0000021344False00000213442024-08-212024-08-210000021344ko:CommonStock0.25ParValueMember2024-08-212024-08-210000021344ko:A1.875NotesDue2026Member2024-08-212024-08-210000021344ko:A0.750NotesDue2026Member2024-08-212024-08-210000021344ko:A1.125NotesDue2027Member2024-08-212024-08-210000021344ko:A125NotesDue2029KO29AMember2024-08-212024-08-210000021344ko:A125NotesDue2029KO29BMember2024-08-212024-08-210000021344ko:A0400NotesDue2030Member2024-08-212024-08-210000021344ko:A1.250NotesDue2031Member2024-08-212024-08-210000021344ko:A3.125NotesDue2032Member2024-08-212024-08-210000021344ko:A375NotesDue2033Member2024-08-212024-08-210000021344ko:A500NotesDue2033Member2024-08-212024-08-210000021344ko:A1.625NotesDue2035Member2024-08-212024-08-210000021344ko:A1.100NotesDue2036Member2024-08-212024-08-210000021344ko:A0950NotesDue2036Member2024-08-212024-08-210000021344ko:A3.375NotesDue2037Member2024-08-212024-08-210000021344ko:A800NotesDue2040Member2024-08-212024-08-210000021344ko:A1000NotesDue2041Member2024-08-212024-08-210000021344ko:A3.500NotesDue2044Member2024-08-212024-08-210000021344ko:A3.750NotesDue2053Member2024-08-212024-08-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 21, 2024

COCA COLA CO

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-02217 | 58-0628465 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| One Coca-Cola Plaza | | |

| Atlanta, | Georgia | | 30313 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (404) 676-2121

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.25 Par Value | KO | New York Stock Exchange |

| 1.875% Notes Due 2026 | KO26 | New York Stock Exchange |

| 0.750% Notes Due 2026 | KO26C | New York Stock Exchange |

| 1.125% Notes Due 2027 | KO27 | New York Stock Exchange |

| 0.125% Notes Due 2029 | KO29A | New York Stock Exchange |

| 0.125% Notes Due 2029 | KO29B | New York Stock Exchange |

| 0.400% Notes Due 2030 | KO30B | New York Stock Exchange |

| 1.250% Notes Due 2031 | KO31 | New York Stock Exchange |

| 3.125% Notes Due 2032 | KO32 | New York Stock Exchange |

| 0.375% Notes Due 2033 | KO33 | New York Stock Exchange |

| 0.500% Notes Due 2033 | KO33A | New York Stock Exchange |

| 1.625% Notes Due 2035 | KO35 | New York Stock Exchange |

| 1.100% Notes Due 2036 | KO36 | New York Stock Exchange |

| 0.950% Notes Due 2036 | KO36A | New York Stock Exchange |

| 3.375% Notes Due 2037 | KO37 | New York Stock Exchange |

| 0.800% Notes Due 2040 | KO40B | New York Stock Exchange |

| 1.000% Notes Due 2041 | KO41 | New York Stock Exchange |

| 3.500% Notes Due 2044 | KO44 | New York Stock Exchange |

| 3.750% Notes Due 2053 | KO53 | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 21, 2024, the Talent and Compensation Committee (the “Committee”) of the Board of Directors of The Coca-Cola Company (the “Company”) approved the adoption of supplement award notifications (the “Supplements”) applicable to certain 2022 and 2023 restricted stock unit agreements and performance share unit agreements granted under The Coca-Cola Company 2014 Equity Plan (the “Awards”).

The Supplements provide employees holding outstanding Awards with certain benefits in the event of the employee’s (i) involuntary termination due to a reduction in workforce, internal reorganization or job elimination (an “Involuntary Termination”) or (ii) termination in connection with the employee’s participation in a voluntary separation program sponsored by the Company or any of its subsidiaries (a “Separation” or, together with an Involuntary Termination, a “Qualifying Termination”). In the event of a Qualifying Termination, unvested performance share units and restricted stock units with a vest date within 10 months from the date of termination shall continue to vest (in the case of performance shares units, subject to satisfaction of applicable performance criteria) and all other unvested awards shall be forfeited. In connection with an Involuntary Termination, the terminated employee must sign a release of all claims and, if requested by the Company, a confidentiality and non-competition agreement, in order to receive such benefits. The Supplements align these provisions with the terms currently applicable to similar awards granted in 2024.

The foregoing description of the Supplements is qualified in its entirety by reference to the full text of the Supplements, which are filed as Exhibit 10.1 and Exhibit 10.2 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the iXBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | THE COCA-COLA COMPANY

(REGISTRANT) |

| | |

| Date: August 21, 2024 | By: | /s/ Monica Howard Douglas |

| | Monica Howard Douglas

Executive Vice President and Global General Counsel |

Supplemental Award Notification

2022 and 2023 Performance Share Units (PSUs)

This document is a supplemental document that replaces the Employment Events Appendix for all 2022 and 2023 Performance Share Unit (PSU) awards. All other terms and conditions of The Coca-Cola Company 2014 Equity Plan and related agreements continue to apply, including, but not limited to, the provisions related to prohibited activities.

Employment Events Appendix

The table below sets out the impact to your Award (if any) upon certain employment events. The terms of the table below apply to vested and unvested portions of an Award equally, unless otherwise stated. Except as otherwise specified herein, all other terms and conditions of your Award continue to apply.

| | | | | |

Event | Impact to your Award |

| Disability | Whether your employment with the Company or a Subsidiary terminates because of Disability or whether you remain employed, there is no impact to your Award. |

| Death | Any Award that has not been accepted terminates immediately upon your death and may not be transferred to your heirs. If you die while employed with the Company or a Subsidiary, your Award immediately vests, and your estate will be paid, within 90 days after your death, a cash amount equal to the value of (1) the target number of shares of Stock subject to the Award, if you die before the end of the performance period, or (2) the shares of Stock earned, if you die after the end of the performance period. The value shall be determined based on the closing price of the Stock on the date of death (or in the case of a non-trading day, the next trading day). |

| Leave of absences1 | If you are on (1) US military leave, (2) a Company-paid leave of absence (meaning paid under Company payroll), or (3) an unpaid leave of absence (approved pursuant to a published Company policy available to all employees covered under the policy) of 12 months or less, there is no impact to your Award. For all other leaves of absence not specified in the paragraph above, including all approved unpaid leaves that extend beyond 12 months: •any portion of your Award that is unvested is immediately forfeited1; or •if the Committee identifies a valid business interest in doing otherwise, it may specify what provisions it deems appropriate at its sole discretion (provided that the Committee shall have no obligation to consider any such matters). |

1 If an approved unpaid leave of absence extends beyond 12 months, the portion of your Award that is unvested as of the end of the 12th month is forfeited.

| | | | | |

Event | Impact to your Award |

| Transfer | If you transfer (1) between the Company and any Subsidiary or, (2) at the Committee’s discretion, to an Affiliate that is not a Subsidiary, there is no impact to your Award. |

| Termination2 | A. If your employment with the Company or a Subsidiary terminates after attaining age 60: •Awards held less than 12 months are immediately forfeited, and •there is no impact on Awards held at least 12 months. |

B. If your employment with the Company or a Subsidiary terminates involuntarily for any reason other than for cause within one year after a Change in Control, your Award will be treated as described in the Plan. |

C. If your employment with the Company or a Subsidiary terminates prior to attaining age 60 (or after attaining age 60 and your award would be forfeited under paragraph A) because of (1) an involuntarily termination due to a reduction in workforce, internal reorganization, or job elimination and you sign a release of all claims and, if requested, an agreement on confidentiality and competition, or (2) you participate in a Company or Subsidiary-sponsored voluntary separation program: •if any portion of your Award normally vests within 10 months after your termination date, there is no impact to that portion of your Award, and •all other Awards, or portions thereof, are immediately forfeited. |

D. If your employment (1) with the Company or a Subsidiary terminates for any other reason, or (2) with an Affiliate (that is not a Subsidiary) terminates for any reason2 , your Award is immediately forfeited. Notwithstanding anything herein, if your employment with an Affiliate terminates and you immediately become employed by the Company or a Subsidiary, there is no impact on your Award. |

For the purposes of your Award, you are deemed to have terminated employment on the date you are no longer actively providing services to the relevant entity or entities, regardless of the reasons for termination and whether or not later found to be invalid or in breach of your employment agreement, if any, or employment laws in the jurisdiction where you are employed. The Committee has exclusive discretion to decide when you are considered to be no longer actively providing services for the purposes of your Award. However, you will not be considered to be actively providing services during any contractual notice period or any period of “garden leave” or similar period mandated under employment laws in the jurisdiction where you are employed or in your employment agreement, if any, unless the Committee decides otherwise.

2 This would apply in the case where the Committee determined that your transfer to the Affiliate would not impact your Award. If your employer no longer meets the definition of “Affiliate”, you are deemed to have terminated employment for the purposes of the Plan.

Supplemental Award Notification

2022 and 2023 Restricted Stock Units (RSUs)

This document is a supplemental document that replaces the Employment Events Appendix for all 2022 and 2023 Restricted Stock Unit (RSU) awards (except for Emerging Talent Retention Awards (ETRA)). All other terms and conditions of The Coca-Cola Company 2014 Equity Plan and related agreements continue to apply, including, but not limited to, the provisions related to prohibited activities.

Employment Events Appendix

The table below sets out the impact to your Award (if any) upon certain employment events. The terms of the table below apply to vested and unvested portions of an Award equally, unless otherwise stated. Except as otherwise specified herein, all other terms and conditions of your Award continue to apply.

| | | | | |

Event | Impact to your Award |

| Disability | If your employment with the Company or a Subsidiary terminates because of Disability, your Award immediately vests, and shares of Stock will be released within 90 days after your termination date. Otherwise, if you remain employed, there is no impact to your Award. |

| Death | Any Award that has not been accepted terminates immediately upon your death and may not be transferred to your heirs. If you die while employed with the Company or a Subsidiary, your Award immediately vests, and your estate will be paid, within 90 days after your death, a cash amount equal to the value of the shares of Stock subject to the Award. The value shall be determined based on the closing price of the Stock on the date of death (or in the case of a non-trading day, the next trading day).

|

| Leave of absences1 | If you are on (1) US military leave, (2) a Company-paid leave of absence (meaning paid under Company payroll), or (3) an unpaid leave of absence (approved pursuant to a published Company policy available to all employees covered under the policy) of 12 months or less, there is no impact to your Award. For all other leaves of absence not specified in the paragraph above, including all approved unpaid leaves that extend beyond 12 months: •any portion of your Award that is unvested is immediately forfeited1; or •if the Committee identifies a valid business interest in doing otherwise, it may specify what provisions it deems appropriate at its sole discretion (provided that the Committee shall have no obligation to consider any such matters). |

1 If an approved unpaid leave of absence extends beyond 12 months, the portion of your Award that is unvested as of the end of the 12th month is forfeited.

| | | | | |

Event | Impact to your Award |

| Transfer | If you transfer (1) between the Company and any Subsidiary or, (2) at the Committee’s discretion, to an Affiliate that is not a Subsidiary, there is no impact to your Award. |

| Termination2 | A. If your employment with the Company or a Subsidiary terminates after attaining age 60: •Awards held less than 12 months are immediately forfeited, and •Awards held at least 12 months immediately vest and shares of Stock will be released within 90 days after your termination date. |

B. If your employment with the Company or a Subsidiary terminates involuntarily for any reason other than for cause within one year after a Change in Control, your Award will be treated as described in the Plan. |

C. If your employment with the Company or a Subsidiary terminates prior to attaining age 60 (or after attaining age 60 and your award is not immediately vested under paragraph A) because of (1) an involuntarily termination due to a reduction in workforce, internal reorganization, or job elimination and you sign a release of all claims and, if requested, an agreement on confidentiality and competition, or (2) you participate in a Company or Subsidiary-sponsored voluntary separation program: •if any portion of your Award normally vests within 10 months after your termination date, there is no impact to that portion of your Award, and •All other Awards, or portions thereof, are immediately forfeited. |

D. If your employment (1) with the Company or a Subsidiary terminates for any other reason, or (2) with an Affiliate (that is not a Subsidiary) terminates for any reason3, your Award is immediately forfeited. Notwithstanding anything herein, if your employment with an Affiliate terminates and you immediately become employed by the Company or a Subsidiary, there is no impact on your Award. |

For the purposes of your Award, you are deemed to have terminated employment on the date you are no longer actively providing services to the relevant entity or entities, regardless of the reasons for termination and whether or not later found to be invalid or in breach of your employment agreement, if any, or employment laws in the jurisdiction where you are employed. The Committee has exclusive discretion to decide when you are considered to be no longer actively providing services for the purposes of your Award. However, you will not be considered to be actively providing services during any contractual notice period or any period of “garden leave” or similar period mandated under employment laws in the jurisdiction where you are employed or in your employment agreement, if any, unless the Committee decides otherwise.

2 If required by Section 409A of the Code, the payment may not be made (if applicable) until at least six months following the termination date.

3 This also would apply in the case where the Committee determined that your transfer to the Affiliate would not impact your Award. If your employer no longer meets the definition of “Affiliate”, you are deemed to have terminated employment for the purposes of the Plan.

v3.24.2.u1

Cover Page Document

|

Aug. 21, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 21, 2024

|

| Entity Registrant Name |

COCA COLA CO

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-02217

|

| Entity Tax Identification Number |

58-0628465

|

| Entity Address, Address Line One |

One Coca-Cola Plaza

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30313

|

| City Area Code |

(404)

|

| Local Phone Number |

676-2121

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000021344

|

| Amendment Flag |

false

|

| Common Stock, $0.25 Par Value [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.25 Par Value

|

| Trading Symbol |

KO

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes Due 2026 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes Due 2026

|

| Trading Symbol |

KO26

|

| Security Exchange Name |

NYSE

|

| 0.750% Notes Due 2026 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.750% Notes Due 2026

|

| Trading Symbol |

KO26C

|

| Security Exchange Name |

NYSE

|

| 1.125% Notes Due 2027 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Notes Due 2027

|

| Trading Symbol |

KO27

|

| Security Exchange Name |

NYSE

|

| .125% Notes Due 2029 KO29A |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.125% Notes Due 2029

|

| Trading Symbol |

KO29A

|

| Security Exchange Name |

NYSE

|

| .125% Notes Due 2029 KO29B |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.125% Notes Due 2029

|

| Trading Symbol |

KO29B

|

| Security Exchange Name |

NYSE

|

| 0.400% Notes Due 2030 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.400% Notes Due 2030

|

| Trading Symbol |

KO30B

|

| Security Exchange Name |

NYSE

|

| 1.250% Notes Due 2031 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes Due 2031

|

| Trading Symbol |

KO31

|

| Security Exchange Name |

NYSE

|

| 3.125% Notes Due 2032 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.125% Notes Due 2032

|

| Trading Symbol |

KO32

|

| Security Exchange Name |

NYSE

|

| .375% Notes Due 2033 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.375% Notes Due 2033

|

| Trading Symbol |

KO33

|

| Security Exchange Name |

NYSE

|

| .500% Notes Due 2033 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.500% Notes Due 2033

|

| Trading Symbol |

KO33A

|

| Security Exchange Name |

NYSE

|

| 1.625% Notes Due 2035 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Notes Due 2035

|

| Trading Symbol |

KO35

|

| Security Exchange Name |

NYSE

|

| 1.100% Notes Due 2036 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.100% Notes Due 2036

|

| Trading Symbol |

KO36

|

| Security Exchange Name |

NYSE

|

| 0.950% Notes Due 2036 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.950% Notes Due 2036

|

| Trading Symbol |

KO36A

|

| Security Exchange Name |

NYSE

|

| 3.375% Notes Due 2037 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.375% Notes Due 2037

|

| Trading Symbol |

KO37

|

| Security Exchange Name |

NYSE

|

| .800% Notes Due 2040 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.800% Notes Due 2040

|

| Trading Symbol |

KO40B

|

| Security Exchange Name |

NYSE

|

| 1.000% Notes Due 2041 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.000% Notes Due 2041

|

| Trading Symbol |

KO41

|

| Security Exchange Name |

NYSE

|

| 3.500% Notes Due 2044 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.500% Notes Due 2044

|

| Trading Symbol |

KO44

|

| Security Exchange Name |

NYSE

|

| 3.750% Notes Due 2053 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.750% Notes Due 2053

|

| Trading Symbol |

KO53

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_CommonStock0.25ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A1.875NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A0.750NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A1.125NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A125NotesDue2029KO29AMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A125NotesDue2029KO29BMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A0400NotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A1.250NotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A3.125NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A375NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A500NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A1.625NotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A1.100NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A0950NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A3.375NotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A800NotesDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A1000NotesDue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A3.500NotesDue2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_A3.750NotesDue2053Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

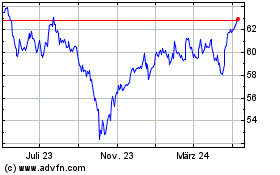

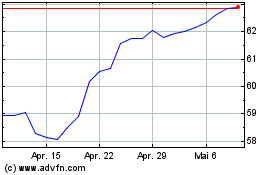

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Aug 2024 bis Sep 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Sep 2023 bis Sep 2024