Bitcoin Realized Cap Hits $832 Billion Milestone As $100K Inflows Begin To Slow

23 Januar 2025 - 1:00PM

NEWSBTC

Despite the low rate of capital inflows, Bitcoin has managed to

surpass the market’s expectations by reaching an all-time high. The

Realized Capitalization of Bitcoin reached an all-time high of $832

billion on Wednesday, demonstrating the confidence of investors and

the fortitude of the asset, according to market insights

from Glassnode. Related Reading: Bitcoin Could Surge To $1.7

Million, According To CryptoQuant And Glassnode What Is Realized

Cap And Why Is It Important? The valuation of Bitcoin is more

refined when viewed through the lens of realized capitalization,

which is a significant departure from market capitalization. This

algorithm determines the value of each Bitcoin by utilizing its

most recent transaction price, rather than the current market price

for all cryptocurrencies. This method monitors the movement of

coins and identifies the locations where long-term holders are

withdrawing profits or where new investors are entering. #Bitcoin‘s

capital inflows have slowed down since passing the $100K price tag.

Despite this, #BTC‘s Realized Cap has hit an ATH of $832B and

continues to grow at a rate of $38.6B per month:

https://t.co/NRjBjI3jMb pic.twitter.com/NefQiKEO38 — glassnode

(@glassnode) January 22, 2025 Bitcoin’s ability to attract new

capital is a reliable indicator that it also retains value within

the network. This is indicative of the increasing confidence in

Bitcoin as a long-term store of value. Inflows Of Capital Generate

Conflicting Signals A period of inconsistent capital inflows into

Bitcoin has coincided with the milestone, which is interesting.

Recent data indicates that Bitcoin Exchange-Traded Funds (ETFs)

experienced substantial outflows of $1.21 billion. Initially, the

outflow pointed to a decrease in institutional investors’

sentiment. However, just a few days later, the story took a

dramatic turn. With an influx of more than $1 billion on January 17

alone, the Bitcoin ETFs had a notable inflow of $3.26 billion from

January 15. This sudden turnaround suggests that there is still a

strong demand for Bitcoin even though there are still occasional

short-term swings in capital inflows. Long-Term Holders: The

Primary Factor Driving Growth It also emphasizes the importance of

long-term holders in the Bitcoin ecosystem, as the majority of

these investors are now opting to maximize their profits as the

confidence in Bitcoin’s ability to maintain its value over time

continues to increase. In the same breadth, new entrants purchase

crypto, frequently at a higher price, thereby increasing the

metric. This behavior discloses an essential insight: Bitcoin’s

expansion is not exclusively contingent upon speculative trading.

This is increasingly becoming a long-term investment for many,

similar to gold or other conventional stores of value. Related

Reading: Bitcoin Price To $122K Next Month? Research Predicts Big

Move Challenges Ahead Although the rise in Realized Cap is a

positive indicator, the market as a whole continues to experience

many challenges. Capital inflows that are slower may pose an issue

if they persist for an extended period. Nevertheless, the existence

of Bitcoin’s ability to establish new benchmarks in such

circumstances suggests that it is maturing as an asset. Featured

image from PCMag, chart from TradingView

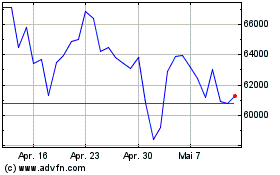

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025