Bitcoin $178K Target In Sight? Analyst Highlights Bollinger Band Retest Mirroring Jan. 2024 Rally

22 Dezember 2024 - 10:00PM

NEWSBTC

Bitcoin has been on a correction path since it reached a new

all-time high of $108,135 on December 17. Notably, this correction

has seen the leading cryptocurrency decline by about 10% up until

the time of writing and even breaking below $93,000 very quickly.

Related Reading: Dogecoin Price Above $10: Historical Data Shows

How High DOGE Will Go This Bull Cycle This notable decline has seen

Bitcoin retesting the Bollinger Bands, and technical analysis

suggests a bounce from here to reach a price target around

$178,000. Bitcoin Retests Monthly Upper Bollinger Band Bitcoin’s

recent price correction has caught the eye of crypto analyst Tony

Severino, who highlighted a critical retest of the monthly upper

Bollinger Band. Sharing his insights on social media platform X,

Severino emphasized the significance of this technical indicator,

which measures market volatility and potential reversal points.

According to him, this development mirrors a similar pattern

observed in January 2024, which eventually led to a substantial

rally after a similar retest. According to the daily candlestick

chart shared by Tony Severino, the upper Bollinger Band is

currently situated just above $96,000, which is around Bitcoin’s

current price. This Bollinger Band retest suggests that Bitcoin

might be entering a new phase of upward momentum after the recent

corrections. Historical Echoes: January 2024’s 86% Rally

Offers A Blueprint Severino’s analysis draws parallels between the

current price movement and Bitcoin’s behavior earlier in 2024. He

noted that in January 2024, a similar retest of the monthly upper

Bollinger Band preceded an 86% rally in Bitcoin’s price. At that

time, Bitcoin was trading near $46,000, following a strong price

rally that was brought forward from late 2023. However, January saw

a brief correction, with Bitcoin’s price dropping to $40,000 to

test the upper Bollinger Band. This test acted as a launchpad for

not only a continued rally but also pushed Bitcoin to break its

then all-time high and surpass $70,000 in March for the first time

in its history. If Bitcoin were to replicate this 86% rally at this

point, it could soar to approximately $178,000, which Severino

noted is aligning with the upper range of his target zone. In

another analysis, the analyst predicted that Bitcoin could reach

its market top as early as January 20, 2025. At the time of

writing, Bitcoin is trading $96,402, still hovering around the

upper Bollinger Band. Interestingly, the leading cryptocurrency is

currently down by 2.11% and 5.4% in the past 24 hours and seven

days, respectively. This pullback has led to the realization of

over $5.72 billion in Bitcoin profits, which has added to the

short-term selling pressure. The impact of this correction is

evident in Bitcoin’s Relative Strength Index (RSI), which has

fallen sharply from 69 on December 17 to its current reading of 45.

Related Reading: Ethereum Investment: Trump Crypto Project Grabs

722 ETH At $2.5 Million However, there are reasons to believe that

the selling pressure may be easing. This is because the RSI level

of 43 has acted as a significant support zone for Bitcoin since

September. If this support holds, it could provide the foundation

for Bitcoin’s move towards $178,000. Featured image from ABC News,

chart from TradingView

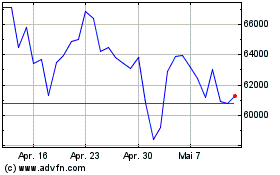

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024