Ethereum’s Price Stalls Below $3,500 as Leverage Ratios Climb—What Next?

23 Januar 2025 - 5:30AM

NEWSBTC

Ethereum has been consolidating in a tight price range for several

months, trading between $3,200 and $3,500. Despite the broader

market’s recent upward movement, ETH still struggles to break out

of this range. This stagnation comes after a prolonged decline from

its all-time high of $4,800, recorded in late 2021. The

cryptocurrency is now down roughly 32% from this peak. Notably,

even the appointment of the new pro-crypto administration and a

renewed sense of regulatory clarity have done little to propel

Ethereum beyond its current resistance levels. Amid these market

conditions, ShayanBTC, a contributor to CryptoQuant’s QuickTake

platform, has highlighted a critical metric that could signal an

impending price move for ETH. Related Reading: Ethereum Futures

Market Shows Renewed Optimism: Is a Break Above $3.5K Near?

Elevated Leverage Ratios In Ethereum And Its Implications According

to Shayan in a recent analysis uploaded on the CryptoQuant

QuickTake platform, the Estimated Leverage Ratio of Ethereum—a

measure of the average leverage used by futures market

participants—has been climbing steadily so far. This rise as

reported by Shayan reflects an increased willingness among traders

to take on risk, even as Ethereum’s price remains stuck in

consolidation. With leverage at elevated levels, the stage may be

set for a significant price swing, though its direction remains

uncertain. Shayan noted: The impending breakout from this range,

driven by the high-leverage environment, is expected to trigger a

significant and impulsive price move. Shayan elaborated that as

more traders take on higher leverage, the market becomes more

susceptible to sharp price movements. This is because if these

leveraged positions are liquidated—either through a short or long

squeeze—it could trigger a sudden and significant price adjustment.

The ongoing consolidation around $3,200–$3,500 has heightened

interest in what lies ahead for Ethereum. The CryptoQuant analyst

wrote: Given the prevailing market sentiment, a bullish breakout

appears more probable. However, traders should monitor the leverage

ratio closely, as any abrupt change could lead to unexpected

volatility and liquidations. ETH Market Performance At the time of

writing, ETH trades at $3,282, declining by 0.1% in the past 24

hours. Interestingly, despite this lackluster performance from ETH,

the asset’s daily trading volume in the past week has been quite

positive. Last Wednesday, ETH’s trading volume sat below $20

billion, however as of today, Ethereum’s daily trading volume

hovers above $24 billion. This is quite an opposite trend

especially when compared to ETH’s market performance over the same

period. Related Reading: Ethereum Appears ‘Bottomed Out,’ Analyst

Predicts A Rally Is Near According to Javon Marks, a renowned

crypto analyst on X, Ethereum appears to be on the verge of a

significant rally to $12,000 due to a similar performance to the

Fib Level as it did in a previous bull cycle. ETH (Ethereum), with

a similar performance to the 1.618 Fib Level as it did this past

bull cycle, could be set for a near +240% increase from here to the

$11,865.6 levels! A 5 Figure ETH may be on the way and

in-development now and this can help many Altcoins into major runs

👀. pic.twitter.com/eJT1Fu986b — JAVON⚡️MARKS (@JavonTM1) December

29, 2024 Featured image created with DALL-E, Chart from TradingView

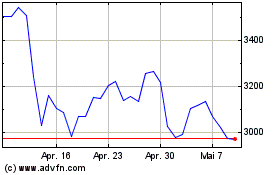

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025