Altius Renewable Royalties Corp. (TSX: ARR) (OTCQX: ATRWF) (“ARR”,

the “Corporation”, or the “Company”) reports that Great Bay

Renewables II (“

Great Bay”), its subsidiary that

is jointly controlled with funds managed by affiliates of Apollo

Global Management (“

Apollo”), has entered into a

US$46 million royalty investment agreement with Longroad Energy

(“

Longroad”) to support Longroad’s acquisition of

the 70 MWac Titan Solar project in Imperial County, CA

(“

Titan”).

Titan represents Great Bay’s first royalty

investment in California. Longroad is a top-tier developer, owner,

and operator of renewable energy projects that owns 1.5 GW of wind

and solar projects across the US and operates and manages a total

of 3.5 GW on behalf of itself and third parties. Great Bay also

holds a royalty on Longroad’s operating Prospero 2 solar project in

Texas.

As part of the Titan acquisition, Longroad is

buying down an existing hedge associated with the project such that

starting in 2026 approximately 70% of the expected revenues will be

market-based with the remainder relating to contracted capacity

payments and renewable energy credits.

The royalty investment has been structured using

royalty rates that vary over time and achieve Great Bay’s

investment hurdles while optimizing Longroad’s project level cash

flow profile. Great Bay expects its royalty on Titan to contribute

approximately US$3 - $3.5 million to its revenues in 2023, and to

average US$4.5 - $5 million annually over its first 10 years.

ARR will fund its 50% share of the royalty

investment with an equivalent amount funded by Apollo, its Great

Bay level joint venture partner.

Frank Getman, CEO of Great Bay, commented,

“Longroad is one of the best in the business. We are pleased to

close our second royalty investment with Longroad, particularly as

this investment proves a new use case for the adoption of our

royalty financing, namely to support third-party project

acquisitions. Our flexible, partner-like capital is increasingly

proving itself to be competitive with other available sources of

capital in the market today, with now approximately US$300 million

in royalty investment agreements signed since inception.”

“Longroad is excited to once again work with

Great Bay by using its innovative royalty financing as part of our

capital structure”, said Pete Keel, Longroad’s CFO. “Great Bay’s

flexible, partner-like investment approach is a great fit with our

business and we look forward to working with its team again in the

future as we continue to grow our operational portfolio.”

Brian Dalton, CEO of ARR, commented, “Our Great

Bay joint venture continues to steadily build upon its first mover

advantage in bringing royalty financing to the renewable energy

natural resource sector and to grow and diversify its portfolio of

cash-flowing royalties. The new power region and use case

attributes of the Titan royalty financing further support our

outlook regarding the growing size of our potential addressable

market as we continue to work to rapidly scale up the business.

Today’s concurrent bought-deal equity financing announcement

further supports this ambition with additional deployment-focused

cash liquidity.”

CDN$35 Million Bought Deal

Financing

The Company is also pleased to announce that it

has entered into an agreement with a syndicate of underwriters led

by TD Securities Inc. and Cormark Securities Inc. (the “Lead

Underwriters” and collectively the “Underwriters”) pursuant to

which the Underwriters have agreed to purchase, on a bought deal

basis, 3,900,000 common shares of the Company (the “Shares”) at a

price of CDN$9.00 per Share (the “Issue Price”) for aggregate gross

proceeds of approximately CDN$35 million (the “Offering”).

The Company has granted the Underwriters an over-allotment

option (the “Over-Allotment Option”) to purchase up to an

additional 585,000 Shares at the Issue Price, exercisable in whole

or in part at any time up to 30 days after the closing of the

Offering.

Altius Minerals Corporation (“Altius”) is participating in the

Offering and has committed to purchase approximately CDN$21 million

in Shares at the Issue Price to allow Altius to maintain its

approximate 59% ownership of the Company at closing of the

Offering.

The Company intends to use the net proceeds from the Offering to

fund its 50% of the acquisition price for Great Bay’s Titan royalty

investment and for general corporate purposes.

The Offering is expected to close on or about December 8, 2022

and is subject to certain conditions including, but not limited to,

the receipt of all necessary approvals, including the approval of

the Toronto Stock Exchange (the “TSX”).

The securities to be issued under the Offering

will be offered by way of a prospectus supplement that will be

filed in each of the provinces and territories of Canada under the

Company's base shelf prospectus dated March 1, 2022 and may be

offered for sale in the United States to Qualified Institutional

Buyers (as defined in Rule 144A under the United States Securities

Act of 1933, as amended (the "1933 Act") by way of private

placement pursuant to an exemption from the registration

requirements of the 1933 Act.

The securities have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements. This

news release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

About ARR

ARR is a renewable energy royalty company whose

business is to provide long-term, royalty level investment capital

to renewable power developers, operators, and originators. ARR has

32 renewable energy royalties representing 735 MW of renewable

power on operating projects and an additional approximately 6 GW on

projects in development phase, across several regional power pools

in the U.S. The Corporation also expects future royalties from

Great Bay’s investments in Bluestar Energy Capital and Hodson

Energy. The Corporation combines industry expertise with

innovative, partner-focused solutions to further the growth of the

renewable energy sector as it fulfills its critical role in

enabling the global energy transition.

Forward-looking information

This news release contains forward‐looking

information as defined under Canadian securities laws which reflect

management’s current expectations. Some of the specific

forward-looking statements contained herein include, but are not

limited to, the projected revenues on Great Bay’s royalty on Titan,

statements with respect to the growth of the addressable market,

the expected closing date of the Offering and the intended use of

proceeds. The statements are based on reasonable assumptions and

expectations of management and ARR provides no assurance that

actual events will meet management's expectations. In certain

cases, forward‐looking information may be identified by such terms

as "anticipates", "believes", "could", "estimates", "expects",

"may", "shall", "will", or "would". Although ARR believes the

expectations expressed in such forward‐looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. Such forward-looking statements

are qualified in their entirety by the inherent risks and

uncertainties surrounding future expectations. Readers should not

place undue reliance on forward-looking information. ARR does not

undertake to update any forward-looking information contained

herein except in accordance with securities regulation. A number of

factors could cause actual results to differ, possibly materially,

from the results discussed in the forward-looking statements.

Additional information about risks and uncertainties is contained

in the filings of ARR under the Company’s profile at

www.sedar.com.

For further information, please contact:

|

Flora WoodEmail: Flora@arr.energyTel: 1.877.576.2209 Direct:

+1.416.346.9020 |

Ben LewisEmail: Ben@arr.energyTel: +1.877.576.2209 |

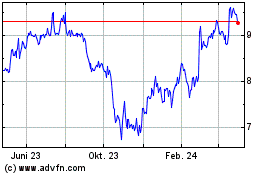

Altius Renewable Royalit... (TSX:ARR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

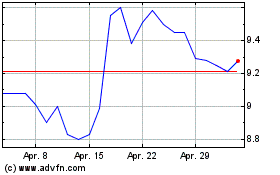

Altius Renewable Royalit... (TSX:ARR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025