UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-40618

Stevanato Group S.p.A.

(Translation of registrant’s name into English)

Via Molinella 17

35017 Piombino Dese – Padua

Italy

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

Stevanato Group S.p.A.

Interim report

for the three and the six months ended June 30, 2024

Table of Contents

INTRODUCTION

The financial information of Stevanato Group included in this Interim Report is presented in Euro except that, in some instances, information is presented in U.S. Dollars. All references in this report to “Euro”, “EUR” and “€” refer to the currency introduced at the start of the third stage of European Economic and Monetary Union pursuant to the Treaty on the Functioning of the European Union, as amended, and all references to “U.S. Dollars”, “USD” and “$” refer to the currency of the United States of America (the “United States”).

Certain totals in the tables included in this document may not add due to rounding. The financial data in the Management Discussion and Analysis of Financial Condition and Results of Operations is presented in millions of Euro, while the percentages presented are calculated using the underlying figures in Euro.

This Interim Report is unaudited.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 6-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Stevanato Group S.p.A. (“we”, “our”, “us”, “Stevanato Group”, the “Company” and, together with its subsidiaries, the “Group”). These forward-looking statements include, or may include, words such as “believe”, “potential”, “increased”, “future”, “remain”, “growing”, “expect”, “foreseeable”, “expected”, “to be”, “estimated”, “assumes”, “would”, “anticipate”, “will”, “plan”, “may”, “forecast”, “result”, and other similar terminology. Forward-looking statements contained in this report include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and operational and commercial capabilities; our expectations regarding the development of our industry and the competitive environment in which we operate; the expansion of our plants and our expectations to increase production capacity; the global supply chain and our committed orders; customer demand and customers' ability to destock higher inventories accumulated during the COVID-19 pandemic; the success of our initiatives to optimize the industrial footprint, harmonize processes and enhance supply chain and logistics strategies; our geographical and industrial footprint; and our goals, strategies and investment plans. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Stevanato Group's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative global economic conditions, inflation, the impact of the conflict between Russia and Ukraine, the evolving events in Israel and Gaza, supply chain and logistical challenges and other negative developments in Stevanato Group’s business or unfavorable legislative or regulatory developments. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (iv) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (v) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vi) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (vii) significant interruptions in our operations could harm our business, financial condition and results of operations; (viii) as a consequence of the COVID-19 pandemic, sales of syringes and vials to and for vaccination programs globally increased resulting in a revenue growth acceleration. The demand for such products may shrink, as the need for COVID-19 related solutions continue to decline; (ix) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; (x) our business, financial condition and results of operations may be impacted by our ability to successfully expand capacity to meet customer demand; (xi) the loss of a significant number of customers or a reduction in orders from a significant number of customers, including through destocking initiatives or lack of transparency of our products held by customers, could reduce our sales and harm our financial performance; (xii) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors; (xiii) our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows; (xiv) we are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies; (xv) given the relevance of our activities in the healthcare sector, investments by non-Italian entities in the Company, as well as certain asset disposals by the Company, may be subject to the prior authorization of the Italian Government (so called "golden powers"); (xvi) if relations between China and the United States deteriorate, our business in the United States and China could be materially and adversely affected; (xvii) cyber security risks and the failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions, could result in damage to our reputation, data integrity and/or subject us to costs, fines or lawsuits under data privacy or other laws or contractual requirements; (xviii) our trade secrets may be misappropriated or disclosed, and confidentiality agreements with directors, employees and third parties may not adequately prevent disclosure of trade secrets and protect other proprietary information; (xix) if we are unable to obtain and maintain patent protection for our technology, products and potential products, or if the scope of the patent protection obtained is not sufficiently broad, we may not be able to compete effectively in our markets; (xx) we depend in part on proprietary technology licensed from others. If we lose our existing licenses or are unable to acquire or license additional proprietary rights from third parties, we may not be able to continue developing our potential products; and (xxi) we are obligated to maintain proper and effective internal controls over financial reporting. Our internal controls were not effective for the year ended December 31, 2023, and in the future may not be determined to be effective, which may adversely affect investor confidence in us and, as a result, the value of our ordinary shares. This list is not exhaustive. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements.

These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements.

For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, refer to the risk factors discussed under “Risk Factors” below and “Item 3D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission on March 7, 2024.

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AT AND FOR THE THREE AND THE SIX MONTHS ENDED JUNE 30, 2024

Stevanato Group S.p.A.

Interim consolidated income statement

for the three and the six months ended June 30, 2024 and 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

(EUR thousand) |

|

|

(EUR thousand) |

|

|

|

Notes |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

9 |

|

|

259,579 |

|

|

|

255,305 |

|

|

|

495,573 |

|

|

|

493,297 |

|

Cost of sales |

|

10 |

|

|

192,056 |

|

|

|

176,401 |

|

|

|

365,852 |

|

|

|

338,134 |

|

Gross Profit |

|

|

|

|

67,523 |

|

|

|

78,904 |

|

|

|

129,721 |

|

|

|

155,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income |

|

11 |

|

|

941 |

|

|

|

4,019 |

|

|

|

2,285 |

|

|

|

5,233 |

|

Selling and marketing expenses |

|

12 |

|

|

7,389 |

|

|

|

6,775 |

|

|

|

13,181 |

|

|

|

12,841 |

|

Research and development expenses |

|

12 |

|

|

8,741 |

|

|

|

8,363 |

|

|

|

19,495 |

|

|

|

16,913 |

|

General and administrative expenses |

|

12 |

|

|

24,365 |

|

|

|

22,921 |

|

|

|

46,071 |

|

|

|

45,129 |

|

Operating Profit |

|

|

|

|

27,969 |

|

|

|

44,864 |

|

|

|

53,259 |

|

|

|

85,513 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

|

13 |

|

|

2,696 |

|

|

|

6,723 |

|

|

|

6,846 |

|

|

|

11,127 |

|

Finance expense |

|

14 |

|

|

1,494 |

|

|

|

7,278 |

|

|

|

5,258 |

|

|

|

16,281 |

|

Profit Before Tax |

|

|

|

|

29,171 |

|

|

|

44,309 |

|

|

|

54,847 |

|

|

|

80,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

15 |

|

|

8,548 |

|

|

|

10,028 |

|

|

|

15,412 |

|

|

|

17,795 |

|

Net Profit |

|

|

|

|

20,623 |

|

|

|

34,281 |

|

|

|

39,435 |

|

|

|

62,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Profit attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the parent |

|

|

|

|

20,625 |

|

|

|

34,241 |

|

|

|

39,439 |

|

|

|

62,506 |

|

Non-controlling interests |

|

|

|

|

(2 |

) |

|

|

40 |

|

|

|

(4 |

) |

|

|

58 |

|

|

|

|

|

|

20,623 |

|

|

|

34,281 |

|

|

|

39,435 |

|

|

|

62,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per ordinary share (in EUR) |

|

16 |

|

|

0.08 |

|

|

|

0.13 |

|

|

|

0.15 |

|

|

|

0.24 |

|

Diluted earnings per ordinary share (in EUR) |

|

16 |

|

|

0.08 |

|

|

|

0.13 |

|

|

|

0.15 |

|

|

|

0.24 |

|

The accompanying notes are an integral part of the Interim Condensed Consolidated Financial Statements

1

Stevanato Group S.p.A.

Interim consolidated statement of comprehensive income

for the three and the six months ended June 30, 2024 and 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

(EUR thousand) |

|

|

(EUR thousand) |

|

|

|

Notes |

|

|

|

|

|

|

|

|

|

|

|

|

Net Profit |

|

|

|

|

20,623 |

|

|

|

34,281 |

|

|

|

39,435 |

|

|

|

62,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gains/(losses) from remeasurement of employee defined benefit plans |

|

|

|

|

137 |

|

|

|

(41 |

) |

|

|

276 |

|

|

|

(122 |

) |

Tax effect relating to those components of OCI |

|

|

|

|

(9 |

) |

|

|

(2 |

) |

|

|

(19 |

) |

|

|

19 |

|

Other comprehensive income/(loss) that will not be classified subsequently to profit or loss |

|

|

|

|

128 |

|

|

|

(43 |

) |

|

|

257 |

|

|

|

(103 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange difference on translation of foreign operations |

|

26 |

|

|

(12,479 |

) |

|

|

3,557 |

|

|

|

(5,105 |

) |

|

|

7,506 |

|

Changes in the fair value of cash flow hedging instruments |

|

|

|

|

(690 |

) |

|

|

(1,577 |

) |

|

|

(768 |

) |

|

|

(649 |

) |

Changes in the time value element - cost of hedge |

|

|

|

|

(46 |

) |

|

|

134 |

|

|

|

(61 |

) |

|

|

(287 |

) |

Tax effect relating to those components of OCI |

|

|

|

|

171 |

|

|

|

409 |

|

|

|

216 |

|

|

|

13 |

|

Other comprehensive income that might be classified subsequently to profit or loss |

|

|

|

|

(13,044 |

) |

|

|

2,524 |

|

|

|

(5,718 |

) |

|

|

6,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income, net of tax |

|

|

|

|

(12,916 |

) |

|

|

2,480 |

|

|

|

(5,461 |

) |

|

|

6,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Comprehensive Income |

|

|

|

|

7,707 |

|

|

|

36,761 |

|

|

|

33,974 |

|

|

|

69,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the parent |

|

|

|

|

7,709 |

|

|

|

36,707 |

|

|

|

33,978 |

|

|

|

68,966 |

|

Non-controlling interests |

|

|

|

|

(2 |

) |

|

|

54 |

|

|

|

(4 |

) |

|

|

78 |

|

|

|

|

|

|

7,707 |

|

|

|

36,761 |

|

|

|

33,974 |

|

|

|

69,044 |

|

The accompanying notes are an integral part of the Interim Condensed Consolidated Financial Statements

2

Stevanato Group S.p.A.

Interim consolidated statement of financial position

at June 30, 2024 and at December 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At June 30, |

|

|

At December 31, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

(EUR thousand) |

|

Assets |

|

Notes |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

Goodwill |

|

|

|

|

49,983 |

|

|

|

49,983 |

|

Intangible assets |

|

17 |

|

|

32,197 |

|

|

|

30,985 |

|

Right of use assets |

|

19 |

|

|

16,876 |

|

|

|

18,249 |

|

Property, plant and equipment |

|

18 |

|

|

1,139,461 |

|

|

|

1,028,489 |

|

Financial assets - investments FVTPL |

|

|

|

|

379 |

|

|

|

676 |

|

Other non-current financial assets |

|

20 |

|

|

5,641 |

|

|

|

5,052 |

|

Deferred tax assets |

|

15 |

|

|

82,827 |

|

|

|

76,251 |

|

|

|

|

|

|

1,327,364 |

|

|

|

1,209,685 |

|

Current assets |

|

|

|

|

|

|

|

|

Inventories |

|

21 |

|

|

302,778 |

|

|

|

255,321 |

|

Contract assets |

|

22 |

|

|

175,970 |

|

|

|

172,580 |

|

Trade receivables |

|

22 |

|

|

236,976 |

|

|

|

301,769 |

|

Other current financial assets |

|

20 |

|

|

2,321 |

|

|

|

4,382 |

|

Tax receivables |

|

23 |

|

|

17,006 |

|

|

|

14,338 |

|

Other receivables |

|

24 |

|

|

56,492 |

|

|

|

43,900 |

|

Cash and cash equivalents |

|

25 |

|

|

78,146 |

|

|

|

69,602 |

|

|

|

|

|

|

869,689 |

|

|

|

861,892 |

|

Total assets |

|

|

|

|

2,197,053 |

|

|

|

2,071,577 |

|

Equity and liabilities |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Share capital |

|

26 |

|

|

22,232 |

|

|

|

21,698 |

|

Reserves and retained earnings |

|

26 |

|

|

1,262,495 |

|

|

|

965,202 |

|

Net profit attributable to equity holders of the parent |

|

26 |

|

|

39,439 |

|

|

|

145,631 |

|

Equity attributable to equity holders of the parent |

|

|

|

|

1,324,166 |

|

|

|

1,132,531 |

|

Non-controlling interests |

|

26 |

|

|

54 |

|

|

|

115 |

|

Total equity |

|

|

|

|

1,324,220 |

|

|

|

1,132,646 |

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Non-current financial liabilities |

|

27 |

|

|

252,373 |

|

|

|

255,639 |

|

Employees benefits |

|

29 |

|

|

7,225 |

|

|

|

7,413 |

|

Non-current provisions |

|

31 |

|

|

4,100 |

|

|

|

3,975 |

|

Deferred tax liabilities |

|

15 |

|

|

10,564 |

|

|

|

9,624 |

|

Non-current advances from customers |

|

34 |

|

|

47,667 |

|

|

|

39,418 |

|

Other non-current liabilities |

|

32 |

|

|

51,342 |

|

|

|

48,474 |

|

|

|

|

|

|

373,271 |

|

|

|

364,543 |

|

Current liabilities |

|

|

|

|

|

|

|

|

Current financial liabilities |

|

27 |

|

|

66,575 |

|

|

|

143,277 |

|

Current provisions |

|

31 |

|

|

1,462 |

|

|

|

1,063 |

|

Trade payables |

|

33 |

|

|

256,942 |

|

|

|

277,815 |

|

Contract liabilities |

|

34 |

|

|

23,501 |

|

|

|

22,306 |

|

Advances from customers |

|

34 |

|

|

11,130 |

|

|

|

22,892 |

|

Tax payables |

|

23 |

|

|

52,283 |

|

|

|

30,798 |

|

Other current liabilities |

|

33 |

|

|

87,669 |

|

|

|

76,237 |

|

|

|

|

|

|

499,562 |

|

|

|

574,388 |

|

Total liabilities |

|

|

|

|

872,833 |

|

|

|

938,931 |

|

Total equity and liabilities |

|

|

|

|

2,197,053 |

|

|

|

2,071,577 |

|

The accompanying notes are an integral part of the Interim Condensed Consolidated Financial Statements

3

Stevanato Group S.p.A.

Interim consolidated statements of changes in equity

for the six months ended June 30, 2024 and 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes |

|

Share

capital |

|

|

Share

premium

reserve |

|

|

Treasury

shares reserve |

|

|

Cash flow

hedge

reserve |

|

|

Cost of hedging reserve |

|

|

Reserve for

actuarial

gains /

(losses) |

|

|

Foreign

currency

translation

reserve |

|

|

Retained

earnings

and other

reserve |

|

|

Equity

attributable to

equity holders

of the parent |

|

|

Non-

controlling

interests |

|

|

Total

equity |

|

|

|

|

|

(EUR thousand) |

|

At January 1, 2024 |

|

|

|

|

21,698 |

|

|

|

389,312 |

|

|

|

(27,233 |

) |

|

|

2,241 |

|

|

|

(83 |

) |

|

|

(287 |

) |

|

|

(10,976 |

) |

|

|

757,859 |

|

|

|

1,132,531 |

|

|

|

115 |

|

|

|

1,132,646 |

|

Other comprehensive income |

|

26 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(567 |

) |

|

|

(46 |

) |

|

|

257 |

|

|

|

(5,105 |

) |

|

|

— |

|

|

|

(5,461 |

) |

|

|

— |

|

|

|

(5,461 |

) |

Net profit |

|

26 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

39,439 |

|

|

|

39,439 |

|

|

|

(4 |

) |

|

|

39,435 |

|

Total comprehensive income |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(567 |

) |

|

|

(46 |

) |

|

|

257 |

|

|

|

(5,105 |

) |

|

|

39,439 |

|

|

|

33,978 |

|

|

|

(4 |

) |

|

|

33,974 |

|

Dividends |

|

26 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,457 |

) |

|

|

(14,457 |

) |

|

|

— |

|

|

|

(14,457 |

) |

Change in the consolidated group |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

56 |

|

|

|

56 |

|

|

|

(56 |

) |

|

|

— |

|

Capital increase |

|

26 |

|

|

534 |

|

|

|

174,376 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

174,910 |

|

|

|

— |

|

|

|

174,910 |

|

Accessory costs to capital increase |

|

26 |

|

|

— |

|

|

|

(5,425 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,425 |

) |

|

|

— |

|

|

|

(5,425 |

) |

Taxes relating to capital increase costs |

|

26 |

|

|

— |

|

|

|

1,302 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,302 |

|

|

|

— |

|

|

|

1,302 |

|

Share-based incentive plans |

|

26 |

|

|

— |

|

|

|

— |

|

|

|

56 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,189 |

|

|

|

1,245 |

|

|

|

— |

|

|

|

1,245 |

|

Other |

|

26 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25 |

|

|

|

25 |

|

|

|

— |

|

|

|

25 |

|

Total effects |

|

|

|

|

534 |

|

|

|

170,253 |

|

|

|

56 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13,187 |

) |

|

|

157,657 |

|

|

|

(56 |

) |

|

|

157,601 |

|

At June 30, 2024 |

|

|

|

|

22,232 |

|

|

|

559,565 |

|

|

|

(27,177 |

) |

|

|

1,674 |

|

|

|

(129 |

) |

|

|

(30 |

) |

|

|

(16,081 |

) |

|

|

784,111 |

|

|

|

1,324,166 |

|

|

|

54 |

|

|

|

1,324,220 |

|

The accompanying notes are an integral part of the Interim Condensed Consolidated Financial Statements

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes |

|

Share

capital |

|

|

Share

premium

reserve |

|

|

Treasury

shares reserve |

|

|

Cash flow

hedge

reserve |

|

|

Cost of hedging reserve |

|

|

Reserve for

actuarial

gains /

(losses) |

|

|

Foreign

currency

translation

reserve |

|

|

Retained

earnings

and other

reserve |

|

|

Equity

attributable to

equity holders

of the parent |

|

|

Non-

controlling

interests |

|

|

Total

equity |

|

|

|

|

|

(EUR thousand) |

|

At January 1, 2023 |

|

|

|

|

21,698 |

|

|

|

389,312 |

|

|

|

(27,740 |

) |

|

|

5,371 |

|

|

|

(179 |

) |

|

|

(74 |

) |

|

|

(15,611 |

) |

|

|

623,353 |

|

|

|

996,130 |

|

|

|

(220 |

) |

|

|

995,910 |

|

Other comprehensive income |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(705 |

) |

|

|

(218 |

) |

|

|

(103 |

) |

|

|

7,486 |

|

|

|

— |

|

|

|

6,460 |

|

|

|

20 |

|

|

|

6,480 |

|

Net profit |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

62,506 |

|

|

|

62,506 |

|

|

|

58 |

|

|

|

62,564 |

|

Total comprehensive income |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(705 |

) |

|

|

(218 |

) |

|

|

(103 |

) |

|

|

7,486 |

|

|

|

62,506 |

|

|

|

68,966 |

|

|

|

78 |

|

|

|

69,044 |

|

Dividends |

|

26 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,294 |

) |

|

|

(14,294 |

) |

|

|

— |

|

|

|

(14,294 |

) |

Share-based incentive plans |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,060 |

|

|

|

3,060 |

|

|

|

— |

|

|

|

3,060 |

|

Other |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

85 |

|

|

|

85 |

|

|

|

— |

|

|

|

85 |

|

Total effects |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,149 |

) |

|

|

(11,149 |

) |

|

|

— |

|

|

|

(11,149 |

) |

At June 30, 2023 |

|

|

|

|

21,698 |

|

|

|

389,312 |

|

|

|

(27,740 |

) |

|

|

4,666 |

|

|

|

(397 |

) |

|

|

(177 |

) |

|

|

(8,125 |

) |

|

|

674,710 |

|

|

|

1,053,947 |

|

|

|

(142 |

) |

|

|

1,053,805 |

|

The accompanying notes are an integral part of the Interim Condensed Consolidated Financial Statements

5

Stevanato Group S.p.A.

Interim consolidated statements of cash flows

for the six months ended June 30, 2024 and 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

(EUR thousand) |

|

|

|

Notes |

|

|

|

|

|

|

Operating activities |

|

|

|

|

|

|

|

|

Profit before tax |

|

|

|

|

54,847 |

|

|

|

80,359 |

|

Adjustments: |

|

|

|

|

|

|

|

|

- depreciation and impairment of property, plant and equipment |

|

18 |

|

|

34,749 |

|

|

|

30,154 |

|

- amortization of intangible assets and right of use assets |

|

17, 19 |

|

|

7,763 |

|

|

|

7,728 |

|

- allowance for doubtful accounts |

|

|

|

|

329 |

|

|

|

294 |

|

- net interest expense/(income) |

|

|

|

|

1,333 |

|

|

|

1,261 |

|

- (gain)/loss from the disposal of non-current assets |

|

|

|

|

(630 |

) |

|

|

23 |

|

Change in other provisions |

|

|

|

|

1,380 |

|

|

|

793 |

|

Change in employee benefits |

|

|

|

|

118 |

|

|

|

(45 |

) |

Other non-cash expenses, net |

|

|

|

|

(5,747 |

) |

|

|

7,733 |

|

Working capital changes: |

|

|

|

|

|

|

|

|

- inventories and contract assets |

|

|

|

|

(51,926 |

) |

|

|

(86,567 |

) |

- trade receivables and other assets |

|

|

|

|

49,751 |

|

|

|

(33,506 |

) |

- trade payables, contract liabilities, advances and other liabilities |

|

|

|

|

5,210 |

|

|

|

58,006 |

|

Interest paid |

|

|

|

|

(2,338 |

) |

|

|

(1,421 |

) |

Interest received |

|

|

|

|

1,193 |

|

|

|

537 |

|

Income tax paid |

|

|

|

|

(2,187 |

) |

|

|

(3,840 |

) |

Net Cash Flows from operating activities |

|

|

|

|

93,845 |

|

|

|

61,509 |

|

Cash Flow from investing activities |

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

|

|

(169,253 |

) |

|

|

(219,916 |

) |

Proceeds from sale of property plant and equipment |

|

|

|

|

3,042 |

|

|

|

1 |

|

Purchase of intangible assets |

|

|

|

|

(5,551 |

) |

|

|

(2,568 |

) |

Proceeds from investments in financial assets |

|

|

|

|

325 |

|

|

|

(2,201 |

) |

Proceeds from life insurance policies redemption |

|

|

|

|

— |

|

|

|

27,908 |

|

Acquisition of a subsidiary |

|

|

|

|

(175 |

) |

|

|

— |

|

Net Cash Flows used in investing activities |

|

|

|

|

(171,612 |

) |

|

|

(196,776 |

) |

Cash Flow from financing activities |

|

|

|

|

|

|

|

|

Net proceeds from follow on offering of ordinary shares |

|

25 |

|

|

169,817 |

|

|

|

— |

|

Payment of principal portion of lease liabilities |

|

|

|

|

(2,849 |

) |

|

|

(3,202 |

) |

Proceeds from borrowings |

|

|

|

|

50,000 |

|

|

|

14,871 |

|

Repayments of borrowings |

|

|

|

|

(129,477 |

) |

|

|

(42,931 |

) |

Net Cash Flows from/ (used in) financing activities |

|

|

|

|

87,491 |

|

|

|

(31,262 |

) |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

|

|

|

9,724 |

|

|

|

(166,529 |

) |

Net foreign exchange differences on cash and cash equivalents |

|

|

|

|

(1,180 |

) |

|

|

(990 |

) |

Cash and cash equivalents at January 1 |

|

|

|

|

69,602 |

|

|

|

228,740 |

|

Cash and cash equivalents at June 30 |

|

|

|

|

78,146 |

|

|

|

61,221 |

|

The accompanying notes are an integral part of the Interim Condensed Consolidated Financial Statements

6

Stevanato Group S.p.A.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(Unaudited)

Stevanato Group S.p.A. (herein referred to as the “Company” and together with its subsidiaries the “Group”) is headquartered in Italy and its registered office is located at via Molinella 17, Piombino Dese (Padova, Italy). The Group is active in the design, production and distribution of products and processes to provide integrated solutions for the bio-pharma and healthcare industries, leveraging on regular investment and the selected acquisition of skills and new technologies to maintain and enhance its status as a global leader in the bio-pharma industry. Principal products are containment solutions, drug delivery systems, medical devices, diagnostic and analytical services, visual inspection machines, assembling and packaging machines, and glass forming machines.

The Group has ten production plants for manufacturing and assembly of bio-pharma and healthcare products (in Italy, Germany, Slovakia, Brazil, Mexico, China, and the United States), four plants for the production of machinery and equipment (in Italy and Denmark), two sites for analytical services (in Italy and the United States) and two commercial offices (in Japan and the United States). The Group is expanding its global capacity primarily for its high-value solutions products. In Italy, the new facilities in Piombino Dese and in Latina started commercial production in 2023. In the United States, the Group is advancing the build out of its new EZ-fill® manufacturing hub in Fishers, Indiana. In late 2023, the plant launched customer validations which are expected to continue into 2026 as part of the planned multi-year ramp-up, with commercial operations expected to start in the second half of 2024. The global footprint allows the Group to sell products and provide services in more than 70 countries worldwide.

Stevanato Group S.p.A. is controlled by Stevanato Holding S.r.l. which holds 73.73% of its share capital.

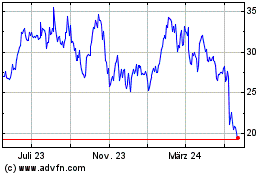

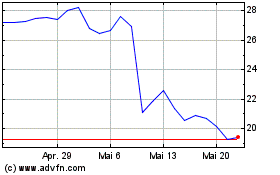

On July 16, 2021, Stevanato Group began trading on the New York Stock Exchange under the STVN ticker.

2.Authorization of Unaudited Interim Condensed Consolidated Financial Statements and compliance with international financial reporting standards

These Unaudited Interim Condensed Consolidated Financial Statements of Stevanato Group S.p.A. were authorized for issuance on August 5, 2024 and have been prepared in accordance with IAS 34 - Interim Financial Reporting. These Unaudited Interim Condensed Consolidated Financial Statements should be read in conjunction with the Group’s consolidated financial statements at and for the year ended December 31, 2023 (the “Consolidated Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). The accounting policies adopted are consistent with those used at December 31, 2023, except as described in Note 3 - Basis of preparation for the Unaudited Interim Condensed Consolidated Financial Statements “New standards, amendments and interpretations”.

3.Basis of preparation for Unaudited Interim Condensed Consolidated Financial Statements

The preparation of the Unaudited Interim Condensed Consolidated Financial Statements requires management to make estimates and assumptions that affect the reported amounts of revenue, expenses, assets and liabilities as well as disclosures of contingent liabilities. If in the future such estimates and assumptions, which are based on management’s best judgment at the date of these Unaudited Interim Condensed Consolidated Financial Statements, deviate from the actual circumstances, the original estimates and assumptions will be modified as appropriate in the period in which the circumstances change. Reference should be made to the section “Use of estimates” in the Consolidated Financial Statements for a detailed description of the more significant valuation procedures used by the Group.

Impairment tests of non-current assets (including goodwill and assets with an indefinite useful life for which impairment tests are performed for the preparation of the annual Consolidated Financial Statements) are not performed for the preparation of the Unaudited Interim Condensed Consolidated Financial Statements unless impairment indicators have been identified.

The actuarial valuations that are required for the determination of employee benefit provisions are also usually carried out during the preparation of the annual consolidated financial statements, except in the event of significant market fluctuations or significant

plan amendments, curtailments or settlements. IAS 34 also requires the disclosure of the nature and amount of items affecting net income that are unusual due to their nature, size or significance.

These Unaudited Interim Condensed Consolidated Financial Statements include the interim condensed consolidated income statement, the interim condensed consolidated statement of comprehensive income, the interim condensed consolidated statement of financial position, the interim condensed consolidated statement of changes in equity, the interim condensed consolidated cash flow statement and the accompanying condensed notes. The Unaudited Interim Condensed Consolidated Financial Statements are presented in Euro, which is the functional and presentation currency of the Company, and amounts are stated in thousands of Euros, unless otherwise indicated.

The Group has prepared the financial statements on the basis that it will continue to operate as a going concern. The Company’s management considers that there are currently no material uncertainties that may cast significant doubts over this assumption. Management has formed a judgment that there is a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future, and not less than one year after the date the financial statements are approved to be issued.

As the Group is not including the full set of disclosures, as required in a complete set of financial statements, the interim financial statements of the Group are regarded as ‘condensed’, as per IAS 34.

New standards, amendments and interpretations

The accounting policies adopted in the preparation of the Unaudited Interim Condensed Consolidated Financial Statements are consistent with those followed in the preparation of the Consolidated Financial Statements for the year ended December 31, 2023, except for the adoption of new standards and amendments effective from January 1, 2024. The Group has not early adopted any standard, interpretation or amendment that has been issued but is not yet effective.

The following amendments and new standards effective from January 1, 2024 were adopted for the first time in 2024 and did not have a material impact on the Unaudited Interim Condensed Consolidated Financial Statements of the Group:

In January 2020, the IASB issued amendments to IAS 1 — Presentation of Financial Statements: Classification of Liabilities as Current or Non-Current to clarify how to classify debt and other liabilities as current or non-current, and in particular how to classify liabilities with an uncertain settlement date and liabilities that may be settled by converting to equity. These amendments are effective on or after January 1, 2024.

In September 2022, the IASB issued amendments to IFRS 16 — Leases: Liability in a Sale and Leaseback to improve the requirements for sale and leaseback transactions, which specify the measurement of the liability arising in a sale and leaseback transaction, to ensure the seller-lessee does not recognize any amount of the gain or loss that relates to the right of use it retains. These amendments are effective on or after January 1, 2024.

In October 2022, the IASB issued amendments to IAS 1 — Presentation of Financial Statements: Non-current Liabilities with Covenants, that clarify how conditions with which an entity must comply within twelve months after the reporting period affect the classification of a liability. These amendments are effective on or after January 1, 2024.

In May 2023, the IASB issued amendments to IAS 7 — Statement of Cash Flows and IFRS 7 — Financial Instruments: Disclosures: Supplier Finance Arrangements, that introduce new disclosure requirements to enhance the transparency and usefulness of the information provided by entities about supplier finance arrangements and are intended to assist users of financial statements in understanding the effects of supplier finance arrangements on an entity’s liabilities, cash flows and exposure to liquidity risk. The amendments are effective on or after January 1, 2024.

The standards, amendments and interpretations issued by the IASB that will have mandatory application in 2025 or subsequent years are listed below:

In August 2023, the IASB issued amendments to IAS 21 — The Effects of Changes in Foreign Exchange Rates: Lack of Exchangeability, to clarify how an entity has to apply a consistent approach to assessing whether a currency is exchangeable into another currency and, when it is not, to determine the exchange rate to use and the disclosures to provide. These amendments are effective on or after January 1, 2025. The Group does not expect any material impact from the adoption of these amendments.

In April 2024, the IASB issued the new standard IFRS 18 — Presentation and Disclosure in Financial Statements, with the aim to give investors more transparent and comparable information about companies' financial performance through the introduction of three sets of new requirements: improved comparability in the income statement; enhanced transparency of management-defined

performance measures; more useful grouping of information in the financial statements. The new standard will affect all companies using IFRS Accounting Standards and will replace IAS 1 — Presentation of Financial Statements (while some of its requirements will be carried forward in IFRS 18). The standard is effective on or after January 1, 2027 but early adoption is possible.

In May 2024, the IASB issued amendments to IFRS 9 — Financial Instruments and IFRS 7 — Financial Instruments-Disclosure, with the aim to set financial liabilities using an electronic payment system and to assess contractual cash flow characteristics of financial assets, including those with environmental, social and governance (ESG)-linked features. They also amended disclosure requirements relating to investments in equity instruments designated at fair value through other comprehensive income and added disclosure requirements for financial instruments with contingent features that do not relate directly to basic lending risks and costs. The amendments are effective for annual reporting periods beginning on or after 1 January 2026, but early adoption is possible.

In July 2024, the IASB published 'Annual Improvements to IFRS Accounting Standards — Volume 11'. It contains amendments to five standards as result of the IASB's annual improvements project (IFRS 1 — First-time Adoption of International Financial Reporting Standards, IFRS 7 — Financial Instruments: Disclosures, IFRS 9 — Financial Instruments, IFRS 10 — Consolidated Financial Statements, IAS 7 — Statement of Cash Flows). The amendments are effective for annual reporting periods beginning on or after 1 January 2026, with earlier application permitted.

Stevanato Group S.p.A. is the parent company of the Group and it holds, directly and indirectly, interests in the Group’s operating companies. There are no changes in the scope of consolidation for the periods presented in this Unaudited Interim Condensed Consolidated Financial Statements.

Subsidiaries

The Unaudited Interim Condensed Consolidated Financial Statements of the Group include the following companies controlled by the parent company Stevanato Group S.p.A. directly or indirectly through the subsidiaries Stevanato Group International a.s., Balda Medical GmbH and Spami S.r.l.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% equity interest |

Name |

|

Segment |

|

Description |

|

Country of incorporation |

|

Jun. 30,

2024 |

|

Dec. 31,

2023 |

Nuova Ompi S.r.l. |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of drug containment solutions and development of integrated solutions for the pharmaceutical industry |

|

Italy |

|

100% |

|

100% |

Spami S.r.l. |

|

Engineering |

|

Production plant and machinery |

|

Italy |

|

100% |

|

100% |

Perugini S.r.l. |

|

Engineering |

|

Production of consumables and mechanical components for industrial machines |

|

Italy |

|

100% |

|

100% |

Stevanato Group International a.s. |

|

Holding |

|

Service/Subholding company |

|

Slovakia |

|

100% |

|

100% |

Medical Glass a.s. |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of drug containment solutions |

|

Slovakia |

|

99.74% |

|

99.74% |

Stevanato Group N.A. S. de RL de CV |

|

Biopharmaceutical and Diagnostic Solutions |

|

Service company |

|

Mexico |

|

100% |

|

100% |

Ompi N.A. S. de RL de CV |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of drug containment solutions |

|

Mexico |

|

100% |

|

100% |

Ompi of America inc. |

|

Biopharmaceutical and Diagnostic Solutions |

|

Sale of drug containment solutions and analytical services |

|

USA |

|

100% |

|

100% |

Ompi do Brasil I. e C. de Em. Far. Ltda |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of drug containment solutions |

|

Brazil |

|

100% |

|

100% |

Ompi Pharm. Packing Techn. Co. Ltd |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of drug containment solutions |

|

China |

|

100% |

|

100% |

Stevanato Group Denmark A/S |

|

Engineering |

|

Production plant and machinery |

|

Denmark |

|

100% |

|

100% |

Medirio SA |

|

Biopharmaceutical and Diagnostic Solutions |

|

Research and development |

|

Switzerland |

|

100% |

|

100% |

Balda Medical Gmbh |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of in-vitro diagnostic solutions |

|

Germany |

|

100% |

|

100% |

Balda C. Brewer Inc. |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of in-vitro diagnostic solutions |

|

USA |

|

100% |

|

100% |

Balda Precision Inc. |

|

Biopharmaceutical and Diagnostic Solutions |

|

Production of metal components |

|

USA |

|

100% |

|

100% |

Ompi of Japan Co., Ltd. |

|

Biopharmaceutical and Diagnostic Solutions |

|

Sale of drug containment solutions |

|

Japan |

|

100% |

|

100% |

Non-controlling interests

The equity and the net profit attributable to non-controlling interests at June 30, 2024 relate to Medical Glass a.s. in which the Group holds a 99.74% interest.

The Group is exposed to the following financial risks connected with its operations:

•financial market risk, mainly related to foreign currency exchange rates and interest rates;

•liquidity risk, mainly related to difficulties in meeting the obligations associated with financial liabilities that are settled in cash or other financial assets, and to the availability of funds and access to the credit market, should the Group require it, and to financial instruments in general;

•credit risk, arising both from its normal commercial relations with customers, and its financing activities;

•commodity risk, arising from the fluctuation in commodities prices, driven by external market factors, especially for natural gas and electricity. Such fluctuations in commodities price can cause significant business challenges that can, in turn, affect production costs, product pricing, margins and cash flows, value of assets and liabilities.

These risks could significantly affect the Group’s financial position, results of operations and cash flows. Therefore, the Group identifies and monitors these risks to identify potential negative effects in advance and takes action to mitigate them, primarily

through its operating and financing activities and, if required, through the use of derivative financial instruments.

The Unaudited Interim Condensed Consolidated Financial Statements do not include all the information and notes on financial risk management required in the annual consolidated financial statements. For a detailed description of the financial risk factors and financial risk management of the Group, reference should be made to Note 38 of the Consolidated Financial Statements at and for the year ended December 31, 2023.

6.Foreign currency exchange

The principal foreign currency exchange rates used to translate other currencies into Euro were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTRY |

|

ISO

CODE |

|

Average for the

six months ended

June 30, |

|

|

At

June 30, |

|

|

Average for the

six months ended

June 30, |

|

|

At

June 30, |

|

|

At

December 31, |

|

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

CHINA |

|

CNY |

|

|

7.8011 |

|

|

|

7.7748 |

|

|

|

7.4894 |

|

|

|

7.8983 |

|

|

|

7.8509 |

|

UNITED STATES |

|

USD |

|

|

1.0813 |

|

|

|

1.0705 |

|

|

|

1.0807 |

|

|

|

1.0866 |

|

|

|

1.1050 |

|

MEXICO |

|

MXN |

|

|

18.5089 |

|

|

|

19.5654 |

|

|

|

19.6457 |

|

|

|

18.5614 |

|

|

|

18.7231 |

|

DENMARK |

|

DKK |

|

|

7.4580 |

|

|

|

7.4575 |

|

|

|

7.4462 |

|

|

|

7.4474 |

|

|

|

7.4529 |

|

BRAZIL |

|

BRL |

|

|

5.4922 |

|

|

|

5.8915 |

|

|

|

5.4827 |

|

|

|

5.2788 |

|

|

|

5.3618 |

|

SWITZERLAND |

|

CHF |

|

|

0.9615 |

|

|

|

0.9634 |

|

|

|

0.9856 |

|

|

|

0.9788 |

|

|

|

0.9260 |

|

JAPAN |

|

JPY |

|

|

164.4613 |

|

|

|

171.9400 |

|

|

|

145.7604 |

|

|

|

157.1600 |

|

|

|

156.3300 |

|

7.Seasonality of operations

The Group is not impacted by seasonality.

Management identifies two operating segments, based on the internal organization and reporting structure of the Group. The criteria used to identify the Group’s operating segments are consistent with the way the chief operating decision-maker (identified in the Chief Executive Officer of Stevanato Group S.p.A.) assigns resources and monitors performance. The two operating segments are:

•Biopharmaceutical and Diagnostic Solutions, which includes the products, processes and services developed and provided in connection with the containment and delivery of pharmaceutical and biotechnology drugs and reagents (such as vials, cartridges, syringes and drug delivery systems like pen injectors, auto injectors and wearables), as well as the production of diagnostic consumables. This segment deals mainly with the development and manufacturing of Drug Containment Solutions (DCS), In-Vitro Diagnostic Solutions (IVD) and Drug Delivery Systems (DDS). The business model is complex and requires constant cooperation with each customer for the development of the specific products they need, and it is based on sophisticated technical and industrial processes. This segment also delivers analytical and regulatory support services focused on investigating the physiochemical properties of primary packaging materials and components and studying the interactions between drug containment solutions and the drugs they will contain;

•Engineering, which includes the equipment and technologies developed and provided to support the end-to-end pharmaceutical, biotechnology and diagnostic manufacturing processes (assembly, visual inspection, packaging and serialization and glass converting). The Engineering segment designs, develops and produces equipment and machinery for our internal use and for external customers. The Group assembles equipment and machinery and develops the software necessary for its functioning in addition to working closely with the customers to install the machinery and equipment in their production sites, ensuring that the machines are correctly calibrated and properly functioning. The after-sales services mainly consist of providing spare parts for our machinery and equipment as well as maintenance activity on the machines sold.

The operating segments described above are also identified as reportable segments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at and for the three months ended June 30, 2024 |

|

|

|

Biopharmaceutical

and Diagnostic

Solutions |

|

|

Engineering |

|

|

Total

segments |

|

|

Adjustments,

eliminations

and

unallocated

items |

|

|

Consolidated |

|

|

|

(EUR thousand) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

|

|

222,366 |

|

|

|

37,213 |

|

|

|

259,579 |

|

|

|

— |

|

|

|

259,579 |

|

Inter-segment |

|

|

664 |

|

|

|

42,351 |

|

|

|

43,015 |

|

|

|

(43,015 |

) |

|

|

— |

|

Revenue |

|

|

223,030 |

|

|

|

79,564 |

|

|

|

302,594 |

|

|

|

(43,015 |

) |

|

|

259,579 |

|

Cost of sales |

|

|

161,337 |

|

|

|

71,353 |

|

|

|

232,690 |

|

|

|

(40,634 |

) |

|

|

192,056 |

|

Gross Profit |

|

|

61,693 |

|

|

|

8,211 |

|

|

|

69,904 |

|

|

|

(2,381 |

) |

|

|

67,523 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income |

|

|

970 |

|

|

|

19 |

|

|

|

989 |

|

|

|

(48 |

) |

|

|

941 |

|

Selling and marketing expenses |

|

|

6,426 |

|

|

|

1,080 |

|

|

|

7,506 |

|

|

|

(117 |

) |

|

|

7,389 |

|

Research and development expenses |

|

|

6,720 |

|

|

|

1,632 |

|

|

|

8,352 |

|

|

|

389 |

|

|

|

8,741 |

|

General and administrative expenses |

|

|

17,248 |

|

|

|

3,428 |

|

|

|

20,676 |

|

|

|

3,689 |

|

|

|

24,365 |

|

Operating Profit |

|

|

32,269 |

|

|

|

2,090 |

|

|

|

34,359 |

|

|

|

(6,390 |

) |

|

|

27,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of which amortization and depreciation and impairment of PPE |

|

|

19,275 |

|

|

|

1,064 |

|

|

|

20,339 |

|

|

|

509 |

|

|

|

20,848 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

1,711,644 |

|

|

|

596,022 |

|

|

|

2,307,666 |

|

|

|

(110,613 |

) |

|

|

2,197,053 |

|

Total liabilities |

|

|

590,278 |

|

|

|

444,911 |

|

|

|

1,035,189 |

|

|

|

(162,356 |

) |

|

|

872,833 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, 2023 |

|

|

|

Biopharmaceutical

and Diagnostic

Solutions |

|

|

Engineering |

|

|

Total

segments |

|

|

Adjustments,

eliminations

and

unallocated

items |

|

|

Consolidated |

|

|

|

(EUR thousand) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

|

|

204,809 |

|

|

|

50,496 |

|

|

|

255,305 |

|

|

|

— |

|

|

|

255,305 |

|

Inter-segment |

|

|

435 |

|

|

|

42,957 |

|

|

|

43,392 |

|

|

|

(43,392 |

) |

|

|

— |

|

Revenue |

|

|

205,244 |

|

|

|

93,453 |

|

|

|

298,697 |

|

|

|

(43,392 |

) |

|

|

255,305 |

|

Cost of sales |

|

|

140,360 |

|

|

|

72,452 |

|

|

|

212,812 |

|

|

|

(36,411 |

) |

|

|

176,401 |

|

Gross Profit |

|

|

64,884 |

|

|

|

21,001 |

|

|

|

85,885 |

|

|

|

(6,981 |

) |

|

|

78,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income |

|

|

4,099 |

|

|

|

(1 |

) |

|

|

4,098 |

|

|

|

(79 |

) |

|

|

4,019 |

|

Selling and marketing expenses |

|

|

2,719 |

|

|

|

936 |

|

|

|

3,655 |

|

|

|

3,120 |

|

|

|

6,775 |

|

Research and development expenses |

|

|

6,021 |

|

|

|

1,784 |

|

|

|

7,805 |

|

|

|

558 |

|

|

|

8,363 |

|

General and administrative expenses |

|

|

19,692 |

|

|

|

3,788 |

|

|

|

23,480 |

|

|

|

(559 |

) |

|

|

22,921 |

|

Operating Profit |

|

|

40,551 |

|

|

|

14,492 |

|

|

|

55,043 |

|

|

|

(10,179 |

) |

|

|

44,864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of which amortization and depreciation |

|

|

18,557 |

|

|

|

907 |

|

|

|

19,464 |

|

|

|

50 |

|

|

|

19,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at and for the six months ended June 30, 2024 |

|

|

|

Biopharmaceutical

and Diagnostic

Solutions |

|

|

Engineering |

|

|

Total

segments |

|

|

Adjustments,

eliminations

and

unallocated

items |

|

|

Consolidated |

|

|

|

(EUR thousand) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

|

|

421,298 |

|

|

|

74,275 |

|

|

|

495,573 |

|

|

|

— |

|

|

|

495,573 |