Half Of All Bitcoin Unmoved In 2 Years: What Does This Mean For The BTC Price?

07 Februar 2023 - 7:00PM

NEWSBTC

A popular crypto analyst called “Documenting Bitcoin” released

fresh data on Tuesday showing that half of all Bitcoin (meaning

9.64 million BTC worth $86.4 billion) have not been moved for the

last two years. At the time of writing, there is 19.28 million BTC

in circulation, and the number of untouched coins represents about

50% of the current supply. Unmoved BTC is determined by how much of

the cryptocurrency has remained illiquid inside its holders’

wallets over a given period compared to its total supply.

Institutional Demands Driving Up BTC Price

The data shows that 50% of the Bitcoin in

circulation has remained intact within its wallet for two years.

This coincides with a period in which the digital coin saw

increased adoption by institutional investors. Institutions have

been purchasing large amounts of Bitcoin and holding it for

long-term purposes without the intent to sell. This has helped to

increase the valuation of the coin. Related Reading: Bitcoin and

Ethereum Whale Activities Plummet – Are Whales Getting Bored?

Though Bitcoin price hit its all-time high record of the $69,000

mark in November 2021, investors have shown no signs of selling

because their long-term investment strategy seems to be in play.

Investors have opted to hold the coin for the last two years

despite price swings. Institutions continue to see the long-term

potential of the cryptocurrency and have been increasing their

allocations despite the sector going through a severe bear market.

Data released last November showed that 62% of institutions

invested in cryptocurrency had increased their holdings over the

previous 12 months. The survey indicated that only 12% of

institutional investors had reduced their crypto exposure, meaning

that most institutions have remained bullish on virtual coins

long-term despite prices dropping. Of course, the crypto winter

presented an opportunity for long-term users to purchase in the

dip. Half of Bitcoin has remained unmoved for two years, implying

that the virtual asset is developing its momentum toward becoming a

store of value and digital gold. This is an essential development

for the Bitcoin ecosystem as it signals a growing level of

long-term confidence and stability among investors. The demand has

outweighed the supply of new coins. Bitcoin has a maximum of 21

million coins that mining can produce. With this fixed supply, an

ever-rising demand appears to send the crypto’s price surging.

Bitcoin Price Action Looking at the price chart below, Bitcoin was

trading its value at around $50,000 in December 2021. However, at

the beginning of 2022, things started falling apart. In January

last year, its price fell below $42,000. In May, the crypto was

trading for about $39,000, with a sudden plunge to $29,000. June

was when the crypto asset fluctuated its price between $19,000 and

$20,000. November was when the BTC price dropped to the $16,000

level, and since then, the crypto has managed to rally its price

relatively. Related Reading: Bitcoin Surges To $23,000 As Miners

Sales Sees Multi-Year Low So far, Bitcoin has soared its value by

about 40% this year. The cryptocurrency currently trades at

$23,011, up 0.43% in the last 24 hours, with a trading volume of

$24 billion. The digital asset is ranked the most prominent

cryptocurrency, with a market cap of $443 billion, according to

Coinmarketcap. Featured image from Unsplash, Chart from

TradingView.com

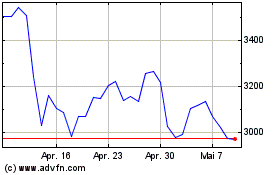

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024