UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-40618

Stevanato Group S.p.A.

(Translation of registrant’s name into English)

Via Molinella 17

35017 Piombino Dese – Padua

Italy

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

Stevanato Group S.p.A. |

|

|

|

|

Date: November 5, 2024 |

|

By: |

/s/ Franco Stevanato |

|

|

Name: |

Franco Stevanato |

|

|

Title: |

Chief Executive Officer |

Stevanato Group �Q3 2024 Financial Results November 5, 2024 Exhibit 99.1

Q3 2024 Financial Results Safe Harbor Statement Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Stevanato Group S.p.A. (“we”, “our”, “us”, “Stevanato Group” or the “Company”) and which involve known and unknown risks, uncertainties and assumptions because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of the Company. These forward-looking statements include, or may include words such as "continue," "increase," "improve," "address," "position," "optimize," "right-size," "harmonize," "believe," "will," "remains," "rise," "expect," "strong," "growing," "advancing," "expected," "anticipate," "achieving," "expand," "drive," ”scaling,” “aimed,” “continued,” “remain,” “will return,” and other similar terminology. Forward-looking statements contained in this presentation include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and operational and commercial capabilities; our expectations regarding the development of our industry and the competitive environment in which we operate; the expansion of our plants and our expectations to increase production capacity; the global supply chain and our committed orders; customer demand and customers’ ability to destock higher inventories accumulated during the COVID-19 pandemic; the success of the Company's initiatives to optimize the industrial footprint, harmonize processes and enhance supply chain and logistics strategies; our geographical and industrial footprint and our goals, strategies, and investment plans. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Stevanato Group’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative global economic conditions, inflation, the impact of the conflict between Russia and Ukraine, the evolving events in Israel and Gaza, supply chain and logistical challenges and other negative developments in Stevanato Group’s business or unfavorable legislative or regulatory developments. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (iv) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (v) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vi) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (vii) significant interruptions in our operations could harm our business, financial condition and results of operations; (viii) as a consequence of the COVID-19 pandemic, global sales of syringes and vials to and for vaccination programs had increased, resulting in a revenue growth acceleration. The demand for such products may continue to shrink if the need for COVID-19 related solutions continues to decline; (ix) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; (x) our business, financial condition and results of operations may be impacted by our ability to successfully expand capacity to meet customer demand; (xi) the loss of a significant number of customers or a reduction in orders from a significant number of customers, including through destocking initiatives or lack of transparency of our products held by customers, could reduce our sales and harm our financial performance; (xii) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors; (xiii) our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows; (xiv) we are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies; (xv) given the relevance of our activities in the healthcare sector, investments by non-Italian entities in the Company, as well as certain asset disposals by the Company, may be subject to the prior authorization of the Italian Government (so called “golden powers”); (xvi) if relations between China and the United States deteriorate, our business in the United States and China could be materially and adversely affected; (xvii) cyber security risks and the failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions, could result in damage to our reputation, data integrity and/or subject us to costs, fines or lawsuits under data privacy or other laws or contractual requirements; (xviii) our trade secrets may be misappropriated or disclosed, and confidentiality agreements with directors, employees and third parties may not adequately prevent disclosure of trade secrets and protect other proprietary information; (xix) if we are unable to obtain and maintain patent protection for our technology, products and potential products, or if the scope of the patent protection obtained is not sufficiently broad, we may not be able to compete effectively in our markets; (xx) we depend in part on proprietary technology licensed from others. If we lose our existing licenses or are unable to acquire or license additional proprietary rights from third parties, we may not be able to continue developing our potential products; and (xxi) we are obligated to maintain proper and effective internal control over financial reporting. Our internal controls were not effective for the year ended December 31, 2023, and in the future may not be determined to be effective, which may adversely affect investor confidence in us and, as a result, the value of our ordinary shares; and any other risk described under the headings “Risk Factors”, “Operating and Financial Review and Prospects” and “Business” in our most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. This list is not exhaustive. We caution you therefore against relying on these forward-looking statements and we qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements. For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, refer to the risk factors discussed in our most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Non-GAAP Financial Information This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP financial measures. Management monitors and evaluates its operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. The Company believes that these non-GAAP financial measures provide useful and relevant information regarding its performance and improve its ability to assess its financial condition. While similar measures are widely used in the industry in which the Company operates, the financial measures it uses may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Accordingly, you should not place undue reliance on any non-IFRS financial measures contained in this presentation.

Q3 2024 Financial Results Stevanato Group Third Quarter 2024 Financial Results Earnings Call Franco�Stevanato Chairman & CEO Marco�Dal Lago CFO Lisa�Miles IR

Franco Stevanato Chairman & Chief Executive Officer Q3 2024 Financial Results

Q3 2024 Financial Results Third Quarter 2024 Performance Update Vial destocking: still expect vial orders will begin to pick up at the end of the year, with a gradual recovery in 2025 Positive market signals; collaboration with customers in Q3 2024 reaffirms our view Customers working down inventories at different rates Strong demand for our HVS: YTD +18% yoy Momentum in biologics and trend towards high-performance primary packaging reinforces our investment strategy in HVS capacity to match customer demand Q3 Revenue in line, but margins were below our expectations Lowering FY 2024 guidance for adj. EBITDA and adj. DEPS Main factors: higher costs in Engineering as we continue to implement our business optimization plan, and to a lesser extent, higher costs in the U.S. as we increase validation activities Engineering: initial benefits from actions taken. Completed several complex projects in Q3 2024 for key customers that were previously delayed Business optimization plan designed to: (i) address current challenges, (ii) improve the health of the business, and (iii) position the segment to return to profitable growth Main steps: (i) optimize footprint in alignment with product strategy; (ii) right-size operational structure; and (iii) harmonize industrial processes We believe these actions will lead to an improved operational structure that will yield both cost savings and gains in productivity Demand remains favorable, underpinned by long-term tailwinds such as (i) the rise in biologics, (ii) the adoption of DDS, (iii) higher regulatory standards (Annex One), and (iv) the trend towards ready-to-use (RTU) systems

Q3 2024 Financial Results Achieved Key Milestones in Demand-Driven Capacity Expansion Latina, Italy Advancing as planned: scaling production, improving utilization, and beginning to gain efficiencies In Q3 2024, the Latina project became profitable at the gross profit level Fishers (IN), U.S. In Q3 2024, successfully commenced commercial production generating our first commercial revenue Completed the installation of our second high-speed line and started validation activities across several key customers Customer validations expected to continue into 2026

Q3 2024 Financial Results Business and Other Recent Developments Advancing on wider HVS portfolio Initiative aimed at educating the industry as customers consider transition to sterilized vials and cartridges Over the last 30 years, syringe market converted to sterilized solutions; we believe customers will continue to adopt RTU vials and cartridges, replicating what happened with syringes RTU solutions meet growing demand for: greater efficiency faster production times enhanced product quality facilitate compliance with Annex One Support customers’ assessment and decision-making with scientific research, symposiums, webinars, and white papers Recently won a strategic supply agreement to support the commercialization of a groundbreaking, needle-free epinephrine nasal spray (neffy®)* Under the agreement, we will produce our premium micro vials (HVS) used in the neffy® device __________ * neffy® is a registered trademark of ARS Pharmaceuticals Operations, Inc

Marco Dal Lago Chief Financial Officer Q3 2024 Financial Results

Q3 2024 Financial Results Q3 2024: Financial Highlights __________ All comparisons refer to Q3 2023 unless otherwise specified. * Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA, adjusted EBITDA margin, are non-GAAP financial measures. Please refer to slides 17 to 22 for a reconciliation of non-GAAP measures † May not add up due to rounding (€ Million) Q3 2024 : Revenue Q3 2024: Margins 185 86�(32%) Q3 2023 177 100�(36%) Q3 2024 271 278 † +17% +2% HVS non-HVS Gross profit margin decreased to 26.8% Temporary headwinds impacting margins in 3Q include: Vial Destocking, including the underutilization of vial lines and lower revenue from more accretive EZ-fill® vials, Inefficiencies and higher costs tied to Fishers ramp up, Higher costs in Engineering We believe these headwinds are temporary and will gradually subside, which in turn will lead to a step-up in margins Operating profit margin of 14.8% (Adj. operating profit margin of 16.3%) Net profit of €30.0M, or €0.11 of diluted EPS (adj. net profit* of €33.1M, or €0.12 of adjusted diluted EPS*) Adjusted EBITDA* of €63.7M; adjusted EBITDA margin* of 22.9% In Q3 2024, revenue increase of 2% driven by 6% growth in the BDS Segment, which offset a 15% decline in the Engineering Segment HVS increased 17% yoy, reaching 36% of total revenue Currently forecasting strong Q4 2024 for HVS; updating FY 2024 target range to 37% to 39%, compared with 36% to 39%

Q3 2024 Financial Results Typical Path to Profitability of New Manufacturing Facility % Example of Timing and Phasing of a New Facility* ILLUSTRATIVE Positive GPM Group’s GPM Target GPM t Commercial production start Site broke ground Site acquisition (brownfield): Q1 2022 Commercial production start: Q4 2023 In Q3 2024, new Latina manufacturing facility was slightly positive to Gross Profit Margin Current temporary inefficiencies reflect the under absorption of expenses and the ongoing activities for the multi-year capacity ramp As capacity, productivity and revenue increase, the unfavorable impacts are expected to gradually abate, and we expect to benefit from the higher utilization, better product mix, and scale New Latina Site (Cisterna di Latina) Full capacity ramp *Timing of the path to profitability can vary based on the type of investment (e.g., greenfield vs brownfield) and on the size of the investment

Q3 2024 Financial Results Q3 2024 Segment Trends 219 Q3 2023 233 Q3 2024 Q3 2024 revenue increased 6% (7% at cc), driven by HVS syringes and other products Growth offset by 38% revenue decline in vials (more pronounced in EZ-fill® vials) Revenue from HVS grew 17%, while revenue from other containment and delivery solutions was consistent with the same period last year Gross profit margin decreased to 28%, tempered by (i) vial destocking, as well as (ii) start-up inefficiencies and higher costs in Fishers; and operating profit margin was 16.9% Biopharmaceutical and Diagnostic Solutions Segment (BDS) REVENUE (€ Million) GROSS PROFIT MARGIN (%) Engineering Segment 32.7 Q3 2023 28.0 Q3 2024 52 Q3 2023 45 Q3 2024 Q3 2024 revenue decreased 15% to €44.8 million. Gross profit margin decreased to 15.6%; and operating profit margin was 10.1% Making progress with our optimization plan, but it will continue to take some time. We believe we have set the path for continued operational and financial improvement REVENUE (€ Million) GROSS PROFIT MARGIN (%) 18.5 Q3 2023 15.6 Q3 2024 __________ All comparisons refer to Q3 2023 unless otherwise specified. Rounded figures

Q3 2024 Financial Results Balance Sheet and Cash Flow Items In Third Quarter 2024 At Quarter Ended September 30, 2024 (€ 28.4M) Free Cash Flow* € 284.3M Net Debt* € 78.0M Total Cash and Cash Equivalents € 58.8M CapEx* € 18.3M Net Cash Generated from Operations __________ *Net Debt, CapEx, Free Cash Flow are non-GAAP financial measures. Please refer to slides 17 to 22 for a reconciliation of non-GAAP measures.

Q3 2024 Financial Results Maintaining FY24 Revenue guidance. Updating Adj. EBITDA and DEPS __________ *Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin, Net Debt, CapEx, Free Cash Flow are non-GAAP financial measures. Please refer to slides 17 to 22 for a reconciliation of non-GAAP measures. PRIOR Guidance UPDATED Guidance Revenue € 1.090B - € 1.110B - Implied Revenue Growth 0.4% - 2% - Adjusted DEPS* € 0.48 - € 0.50 € 0.47 - € 0.49 Adjusted EBITDA* € 264.0M - € 272.0M € 257.0M - € 263.0M Trajectory for 2025 Our expectations for 2025 remain unchanged, and we remain cautious in the near term Still expect that the pace of recovery in bulk and EZ-fill® vials will be the largest swing factor in the level of FY25 growth Favorable tailwinds in high-performance syringes and other product categories such as cartridges, IVD and DDS We also anticipate improvements in the Engineering Segment alongside the implementation of our optimization plan Long-term growth construct remains intact Updated Adj. EBITDA and Adj. DEPS guidance for FY24 reflect (i) additional costs associated with the ongoing actions on our Engineering optimization plan; and (ii) to a lesser extent, higher costs as we increase our validation activities in the U.S.

Franco Stevanato Chairman & Chief Executive Officer Q3 2024 Financial Results

Q3 2024 Financial Results Fundamentals Remain Strong with Favorable Secular Tailwinds Focused on execution and achieving long-term objectives. FY 2024 presented challenges, but several reasons to be confident in our strategic direction: Continue to deliver organic growth, primarily driven by HVS, indicating we are investing in the right areas to meet growing demand Expect to increasingly benefit from the new capacity as we ramp-up and drive profitable growth Optimistic that the vial market will return to historical volumes and growth rates Clear and actionable plan to optimize the operations and improve the execution in our Engineering Segment These factors, coupled with the strong fundamentals of our business, are expected to set the stage for us to (i) return to durable double-digit organic growth, (ii) expand margins and (iii) drive long-term shareholder value

Stevanato Group �Q3 2024 Financial Results

This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted DEPS, Capital Employed, Net Cash, Free Cash Flow, and CapEx. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Reconciliation of Non-GAAP Financial Measures Q3 2024 Financial Results

Q3 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (1/5) Reconciliation of EBITDA (Amounts in € millions) Calculation of Net Profit margin, Operating Profit Margin, Adjusted EBITDA Margin and Adjusted Operating Profit Margin (Amounts in € millions) Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions)

Q3 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (2/5) Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Income Taxes, Net Profit, and Diluted EPS (Amounts in € millions, except per share data) (1) During the three and nine months ended September 30, 2024, the Group recorded €3.5 million and €9.2 million, respectively, of start-up costs for the new plants in Fishers, Indiana, United States, and in Latina, Italy. During the three and nine months ended September 30, 2023, the Group recorded €2.8 million and €9.4 million, respectively, of start-up costs for the new plants in Fishers, Indiana, United States, and in Latina, Italy. These costs are primarily related to labor costs incurred prior to the commencement of commercial operations that are associated with recruiting, hiring, training and travel expenses of personnel. (2) During the three and nine months ended September 30, 2024, the Group recorded €0.5 million and €3.6 million, respectively, of restructuring and related charges among general and administrative expenses and research and development expenses. During the three and nine months ended September 30, 2023, the Group recorded €0.2 million and €0.3 million, respectively, of restructuring and related charges among general and administrative expenses. These charges are mainly employee costs related to the reorganization of certain business functions. (3) During the three and the nine months ended September 30, 2024, the Group recorded €0.2 million related to personnel expenses, including other severance costs. (4) The income tax adjustment is calculated by multiplying the applicable nominal tax rate to the adjusting items.

Q3 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (3/5) Capital Employed (Amounts in € millions)

Q3 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (4/5) Net (Debt) / Net Cash (Amounts in € millions) Free Cash Flow (Amounts in € millions) CAPEX (Amounts in € millions)

Q3 2024 Financial Results Reconciliation of Non-GAAP Financial Measures (5/5) Reconciliation of 2024 Guidance (Updated) Reported and Adjusted EBITDA, Operating Profit, Net Profit, Diluted EPS (Amounts in € millions, except per share data) * *Amounts may not add due to rounding

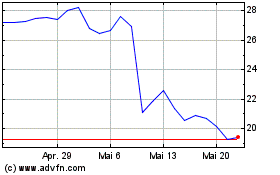

Stevanato (NYSE:STVN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

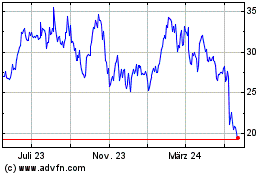

Stevanato (NYSE:STVN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024