires in our Supply

Chain Organization, such as Global Supply Managers and Supplier Industrialization Engineers.

Tesla maintains a specialized Responsible Sourcing team within its

Supply Chain Organization to lead human rights and environmental due diligence efforts. In addition, an internal cross-functional Tesla

Responsible Sourcing Steering Committee (the “Steering Committee”), composed of Tesla leadership from Supply Chain, Investor

Relations, and Legal, oversees these due diligence efforts and potential risks within our

supply chain. In addition, our efforts are overseen and approved by the Steering Committee, including our Vice Presidents of Global Supply

Management.

Step 2: Identify and Assess Risk in the Supply Chain

Tesla’s risk identification and assessment process begins with

the RCOI process detailed above and by leveraging the CMRT. In-scope Tier 1 suppliers are engaged multiple times during this process,

and internal stakeholders, such as Global Supply Managers, emphasize the importance of their participation. Supplier data is collected

and reviewed over a period of time to allow for follow-up and further validation.

Supplier responses are continually reviewed throughout the process

to ensure consistency with expected responses, and suppliers are asked to provide evidence of their own due diligence processes. Utilizing

a reputable third-party, we also assess each CMRT received and follow up with suppliers who provided incomplete or invalid responses.

When a supplier discloses that it has non-conformant SoRs in its supply chain, Tesla or our third-party service provider informs the supplier

of our expectation to source only from suppliers that have successfully completed a responsible sourcing assessment such as the RMAP,

per our Responsible Sourcing Policy.

SoR information is assessed against information provided by the RMI

for validity as a SoR. Valid SoRs are then reviewed for their status as “conformant to” or “active in” a responsible

sourcing audit program. Where we have serious concerns with an SoR’s sourcing practices and timely mitigation is not feasible, we

deem that SoR high risk even if it is conformant with a responsible sourcing audit program. We escalate suppliers who report non-conformant

or high-risk SoRs to the Tesla contacts that manage the business relationship for appropriate action.

With our service provider, Tesla monitors responses from suppliers

on their own internal policies and processes regarding responsible sourcing of minerals. We provide feedback to suppliers when they do

not meet our expectations. For the 2023 reporting period, we utilized a dashboard to track CMRT submissions against priority topics and

metrics. The dashboard included the number of Tier 1 suppliers that reported high-risk SoRs in their CMRT submission and the number and

name of high-risk SoRs reported by each supplier. This dashboard was used to escalate follow-up with suppliers, with the support of Tesla

Global Supply Managers. We hosted multiple office hours for Global Supply Managers to further educate them on the need to prioritize these

asks with suppliers. We also utilized an enhanced due diligence survey to request corrective action plans, including removal of high-risk

SoRs, from suppliers when they submitted CMRTs that included high-risk SoRs.

2023 marked the sixth year of Tesla’s social and environmental

compliance audits, which follow the Responsible Business Alliance's audit guidance. Through this program, Tesla assesses certain suppliers

on issues including their management systems for responsible sourcing of minerals by commissioning third-party audits to assess conformance

with the Code. We continued to expand the scope of our audits in both the number and geographic location of suppliers who underwent these

audits. We use audits as a tool for driving continuous improvement with our suppliers by ensuring that corrective actions are implemented

for identified issues and requiring closure audits where a priority non- conformance is identified. In 2023, we also surveyed a large

portion of our supply chain through a Supplier Self-Assessment Questionnaire, which includes questions related to minerals and materials

in the supply chain.

Ultimately, we aim to improve on-the-ground conditions in and around

mining communities. In 2023, a representative from Tesla's Responsible Sourcing team traveled to 3TG production regions in Latin America,

specifically Peru, to learn more about the supply chain. Mineral sourcing in Peru is higher risk for illegal mining, organized crime and

environmental deforestation. Tesla visited two artisanal mines and two processing facilities in a gold production region in Peru to meet

with supply chain representatives and local stakeholders, observe on-the-ground conditions and identify opportunities for impact and encourage

participation in the RMAP audit program. As a result of our engagement, a gold aggregator underwent an RMAP assessment – becoming

the first aggregator to initiate the RMAP assessment in the country. To enable broader learning, Tesla shared lessons learned from this

upstream sourcing region delegation with peers through the RMI Smelter Engagement Team workgroup. Tesla also engaged with non-governmental

organizations on potential social and environmental risks in Latin America gold supply chains, including representatives from indigenous

groups to share its approach and hear feedback on opportunities to improve.

Step 3: Design and Implement a Strategy to Respond to Identified

Risks

We monitor SoR validation progress by the RMI or other cross-recognized

SoR responsible sourcing audit programs. If suppliers or SoRs fail to meet Tesla’s standards, we communicate the need to improve,

in accordance with the framework of progressive improvement under the OECD Guidance. Any concerns with supplier responses throughout the

data collection process are escalated for further review and action.

In alignment with OECD Guidance, Tesla shares the names of SoRs provided

to us that have not been validated to the RMI for validation and audit. To help determine the reasonable country of origin for the 3TG

in our supply chain, we continue to monitor and rely upon the RMI’s progress in identifying and validating SoRs.

With recognition of the importance of cross-industry

collaboration and to share best practices, Tesla continues to actively participate in the RMI including relevant working groups, described

in additional detail in the “Industry Collaboration” section, above.

As a result of Tesla’s 2022 in-person engagement in the DRC region,

in 2023, Tesla supported the expansion of the Better Mining Supply Chain Due Diligence Monitoring, Corrective Action Plans and 3T minerals

traceability program in the DRC and Rwanda to two additional 3T mine sites, enabling on one hand a substantial increase in volume of Better

Mining-assured 3T minerals, and on the other hand, an increase of the number of impacted workers by 44.5% in these most upstream positions

of the global minerals supply chain. In addition, in 2023 Tesla initiated the “Tesla Tech for Good” product donation project

aimed at mitigating adverse human rights impacts of mining while simultaneously driving GHG reductions. Read more about these efforts

in Tesla’s 2023 Impact Report.

Step 4: Perform Independent Third-Party Audit

of Supply Chain Due Diligence

As outlined in the OECD Guidance, we support the RMI, an industry initiative

which audits due diligence activities of SoRs. We rely on the RMI program and OECD-aligned independent assessment programs cross-recognized

by RMI to determine if 3TG facilities reported by our suppliers are conformant with audit standards. We continue to work with the RMI

to aim to strengthen their audit program.

We support the RMI’s SoR outreach efforts and RMAP audits through

our membership and participation in working groups. In 2023, we contributed to the RMI’s Audit Fund, a fund designed to encourage

SoRs to undergo an independent third-party assessment, increasing our contribution from 2022 to fund more audits. The Audit Fund offers

SoRs an incentive for participating in the RMAP by fully paying for the costs of their initial audit and supporting needs-based re-assessments.

By voluntarily providing financial support to the Audit Fund, Tesla participates in financial cost-sharing of upstream supply chain due

diligence. We reserve the right to ask any Tier 1 supplier to audit their 3TG supply chain due diligence program using a third-party independent

auditor.

The data on which we rely for certain statements

in this declaration are obtained through our membership in the RMI using the RCOI report for RMI member ID: TSLA.

Step 5: Report on Supply Chain Due Diligence

We report on our due diligence efforts as required by law and to comply

with Rule 13p-1 under the Securities Exchange Act of 1934, as amended. This report is also available on Tesla’s publicly available

Legal page (www.tesla.com/about/legal). We also report on our efforts within the annual Tesla Impact Report.

Continuous Improvement

Tesla is working to continuously improve our responsible sourcing efforts.

Our goal is that wherever Tesla’s supply chain has an impact, local conditions for stakeholders continuously improve as a result

of our purchasing decisions and relationships. We strive to source all of our 3TG through conformant SoRs and support upstream positive

impact. We work to stay up to date on current and emerging risks and regularly update our policies, standards, and management systems

to meet challenges and address existing and emerging issues more effectively. In order to further strengthen our efforts, we:

| § | Continue to participate in cross-industry groups such as the RMI; |

| § | Continue to work with in-scope suppliers to improve response rates to our

requests, improve the quality and accuracy of their responses, and encourage their sourcing from conformant SoRs that meet Tesla expectations; |

| § | Continue to contractually require participation from our suppliers in our

due diligence process; |

| § | Encourage suppliers to conduct responsible sourcing from the DRC region by

using conformant SoRs, and discourage the creation of a de facto embargo on sourcing from the DRC region; |

| § | Through participation in RMI’s workgroups, encourage SoRs to participate

in RMAP protocol and thus enable responsible sourcing from the DRC region or other CAHRAs; |

| § | Enhance efforts to understand on-the-ground opportunities for impact, including

through engagements with upstream parties, non-governmental organizations and other stakeholders; |

| § | Enhance efforts to implement on-the-ground opportunities for impact, in consultation

with local stakeholders; and |

| § | Explore opportunities to further Tesla’s mission to accelerate the

world’s transition to sustainable energy as it relates to the responsible sourcing of minerals. |

Forward-Looking Statements

Certain statements in this report are forward-looking statements that

are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations. Various

important factors could cause actual results to differ materially, including the risks identified in our SEC filings. Tesla disclaims

any obligation to update any forward- looking statement contained in this report.

Results of Reasonable Country of Origin Inquiry & Due Diligence

Annex I

Due to Tesla’s downstream position in the supply chain, any efforts

to understand the origin of raw materials rely heavily on the cooperation of our Tier 1 and upstream suppliers. Even though we request

our Tier 1 suppliers provide Tesla-specific information, we are unable to reliably confirm whether any specific 3TG facility is present

in our supply chain. Additionally, based on the information that is provided and the nature of the supply chain, the Tier 1 supplier is

unable to directly link the specific 3TG facility, or mine of origin, to the product provided to Tesla. As a result, we continue to engage

with our suppliers to improve due diligence efforts and transparency to be able to further address any potential risks or non- conformances.

Based on our due diligence efforts to date, and despite the limitations described above, we believe that the following list of countries

of origin reflects countries from which our suppliers may have sourced from conformant SoRs and refiners. This list may be overinclusive

due to the RMI’s database including countries of origin from the supply chains of all of its participants and not just Tesla. Tesla

will continue to work with our suppliers to encourage sourcing only from conformant SoRs, including by encouraging suppliers to have their

non-participating SoRs successfully participate in an audit program.

Materials sourced through conformant SoRs are considered by the international

community as responsible sources of 3TG materials. At the same time, we recognize that audit programs have inherent challenges. In 2023,

Tesla continued to work to better understand the potential challenges associated with the audit programs in the 3TG space, both at the

SoR level and the further upstream mine-level. Where appropriate, we voiced our concerns and worked with local stakeholders to support

improvements. Where we saw programs that offered more opportunity for transparency and positive impact, we increased our involvement.

For example, read more about our efforts to help scale Better Mining in the Step 3 section, above.

Tesla continues to work to gain further insight and transparency into

our and our suppliers’ supply chains for 3TG, including fully identifying countries of origin of 3TG and the SoRs used to process

the necessary 3TG in Tesla’s products.

It is important to note we do not have direct relationships with 3TG

sub-suppliers or SoRs in many of these countries and our influence on the supply chain when it is several tiers removed is limited. Therefore,

although a country may be listed in the tables below, it may not actually be a source in Tesla’s 3TG supply chain. There is currently

no completely accurate methodology to identify only those specific countries that are included in parts supplied to Tesla, therefore the

list of countries includes more countries than are in fact in Tesla’s supply chain. As our processes continue to improve and the

specificity of the RCOI information increases, this list may fluctuate year over year. Information provided by our suppliers in the list

below is inclusive of all of 2023.

| Gold |

Tantalum |

Tin |

Tungsten |

| Algeria,

Andorra, Antigua and Barbuda, Argentina, Australia, Austria, Azerbaijan, Bahamas, Bangladesh, Barbados, Belarus, Belgium, Benin,

Bolivia (Pluralnational State of), Bosnia and Herzegovina, Botswana, Brazil, Bulgaria, Burkina Faso, Cambodia, Cameroon, Canada,

Cayman Islands, Chile, China, Colombia, Costa Rica, Cote d'Ivoire, Croatia, Curacao, Cyprus, Czech Republic, Democratic

Republic of the Congo, Denmark, Dominican Republic, Ecuador, Egypt, El Salvador, Estonia, Fiji, Finland, France, French Guiana,

Georgia, Germany, Ghana, Greece, Grenada, Guatemala, Guinea, Guyana, Honduras,

Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica,

Japan, Jordan, Kazakhstan, Kenya, Kuwait, Kyrgyzstan, Lao People’s Democratic Republic, Latvia, Lebanon, Liberia,

Liechtenstein, Lithuania, Luxembourg, Macao, Malaysia, Mali, Malta, Mauritania, Mauritius, Mexico, Monaco, Mongolia, Morocco,

Mozambique, Namibia, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, Norway, Oman, Pakistan, Panama, Papua New Guinea, Peru,

Philippines, Poland, Portugal, Puerto Rico, South Korea, Romania, Russia, Saint Kitts and Nevis, Saudi Arabia, Senegal, Serbia,

Singapore, Sint Maarten, Slovakia, Slovenia, South Africa, South Korea, Spain, St Vincent and Grenadines, Sudan, Suriname, Sweden,

Switzerland, Tajikistan, Taiwan, Tanzania, Thailand, Trinidad and Tobago, Tunisia, Turkey, Turks and Caicos, Ukraine, United

Arab Emirates, United Kingdom of Great Britain and Northern Ireland, United States of America, Uruguay, Uzbekistan, Vietnam, Zambia,

Zimbabwe |

Australia, Belarus, Brazil, Burundi, Canada, China, Czech Republic, Democratic Republic of the Congo, El Salvador, Estonia, Ethiopia, France, Germany, Hong Kong, India,Indonesia, Ireland, Israel, Japan, Madagascar, Mexico, Mozambique, Nigeria, Russian Federation, Rwanda, Sierra Leone, Singapore, South Korea, Spain, Taiwan, Thailand, United Kingdom of Great Britain and Northern Ireland, United States of America |

Argentina, Australia, Austria, Bangladesh, Belarus, Belgium, Bolivia (Plurinational State of), Brazil, Bulgaria, Burundi, Canada, Chile, China, Croatia, Cyprus, Czech Republic, Democratic Republic of the Congo, Denmark, Egypt, Finland, France, Germany, Greece, Honduras, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Laos, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Mexico, Mongolia, Morocco, Myanmar, Netherlands, New Zealand, Nigeria, Pakistan, Peru, Philippines, Poland, Portugal, Puerto Rico, Romania, Russian Federation, Rwanda, Saudia Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Tanzania, Thailand, Tunisia, Turkey, Taiwan, United Arab Emirates, United Kingdom of Great Britain and Northern Ireland, United States of America, Uruguay, Vietnam |

Australia, Austria, Bolivia, Brazil, Burundi, China, Democratic Republic of the Congo, Germany, India, Ireland, Israel, Japan, Kazakhstan, Malaysia, Mexico, Mongolia, Myanmar, Netherlands, Nigeria, Portugal, Russian Federation, Rwanda, Singapore, South Korea, Spain, Taiwan, Tanzania, Thailand, Turkey, Uganda, United Kingdom of Great Britain and Northern Ireland, United States of America, Vietnam |

Countries listed in bold are considered

“covered countries” (i.e., the DRC and its adjoining countries) under U.S. conflict minerals disclosure rules.

Annex II

SoRs Identified

Tesla suppliers identified more than 506 unique SoR or other entity

names across all CMRT responses received. As part of our due diligence process, we identified 356 or 70%, as eligible and operational

SoRs (meaning the RMI has classified these facilities as valid, eligible and operational SoRs based on their industry-setting definition)

and 234, or 66%, as engaged with the RMI or conformant. Identification was performed by both Tesla’s engaged third-party service

provider as well as an internal review of SoR names as compared to the RMI’s SoR database. As we continue to engage with SoRs directly

and through stakeholder initiatives, we hope to see SoR conformance rates increase.

SoR Summary

Tesla does not directly purchase any 3TG material and we do not deal

directly with any 3TG SoR. The following list of facilities are SoRs reported by Tesla Tier 1 suppliers that may, or may not, be in Tesla’s

supply chain. The facility locations are listed as they appear on the RMI Facility Database as of April 8, 2024. As a result of the

industry-wide CMRT data request, collection and submission process, inclusion in this list is not a confirmation that 3TG from any particular

facility are incorporated into Tesla products. In many cases, Tesla Tier 1 suppliers do not have the capability to identify raw materials

from certain SoRs or mines which are ultimately used in the products produced for Tesla. For this reason, among others, the list is overinclusive,

and does not directly link to Tesla suppliers or Tesla. We publish this list to promote supply chain transparency, hold ourselves and

our suppliers accountable to progressive, continuous improvement of responsible sourcing practices, encourage continued SoR participation

in RMAP and encourage SoRs that are not yet participating in a responsible sourcing program to accelerate their efforts to demonstrate

responsible mineral procurement practices.

| Metal |

Smelter Name |

Country |

Smelter ID |

| Gold |

Advanced Chemical Company |

United States Of America |

CID000015 |

| Gold |

Aida Chemical Industries Co., Ltd. |

Japan |

CID000019 |

| Gold |

Agosi AG |

Germany |

CID000035 |

| Gold |

Almalyk Mining and Metallurgical Complex (AMMC) |

Uzbekistan |

CID000041 |

| Gold |

AngloGold Ashanti Corrego do Sitio Mineracao |

Brazil |

CID000058 |

| Gold |

Argor-Heraeus S.A. |

Switzerland |

CID000077 |

| Gold |

Asahi Pretec Corp. |

Japan |

CID000082 |

| Gold |

Asaka Riken Co., Ltd. |

Japan |

CID000090 |

| Gold |

Atasay Kuyumculuk Sanayi Ve Ticaret A.S. |

Turkey |

CID000103 |

| Gold |

Aurubis AG |

Germany |

CID000113 |

| Gold |

Bangko Sentral ng Pilipinas (Central Bank of the Philippines) |

Philippines |

CID000128 |

| Gold |

Boliden AB |

Sweden |

CID000157 |

| Gold |

C. Hafner GmbH + Co. KG |

Germany |

CID000176 |

| Gold |

Caridad |

Mexico |

CID000180 |

| Gold |

CCR Refinery - Glencore Canada Corporation |

Canada |

CID000185 |

| Gold |

Cendres + Metaux S.A. |

Switzerland |

CID000189 |

| Gold |

Yunnan Copper Industry Co., Ltd. |

China |

CID000197 |

| Gold |

Chimet S.p.A. |

Italy |

CID000233 |

| Gold |

Chugai Mining |

Japan |

CID000264 |

| Gold |

Daye Non-Ferrous Metals Mining Ltd. |

China |

CID000343 |

| Gold |

DSC (Do Sung Corporation) |

Korea, Republic Of |

CID000359 |

| Gold |

Dowa |

Japan |

CID000401 |

| Gold |

Eco-System Recycling Co., Ltd. East Plant |

Japan |

CID000425 |

| Gold |

JSC Novosibirsk Refinery |

Russian Federation |

CID000493 |

| Gold |

Refinery of Seemine Gold Co., Ltd. |

China |

CID000522 |

| Gold |

Guoda Safina High-Tech Environmental Refinery Co., Ltd. |

China |

CID000651 |

| Gold |

Hangzhou Fuchunjiang Smelting Co., Ltd. |

China |

CID000671 |

| Gold |

LT Metal Ltd. |

Korea, Republic Of |

CID000689 |

| Gold |

Heimerle + Meule GmbH |

Germany |

CID000694 |

| Gold |

Heraeus Metals Hong Kong Ltd. |

China |

CID000707 |

| Gold |

Heraeus Germany GmbH & Co. KG |

Germany |

CID000711 |

| Gold |

Hunan Chenzhou Mining Co., Ltd. |

China |

CID000767 |

| Gold |

Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. |

China |

CID000773 |

| Gold |

HwaSeong CJ CO., LTD. |

Korea, Republic Of |

CID000778 |

| Gold |

Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. |

China |

CID000801 |

| Gold |

Ishifuku Metal Industry Co., Ltd. |

Japan |

CID000807 |

| Gold |

Istanbul Gold Refinery |

Turkey |

CID000814 |

| Gold |

Japan Mint |

Japan |

CID000823 |

| Gold |

Jiangxi Copper Co., Ltd. |

China |

CID000855 |

| Gold |

Asahi Refining USA Inc. |

United States Of America |

CID000920 |

| Gold |

Asahi Refining Canada Ltd. |

Canada |

CID000924 |

| Gold |

JSC Ekaterinburg Non-Ferrous Metal Processing Plant |

Russian Federation |

CID000927 |

| Gold |

JSC Uralelectromed |

Russian Federation |

CID000929 |

| Gold |

JX Nippon Mining & Metals Co., Ltd. |

Japan |

CID000937 |

| Gold |

Kazakhmys Smelting LLC |

Kazakhstan |

CID000956 |

| Gold |

Kazzinc |

Kazakhstan |

CID000957 |

| Gold |

Kennecott Utah Copper LLC |

United States Of America |

CID000969 |

| Gold |

Kojima Chemicals Co., Ltd. |

Japan |

CID000981 |

| Gold |

Kyrgyzaltyn JSC |

Kyrgyzstan |

CID001029 |

| Gold |

L’azurde Company For Jewelry |

Saudi Arabia |

CID001032 |

| Gold |

Lingbao Gold Co., Ltd. |

China |

CID001056 |

| Gold |

Lingbao Jinyuan Tonghui Refinery Co., Ltd. |

China |

CID001058 |

| Gold |

LS MnM Inc. |

Korea, Republic Of |

CID001078 |

| Gold |

Luoyang Zijin Yinhui Gold Refinery Co., Ltd. |

China |

CID001093 |

| Gold |

Materion |

United States Of America |

CID001113 |

| Gold |

Matsuda Sangyo Co., Ltd. |

Japan |

CID001119 |

| Gold |

Metalor Technologies (Suzhou) Ltd. |

China |

CID001147 |

| Gold |

Metalor Technologies (Hong Kong) Ltd. |

China |

CID001149 |

| Gold |

Metalor Technologies (Singapore) Pte., Ltd. |

Singapore |

CID001152 |

| Gold |

Metalor Technologies S.A. |

Switzerland |

CID001153 |

| Gold |

Metalor USA Refining Corporation |

United States Of America |

CID001157 |

| Gold |

Metalurgica Met-Mex Penoles S.A. De C.V. |

Mexico |

CID001161 |

| Gold |

Mitsubishi Materials Corporation |

Japan |

CID001188 |

| Gold |

Mitsui Mining and Smelting Co., Ltd. |

Japan |

CID001193 |

| Gold |

Moscow Special Alloys Processing Plant |

Russian Federation |

CID001204 |

| Gold |

Nadir Metal Rafineri San. Ve Tic. A.S. |

Turkey |

CID001220 |

| Gold |

Navoi Mining and Metallurgical Combinat |

Uzbekistan |

CID001236 |

| Gold |

Nihon Material Co., Ltd. |

Japan |

CID001259 |

| Gold |

Ohura Precious Metal Industry Co., Ltd. |

Japan |

CID001325 |

| Gold |

OJSC “The Gulidov Krasnoyarsk Non- Ferrous Metals Plant” (OJSC Krastsvetmet) |

Russian Federation |

CID001326 |

| Gold |

MKS PAMP S.A. |

Switzerland |

CID001352 |

| Gold |

Penglai Penggang Gold Industry Co., Ltd. |

China |

CID001362 |

| Gold |

Prioksky Plant of Non-Ferrous Metals |

Russian Federation |

CID001386 |

| Gold |

PT Aneka Tambang (Persero) Tbk |

Indonesia |

CID001397 |

| Gold |

PX Precinox S.A. |

Switzerland |

CID001498 |

| Gold |

Rand Refinery (Pty) Ltd. |

South Africa |

CID001512 |

| Gold |

Royal Canadian Mint |

Canada |

CID001534 |

| Gold |

Sabin Metal Corp. |

United States Of America |

CID001546 |

| Gold |

Samduck Precious Metals |

Korea, Republic Of |

CID001555 |

| Gold |

Samwon Metals Corp. |

Korea, Republic Of |

CID001562 |

| Gold |

SEMPSA Joyeria Plateria S.A. |

Spain |

CID001585 |

| Gold |

Shandong Tiancheng Biological Gold Industrial Co., Ltd. |

China |

CID001619 |

| Gold |

Shandong Zhaojin Gold & Silver Refinery Co., Ltd. |

China |

CID001622 |

| Gold |

Sichuan Tianze Precious Metals Co., Ltd. |

China |

CID001736 |

| Gold |

SOE Shyolkovsky Factory of Secondary Precious Metals |

Russian Federation |

CID001756 |

| Gold |

Solar Applied Materials Technology Corp. |

Taiwan |

CID001761 |

| Gold |

Sumitomo Metal Mining Co., Ltd. |

Japan |

CID001798 |

| Gold |

Super Dragon Technology Co., Ltd. |

China |

CID001810 |

| Gold |

Tanaka Kikinzoku Kogyo K.K. |

Japan |

CID001875 |

| Gold |

Great Wall Precious Metals Co., Ltd. of CBPM |

China |

CID001909 |

| Gold |

Shandong Gold Smelting Co., Ltd. |

China |

CID001916 |

| Gold |

Tokuriki Honten Co., Ltd. |

Japan |

CID001938 |

| Gold |

Tongling Nonferrous Metals Group Co., Ltd. |

China |

CID001947 |

| Gold |

Torecom |

Korea, Republic Of |

CID001955 |

| Gold |

Umicore S.A. Business Unit Precious Metals Refining |

Belgium |

CID001980 |

| Gold |

United Precious Metal Refining, Inc. |

United States Of America |

CID001993 |

| Gold |

Valcambi S.A. |

Switzerland |

CID002003 |

| Gold |

Western Australian Mint (T/a The Perth Mint) |

Australia |

CID002030 |

| Gold |

Yamakin Co., Ltd. |

Japan |

CID002100 |

| Gold |

Yokohama Metal Co., Ltd. |

Japan |

CID002129 |

| Gold |

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

China |

CID002224 |

| Gold |

Gold Refinery of Zijin Mining Group Co., Ltd. |

China |

CID002243 |

| Gold |

Morris and Watson |

New Zealand |

CID002282 |

| Gold |

SAFINA A.S. |

Czechia |

CID002290 |

| Gold |

Guangdong Jinding Gold Limited |

China |

CID002312 |

| Gold |

Umicore Precious Metals Thailand |

Thailand |

CID002314 |

| Gold |

MMTC-PAMP India Pvt., Ltd. |

India |

CID002509 |

| Gold |

KGHM Polska Miedz Spolka Akcyjna |

Poland |

CID002511 |

| Gold |

Fidelity Printers and Refiners Ltd. |

Zimbabwe |

CID002515 |

| Gold |

Singway Technology Co., Ltd. |

Taiwan |

CID002516 |

| Gold |

Shandong Humon Smelting Co., Ltd. |

China |

CID002525 |

| Gold |

Shenzhen Zhonghenglong Real Industry Co., Ltd. |

China |

CID002527 |

| Gold |

Al Etihad Gold Refinery DMCC |

United Arab Emirates |

CID002560 |

| Gold |

Emirates Gold DMCC |

United Arab Emirates |

CID002561 |

| Gold |

International Precious Metal Refiners |

United Arab Emirates |

CID002562 |

| Gold |

Kaloti Precious Metals |

United Arab Emirates |

CID002563 |

| Gold |

Sudan Gold Refinery |

Sudan |

CID002567 |

| Gold |

T.C.A S.p.A |

Italy |

CID002580 |

| Gold |

REMONDIS PMR B.V. |

Netherlands |

CID002582 |

| Gold |

Fujairah Gold FZC |

United Arab Emirates |

CID002584 |

| Gold |

Industrial Refining Company |

Belgium |

CID002587 |

| Gold |

Shirpur Gold Refinery Ltd. |

India |

CID002588 |

| Gold |

Korea Zinc Co., Ltd. |

Korea, Republic Of |

CID002605 |

| Gold |

Marsam Metals |

Brazil |

CID002606 |

| Gold |

TOO Tau-Ken-Altyn |

Kazakhstan |

CID002615 |

| Gold |

Abington Reldan Metals, LLC |

United States Of America |

CID002708 |

| Gold |

Shenzhen CuiLu Gold Co., Ltd. |

China |

CID002750 |

| Gold |

Albino Mountinho Lda. |

Portugal |

CID002760 |

| Gold |

SAAMP |

France |

CID002761 |

| Gold |

L'Orfebre S.A. |

Andorra |

CID002762 |

| Gold |

8853 S.p.A. |

Italy |

CID002763 |

| Gold |

Italpreziosi |

Italy |

CID002765 |

| Gold |

WIELAND Edelmetalle GmbH |

Germany |

CID002778 |

| Gold |

Ogussa Osterreichische Gold- und Silber- Scheideanstalt GmbH |

Austria |

CID002779 |

| Gold |

AU Traders and Refiners |

South Africa |

CID002850 |

| Gold |

GGC Gujrat Gold Centre Pvt. Ltd. |

India |

CID002852 |

| Gold |

Sai Refinery |

India |

CID002853 |

| Gold |

Modeltech Sdn Bhd |

Malaysia |

CID002857 |

| Gold |

Bangalore Refinery |

India |

CID002863 |

| Gold |

Kyshtym Copper-Electrolytic Plant ZAO |

Russian Federation |

CID002865 |

| Gold |

Degussa Sonne / Mond Goldhandel GmbH |

Germany |

CID002867 |

| Gold |

Pease & Curren |

United States Of America |

CID002872 |

| Gold |

JALAN & Company |

India |

CID002893 |

| Gold |

SungEel HiMetal Co., Ltd. |

Korea, Republic Of |

CID002918 |

| Gold |

Planta Recuperadora de Metales SpA |

Chile |

CID002919 |

| Gold |

ABC Refinery Pty Ltd. |

Australia |

CID002920 |

| Gold |

Safimet S.p.A |

Italy |

CID002973 |

| Gold |

State Research Institute Center for Physical Sciences and Technology |

Lithuania |

CID003153 |

| Gold |

African Gold Refinery** |

Uganda |

CID003185 |

| Gold |

Gold Coast Refinery |

Ghana |

CID003186 |

| Gold |

NH Recytech Company |

Korea, Republic Of |

CID003189 |

| Gold |

QG Refining, LLC |

United States Of America |

CID003324 |

| Gold |

Dijllah Gold Refinery FZC |

United Arab Emirates |

CID003348 |

| Gold |

CGR Metalloys Pvt Ltd. |

India |

CID003382 |

| Gold |

Sovereign Metals |

India |

CID003383 |

| Gold |

Eco-System Recycling Co., Ltd. North Plant |

Japan |

CID003424 |

| Gold |

Eco-System Recycling Co., Ltd. West Plant |

Japan |

CID003425 |

| Gold |

Augmont Enterprises Private Limited |

India |

CID003461 |

| Gold |

Kundan Care Products Ltd. |

India |

CID003463 |

| Gold |

Emerald Jewel Industry India Limited (Unit 1) |

India |

CID003487 |

| Gold |

Emerald Jewel Industry India Limited (Unit 2) |

India |

CID003488 |

| Gold |

Emerald Jewel Industry India Limited (Unit 3) |

India |

CID003489 |

| Gold |

Emerald Jewel Industry India Limited (Unit 4) |

India |

CID003490 |

| Gold |

K.A. Rasmussen |

Norway |

CID003497 |

| Gold |

Alexy Metals |

United States Of America |

CID003500 |

| Gold |

MD Overseas |

India |

CID003548 |

| Gold |

Metallix Refining Inc. |

United States Of America |

CID003557 |

| Gold |

Metal Concentrators SA (Pty) Ltd. |

South Africa |

CID003575 |

| Gold |

WEEEREFINING |

France |

CID003615 |

| Gold |

Gold by Gold Colombia |

Colombia |

CID003641 |

| Gold |

Dongwu Gold Group |

China |

CID003663 |

| Gold |

Sam Precious Metals |

United Arab Emirates |

CID003666 |

| Gold |

Coimpa Industrial LTDA |

Brazil |

CID004010 |

| Gold |

SHENZHEN JINJUNWEI RESOURCE COMPREHENSIVE DEVELOPMENT CO., LTD. |

China |

CID004435 |

| Gold |

GG Refinery Ltd. |

Tanzania |

CID004506 |

| Gold |

Attero Recycling Pvt Ltd |

India |

CID004697 |

| Gold |

Inca One (Chala One Plant) |

Peru |

CID004704 |

| Gold |

Inca One (Koricancha Plant) |

Peru |

CID004705 |

| Gold |

Impala Refineries – Platinum Metals Refinery (PMR) |

South Africa |

CID004714 |

| Tantalum |

Guangdong Rising Rare Metals-EO Materials Ltd. |

China |

CID000291 |

| Tantalum |

F&X Electro-Materials Ltd. |

China |

CID000460 |

| Tantalum |

XIMEI RESOURCES (GUANGDONG) LIMITED |

China |

CID000616 |

| Tantalum |

JiuJiang JinXin Nonferrous Metals Co., Ltd. |

China |

CID000914 |

| Tantalum |

Jiujiang Tanbre Co., Ltd. |

China |

CID000917 |

| Tantalum |

AMG Brasil |

Brazil |

CID001076 |

| Tantalum |

Metallurgical Products India Pvt., Ltd. |

India |

CID001163 |

| Tantalum |

Mineracao Taboca S.A. |

Brazil |

CID001175 |

| Tantalum |

Mitsui Mining and Smelting Co., Ltd. |

Japan |

CID001192 |

| Tantalum |

NPM Silmet AS |

Estonia |

CID001200 |

| Tantalum |

Ningxia Orient Tantalum Industry Co., Ltd. |

China |

CID001277 |

| Tantalum |

QuantumClean |

United States Of America |

CID001508 |

| Tantalum |

Yanling Jincheng Tantalum & Niobium Co., Ltd. |

China |

CID001522 |

| Tantalum |

Solikamsk Magnesium Works OAO |

Russian Federation |

CID001769 |

| Tantalum |

Taki Chemical Co., Ltd. |

Japan |

CID001869 |

| Tantalum |

Telex Metals |

United States Of America |

CID001891 |

| Tantalum |

Ulba Metallurgical Plant JSC |

Kazakhstan |

CID001969 |

| Tantalum |

Hengyang King Xing Lifeng New Materials Co., Ltd. |

China |

CID002492 |

| Tantalum |

D Block Metals, LLC |

United States Of America |

CID002504 |

| Tantalum |

FIR Metals & Resource Ltd. |

China |

CID002505 |

| Tantalum |

Jiujiang Zhongao Tantalum & Niobium Co., Ltd. |

China |

CID002506 |

| Tantalum |

XinXing HaoRong Electronic Material Co., Ltd. |

China |

CID002508 |

| Tantalum |

Jiangxi Dinghai Tantalum & Niobium Co., Ltd. |

China |

CID002512 |

| Tantalum |

KEMET de Mexico |

Mexico |

CID002539 |

| Tantalum |

TANIOBIS Co., Ltd. |

Thailand |

CID002544 |

| Tantalum |

TANIOBIS GmbH |

Germany |

CID002545 |

| Tantalum |

Materion Newton Inc. |

United States Of America |

CID002548 |

| Tantalum |

TANIOBIS Japan Co., Ltd. |

Japan |

CID002549 |

| Tantalum |

TANIOBIS Smelting GmbH & Co. KG |

Germany |

CID002550 |

| Tantalum |

Global Advanced Metals Boyertown |

United States Of America |

CID002557 |

| Tantalum |

Global Advanced Metals Aizu |

Japan |

CID002558 |

| Tantalum |

Resind Industria e Comercio Ltda. |

Brazil |

CID002707 |

| Tantalum |

Jiangxi Tuohong New Raw Material |

China |

CID002842 |

| Tantalum |

RFH Yancheng Jinye New Material Technology Co., Ltd. |

China |

CID003583 |

| Tantalum |

5D Production OU |

Estonia |

CID003926 |

| Tantalum |

PowerX Ltd. |

Rwanda |

CID004054 |

| Tin |

Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. |

China |

CID000228 |

| Tin |

Alpha |

United States Of America |

CID000292 |

| Tin |

PT Aries Kencana Sejahtera |

Indonesia |

CID000309 |

| Tin |

PT Premium Tin Indonesia |

Indonesia |

CID000313 |

| Tin |

Dowa |

Japan |

CID000402 |

| Tin |

EM Vinto |

Bolivia (Plurinational State Of) |

CID000438 |

| Tin |

Estanho de Rondonia S.A. |

Brazil |

CID000448 |

| Tin |

Fenix Metals |

Poland |

CID000468 |

| Tin |

Gejiu Non-Ferrous Metal Processing Co., Ltd. |

China |

CID000538 |

| Tin |

Gejiu Zili Mining And Metallurgy Co., Ltd. |

China |

CID000555 |

| Tin |

Gejiu Kai Meng Industry and Trade LLC |

China |

CID000942 |

| Tin |

China Tin Group Co., Ltd. |

China |

CID001070 |

| Tin |

Malaysia Smelting Corporation (MSC) |

Malaysia |

CID001105 |

| Tin |

Metallic Resources, Inc. |

United States Of America |

CID001142 |

| Tin |

Mineracao Taboca S.A. |

Brazil |

CID001173 |

| Tin |

Minsur |

Peru |

CID001182 |

| Tin |

Mitsubishi Materials Corporation |

Japan |

CID001191 |

| Tin |

Jiangxi New Nanshan Technology Ltd. |

China |

CID001231 |

| Tin |

Novosibirsk Tin Combine |

Russian Federation |

CID001305 |

| Tin |

O.M. Manufacturing (Thailand) Co., Ltd. |

Thailand |

CID001314 |

| Tin |

Operaciones Metalurgicas S.A. |

Bolivia (Plurinational State Of) |

CID001337 |

| Tin |

PT Artha Cipta Langgeng |

Indonesia |

CID001399 |

| Tin |

PT Babel Inti Perkasa |

Indonesia |

CID001402 |

| Tin |

PT Babel Surya Alam Lestari |

Indonesia |

CID001406 |

| Tin |

PT Bangka Tin Industry |

Indonesia |

CID001419 |

| Tin |

PT Belitung Industri Sejahtera |

Indonesia |

CID001421 |

| Tin |

PT Bukit Timah |

Indonesia |

CID001428 |

| Tin |

PT Mitra Stania Prima |

Indonesia |

CID001453 |

| Tin |

PT Panca Mega Persada |

Indonesia |

CID001457 |

| Tin |

PT Prima Timah Utama |

Indonesia |

CID001458 |

| Tin |

PT Refined Bangka Tin |

Indonesia |

CID001460 |

| Tin |

PT Sariwiguna Binasentosa |

Indonesia |

CID001463 |

| Tin |

PT Stanindo Inti Perkasa |

Indonesia |

CID001468 |

| Tin |

PT Timah Tbk Kundur |

Indonesia |

CID001477 |

| Tin |

PT Timah Tbk Mentok |

Indonesia |

CID001482 |

| Tin |

PT Tinindo Inter Nusa |

Indonesia |

CID001490 |

| Tin |

PT Tommy Utama |

Indonesia |

CID001493 |

| Tin |

Rui Da Hung |

Taiwan |

CID001539 |

| Tin |

Thaisarco |

Thailand |

CID001898 |

| Tin |

Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. |

China |

CID001908 |

| Tin |

VQB Mineral and Trading Group JSC |

Vietnam |

CID002015 |

| Tin |

White Solder Metalurgia e Mineracao Ltda. |

Brazil |

CID002036 |

| Tin |

Yunnan Chengfeng Non-ferrous Metals Co., Ltd. |

China |

CID002158 |

| Tin |

Tin Smelting Branch of Yunnan Tin Co., Ltd. |

China |

CID002180 |

| Tin |

CV Venus Inti Perkasa |

Indonesia |

CID002455 |

| Tin |

Magnu's Minerais Metais e Ligas Ltda. |

Brazil |

CID002468 |

| Tin |

PT Tirus Putra Mandiri |

Indonesia |

CID002478 |

| Tin |

Melt Metais e Ligas S.A. |

Brazil |

CID002500 |

| Tin |

PT ATD Makmur Mandiri Jaya |

Indonesia |

CID002503 |

| Tin |

O.M. Manufacturing Philippines, Inc. |

Philippines |

CID002517 |

| Tin |

CV Ayi Jaya |

Indonesia |

CID002570 |

| Tin |

Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company |

Vietnam |

CID002572 |

| Tin |

Nghe Tinh Non-Ferrous Metals Joint Stock Company |

Vietnam |

CID002573 |

| Tin |

Tuyen Quang Non-Ferrous Metals Joint Stock Company |

Vietnam |

CID002574 |

| Tin |

PT Rajehan Ariq |

Indonesia |

CID002593 |

| Tin |

PT Cipta Persada Mulia |

Indonesia |

CID002696 |

| Tin |

An Vinh Joint Stock Mineral Processing Company |

Vietnam |

CID002703 |

| Tin |

Resind Industria e Comercio Ltda. |

Brazil |

CID002706 |

| Tin |

Super Ligas |

Brazil |

CID002756 |

| Tin |

Aurubis Beerse |

Belgium |

CID002773 |

| Tin |

Aurubis Berango |

Spain |

CID002774 |

| Tin |

PT Bangka Prima Tin |

Indonesia |

CID002776 |

| Tin |

PT Sukses Inti Makmur (SIM) |

Indonesia |

CID002816 |

| Tin |

PT Menara Cipta Mulia |

Indonesia |

CID002835 |

| Tin |

HuiChang Hill Tin Industry Co., Ltd. |

China |

CID002844 |

| Tin |

Modeltech Sdn Bhd |

Malaysia |

CID002858 |

| Tin |

Guangdong Hanhe Non-Ferrous Metal Co., Ltd. |

China |

CID003116 |

| Tin |

Chifeng Dajingzi Tin Industry Co., Ltd. |

China |

CID003190 |

| Tin |

PT Bangka Serumpun |

Indonesia |

CID003205 |

| Tin |

Pongpipat Company Limited |

Myanmar |

CID003208 |

| Tin |

Tin Technology & Refining |

United States Of America |

CID003325 |

| Tin |

Dongguan CiEXPO Environmental Engineering Co., Ltd. |

China |

CID003356 |

| Tin |

Ma'anshan Weitai Tin Co., Ltd. |

China |

CID003379 |

| Tin |

PT Rajawali Rimba Perkasa |

Indonesia |

CID003381 |

| Tin |

Luna Smelter, Ltd. |

Rwanda |

CID003387 |

| Tin |

Yunnan Yunfan Non-ferrous Metals Co., Ltd. |

China |

CID003397 |

| Tin |

Precious Minerals and Smelting Limited |

India |

CID003409 |

| Tin |

Gejiu City Fuxiang Industry and Trade Co., Ltd. |

China |

CID003410 |

| Tin |

PT Mitra Sukses Globalindo |

Indonesia |

CID003449 |

| Tin |

CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda |

Brazil |

CID003486 |

| Tin |

CRM Synergies |

Spain |

CID003524 |

| Tin |

Fabrica Auricchio Industria e Comercio Ltda. |

Brazil |

CID003582 |

| Tin |

DS Myanmar |

Myanmar |

CID003831 |

| Tin |

PT Putera Sarana Shakti (PT PSS) |

Indonesia |

CID003868 |

| Tin |

Mining Minerals Resources SARL |

Congo, Democratic Republic Of The |

CID004065 |

| Tin |

Takehara PVD Materials Plant / PVD Materials Division of MITSUI MINING & SMELTING CO., LTD. |

Japan |

CID004403 |

| Tin |

Malaysia Smelting Corporation Berhad (Port Klang) |

Malaysia |

CID004434 |

| Tin |

PT Mitra Graha Raya |

Indonesia |

CID004685 |

| Tin |

RIKAYAA GREENTECH PRIVATE LIMITED |

India |

CID004692 |

| Tin |

Woodcross Smelting Company Limited |

Uganda |

CID004724 |

| Tungsten |

A.L.M.T. Corp. |

Japan |

CID000004 |

| Tungsten |

Kennametal Huntsville |

United States Of America |

CID000105 |

| Tungsten |

Guangdong Xianglu Tungsten Co., Ltd. |

China |

CID000218 |

| Tungsten |

Chongyi Zhangyuan Tungsten Co., Ltd. |

China |

CID000258 |

| Tungsten |

CNMC (Guangxi) PGMA Co., Ltd. |

China |

CID000281 |

| Tungsten |

Global Tungsten & Powders Corp. |

United States Of America |

CID000568 |

| Tungsten |

Hunan Chenzhou Mining Co., Ltd. |

China |

CID000766 |

| Tungsten |

Hunan Jintai New Material Co., Ltd. |

China |

CID000769 |

| Tungsten |

Japan New Metals Co., Ltd. |

Japan |

CID000825 |

| Tungsten |

Kennametal Fallon |

United States Of America |

CID000966 |

| Tungsten |

Wolfram Bergbau und Hutten AG |

Austria |

CID002044 |

| Tungsten |

Xiamen Tungsten Co., Ltd. |

China |

CID002082 |

| Tungsten |

Jiangxi Minmetals Gao'an Non-ferrous Metals Co., Ltd. |

China |

CID002313 |

| Tungsten |

Ganzhou Jiangwu Ferrotungsten Co., Ltd. |

China |

CID002315 |

| Tungsten |

Jiangxi Yaosheng Tungsten Co., Ltd. |

China |

CID002316 |

| Tungsten |

Jiangxi Xinsheng Tungsten Industry Co., Ltd. |

China |

CID002317 |

| Tungsten |

Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. |

China |

CID002318 |

| Tungsten |

Malipo Haiyu Tungsten Co., Ltd. |

China |

CID002319 |

| Tungsten |

Xiamen Tungsten (H.C.) Co., Ltd. |

China |

CID002320 |

| Tungsten |

Jiangxi Gan Bei Tungsten Co., Ltd. |

China |

CID002321 |

| Tungsten |

Ganzhou Seadragon W & Mo Co., Ltd. |

China |

CID002494 |

| Tungsten |

Asia Tungsten Products Vietnam Ltd. |

Vietnam |

CID002502 |

| Tungsten |

Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch |

China |

CID002513 |

| Tungsten |

H.C. Starck Tungsten GmbH |

Germany |

CID002541 |

| Tungsten |

TANIOBIS Smelting GmbH & Co. KG |

Germany |

CID002542 |

| Tungsten |

Masan Tungsten Chemical LLC (MTC) |

Vietnam |

CID002543 |

| Tungsten |

Jiangwu H.C. Starck Tungsten Products Co., Ltd. |

China |

CID002551 |

| Tungsten |

Niagara Refining LLC |

United States Of America |

CID002589 |

| Tungsten |

China Molybdenum Co., Ltd. |

China |

CID002641 |

| Tungsten |

Hydrometallurg, JSC |

Russian Federation |

CID002649 |

| Tungsten |

Unecha Refractory metals plant |

Russian Federation |

CID002724 |

| Tungsten |

Philippine Chuangxin Industrial Co., Inc. |

Philippines |

CID002827 |

| Tungsten |

ACL Metais Eireli |

Brazil |

CID002833 |

| Tungsten |

Moliren Ltd. |

Russian Federation |

CID002845 |

| Tungsten |

Lianyou Metals Co., Ltd. |

Taiwan |

CID003407 |

| Tungsten |

JSC "Kirovgrad Hard Alloys Plant" |

Russian Federation |

CID003408 |

| Tungsten |

NPP Tyazhmetprom LLC |

Russian Federation |

CID003416 |

| Tungsten |

Hubei Green Tungsten Co., Ltd. |

China |

CID003417 |

| Tungsten |

Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. |

Brazil |

CID003427 |

| Tungsten |

Cronimet Brasil Ltda |

Brazil |

CID003468 |

| Tungsten |

Artek LLC |

Russian Federation |

CID003553 |

| Tungsten |

Fujian Xinlu Tungsten |

China |

CID003609 |

| Tungsten |

OOO “Technolom” 2 |

Russian Federation |

CID003612 |

| Tungsten |

OOO “Technolom” 1 |

Russian Federation |

CID003614 |

| Tungsten |

LLC Vostok |

Russian Federation |

CID003643 |

| Tungsten |

YUDU ANSHENG TUNGSTEN CO., LTD. |

China |

CID003662 |

| Tungsten |

HANNAE FOR T Co., Ltd. |

Korea, Republic Of |

CID003978 |

| Tungsten |

Tungsten Vietnam Joint Stock Company |

Vietnam |

CID003993 |

| Tungsten |

Nam Viet Cromit Joint Stock Company |

Vietnam |

CID004034 |

| Tungsten |

DONGKUK INDUSTRIES CO., LTD. |

Korea, Republic Of |

CID004060 |

| Tungsten |

Shinwon Tungsten (Fujian Shanghang) Co., Ltd. |

China |

CID004430 |

** Certain Tier 1 suppliers reported the presence of this entity

that was sanctioned by the United States Department of Treasury, Office of Foreign Assets Control on March 17, 2022, specifically,

CID003185 - African Gold Refinery. Because of the over-reporting nature of the industry CMRT information collection process, and the nature

of the supply chains and goods, we are unable to confirm this, or any, SoR is or was active in our supply chain. Tesla is in communication

with Tier 1 suppliers who listed this SoR, and will continue necessary follow-up to have this SoR removed from their supply chain. Overall,

we continue to engage with our Tier 1 suppliers to improve due diligence efforts and transparency.

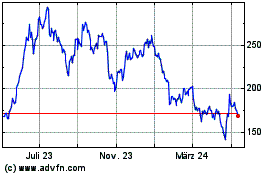

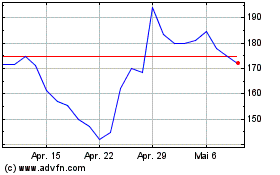

Tesla (NASDAQ:TSLA)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

Von Jun 2023 bis Jun 2024