Bitcoin Leverage Ratio Plunges, Here’s What This Means

16 März 2023 - 8:38PM

NEWSBTC

On-chain data shows the Bitcoin estimated leverage ratio has taken

a plunge recently; here’s what this could mean for the market.

Bitcoin’s Estimated Leverage Ratio Has Sharply Declined Recently As

an analyst in a CryptoQuant post pointed out, the leverage has

dropped in the market despite the rally. The relevant indicator

here is the “estimated leverage ratio,” which measures the ratio

between the Bitcoin open interest and the total amount of BTC

stored in all derivative exchanges’ wallets. The “open interest”

refers to the total BTC margined futures contracts currently open

on all derivative exchanges. This metric accounts for both short

and long contracts. The estimated leverage ratio tells us the

average amount of leverage used by futures market users right now.

When the value of this metric is high, it means the average

contract holder is taking on high leverage currently. Such a trend

suggests that market participants are getting bold and willing to

take on a high risk. Generally, high leverage can cause the market

to become unstable. Thus, the price experiences high volatility

when these conditions form. On the other hand, low ratio values

imply users need to use more leverage currently. Naturally, the

price is usually calmer when this trend is observed. Now, here is a

chart that shows the trend in the Bitcoin estimated leverage ratio

over the last few years: Looks like the value of the metric has

sharply gone down in recent days | Source: CryptoQuant As displayed

in the above graph, the Bitcoin estimated leverage ratio had a

pretty high value when the rally started in January of this year

but has since been only going down. Related Reading: Bitcoin

Coinbase Premium Declines, But Still At Green Values, Bullish

Signal? There have been two significant plunges in the metric so

far; the first occurred just as the rally began. This sharp decline

was because the sudden sharp rally liquidated the high amount of

short contracts that had piled up during the bear market lows, thus

wiping out a lot of leverage. This event was an example of a

“liquidation squeeze.” During a squeeze, a sudden price move

triggers mass liquidations that only end up feeding said price to

move further, and thus, cause even more liquidations in the

process. When leverage piles up in the market, squeezes become more

probable. This is the reason why the market can get more volatile

when the leverage is at elevated levels. The chart shows that the

other plunge has come just during the last few days, where BTC has

witnessed a high degree of volatility, with the price fluctuating

wildly both up and down. Related Reading: Bitcoin (BTC) Dominance

Reclaims June 2022 Levels As Altcoins Plummet This trend of the

leverage ratio only going down with the rally is somewhat unusual.

Past rallies have generally accompanied the indicator following an

overall upwards trend because of investors FOMOing in and opening

up high-leverage positions. As for what this strange trend in the

metric may say about the current Bitcoin market, the quant thinks,

“latecomers who get greedy and use crazy leverages are not here

yet.” BTC Price At the time of writing, Bitcoin is trading around

$25,100, up 20% in the last week. BTC displays volatility | Source:

BTCUSD on TradingView Featured image from Maxim Hopman on

Unsplash.com, charts from TradingView.com, CryptoQuant.com

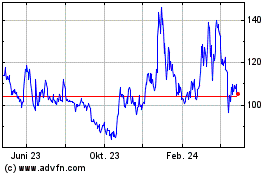

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

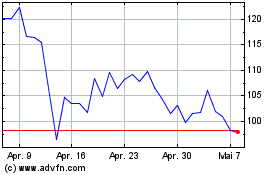

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025