Form 8-K - Current report

28 Oktober 2024 - 10:08PM

Edgar (US Regulatory)

0000920371false00009203712024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2024

Simpson Manufacturing Co., Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13429 | | 94-3196943 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. Employer Identification No.) |

5956 W. Las Positas Boulevard, Pleasanton, CA 94588

(Address of principal executive offices)

(Registrant’s telephone number, including area code): (925) 560-9000

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | SSD | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-2) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Update to Retirement of Brian Magstadt as Chief Financial Officer and Treasurer

As previously reported on a Form 8-K filed July 31, 2024, Brian Magstadt, notified Simpson Manufacturing Co, Inc. (the "Company") on July 25, 2024, that he will retire as Chief Financial Officer and Treasurer, effective December 31, 2024.

On October 23, 2024, the Company and Mr. Magstadt agreed that Mr. Magstadt would step down from his position as Chief Financial Officer, effective December 31, 2024, but will remain employed as an Executive Advisor of the Company until June 30, 2025.

In connection with his transition to the role as an Executive Advisor, Mr. Magstadt will continue to receive a base salary at an annual rate of $568,218, will continue to participate in the Company’s health and welfare arrangements, and will continue to vest in his outstanding equity awards. In connection with his retirement on June 30, 2025, Mr. Magstadt will receive retirement treatment under the existing terms and conditions of his then outstanding equity awards. After December 31, 2024, Mr. Magstadt will no longer serve as an executive officer of the Company or be an “officer” as defined under Rule 16a-1(f) under the Securities Exchange Act of 1934.

Appointment of Matt Dunn as Chief Financial Officer and Treasurer

On October 28, 2024, the Company announced that Matt Dunn, currently the Company's Senior Vice President, Finance, will succeed Mr. Magstadt as Chief Financial Officer and Treasurer, effective January 1, 2025.

Mr. Dunn, age 45, has served as Senior Vice President, Finance of the Company since June 2024. Before joining the Company, Mr. Dunn served as Senior Vice President of Finance, North America at Helen of Troy, from March 2023 to May 2024, and as Senior Vice President of Finance & Operations – Beauty from November 2018 to February 2023. He previously served as President - SINE Wall Division at Inventure Group LLC, from 2016 to 2018. He also spent 12 years in roles of increasing seniority in finance at Procter & Gamble, preceded by three years in operations finance at Kimberly-Clark. Mr. Dunn holds Bachelor of Arts degrees in Finance and Accounting from Cedarville University.

There are no arrangements or understandings between Mr. Dunn and any other persons pursuant to which Mr. Dunn was selected as Chief Financial Officer and Treasurer of the Company. There are no family relationships between Mr. Dunn and any director or executive officer of the Company, and Mr. Dunn has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K nor are any such transactions currently proposed.

In connection with Mr. Dunn’s appointment as Chief Financial Officer and Treasurer, effective January 1, 2025, the Company and Mr. Dunn entered into an offer letter, dated October 17, 2024, which provides for, among other things: (i) annual base salary of $575,000; (ii) target annual Cash Profit Sharing (CPS) bonus opportunity of $431,250 per year (earned from 0% to 200% of target); (iii) target long-term incentive award opportunity of $862,500 for the 2025 grant in the form of target performance stock units (PSUs) (earned from 0% to 200% of target) and restricted stock units (RSUs); and (iv) customary employee benefits and fringe benefits on the same basis as other senior executives of the Company.

A copy of the press release is attached as Exhibit 99.1 and incorporated by reference into this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | Simpson Manufacturing Co., Inc. |

| | | | (Registrant) |

| | | | | |

| | | | | |

| | | | | |

| DATE: | October 28, 2024 | | By | /s/ Cassandra Payton |

| | | | | Cassandra Payton |

| | | | | Executive Vice President, General Counsel |

Simpson Manufacturing Co., Inc. 5956 W. Las Positas Boulevard Pleasanton, CA 94588 Phone: 800.925.5099 Fax: 925.847.1597 www.simpsonmfg.com NEWS RELEASE FOR IMMEDIATE RELEASE Simpson Manufacturing Co. Appoints Matt Dunn as Chief Financial Officer and Treasurer Pleasanton, CA – October 28, 2024 –Simpson Manufacturing Co., Inc. (the “Company”) (NYSE: SSD), an industry leader in engineered structural connectors and building solutions, today announced it has appointed Matt Dunn as Chief Financial Officer and Treasurer, effective January 1, 2025. Mr. Dunn has served as Simpson’s Senior Vice President of Finance since June 2024 and will succeed Brian Magstadt. Mr. Magstadt will continue in his role as CFO through the end of 2024, after which he will remain employed as an Executive Advisor to assist with the transition until his retirement on June 30, 2025. This strategic hire follows a comprehensive search for the ideal candidate with a proven track record of demonstrated leadership, strategic capabilities and values that align with Simpson’s core principles of doing business, as inspired by the Company’s Founder. As CFO, Mr. Dunn will oversee the financial and risk management operations of the Company, including the financial strategy, metrics and ongoing monitoring of control systems. He also will manage the Company’s capital request, allocation, and budgeting processes; monitor cash balances and cash forecasts; implement cash investment strategies; and maintain and lead its finance, audit, and tax teams. Additionally, Mr. Dunn will be responsible for evaluating potential mergers and acquisitions that align with Simpson’s growth goals, supervising acquisition due diligence and negotiating acquisitions. Mr. Dunn brings more than 23 years of experience in the financial management of numerous high-profile brands in leadership roles spanning corporate finance and strategy. Prior to joining Simpson, he most recently served as Senior Vice President of Finance, North America at Helen of Troy, a $2 billion global consumer products company, where he oversaw the financial performance of its largest region. Preceding that, Mr. Dunn led the retaining wall division of Exhibit 99.1

Simpson Manufacturing Co., Inc. 5956 W. Las Positas Boulevard Pleasanton, CA 94588 Phone: 800.925.5099 Fax: 925.847.1597 www.simpsonmfg.com Inventure Group, a privately held civil construction products company. He also spent 12 years in roles of increasing seniority in finance at Procter & Gamble, preceded by three years in operations finance at Kimberly-Clark. Mr. Dunn holds Bachelor of Arts degrees in Finance and Accounting from Cedarville University. Mike Olosky, Simpson's President and Chief Executive Officer, commented, “We are delighted to appoint Matt as Simpson’s new CFO. Matt is a highly accomplished finance professional with an impressive track record of driving strong results and forward thinking. He has already made valuable contributions in his short time at the Company, and I am confident he will be an integral player in further solidifying Simpson as a leader in the building products space. Additionally, I’d like to extend my gratitude to Brian Magstadt for his 20 years of service with the Company. We wish him all the best in his retirement.” “Simpson’s proven business model, strong brand recognition, and trusted reputation make it an honor to be named CFO at such an exciting time in the Company’s evolution,” said Mr. Dunn. “I’d like to extend my appreciation to Brian for his continued guidance over the next several months and support in helping to ensure a seamless transition. I look forward to leveraging my experience to further Simpson’s mission and to drive continued success for all of our stakeholders.” About Simpson Manufacturing Co., Inc. Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiaries, including Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shear walls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing fiber materials. The Company primarily supplies its building product solutions to both the residential and commercial markets in North America and Europe. The Company's common stock trades on the New York Stock Exchange under the symbol "SSD."

Simpson Manufacturing Co., Inc. 5956 W. Las Positas Boulevard Pleasanton, CA 94588 Phone: 800.925.5099 Fax: 925.847.1597 www.simpsonmfg.com Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our ongoing integration of ETANCO, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing. Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic and other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, the operations of our customers, suppliers and business partners, and our ongoing integration of ETANCO, as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC.

Simpson Manufacturing Co., Inc. 5956 W. Las Positas Boulevard Pleasanton, CA 94588 Phone: 800.925.5099 Fax: 925.847.1597 www.simpsonmfg.com We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition. CONTACT: Addo Investor Relations investor.relations@strongtie.com (310) 829-5400

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

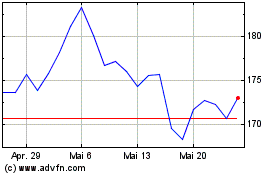

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024