AI budgets in wealth management to surge from

16% to 37%, but a readiness gap in regulatory compliance and

skilling of talent threatens to slow down efforts

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO), a leading

technology services and consulting company, today unveiled insights

from its report, "AI in Wealth Management: Navigating an

Evolving Data-Driven Landscape". The report, based on a survey

conducted among 100 executives in the U.S., examines how artificial

intelligence (AI) is changing the wealth management landscape and

emphasizes the importance of strategic investments in technology

infrastructure. It also highlights the role of talent and effective

governance in leveraging AI to drive competitive edge.

According to the report, the wealth management landscape is

experiencing a profound metamorphosis, as AI-driven innovation

promises to deliver higher levels of personalization and deeper

customer and market insights. In line with that promise, the survey

points to a significant future uptick in AI investments, with IT

budget allocations for AI expected to more than double—from 16 to

37 percent—within the next 3-5 years.

All surveyed firms indicate that they have started adopting AI

in different parts of their operations. However, less than half (44

percent) say they are using AI extensively. That said, these

extensive users report tangible benefits, with 73 percent

experiencing significant competitive advantage because of AI

adoption. These extensive users also lead the pack in leveraging AI

to enhance client engagement, with 65 percent expecting significant

AI-driven changes in client relationship management over the next

1-2 years.

Overall, more than three quarters (77 percent) of surveyed firms

report improved decision-making with AI-driven predictive analytics

and 76 percent note overall operational efficiency improvements.

Meanwhile, risk management is one of the key areas disrupted by AI,

according to more than half (53 percent) of the firms, followed by

research and analysis (45 percent).

“These findings suggest that AI offers wealth management firms a

chance to innovate, stand out, and succeed in an increasingly

competitive market,” said Ritesh Talapatra, Vice President and

Sector Head for Capital Markets and Insurance, Wipro Limited.

“This technological shift comes at a time when the industry faces

several challenges, including pressures on Assets Under Management

(AUM), fluctuating revenues, increasing operational costs, and

rising client expectations. In this context, AI emerges as a

powerful tool to deliver customized wealth management guidance,

optimized client satisfaction, and maximized financial returns. At

Wipro, we are committed to bringing these solutions to our wealth

management clients to fuel their future growth.”

The report also underscores the pivotal role of advisors in

effectively integrating AI into financial advice to meet the

diverse and evolving needs of investors. As such, one key challenge

for organizations is the skills gap in AI. To meet this challenge,

68 percent of organizations say they are prioritizing training and

recruitment in of employees in AI.

Further, the report shines a light on the challenges related to

the regulatory environment. Almost two-thirds (62 percent) of firms

identify the absence of clear regulatory guidelines as a top

challenge in AI adoption. Additionally, majority of firms highlight

regulatory and compliance challenges (55 percent) and biased and

discriminatory outputs (54 percent) as significant barriers to AI

adoption.

“AI is rapidly moving from a peripheral technology to a core

component of wealth management operations,” continued Talapatra,

Wipro Limited. “As firms embrace AI, regulatory scrutiny around

AI has intensified significantly. Ensuring AI implementations are

not only innovative but also fully compliant with the latest

regulatory standards will be a growing challenge for companies.

Ensuring that AI systems are explainable and trustworthy is

essential for maintaining both regulatory compliance and client

confidence.”

In closing, the report highlights that successful integration of

AI goes beyond mere technological implementation. It recommends

firms to leverage AI to fundamentally reimagine how wealth

management services are delivered and experienced and to cultivate

a culture that not only accepts AI technology, but actively

embraces change and innovation.

For more information and access to the full report, click

here

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading

technology services and consulting company focused on building

innovative solutions that address clients’ most complex digital

transformation needs. Leveraging our holistic portfolio of

capabilities in consulting, design, engineering, and operations, we

help clients realize their boldest ambitions and build

future-ready, sustainable businesses. With over 230,000 employees

and business partners across 65 countries, we deliver on the

promise of helping our clients, colleagues, and communities thrive

in an ever-changing world. For additional information, visit us at

www.wipro.com.

Forward-Looking Statements

The forward-looking statements contained herein represent

Wipro’s beliefs regarding future events, many of which are by their

nature, inherently uncertain and outside Wipro’s control. Such

statements include, but are not limited to, statements regarding

Wipro’s growth prospects, its future financial operating results,

and its plans, expectations and intentions. Wipro cautions readers

that the forward-looking statements contained herein are subject to

risks and uncertainties that could cause actual results to differ

materially from the results anticipated by such statements. Such

risks and uncertainties include, but are not limited to, risks and

uncertainties regarding fluctuations in our earnings, revenue and

profits, our ability to generate and manage growth, complete

proposed corporate actions, intense competition in IT services, our

ability to maintain our cost advantage, wage increases in India,

our ability to attract and retain highly skilled professionals,

time and cost overruns on fixed-price, fixed-time frame contracts,

client concentration, restrictions on immigration, our ability to

manage our international operations, reduced demand for technology

in our key focus areas, disruptions in telecommunication networks,

our ability to successfully complete and integrate potential

acquisitions, liability for damages on our service contracts, the

success of the companies in which we make strategic investments,

withdrawal of fiscal governmental incentives, political

instability, war, legal restrictions on raising capital or

acquiring companies outside India, unauthorized use of our

intellectual property and general economic conditions affecting our

business and industry.

Additional risks that could affect our future operating results

are more fully described in our filings with the United States

Securities and Exchange Commission, including, but not limited to,

Annual Reports on Form 20-F. These filings are available at

www.sec.gov. We may, from time to time, make additional written and

oral forward-looking statements, including statements contained in

the company’s filings with the Securities and Exchange Commission

and our reports to shareholders. We do not undertake to update any

forward-looking statement that may be made from time to time by us

or on our behalf.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028980126/en/

Media Contact: Wipro Media Relations

media-relations@wipro.com

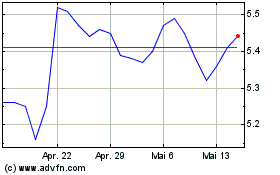

Wipro (NYSE:WIT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Wipro (NYSE:WIT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024