Bitcoin’s Miner Sentiment Signals: Are We Nearing a Market Rebound?

04 Januar 2025 - 11:00AM

NEWSBTC

The Bitcoin market continues to draw attention as key on-chain

indicators reveal insights into miner sentiment and Bitcoin’s

quarterly performance trends. A recent analysis by CryptoQuant

analysts highlights how shifts in miner sentiment correlate with

Bitcoin price movements, while year-end data paints a picture of

Bitcoin’s overall market behavior in 2024. These insights are

critical for investors looking to navigate Bitcoin’s market

dynamics and anticipate potential trends in 2025. Related Reading:

Can Bitcoin Price Reach A New All-Time High? This Golden Cross

Suggests So The Role of Miner Sentiment In Market Dynamics Miner

sentiment is often viewed as a crucial metric in predicting Bitcoin

price movements. Historically, negative miner sentiment—typically

observed through indicators like hashrate, difficulty, block count,

and block rewards—has often signaled market bottoms or the early

stages of recovery trends. Additionally, the relationship between

miner sentiment and Bitcoin price movements has remained consistent

across various market cycles. A CryptoQuant analyst known as

datascope pointed out that periods of sharply negative miner

sentiment, highlighted by significant drops in hashrate and

increased block production difficulty, often precede substantial

price recoveries. This phenomenon was evident during Bitcoin’s

market cycles in 2017, 2018, and 2020, where negative miner

sentiment coincided with market bottoms and subsequent rallies. In

the context of the current market phase, the analyst observed

heightened miner sentiment volatility, suggesting increased

uncertainty and potential market corrections. However, the data

also indicates that significant declines in miner sentiment often

create strategic buying opportunities. Furthermore, with Bitcoin

mining profitability becoming more challenging due to increasing

difficulty levels, miner behavior is expected to play an even more

prominent role in determining market sentiment in the coming months

Bitcoin Year-End Performance Overview In addition to miner

sentiment, Bitcoin’s overall market performance in the final

quarter of 2024 offers important insights. According to another

CryptoQuant analyst known as Crazzyblockk, Bitcoin’s market

capitalization increased by 55%, while its realized capitalization

rose by 28.9% during Q4 of 2024. Although these figures represent

substantial growth, they fall slightly below the 58% market cap

growth seen in Q1 2024. However, the realized cap growth in Q4

outpaced that of Q1, indicating stronger capital inflows into

Bitcoin during the final months of the year. When compared to

previous Bitcoin cycles, the gains in Q4 2024 were more measured

than the sharp increases seen during earlier bull runs.

Historically, during peak bullish phases, Bitcoin often recorded

market cap growth nearing 100% and realized cap gains of 50-70%.

Related Reading: $33.14 Billion At Risk If The Bitcoin Price Hits

$72,462, Here’s Why Regardless the analyst mentioned that Q4 2024

can be considered to be “Bitcoin’s best quarter of the year.”

Looking ahead to 2025, Crazzyblockk appears to remain cautiously

optimistic about Bitcoin’s long-term growth potential. The analyst

noted: While history does not always repeat itself, we can

cautiously speculate that the bullish sentiment among Bitcoin

holders leaves room for long-term growth in 2025. However, this

does not rule out the possibility of short-term corrections along

the way Featured image created with DALL-E, Chart from TradingView

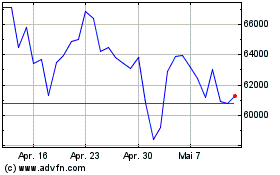

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025