Aura Minerals Inc. ("Aura Minerals" or the "Company") (TSX:ORA) announces

financial and operating results for 2013.

This release does not constitute management's discussion and analysis ("MD&A")

as contemplated by applicable securities laws and should be read in conjunction

with the MD&A and the Company's audited consolidated financial statements for

the three months and year ended December 31, 2013, which are available on SEDAR

at www.sedar.com and on the Company's website. Unless otherwise noted,

references herein to "$" are to thousands of United States dollar. References to

"C$" are to the Canadian dollar. Tables are expressed in thousands of United

States dollar, except where otherwise noted.

Highlights:

-- Operating cash flow(1) of $66,847 for the year ended December 31, 2013

compared to $38,317 for the year ended December 31, 2012;

-- Net sales revenue for 2013 increased by 8% over 2012. Gold sales and

copper concentrate sales revenues increased by 7% and 11% over 2012,

respectively;

-- Gold ounce ("oz") production for 2013 was 19% higher than in the prior

year and Aranzazu's copper production for the years ended December 31,

2013 and 2012 was 13,615,949 pounds and 10,980,100 pounds, respectively,

an increase of 24%;

-- Gross margin of $(5,693) for 2013 as compared to a gross margin of

$(15,314) for 2012;

-- Loss for the year ended December 31, 2013 (after a non-recurring loss on

the disposal of non-core exploration properties of $8,760 and impairment

charges of $56,191) of $74,193 or $0.32 per share compared to a loss of

$54,942 or $0.24 per share for the year ended December 31, 2012;

-- Subsequent to year end, the Company obtained a $22,500 gold loan from

Auramet International LLC, the proceeds of which have been utilized to

settle the Company's entire outstanding obligations pursuant to the

Company's Amended Credit Facility.

(1) Please see the cautionary note at the end of this press release.

Jim Bannantine, the Company's President and Chief Executive Officer stated:

"Aura continued to achieve strong operating cash flows in 2013 through improved

production efficiencies at our existing operations. As a result of the improved

production efficiencies and cost reductions at our gold mines the Company

achieved record gold production and outperformed initial Company guidance

despite a year where there was a substantial drop in the gold price. Our copper

production from our Aranzazu project has also increased substantially year on

year.

Mine development at Aranzazu has increased plant feed to realize economies of

scale with higher plant throughput and we have been optimizing our revenues

through the strict and controlled blending of ore feed arsenic. Initial

engineering studies for the expansion have continued, and financing pending, we

anticipate increasing our production to 4,500 tonnes per day, which is expected

by 2016.

At the San Andres Mine, 2013's production has been improved by the addition of a

new secondary crusher with increased availability and utilization, increasing

throughput and a focus on de-bottlenecking the plant. In addition, the grades

have been better than originally forecasted and we expect to see continued

growth in production this year.

Sao Francisco had an excellent 2013, surpassing all of our expectations, and we

expect to see another full year of strong production with continued decreases in

cash costs, based upon a revised geological block model which has identified

additional mineralization to our block model. Although Sao Vicente ceased its

mining operations in November, we achieved better than expected feed material

which enabled us to maximize the plant capacity throughout the year.

The Serrote development Project remains a valuable option for Aura to

significantly increase the size of the Company, and we're investigating a number

of options to realize that value, including potentially re-sequencing the

project schedule, reducing capital expenditure, finding an equity partner and

securing project-based financing.

In March 2014, we were able to agree on a $22.5 million gold loan facility which

we used to refinance our current balance sheet. This has enabled us to continue

to focus our efforts on a larger corporate financing package to enable us to

proceed with the full Aranzazu expansion, for which we remain optimistic, based

on discussions with potential lenders.

A focus on all costs at site and at corporate and strict cash conservation

methods has resulted in our being able to operate profitably and grow, realizing

the full potential of our assets which have capacity for significant organic

growth."

Production and Cash Costs

Gold oz production in the fourth quarter of 2013 was 3% lower as compared to the

fourth quarter of 2012. For the year ended December 31, 2013, gold oz production

was 19% higher than in the prior year. Gold production and cash costs(1) for the

three and twelve months ended December 31, 2013 and 2012 were as follows:

For the three months ended For the year ended

December 31, 2013 December 31, 2013

Oz Produced Cash Costs(1) Oz Produced Cash Costs(1)

----------------------------------------------------------------------------

San Andres 15,017 $ 1,244 63,811 $ 1,131

Sao Francisco 25,259 1,048 105,541 1,144

Sao Vicente 8,230 906 37,604 1,288

----------------------------------------------------------------------------

Total /

Average 48,506 $ 1,085 206,956 $ 1,166

----------------------------------------------------------------------------

----------------------------------------------------------------------------

For the three months ended For the year ended

December 31, 2012 December 31, 2012

Oz Produced Cash Costs(1) Oz Produced Cash Costs(1)

----------------------------------------------------------------------------

San Andres 11,936 $ 1,242 59,751 $ 1,015

Sao Francisco 29,368 1,218 80,357 1,528

Sao Vicente 8,952 1,092 33,155 1,537

----------------------------------------------------------------------------

Total /

Average 50,256 $ 1,201 173,263 $ 1,353

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Copper production at Aranzazu for the fourth quarter of 2013 and 2012 was

3,642,482 pounds and 2,223,100 pounds, respectively, an increase of 64%. On-site

average cash cost(1) per pound of payable copper produced, net of gold and

silver credits was $3.63 for the fourth quarter of 2013 compared to $5.42 for

the fourth quarter of 2012, inclusive of net realizable value write downs of

$0.76 and $1.25 for the fourth quarters of 2013 and 2012, respectively. Copper

production at Aranzazu for the years ended December 31, 2013 and 2012

was13,615,949 pounds and 10,980,100 pounds, respectively, an increase of 24%.

On-site average cash cost(1) per pound of payable copper produced net of gold

and silver credits was $4.15 for the full year of 2013 compared to $3.63 for the

full year of 2012 inclusive of net realizable value write-downs of $0.74 and

$0.56 for the years 2013 and 2012, respectively.

Gold production at San Andres in the fourth quarter of 2013 increased by 26%

over the comparable period primarily due to higher grades and recoveries.

Average cash cost per oz of gold produced(1) at San Andres in the fourth quarter

of 2013 was relatively flat when compared with the fourth quarter of 2012. The

15,000 metre drilling program for 2013 continued with priority on near term

production targets with higher grades and a similar program is expected to

continue into 2014.

Gold production at Sao Francisco in the fourth quarter of 2013 was 14% lower

than the fourth quarter of 2012 due primarily to lower plant feed. Average cash

cost per oz of gold produced(1) at Sao Francisco in the fourth quarter of 2013

was 14% lower than the fourth quarter of 2012. The lower average cash cost per

oz of gold produced(1) in the fourth quarter of 2013 was primarily due to the

higher grades encountered and increased recoveries from the leach while mining

costs were lower due to less material moved and also benefitted from the

weakening of the Brazilian real.

Mining at Sao Francisco is expected to continue to the end of 2014 as

exploration drilling in 2013 and a revised geological block model has identified

additional mineralized material in several areas of the pit. An updated

reconciliation indicates that certain waste and low grade zones could convert to

additional plant feed. Processing may be extended into 2015 as a result of the

positive reconciliation and the additional mineralization identified.

During the fourth quarter of 2013, 8% less gold ounces were produced as Sao

Vicente as compared to the fourth quarter of 2012. The average cost per oz of

gold produced(1) in the fourth quarter of 2013 was 17% lower than the fourth

quarter of 2012 due to the majority of ore being sourced from the stockpile, as

well as improved grades and recoveries from the heaps. There was also sufficient

feed material in the stockpiles to keep the plant operating at over 100,000

tonnes per month during Q4 2013.

Cyanide will continue to be added to the Sao Vicente heap leach pads in early

2014 and we will then irrigate the heap throughout 2014, initially to recover

any residual gold ounces, but thereafter to neutralize the cyanide and pH of the

heap.

At Aranzazu, copper concentrate production increased by 59% in the fourth

quarter of 2013 as compared to the fourth quarter of 2012, due to the effect of

a 37% increase in copper grade as a result of a planned shift to higher grade

underground mining, offset by a 4% decrease in the copper recoveries. Aranzazu's

mine development focused on near-term development in Q4 2013. This is expected

to continue throughout 2014.

Average cash cost per payable pound of copper produced(1) at Aranzazu for the

three months ended December 31, 2013 decreased by 28% as compared to the three

months ended December 31, 2012. These average cash costs are inclusive of net

realizable value write-downs of $0.76 and $1.25 for the fourth quarters of 2013

and 2012 respectively

The average arsenic level in the copper concentrate was 0.99% during the three

months ended December 31, 2013. Aranzazu implemented a successful program of

blending during 2013 to ensure that value could be maximized from the sales of

concentrates. This resulted in significant improvements in the levels of arsenic

encountered in the concentrate production.

(1) Please see the cautionary note at the end of this press release.

Serrote

The Serrote project early development phase is continuing and the Company is

continuing to pursue options to maximize the value of Serrote including, but not

limited to, a disposal of a majority interest in the project equity and the

Company is also considering a revised development and operating plan that would

require lower capital expenditures and an earlier execution schedule.

Brazilian Mines - Value Maximization

The Company continues to investigate multiple options to maximize the disposal

and closure value of the assets of the Brazilian Mines, including selling the

plant and equipment and utilizing key members of their operating teams at our

other locations.

Revenues and Cost of Goods Sold

Revenues for the year ended December 31, 2013 increased 8% compared to the year

ended December 31, 2012. The increase in revenues resulted from a 7% increase in

gold sales and a 11% increase in copper concentrate sales.

The increase in gold sales is attributable to a 27% increase in gold sales

volumes partially offset by a 15% decrease in the realized average gold price

per ounce.

The increase in copper concentrate net sales is primarily attributable to a 24%

increase in DMT sold offset by a 10% decrease in average price realized. Total

revenues for the year ended December 31, 2013 at Aranzazu related to the

shipment of 24,995 DMT of copper concentrate compared to 20,321 DMT of copper

concentrate for the year ended December 31, 2012. Total concentrate shipment

revenues for the year ended December 31, 2013 and 2012 were $1,642 per DMT and

$1,819 per DMT, respectively. The lower concentrate shipment revenue per DMT is

due to both lower commodity prices and the comparative effect of the

arsenic-related treatment and refining charges and penalties (such charges were

implemented mid-way through Q2 2012). The negotiated improvements to off-take

contracts only took effect in the later part of 2013.

For the year ended December 31, 2013 and 2012, total cost of goods sold from San

Andres was $82,084 or $1,255 per oz compared to $64,188 or $1,218 per oz,

respectively. For the years ended December 31, 2013 and 2012, cash operating

costs were $1,124 per oz and $1,019 per oz, respectively, while non-cash

depletion and amortization charges were $131 per oz and $199 per oz,

respectively. The cash operating costs for the year ended December 31, 2013

included a write-down of $880 or $13 per oz to bring production inventory to its

net realizable value (2012: $nil or $nil per oz).

Total cost of goods sold from the Brazilian Mines for the year ended December

31, 2013 and 2012 was $192,592 or $1,342 per oz and $209,425 or $1,866 per oz,

respectively. For the years ended December 31, 2013 and 2012, cash operating

costs were $1,090 per oz and $1,512 per oz, respectively, while non-cash

depletion and amortization charges were $252 per oz and $354 per oz,

respectively. The cash operating costs for the year ended December 31, 2013

included a write-down of $23,401 or $163 per oz to bring production inventory to

its net realizable value (2012: $33,883 or $302 per oz).

Total cost of goods sold from Aranzazu for the years ended December 31, 2013 and

2012 was $61,893 or $2,476 per DMT and $49,113 or $2,417 per DMT, respectively.

For the years ended December 31, 2013 and 2012, cash operating costs were $2,082

per DMT and $2,069 per DMT, respectively, while non-cash depletion and

amortization charges were $394 per DMT and $348 per DMT, respectively. The cash

operating costs for the year ended December 31, 2013 included a write-down of

$10,074 or $403 per DMT to bring production inventory to its net realizable

value (2012: $6,173 or $304 per DMT).

Additional Highlights

For the year ended December 31, 2013 and 2012, general and administrative costs

were $16,078 and $18,593, respectively. Salaries, wages and benefits and travel

expenses decreased due to reorganizations at the Company's corporate offices.

Share-based payment expense decreased 61% as a result of a lower value assigned

to stock options granted during the period and prior period forfeitures.

Professional and consulting fees decreased due to the Company limiting spending

on special projects during the period. Other expenses for 2013 include $2,100

relating to a non-recurring provision for employee travel liabilities and also

separate taxation penalties assessed on the late payment of instalments relating

to prior periods at the Company's operations.

Exploration costs for the year ended December 31, 2013 and 2012 were $1,987 and

$7,696 respectively. This decrease in exploration costs reflect the completion

of Serrote's feasibility study and Aranzazu's PEA in 2012. The 2013 exploration

program at San Andres is expected to result in the publication of a resource

update during 2014.

For the year ended December 31, 2013, the Company recorded an impairment charge

of $16,021 related to the long-lived assets of the Sao Francisco Mine and

$40,172 related to the long-lived assets of the San Andres Mine and a loss on

disposal relating to the non-core Brazilian exploration properties of $8,760.

Finance costs for the year ended December 31, 2013 and 2012 were $5,817 and

$4,917, respectively. The decrease in the overall accretion charge relates to

changes to the estimate of the net smelter return royalty payable and changes in

provisions for the mine closure cost and restoration. The service cost on the

post-employment benefit was re-calculated at December 31, 2013 for the entire

2013 year, resulting in an adjustment to the expense for the 2013 year. An

increase in the interest expense on debt and other interest and finance costs

reflects the additional forbearance period transaction costs, interest rates and

payment-in-kind interest charges.

Other gains for the year ended December 31, 2013 were $13,402, as compared to

other losses for the year ended December 31, 2012 of $5,099. Income tax recovery

for the year ended December 31, 2013 was $7,677 compared to an income tax

expense of $3,385 for the year ended December 31, 2012 was $3,385.

For the year ended December 31, 2013, the Company recorded a loss of $74,193

which compares to a loss of $54,942 for the year ended December 31, 2012.

Outlook and Strategy

Aura Minerals' future profitability, operating cash flows and financial position

will be closely related to the prevailing prices of gold and copper. Key factors

influencing the price of gold and copper include the supply of and demand for

these commodities, the relative strength of currencies (particularly the U.S.

dollar) and macroeconomic factors such as current and future expectations for

inflation and interest rates. Management believes that the short-to-medium term

economic environment is likely to remain relatively supportive for both

commodity prices but with continued volatility for both commodities. In order to

decrease risks associated with commodity price volatility the Company will

continue to evaluate entering into additional hedging programs.

Other key factors influencing profitability and operating cash flows are

production levels (impacted by grades, ore quantities, labour, plant and

equipment availabilities, and process recoveries) and production and processing

costs (impacted by production levels, prices and usage of key consumables,

labour, inflation, and exchange rates).

Aura Minerals' production and cash cost per oz(1) guidance for the 2014 year is

as follows:

Gold Mines Cash Cost per oz(1) 2014 Production

----------------------------------------------------------------------------

San Andres $ 800 - $ 950 75,000 - 85,000 oz

Sao Francisco $ 900 - $ 1,050 75,000 - 85,000 oz

Sao Vicente $ 525 - $ 675 5,500 - 7,500 oz

----------------------------------------------------------------------------

Total $ 850 - $ 1,000 155,500 - 177,500 oz

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Aranzazu's production for 2014 is expected to be between 18,000,000 and

19,500,000 pounds of copper at a range of $2.60 to $3.15 average cash cost per

payable pound(1) of copper.

In the first quarter of 2014 and to the date of this press release, the

indicators have been that the pro-rata guidance will be achieved at each

operating mine.

For 2014, total capital spending is expected to be $36,000. Of this amount,

$20,000 relates to the development and expansion of Aranzazu, while $12,000

relates to San Andres plant upgrades, Phase V of the heap leach expansion and

community expenditures. The remaining portion will be spent on various

miscellaneous projects in the group, including the Serrote development project.

The capital expenditure programs for the expansion of Aranzazu and the

development of Serrote are dependent upon successful completion of financing.

(1) Please see the cautionary note at the end of this press release.

Conference Call

Aura Minerals' management will host a conference call and audio webcast for

analysts and investors on Thursday, March 27, 2014 at 9:00 a.m. (Eastern Time)

to review the 2013 results. Participants may access the call by dialing

416-340-8530 or the toll-free access at 1-888-340-9642. Participants are

encouraged to call in 10 minutes prior to the scheduled start time to avoid

delays.

The call is being webcast and can be accessed at Aura Minerals' website at

www.auraminerals.com. Those who wish to listen to a recording of the conference

call at a later time may do so by dialing 905-694-9451 or 1-800-408-3053

(Passcode 5178729#). The conference call replay will be available from 2:00 p.m.

on March 27, 2014, until 11:59 p.m. (EST) on April 10, 2014.

Non-GAAP Measures

This news release includes certain non-GAAP performance measures, in particular,

the average cash cost of gold per oz, average cash cost per payable pound of

copper and operating cash flow which are non-GAAP performance measures. These

non-GAAP measures do not have any standardized meaning within IFRS and therefore

may not be comparable to similar measures presented by other companies. The

Company believes that these measures provide investors with additional

information which is useful in evaluating the Company's performance and should

not be considered in isolation or as a substitute for measures of performance

prepared in accordance with IFRS.

Average cash costs per oz of gold or per payable pound of copper are presented

as they represent an industry standard method of comparing certain costs on a

per unit basis. Total cash costs of gold produced include on-site mining,

processing and administration costs, off-site refining and royalty charges,

reduced by silver by-product credits, but exclude amortization, reclamation, and

exploration costs, as well as capital expenditures. Total cash costs of gold

produced are divided by oz produced to arrive at per oz cash costs. Similarly,

total cash costs of copper produced include the above costs, and are net of gold

and silver by-products, but include offsite treatment and refining charges.

Total cash costs of copper produced are divided by payable pounds of copper

produced to arrive at per payable pound cash costs.

Operating cash flow is the term the Company uses to describe the cash that is

generated from operations excluding depletion and amortization, stock based

compensation, impairment charges and the effect of changes in working capital.

About Aura Minerals Inc.

Aura Minerals is a Canadian mid-tier gold and copper production company focused

on the development and operation of gold and base metal projects in the

Americas. The Company's producing assets include the copper-gold-silver Aranzazu

mine in Mexico, the San Andres gold mine in Honduras and the Sao Francisco and

Sao Vicente gold mines in Brazil. The Company's core development asset is the

copper-gold-iron Serrote project in Brazil. Recent achievements on the Serrote

project include: completion of basic engineering; significant progress on land

acquisitions and community resettlement, with approximately 70% of the project

area now acquired; and engineering-only award of long lead equipment. Detailed

negotiations for debt and equity financing of the project are continuing.

National Instrument 43-101 Compliance

Unless otherwise indicated, Aura Minerals has prepared the technical information

in this press release ("Technical Information") based on information contained

in the technical reports and news releases (collectively the "Disclosure

Documents") available under the Company's profile on SEDAR at www.sedar.com.

Each Disclosure Document was prepared by or under the supervision of a qualified

person (a "Qualified Person") as defined in National Instrument 43-101 -

Standards of Disclosure for Mineral Projects ("NI 43-101"). Readers are

encouraged to review the full text of the Disclosure Documents which qualifies

the Technical Information. Readers are advised that mineral resources that are

not mineral reserves do not have demonstrated economic viability. The Disclosure

Documents are each intended to be read as a whole, and sections should not be

read or relied upon out of context. The Technical Information is subject to the

assumptions and qualifications contained in the Disclosure Documents. The

disclosure of Technical Information in this Press Release has been reviewed and

approved by Bruce Butcher, P. Eng., Vice President, Technical Services, a

Qualified Person pursuant to National Instrument 43-101.

Cautionary Note

This news release contains certain "forward-looking information" and

"forward-looking statements", as defined in applicable securities laws

(collectively, "forward-looking statements"). All statements other than

statements of historical fact are forward-looking statements. Forward-looking

statements relate to future events or future performance and reflect the

Company's current estimates, predictions, expectations or beliefs regarding

future events and include, without limitation, statements with respect to: the

amount of mineral reserves and mineral resources; the amount of future

production over any period; the amount of waste tonnes mined; the amount of

mining and haulage costs; cash costs; operating costs; strip ratios and mining

rates; expected grades and ounces of metals and minerals; expected processing

recoveries; expected time frames; prices of metals and minerals; mine life; and

gold hedge programs. Often, but not always, forward-looking statements may be

identified by the use of words such as "expects", "anticipates", "plans",

"projects", "estimates", "assumes", "intends", "strategy", "goals", "objectives"

or variations thereof or stating that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved, or the

negative of any of these terms and similar expressions.

Forward-looking statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are inherently

subject to significant business, economic and competitive uncertainties and

contingencies. Forward-looking statements in this news release and related MD&A

are based upon, without limitation, the following estimates and assumptions: the

presence of and continuity of metals at the Company's Mines at modeled grades;

the capacities of various machinery and equipment; the availability of

personnel, machinery and equipment at estimated prices; exchange rates; metals

and minerals sales prices; appropriate discount rates; tax rates and royalty

rates applicable to the mining operations; cash costs; anticipated mining losses

and dilution; metals recovery rates, reasonable contingency requirements; and

receipt of regulatory approvals on acceptable terms.

Known and unknown risks, uncertainties and other factors, many of which are

beyond the Company's ability to predict or control could cause actual results to

differ materially from those contained in the forward-looking statements.

Specific reference is made to the most recent Annual Information Form on file

with certain Canadian provincial securities regulatory authorities for a

discussion of some of the factors underlying forward-looking statements, which

include, without limitation, gold and copper or certain other commodity price

volatility, changes in debt and equity markets, the uncertainties involved in

interpreting geological data, increases in costs, environmental compliance and

changes in environmental legislation and regulation, interest rate and exchange

rate fluctuations, general economic conditions and other risks involved in the

mineral exploration and development industry. Readers are cautioned that the

foregoing list of factors is not exhaustive of the factors that may affect the

forward-looking statements.

All forward-looking statements herein are qualified by this cautionary

statement. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company undertakes no obligation to update

publicly or otherwise revise any forward-looking statements whether as a result

of new information or future events or otherwise, except as may be required by

law. If the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with respect to

those or other forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Aura Minerals Inc.

Joshua Perelman

(416) 649-1033

(416) 649-1044 (FAX)

info@auraminerals.com

www.auraminerals.com

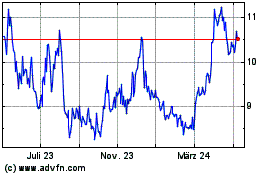

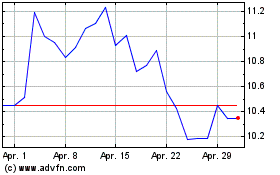

Aura Minerals (TSX:ORA)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Aura Minerals (TSX:ORA)

Historical Stock Chart

Von Mai 2023 bis Mai 2024