Frontier Stockholders Approve Acquisition by Verizon

13 November 2024 - 4:15PM

Business Wire

Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”

or the “Company”) today announced that its stockholders approved

the acquisition by Verizon Communications Inc. (NYSE, NASDAQ: VZ)

(“Verizon”) at its special meeting held on November 13, 2024.

Approximately 63% of stockholders voted “For” the merger agreement

proposal, with ten of the company’s top 12 stockholders voting to

approve the transaction.

On September 5, 2024, Frontier and Verizon announced they had

entered into a merger agreement, pursuant to which Verizon would

acquire Frontier in an all-cash transaction. Frontier stockholders

will receive $38.50 per share in cash, representing a premium of

37% to Frontier’s unaffected share price on September 3, 2024. The

transaction is expected to close by the first quarter of 2026,

subject to receipt of certain regulatory approvals and other

customary closing conditions.

“Today’s vote demonstrates the strong value of the fiber

business we have built over the past four years and our ability to

expand access to reliable connectivity for more Americans,” said

Nick Jeffery, President and Chief Executive Officer, Frontier. “We

look forward to closing this transaction by the first quarter of

2026 and beginning to deliver our premium fiber offering to

millions more customers across our combined network.”

About Frontier

Frontier (NASDAQ: FYBR) is the largest pure-play fiber provider

in the U.S. Driven by our purpose, Building Gigabit America®, we

deliver blazing-fast broadband connectivity that unlocks the

potential of millions of consumers and businesses. For more

information, visit www.frontier.com.

Forward-Looking

Statements

This communication contains “forward-looking statements”

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements address

our expectations or beliefs concerning future events, including,

without limitation, statements that relate to the proposed

transaction. These statements are made on the basis of management’s

views and assumptions, as of the time the statements are made,

regarding future events and performance and contain words such as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,”

“may,” “will,” “would,” or “target.” Forward-looking statements by

their nature address matters that are, to different degrees,

uncertain.

A wide range of factors could materially affect future

developments and performance, including but not limited to: (i) the

risk that the proposed transaction may not be completed in a timely

manner or at all; (ii) the failure to receive, on a timely basis or

otherwise, the required approval of the proposed transaction by

Frontier’s stockholders; (iii) the possibility that any or all of

the various conditions to the consummation of the proposed

transaction may not be satisfied or waived, including the failure

to receive any required regulatory approvals from any applicable

governmental entities (or any conditions, limitations or

restrictions placed on such approvals); (iv) the possibility that

competing offers or acquisition proposals for Frontier will be

made; (v) the occurrence of any event, change or other circumstance

that could give rise to the termination of the definitive

transaction agreement relating to the proposed transaction,

including in circumstances which would require Frontier to pay a

termination fee; (vi) the effect of the announcement or pendency of

the proposed transaction on Frontier’s ability to attract, motivate

or retain key executives and employees, its ability to maintain

relationships with its customers, suppliers and other business

counterparties, or its operating results and business generally;

(vii) risks related to the proposed transaction diverting

management’s attention from Frontier’s ongoing business operations;

(viii) the amount of costs, fees and expenses related to the

proposed transaction; (ix) the risk that Frontier’s stock price may

decline significantly if the merger is not consummated; (x) the

risk of shareholder litigation in connection with the proposed

transaction, including resulting expense or delay; and (xi) (A) the

risk factors described in Part I, Item 1A of Risk Factors in

Frontier’s most recent Annual Report on Form 10-K for the year

ended December 31, 2023 and (B) the other risk factors identified

from time to time in Frontier’s other filings with the SEC. Filings

with the SEC are available on the SEC’s website at

http://www.sec.gov.

This list of factors that may affect actual results and the

accuracy of forward-looking statements is illustrative and is not

intended to be exhaustive. These risks and uncertainties may cause

actual future results to be materially different than those

expressed in such forward-looking statements. The Company does not

intend, nor does it undertake any duty, to update any

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113159549/en/

Investor Contact Spencer Kurn SVP, Investor Relations +1

401-225-0475 spencer.kurn@ftr.com

Media Contact Chrissy Murray VP, Corporate Communications

+1 504-952-4225 chrissy.murray@ftr.com

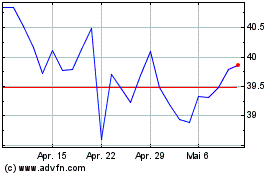

Verizon Communications (NYSE:VZ)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Verizon Communications (NYSE:VZ)

Historical Stock Chart

Von Nov 2023 bis Nov 2024