Assystem: Revenue for the nine months ended 30 september 2023: €421.7 million

26 Oktober 2023 - 6:21PM

Assystem: Revenue for the nine months ended 30 september 2023:

€421.7 million

Revenue for the nine months ended 30

September 2023: €421.7 million Up 17.0%, with 14.3%

like-for-like growth

Paris-La Défense, 26 October 2023, 5.35

p.m. (CEST) – Assystem S.A. (ISIN: FR0000074148 - ASY), an

international engineering group, today released its revenue figures

for the nine months ended 30 September 2023 and the third

quarter of 2023.

Consolidated revenue for the nine months

ended 30 September 2023 and year-on-year changes

vs. 2022 (unaudited)

|

In € millions |

9 months2022 |

9 months2023 |

Total year-on-year change |

Like-for-like year-on-year change(2) |

|

Group |

360.6 |

421.7 |

+17.0% |

+14.3% |

| |

|

|

|

|

|

Nuclear(1) |

253.6 |

293.6 |

+15.8% |

+16.0% |

|

ET&I(1) |

107.0 |

128.1 |

+19.8% |

+10.0% |

|

|

|

|

|

|

(1) Consolidation of the UK company

LogiKal since 1 December 2022 and of Oreka Ingénierie and Relsafe

PRA Consulting since 1 January 2023.

Assystem’s activities in the Pacific area (due to be sold in 2023)

represented €8.6 million in revenue in the first nine months

of 2022 and €10.5 million in the first nine months of

2023.(2) Based on a comparable scope of consolidation

and constant exchange rates.

Assystem’s consolidated revenue totalled €421.7

million in the first nine months of 2023, up 17.0% on the same

period of 2022. Like-for-like growth came to 14.3%, changes in the

scope of consolidation had a positive 4.0% impact (due to the

consolidation of UK-based LogiKal since 1 December 2022 and of

Oreka Ingénierie and Relsafe PRA Consulting since 1 January

2023), and the currency effect was a negative 1.3%.

The trends seen since the beginning of the year

continued, with solid like-for-like growth quarter after quarter,

led by robust demand across all of the Group’s businesses, as well

as the success of our recruitment campaign and higher talent

retention, enabling the planned number of employees to be

reached.

In the third quarter of 2023, consolidated

revenue came to €139.3 million (versus €118.9 million in Q3 2022),

representing a 17.1% year-on-year increase. Like-for-like growth

was 15.0%, changes in the scope of consolidation had a positive

4.3% impact, and the currency effect was a negative 2.2%.

NUCLEAR (70% of nine-month consolidated

revenue)

Revenue from Nuclear activities totalled €293.6

million in the first nine months of 2023, compared with €253.6

million for the same period of 2022. This 15.8% year-on-year

increase breaks down as 16.0% in like-for-like growth, a positive

0.5% impact from changes in the scope of consolidation, and a

negative 0.7% currency effect.

Third-quarter 2023 Nuclear revenue amounted to

€95.5 million, up 16.6% on the €81.9 million recorded for the third

quarter of 2022. Like-for-like growth was 16.5%, changes in the

scope of consolidation had a positive 0.6% impact, and the currency

effect was a negative 0.5%.Growth for this segment was buoyant in

France and very buoyant in the United Kingdom, while Saudi Arabia’s

contribution was limited to the completion of siting studies.

ENERGY TRANSITION & INFRASTRUCTURES

(ET&I) (30% of nine-month consolidated revenue)

ET&I revenue came to €128.1 million in the

first nine months of 2023, versus €107.0 million for the same

period of 2022. Total year-on-year growth was 19.8%, including a

10.0% like-for-like increase, a positive 12.4% impact from changes

in the scope of consolidation, and a negative 2.6% currency effect.

The increasing contribution of siting studies as part of major

infrastructure projects in Saudi Arabia has now steadied, and

represented a high level for the nine months ended 30 September

2023 compared with 2022.

In the third quarter of 2023, ET&I revenue

totalled €43.8 million, compared with €37.0 million in Q3 2022.

This 18.1% year-on-year increase breaks down as 11.8% like-for-like

growth, a positive 12.7% impact from changes in the scope of

consolidation, and a negative 6.4% currency effect.

OUTLOOK FOR FULL-YEAR 2023

Assystem’s targets for full-year 2023 are as

follows:

- consolidated revenue of around €570

million;

- and EBITA1 of around €35

million.

These targets do not include the Group’s

activities in the Pacific area (Assystem Polynésie and Assystem

Nouvelle-Calédonie), for which Assystem has signed a sale agreement

with the two companies’ management, with the sale scheduled to

close by the end of 2023.

2024 FINANCIAL CALENDAR

| 8 February: |

Full-year 2023 revenue release |

|

13 March: |

Full-year 2023 results release – Results

presentation on Thursday 14 March at 10.00 a.m. (CET) |

|

25 April: |

First-quarter 2024 revenue release |

|

24 May: |

Annual General Meeting |

|

25 July: |

First-half 2024 revenue release |

|

11 September: |

First-half 2024 results release – Presentation

meeting on Thursday 12 September at 10.00 a.m. (CEST) |

|

24 October: |

Third-quarter 2024 revenue release |

ABOUT ASSYSTEM

Assystem, one of the world's leading independent

nuclear engineering companies, is committed to accelerating the

energy transition. With more than 55 years of experience in highly

regulated sectors with stringent safety and security constraints,

the Group provides engineering and project management services as

well as digital solutions and services to optimise the performance

of complex infrastructure assets throughout their life cycle.In its

12 countries of operation, Assystem’s 7,000 experts are supporting

energy transition. To achieve an affordable low carbon energy

supply, Assystem is committed to the development of low carbon

electricity (nuclear, renewables and electricity grids) and clean

hydrogen. The Group is also helping drive the use of low carbon

electricity in industrial sectors such as transportation.

For more information please visit

www.assystem.com / Follow Assystem on Twitter: @Assystem

CONTACTS

| Malène

Korvin – Chief Financial Officer – mkorvin@assystem.com -

Tel.: +33 (0)1 41 25 29 00Anne-Charlotte Dagorn –

Communications Director – acdagorn@assystem.com - Tel.: +33 (0)6 83

03 70 29 Agnès Villeret - Komodo

– Investor relations – agnes.villeret@agence-komodo.com – Tel.: +33

(0)6 83 28 04 15 |

QUARTERLY REVENUE

|

In € millions |

Q1 2022 |

Q1 2023 |

Total year-on-year change |

Like-for-like year-on-year change(2) |

|

Group |

120.2 |

143.8 |

+19.7% |

+16.4% |

| |

|

|

|

|

|

Nuclear(1) |

87.7 |

100.9 |

+15.0% |

+15.7% |

|

ET&I(1) |

32.5 |

42.9 |

+32.1% |

+18.3% |

|

In € millions |

Q2 2022 |

Q2 2023 |

Total year-on-year change |

Like-for-like year-on-year change(2) |

|

Group |

121.5 |

138.6 |

+14.1% |

+11.4% |

| |

|

|

|

|

|

Nuclear(1) |

84.0 |

97.2 |

+15.7% |

+16.2% |

|

ET&I(1) |

37.4 |

41.4 |

+10.7% |

+0.7% |

|

|

|

|

|

|

|

In € millions |

Q3 2022 |

Q3 2023 |

Total year-on-year change |

Like-for-like year-on-year change(2) |

|

Group |

118.9 |

139.3 |

+17.1% |

+15.0% |

| |

|

|

|

|

|

Nuclear(1) |

81.9 |

95.5 |

+16.6% |

+16.5% |

|

ET&I(1) |

37.0 |

43.8 |

+18.1% |

+11.8% |

|

|

|

|

|

|

(1) Consolidation of the UK company

LogiKal since 1 December 2022 and of Oreka Ingénierie and Relsafe

PRA Consulting since 1 January 2023. Assystem’s activities in the

Pacific area (due to be sold in 2023) represented €8.6 million

in revenue in the first nine months of 2022 (€3.6 million in Q3

2022) and €10.5 million in the first nine months of 2023 (€4.1

million in Q3 2023).(2) Based on a comparable scope of

consolidation and constant exchange rates.

1 Operating profit before non-recurring items (EBITA – Earnings

before Interest and Taxes – from Activity) including share of

profit of equity-accounted investees (other than Expleo Group and

MPH).

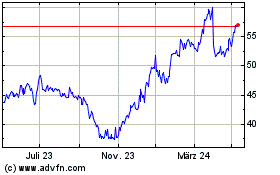

Assystem (EU:ASY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Assystem (EU:ASY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024