Filed Pursuant to Rule 424(b)(5)

Registration No. 333-271504

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 28, 2023)

8,000,000 Common Shares

SFL Corporation Ltd.

SFL

Corporation Ltd. (the “Company”) is offering up to 8,000,000 common shares, par value $0.01 per share (the “common shares”), pursuant to this prospectus supplement.

We have granted the underwriters an over-allotment option to purchase up to an additional 1,200,000 common shares at the public

offering price less the underwriting discounts and commissions. The underwriters can exercise this over-allotment option at any time within 30 days after the date of this prospectus supplement.

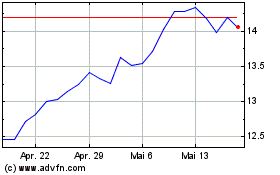

Our common shares are listed on the NYSE under the symbol “SFL.” On July 22, 2024, the last reported sale price of our

common shares on the NYSE was $13.93 per share.

Investing in our common shares involves risks. You should carefully

consider each of the factors described under “Risk Factors” beginning on page S-8 of this prospectus supplement, on page 9 of the accompanying base prospectus and

in the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus, before you make any investment in our common shares.

|

|

|

|

|

|

|

|

|

| |

|

PER SHARE |

|

|

TOTAL |

|

| Public offering price |

|

|

$12.50 |

|

|

|

$100,000,000 |

|

| Underwriting discount(1) |

|

|

$0.46875 |

|

|

|

$3,750,000 |

|

| Proceeds, before expenses, to us |

|

|

$12.03125 |

|

|

|

$96,250,000 |

|

| (1) |

See “Underwriting” for a description of the compensation payable to the underwriters.

|

Neither the U.S. Securities and Exchange Commission, or the Commission, nor any state securities commission has

approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common shares on or about July 25, 2024

Sole Book-Running Manager

Morgan Stanley

Lead

Manager

BTIG

Co-Managers

|

|

|

|

|

|

|

| Arctic Securities |

|

DNB Markets |

|

Fearnley Securities |

|

Pareto Securities |

The date of this prospectus supplement is July 23, 2024

TABLE OF CONTENTS

Prospectus Supplement

Base Prospectus

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus are part of a registration statement that we filed with the

Commission utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common shares and also adds to and updates information

contained in the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement and the base prospectus. The second part, the base prospectus, gives more general information about securities we may offer

from time to time, some of which does not apply to this offering. Generally, when we refer only to the prospectus, we are referring to both parts combined, and when we refer to the accompanying prospectus, we are referring to the base prospectus.

If the description of this offering varies between this prospectus supplement and the accompanying base prospectus, you

should rely on the information in this prospectus supplement. This prospectus supplement, the accompanying base prospectus and the documents incorporated into each by reference include important information about us, the common shares being offered

and other information you should know before investing. You should read this prospectus supplement and the accompanying base prospectus together with additional information described under the heading, “Where You Can Find Additional

Information” before investing in our common shares.

We prepare our financial statements, including all of the

financial statements incorporated by reference in this prospectus supplement, in U.S. dollars and in conformity with accounting principles generally accepted in the United States, or U.S. GAAP. We have a fiscal year end of December 31.

We have authorized only the information contained or incorporated by reference in this prospectus supplement, the accompanying

base prospectus and any free writing prospectus prepared by us or on our behalf or to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. We and the

underwriters take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. We are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and

sales are permitted. The information contained in or incorporated by reference in this prospectus supplement and accompanying base prospectus is accurate only as of the date such information was issued, regardless of the time of delivery of this

prospectus supplement or any sale of our common shares. Our business, financial condition and results of operations and prospects may have changed since those dates.

S-ii

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

Matters discussed in this prospectus supplement and the documents incorporated by reference may constitute

forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking

statements include, but are not limited to, statements concerning plans, objectives, goals, strategies, future events or performance, underlying assumptions and other statements, which are other than statements of historical facts.

SFL Corporation Ltd. and its subsidiaries, or the Company, desires to take advantage of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 and is including this cautionary statement pursuant to this safe harbor legislation. This prospectus supplement and any other written or oral statements made by the Company or on its behalf may

include forward-looking statements, which reflect the Company’s current views with respect to future events and financial performance and are not intended to give any assurance as to future results. When used in this document, the words

“believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “will,” “may,” “should,” “expect,”

“targets,” “likely,” “would,” “could” “seeks,” “continue,” “possible,” “might,” “pending” and similar expressions, terms or phrases may identify

forward-looking statements.

The forward-looking statements herein are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including, without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although the Company

believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control, the Company cannot

assure you that it will achieve or accomplish these expectations, beliefs or projections.

Such statements reflect the

Company’s current views with respect to future events and are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual

results may vary materially from those described herein as anticipated, believed, estimated, expected or intended. The Company is making investors aware that such forward-looking statements, because they relate to future events, are by their very

nature subject to many important factors that could cause actual results to differ materially from those contemplated. In addition to these important factors and matters discussed elsewhere herein, important factors that, in the Company’s view,

could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to:

| |

• |

|

the strength of world economies and currencies; |

| |

• |

|

inflationary pressures and central bank policies intended to combat overall inflation and rising interest

rates and foreign exchange rates; |

| |

• |

|

the Company’s ability to generate cash to service its indebtedness; |

| |

• |

|

the Company’s ability to continue to satisfy its financial and other covenants, or obtain waivers

relating to such covenants from its lenders under its credit facilities; |

| |

• |

|

the availability of financing and refinancing, as well as the Company’s ability to obtain such financing

or refinancing in the future to fund capital expenditures, acquisitions and other general corporate activities and the Company’s ability to comply with the restrictions and other covenants in its financing arrangements; |

| |

• |

|

the Company’s counterparties’ ability or willingness to honor their obligations under agreements

with it; |

S-iii

| |

• |

|

general market conditions in the seaborne transportation industry, which is cyclical and volatile, including

fluctuations in charter hire rates and vessel values; |

| |

• |

|

prolonged or significant downturns in the tanker, dry-bulk carrier,

container, car carrier and/or offshore drilling charter markets; |

| |

• |

|

the volatility of oil and gas prices, which effects, among other things, several sectors of the maritime,

shipping and offshore industries, including oil transportation, dry bulk shipments, oil products transportation, car transportation and drilling rigs; |

| |

• |

|

a decrease in the value of the market values of the Company’s vessels and drilling rigs;

|

| |

• |

|

an oversupply of vessels, including drilling rigs, which could lead to reductions in charter hire rates and

profitability; |

| |

• |

|

any inability to retain and recruit qualified key executives, key employees, key consultants or skilled

workers; |

| |

• |

|

the potential difference in interests between or among certain of the Company’s directors, officers, key

executives and shareholders, including Hemen Holding Limited, or Hemen, our largest shareholder; |

| |

• |

|

the risks associated with the purchase of second-hand vessels; |

| |

• |

|

the aging of the Company’s fleet which could result in increased operating costs, impairment or loss of

hire; |

| |

• |

|

the adequacy of insurance coverage for inherent operational risks, and the Company’s ability to obtain

indemnities from customers, changes in laws, treaties or regulations; |

| |

• |

|

changes in supply and generally the number, size and form of providers of goods and services in the markets in

which the Company operates; |

| |

• |

|

the supply of and demand for oil and oil products and vessels, including drilling rigs, comparable to ours,

including against the background of the possibility of accelerated climate change transition worldwide, including shifts in consumer demand for other energy resources could have an accelerated negative effect on the demand for oil and thus its

transportation and drilling; |

| |

• |

|

changes in market demand in countries which import commodities and finished goods and changes in the amount

and location of the production of those commodities and finished goods and resulting changes to trade patterns; |

| |

• |

|

delays or defaults by the shipyards in the construction of our newbuildings; |

| |

• |

|

technological innovation in the sectors in which we operate and quality and efficiency requirements from

customers; |

| |

• |

|

technology risk associated with energy transition and fleet/systems rejuvenation to alternative propulsions;

|

| |

• |

|

governmental laws and regulations, including environmental regulations, that add to our costs or the costs of

our customers; |

| |

• |

|

potential liability from safety, environmental, governmental and other requirements and potential significant

additional expenditures related to complying with such regulations; |

| |

• |

|

the impact of increasing scrutiny and changing expectations from investors, lenders, charterers and other

market participants with respect to our Environmental, Social and Governance practices; |

| |

• |

|

increased inspection procedures and more restrictive import and export controls; |

| |

• |

|

the imposition of sanctions by the Office of Foreign Assets Control of the Department of the U.S. Treasury or

pursuant to other applicable laws or regulations imposed by the U.S. government, the EU, the United Nations or other governments against the Company or any of its subsidiaries; |

S-iv

| |

• |

|

compliance with governmental, tax, environmental and safety regulation, any

non-compliance with the U.S. Foreign Corrupt Practices Act of 1977 or other applicable regulations relating to bribery; |

| |

• |

|

changes in the Company’s operating expenses, including bunker prices, drydocking and insurance costs;

|

| |

• |

|

fluctuations in currencies and interest rates such as Norwegian Inter-Bank Offer Rate, or NIBOR, and Secured

Overnight Financing Rate, or SOFR; |

| |

• |

|

the impact that any discontinuance, modification or other reform or the establishment of alternative reference

rates may have on the Company’s floating interest rate debt instruments; |

| |

• |

|

the volatility of prevailing spot market charter rates, which affects the amount of profit sharing payment the

Company receives under charters with Golden Ocean Group Limited and other charters; |

| |

• |

|

the volatility of the price of the Company’s common shares; |

| |

• |

|

changes in the Company’s dividend policy; |

| |

• |

|

the future sale of the Company’s common shares or conversion of the Company’s convertible notes;

|

| |

• |

|

the failure to protect the Company’s information security management system against security breaches, or

the failure or unavailability of these systems for a significant period of time; |

| |

• |

|

the entrance into transactions that expose the Company to additional risk outside of its core business;

|

| |

• |

|

difficulty managing planned growth properly; |

| |

• |

|

the Company’s incorporation under the laws of Bermuda and the different rights to relief that may be

available compared to other countries, including the United States; |

| |

• |

|

shareholders’ reliance on the Company to enforce the Company’s rights against contract

counterparties; |

| |

• |

|

dependence on the ability of the Company’s subsidiaries to distribute funds to satisfy financial

obligations and make dividend payments; |

| |

• |

|

the potential for shareholders to not be able to bring a suit against the Company or enforce a judgement

obtained against the Company in the United States; |

| |

• |

|

treatment of the Company as a “passive foreign investment company” by U.S. tax authorities;

|

| |

• |

|

being required to pay taxes on U.S. source income; |

| |

• |

|

the Company potentially becoming subject to corporate income tax in Bermuda in the future;

|

| |

• |

|

the Company’s operations being subject to economic substance requirements; |

| |

• |

|

the exercise of a purchase option by the charterer of a vessel; |

| |

• |

|

potential liability from future litigation, including litigation related to claims raised by public-interest

organizations or activism with regard to failure to adapt or mitigate climate impact; |

| |

• |

|

increased cost of capital or limiting access to funding due to EU Taxonomy or relevant territorial taxonomy

regulations; |

| |

• |

|

the impact on the demand for commercial seaborne transportation and the condition to the financial markets and

any noncompliance with the amendments by the International Maritime Organization (“IMO”), the United Nations agency for maritime safety and the prevention of pollution by vessels, (the amendments hereinafter referred to as IMO 2020), to

Annex VI to the International Convention for the Prevention of Pollution from Ships, 1973, as modified by the Protocol of 1978 relating thereto, collectively referred to as MARPOL 73/78 and herein as MARPOL, which will reduce the maximum amount of

sulfur that vessels may emit into the air and has applied to us since January 1, 2020; |

S-v

| |

• |

|

the arresting or attachment of one or more of the Company’s vessels or rigs by maritime claimants;

|

| |

• |

|

damage to storage, receiving and other shipping inventories’ facilities; |

| |

• |

|

impacts of supply chain disruptions and market volatility surrounding the impacts of the Russian-Ukrainian

conflict and the developments in the Middle East; |

| |

• |

|

potential requisition of the Company’s vessels or rigs by a government during a period of war or

emergency; |

| |

• |

|

world events, political instability, international sanctions or international hostilities, including the

developments in the Ukraine region and in the Middle East, including the conflicts in Israel and Gaza, the Houthi attacks in the Red Sea and potential physical disruption of shipping routes as a result thereof; and |

| |

• |

|

other important factors described from time to time in the reports filed by the Company with the Commission,

including the Annual Report on Form 20-F filed on March 14, 2024. |

This prospectus supplement may contain assumptions, expectations, projections, intentions and beliefs about future events.

These statements are intended as forward-looking statements. The Company may also from time to time make forward-looking statements in other documents and reports that are filed with or submitted to the Commission, in other information sent to the

Company’s security holders, and in other written materials. The Company also cautions that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be

material. The Company undertakes no obligation to publicly update or revise any forward-looking statement contained in this prospectus supplement, whether as a result of new information, future events or otherwise, except as required by law.

S-vi

SUMMARY

This section summarizes some of the key information that is contained or incorporated by reference in this prospectus

supplement. It may not contain all of the information that may be important to you and is qualified in its entirety by the more detailed information and financial statements included or incorporated by reference in this prospectus supplement and the

accompanying base prospectus. As an investor or prospective investor, you should review carefully the entire prospectus, any free writing prospectus that may be provided to you in connection with the offering of the common shares and the information

incorporated by reference in this prospectus supplement, including the section entitled “Risk Factors” beginning on page S-8 of this prospectus supplement, on page 9 of the accompanying base

prospectus, and in our Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Commission on March 14, 2024.

When used in this prospectus supplement, the terms the “Company,” “we,” “our” and

“us” refer to SFL Corporation Ltd. and/or one or more of its subsidiaries, as the context requires. “SFL Corporation Ltd.” refers only to SFL Corporation Ltd. and not its subsidiaries. The financial information of SFL Corporation

Ltd. included or incorporated by reference into this prospectus supplement represents our financial information and the operations of our subsidiaries. Unless otherwise indicated, all references to “dollars” and “$” in this

prospectus supplement are to, and amounts are presented in, United States dollars and our financial information presented in this prospectus supplement that is derived from financial statements incorporated by reference is prepared in accordance

with U.S. GAAP.

Our Company

We are an international maritime infrastructure company with a large and diverse asset base across the maritime, shipping and

offshore asset classes and business sectors. As of July 9, 2024 and including vessels the subject of newbuilding contracts, our assets consist of 18 tankers (including two resale newbuildings and two chemical tankers with expected deliveries in

2024), 15 dry bulk carriers, 39 container vessels (including the five Newbuilding Containership Vessels (defined below) and four partly owned leased-in container vessels in our associated company), seven car

carriers, one jack-up drilling rig and one ultra-deepwater drilling rig.

Most of

our vessels and rigs are employed under long term charters. We believe these existing charters provide us with significant and stable base cash flows and high asset utilization, subject to the full performance of the obligations of our

counterparties under their agreements with us. The fixed-rate charter backlog as of July 9, 2024 and including vessels the subject of newbuilding contracts and charter extensions, was approximately $5.0 billion, with a weighted average

remaining charter term of approximately 6.8 years. Some of our charters include purchase options on behalf of the charterer, which if exercised would reduce our remaining charter coverage and contracted cash flow, but increase our cash position. The

amount of actual revenues earned and the actual periods during which revenues are earned may be different from the backlog projections due to various factors including, off-hire caused by unscheduled repairs,

maintenance and other factors.

Our primary objective is to continue to grow our business through accretive acquisitions

across a diverse range of maritime asset classes. In doing so, our strategy is to generate stable and increasing cash flows by chartering our assets primarily under medium to long term bareboat or time charters.

We have paid dividends for 81 consecutive quarters, including the dividend payment of $0.27 per share declared on May 14,

2024, which was paid on June 26, 2024 to shareholders of record on May 28, 2024. For the years ended December 31, 2023, 2022 and 2021, we paid aggregate dividends in cash to our shareholders in the amounts of $123 million ($0.97

per share), $112 million ($0.88 per share) and $78 million ($0.63 per share) respectively. Our ability to pay dividends is always subject to the discretion of our Board of Directors, the requirements of Bermuda law and the limitations

contained in our debt arrangements and there can be no

S-1

assurance we will continue to pay dividends in equal amounts, if at all. Please see “Risk Factors—Changes in our dividend policy could adversely affect holders of our common

shares.”

We own a substantially modern fleet of vessels and rigs. The following table sets forth the fleet that we

own or charter-in including those in our associated companies as of July 9, 2024 and including vessels the subject of newbuilding contracts and charter extensions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vessel |

|

Built |

|

|

Approximate

Capacity |

|

|

Flag |

|

|

Lease

Classification* |

|

|

Charter

Termination

Date* |

| Suezmaxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marlin Santorini |

|

|

2019 |

|

|

|

150,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2026(9) |

| Marlin Sicily |

|

|

2019 |

|

|

|

150,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2027(9) |

| Marlin Shikoku |

|

|

2019 |

|

|

|

150,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2027(9) |

| SFL Albany |

|

|

2020 |

|

|

|

160,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2028(9) |

| SFL Fraser |

|

|

2020 |

|

|

|

160,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2028(9) |

| SFL Ottawa |

|

|

2015 |

|

|

|

160,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2028(9) |

| SFL Thelon |

|

|

2015 |

|

|

|

160,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2028(9) |

|

|

|

|

|

|

| Product Tankers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SFL Tucana |

|

|

2024 |

|

|

|

115.000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2029(1)(11) |

| SFL Tigris |

|

|

2024 |

|

|

|

115,000 Dwt |

|

|

|

(MI) |

|

|

|

Operating |

|

|

2029(1)(5) |

| SFL Taurus |

|

|

2024 |

|

|

|

115,000 Dwt |

|

|

|

(MI) |

|

|

|

Operating |

|

|

2029(1)(5) |

| SFL Trinity |

|

|

2017 |

|

|

|

114,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2025(10) |

| SFL Sabine |

|

|

2017 |

|

|

|

114,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2025(10) |

| SFL Puma |

|

|

2015 |

|

|

|

115,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2026(9) |

| SFL Tiger |

|

|

2015 |

|

|

|

115,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2026(9) |

| SFL Lion |

|

|

2014 |

|

|

|

115,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2027(9) |

| SFL Panther |

|

|

2015 |

|

|

|

115,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2027(9) |

|

|

|

|

|

|

| Chemical Tanker Carriers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SFL Bonaire |

|

|

2023 |

|

|

|

33,000 Dwt |

|

|

|

(MI) |

|

|

|

Operating |

|

|

2032(5) |

| SFL Aruba |

|

|

2022 |

|

|

|

33,000 Dwt |

|

|

|

(MI) |

|

|

|

Operating |

|

|

2032(5) |

|

|

|

|

|

|

| Capesize Dry Bulk Carriers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Belgravia |

|

|

2009 |

|

|

|

170,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2025(1) |

| Battersea |

|

|

2009 |

|

|

|

170,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2025(1) |

| Golden Magnum |

|

|

2009 |

|

|

|

180,000 Dwt |

|

|

|

HK |

|

|

|

Operating |

|

|

2025(1) |

| Golden Beijing |

|

|

2010 |

|

|

|

176,000 Dwt |

|

|

|

HK |

|

|

|

Operating |

|

|

2025(1) |

| Golden Future |

|

|

2010 |

|

|

|

176,000 Dwt |

|

|

|

HK |

|

|

|

Operating |

|

|

2025(1) |

| Golden Zhejiang |

|

|

2010 |

|

|

|

176,000 Dwt |

|

|

|

HK |

|

|

|

Operating |

|

|

2025(1) |

| Golden Zhoushan |

|

|

2011 |

|

|

|

176,000 Dwt |

|

|

|

HK |

|

|

|

Operating |

|

|

2025(1) |

| KSL China |

|

|

2013 |

|

|

|

180,000 Dwt |

|

|

|

MI |

|

|

|

Operating |

|

|

2025(1) |

|

|

|

|

|

|

| Kamsarmax Dry Bulk Carriers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SFL Yangtze |

|

|

2012 |

|

|

|

82,000 Dwt |

|

|

|

HK |

|

|

|

n/a |

|

|

n/a(2) |

| SFL Pearl |

|

|

2012 |

|

|

|

82,000 Dwt |

|

|

|

HK |

|

|

|

n/a |

|

|

n/a(2) |

|

|

|

|

|

|

| Supramax Dry Bulk Carriers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SFL Hudson |

|

|

2009 |

|

|

|

57,000 Dwt |

|

|

|

MI |

|

|

|

n/a |

|

|

n/a(2) |

| SFL Yukon |

|

|

2010 |

|

|

|

57,000 Dwt |

|

|

|

HK |

|

|

|

n/a |

|

|

n/a(2) |

| SFL Sara |

|

|

2011 |

|

|

|

57,000 Dwt |

|

|

|

HK |

|

|

|

n/a |

|

|

n/a(2) |

| SFL Kate |

|

|

2011 |

|

|

|

57,000 Dwt |

|

|

|

HK |

|

|

|

n/a |

|

|

n/a(2) |

| SFL Humber |

|

|

2012 |

|

|

|

57,000 Dwt |

|

|

|

HK |

|

|

|

n/a |

|

|

n/a(2) |

S-2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vessel |

|

Built |

|

|

Approximate

Capacity |

|

|

Flag |

|

|

Lease

Classification* |

|

|

Charter

Termination

Date* |

|

|

|

|

|

|

|

| Container vessels |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MSC Vaishnavi R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| MSC Julia R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| MSC Arushi R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| MSC Katya R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| MSC Anisha R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| MSC Vidisha R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| MSC Zlata R. |

|

|

2002 |

|

|

|

4,100 TEU |

|

|

|

LIB |

|

|

|

Sales Type |

|

|

|

2025(1)(7) |

|

| Asian Ace |

|

|

2005 |

|

|

|

1,700 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2025 |

|

| Green Ace |

|

|

2005 |

|

|

|

1,700 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2024 |

|

| San Felipe |

|

|

2014 |

|

|

|

8,700 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(10) |

|

| San Felix |

|

|

2014 |

|

|

|

8,700 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(10) |

|

| San Fernando |

|

|

2015 |

|

|

|

8,700 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(10) |

|

| San Francisca |

|

|

2015 |

|

|

|

8,700 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(10) |

|

| Maersk Sarat |

|

|

2015 |

|

|

|

9,500 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2025 |

|

| Maersk Skarstind |

|

|

2016 |

|

|

|

9,500 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2025(10) |

|

| Maersk Shivling |

|

|

2016 |

|

|

|

9,300 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2025(10) |

|

| Maersk Phuket |

|

|

2022 |

|

|

|

2,500 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2029(4) |

|

| Maersk Pelepas |

|

|

2022 |

|

|

|

2,500 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2029(4) |

|

| MSC Anna |

|

|

2016 |

|

|

|

19,200 TEU |

|

|

|

LIB |

|

|

|

Direct Financing |

|

|

|

2031(1)(3) |

|

| MSC Viviana |

|

|

2017 |

|

|

|

19,200 TEU |

|

|

|

LIB |

|

|

|

Direct Financing |

|

|

|

2032(1)(3) |

|

| Thalassa Axia |

|

|

2014 |

|

|

|

14,000 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2024(4)(6) |

|

| Thalassa Doxa |

|

|

2014 |

|

|

|

14,000 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2024(4)(6) |

|

| Thalassa Mana |

|

|

2014 |

|

|

|

14,000 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2024(4)(6) |

|

| Thalassa Tyhi |

|

|

2014 |

|

|

|

14,000 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2024(4)(6) |

|

| Cap San Vincent |

|

|

2015 |

|

|

|

10,600 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(1)(4)(10) |

|

| Cap San Lazaro |

|

|

2015 |

|

|

|

10,600 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(1)(4)(10) |

|

| Cap San Juan |

|

|

2015 |

|

|

|

10,600 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2030(1)(4)(10) |

|

| MSC Erica |

|

|

2016 |

|

|

|

19,400 TEU |

|

|

|

LIB |

|

|

|

Direct Financing |

|

|

|

2033(1)(3) |

|

| MSC Reef |

|

|

2016 |

|

|

|

19,400 TEU |

|

|

|

LIB |

|

|

|

Direct Financing |

|

|

|

2033(1)(3) |

|

| SFL Maui |

|

|

2013 |

|

|

|

6,800 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2027(1)(4) |

|

| SFL Hawaii |

|

|

2014 |

|

|

|

6,800 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2027(1)(4) |

|

| Maersk Zambezi |

|

|

2020 |

|

|

|

5,300 TEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2028(1) |

|

| Savannah Express (ex Thalassa Patris) |

|

|

2013 |

|

|

|

15,400 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2028(4) |

|

| Baltimore Express (ex Thalassa Elpida) |

|

|

2014 |

|

|

|

15,400 TEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2028(4) |

|

| TBN (newbuild) |

|

|

2028 |

|

|

|

16,800 TEU |

|

|

|

(LIB) |

|

|

|

Operating |

|

|

|

2038(12) |

|

| TBN (newbuild) |

|

|

2028 |

|

|

|

16,800 TEU |

|

|

|

(LIB) |

|

|

|

Operating |

|

|

|

2038(12) |

|

| TBN (newbuild) |

|

|

2028 |

|

|

|

16,800 TEU |

|

|

|

(LIB) |

|

|

|

Operating |

|

|

|

2038(12) |

|

| TBN (newbuild) |

|

|

2028 |

|

|

|

16,800 TEU |

|

|

|

(LIB) |

|

|

|

Operating |

|

|

|

2038(12) |

|

| TBN (newbuild) |

|

|

2028 |

|

|

|

16,800 TEU |

|

|

|

(LIB) |

|

|

|

Operating |

|

|

|

2038(12) |

|

|

|

|

|

|

|

| Car Carriers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SFL Composer |

|

|

2005 |

|

|

|

6,500 CEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2026(4) |

|

| SFL Conductor |

|

|

2006 |

|

|

|

6,500 CEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2027(4) |

|

| Arabian Sea |

|

|

2010 |

|

|

|

4,900 CEU |

|

|

|

MI |

|

|

|

Operating |

|

|

|

2028(4) |

|

| Emden |

|

|

2023 |

|

|

|

7,000 CEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2033(4) |

|

| Wolfsburg |

|

|

2023 |

|

|

|

7,000 CEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2034(4) |

|

| Odin Highway |

|

|

2024 |

|

|

|

7,000 CEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2034(4)(11) |

|

S-3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vessel |

|

Built |

|

|

Approximate

Capacity |

|

|

Flag |

|

|

Lease

Classification* |

|

|

Charter

Termination

Date* |

|

| Thor Highway |

|

|

2024 |

|

|

|

7,000 CEU |

|

|

|

LIB |

|

|

|

Operating |

|

|

|

2034(4)(11) |

|

|

|

|

|

|

|

| Jack-Up Drilling Rig |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Linus |

|

|

2014 |

|

|

|

450 ft |

|

|

|

NOR |

|

|

|

Drilling Contract |

|

|

|

2028(8) |

|

|

|

|

|

|

|

| Ultra-Deepwater Drill Unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hercules |

|

|

2008 |

|

|

|

10,000 ft |

|

|

|

CYP |

|

|

|

Drilling Contract |

|

|

|

n/a(8) |

|

| * |

Lease classifications and charter termination dates are as of July 9, 2024. |

Key to Flags: HK – Hong Kong, LIB – Liberia, MI – Marshall Islands, NOR – Norway, CYP – Cyprus

Notes:

| (1) |

Charterer has purchase options or obligations during the term or at the end of the charter.

|

| (2) |

Currently employed on a short-term charter or trading in the spot market. |

| (3) |

Vessel chartered-in and out on direct financing leases and included

in associated companies. |

| (4) |

Vessel chartered-in as finance leases and out as operating leases.

|

| (5) |

Vessels are expected to be delivered to the Company in 2024. Lease assessment is preliminary and may change.

|

| (6) |

The charters in respect of these vessels end in 2024 and the vessels are then contracted to commence a

five-year time charter with another counterparty. |

| (7) |

The charters in respect of these vessels were extended in 2020 and lease classification changed from

operating leases to sales type leases. |

| (8) |

Following redelivery from Seadrill in September 2022, Linus continued to be employed under its

long term drilling contract with ConocoPhillips which expires in the fourth quarter of 2028. The harsh environment semi-submersible drilling rig Hercules was employed on a bareboat charter to Seadrill until the end of December 2022,

whereupon the rig was redelivered to us. Hercules is currently contracted on a short-term basis. |

| (9) |

Charterer has the right to trigger a sale to a third party, at any time after the first year, with net

proceeds over an agreed sum to be shared between the charterer and SFL, with profit split on a previously agreed upon basis of calculation. |

| (10) |

Charter was extended in 2024. Lease assessment is preliminary and may change. |

| (11) |

Vessel was delivered in 2024. Lease assessment is preliminary and may change. |

| (12) |

Vessels are expected to be delivered to the Company in 2028. Lease assessment is preliminary and may change.

|

Substantially, all of our owned vessels and rigs as of July 9, 2024 are pledged under mortgages,

excluding two 1,700 TEU container vessels and five Supramax drybulk carriers.

Other than our interests in the vessels and

drilling rigs described above, we do not own any material physical properties. We lease office space in Oslo from Front Ocean Management AS, in Singapore from Golden Ocean Shipping Co Pte. Ltd., and in London from Frontline Corporate Services Ltd,

all related parties.

Recent and Other Developments

In April 2024, the Company issued a $150 million senior unsecured sustainability-linked note in the Nordic high yield bond

market. The bond matures in four years and bears a coupon of 8.25%. Following the issuance of this note, the Company exercised its call option on a NOK 700 million bond maturing in June, thus extinguishing this debt in full.

S-4

In April 2024, the Company agreed to acquire two LNG dual-fuel 33,000 dwt

chemical carriers from an unrelated third party for a total purchase price of $113.6 million. The Company has arranged long term employment for a minimum of eight years and expects to take delivery of the vessels in the third quarter of 2024.

On May 14, 2024, the Board of Directors declared a dividend of $0.27 per share which was paid in cash on

June 26, 2024 to shareholders of record on May 28, 2024.

In June 2024, the Company entered into a

$37 million JOLCO financing arrangement for the previously debt free 2,500 TEU container vessel Maersk Phuket.

In June 2024, the Company took delivery of the new product tanker SFL Tucana, which commenced a five-year time charter

to a world-leading energy and commodities company.

In June 2024, the Company entered into newbuilding contracts to build

five LNG dual-fuel 16,800 TEU container vessels (the “Newbuilding Containership Vessels”) with scheduled deliveries in 2028 and an aggregate contract cost of approximately $1 billion. Concurrently, the Company agreed 10-year time charters relating to each of the Newbuilding Containership Vessels to a leading liner company from their respective deliveries, adding approximately $1.2 billion to the fixed-rate charter backlog.

In July 2024, the Company agreed to enter into new five-year time charters on four 8,700 TEU container vessels, which

will add approximately $240 million to the Company’s fixed-rate charter backlog.

Market Outlook

We believe that the increase in newbuilding prices, the decrease in yard capacity and the low orderbook as a percentage of the

overall fleet create vessel supply restrictions that limit fleet expansion, which, coupled with increasing seaborne trade, provides the basis for an attractive market outlook in terms of earnings and asset values.

Corporate Information

We

are SFL Corporation Ltd. a company incorporated under the laws of Bermuda on October 10, 2003, as a Bermuda exempted company under the Companies Act (Company No. EC-34296). We are engaged primarily in the

ownership and operation of vessels and offshore related assets, and also involved in the charter, purchase and sale of assets. We operate through our vessel owning and other subsidiaries incorporated in Bermuda, Cyprus, Liberia, Norway,

Singapore, the United Kingdom and the Marshall Islands. Our registered and principal executive offices are located at Par-la-Ville Place, 14 Par-la-Ville Road, Hamilton, HM 08, Bermuda, and our telephone number is +1 (441) 295-9500. We maintain an internet site

at https://www.sflcorp.com.

The information contained at our internet site is not incorporated by reference into

this prospectus supplement, and you should not consider it a part of this prospectus supplement.

The information above

concerning us is only a summary and does not purport to be comprehensive or complete. For additional information about us, you should refer to the information described in “Where You Can Find Additional Information” in this prospectus

supplement.

S-5

THE OFFERING

| The Issuer |

SFL Corporation Ltd. |

| Common Shares Outstanding as of the Date of this Prospectus Supplement |

137,708,524(1) |

| Common Shares to be Offered by the Company |

8,000,000 common shares (or 9,200,000 common shares, assuming full exercise of the underwriters’ over-allotment option to purchase

additional shares). |

| Common Shares to be Outstanding Immediately After this Offering |

145,708,524 common shares (or 146,908,524 common shares, assuming full exercise of the underwriters’ over-allotment option to

purchase additional shares). |

| Use of Proceeds |

We estimate that we will receive net proceeds of approximately $96.0 million from this offering assuming the underwriters’

over-allotment option to purchase additional shares is not exercised, and approximately $110.4 million if the underwriters’ over-allotment option to purchase additional shares is exercised in full, in each case after deducting

underwriting discounts and estimated offering expenses payable by us. |

| |

We intend to use the net proceeds from any sales of common shares from this offering, after deducting the

underwriters’ commissions and our offering expenses, for general corporate purposes, including but not limited to fund vessel acquisitions. We continuously evaluate potential transactions that we believe will be accretive to earnings, enhance

shareholder value or are in the best interests of the Company, which may include pursuit of other business combinations, the acquisition of vessels or related businesses, the expansion of our operations, repayment of existing debt, share

repurchases, short term investments, other equity or debt offerings or other transactions. |

| (1) |

As of the date of this prospectus supplement, there were a total of 137,708,524 common shares were

outstanding, which includes (i) 8,000,000 shares issued as part of a share lending arrangement relating to the Company’s issuance of 5.75% senior unsecured convertible notes in October 2016 and 3,765,842 shares issued as a part of a share

lending arrangement relating to the Company’s issuance of 4.875% senior unsecured convertible notes in April and May 2018; and excludes (ii) 1,095,095 shares repurchased by the Company under its Share Repurchase Program and held as treasury

stock as at March 31, 2024. The Company entered into a general share lending agreement with another counterparty and after the maturity of the bonds, 8,000,000 shares and 3,765,142 shares (as reduced by 700 shares which were

cancelled), respectively, from each issuance under the two initial share lending arrangements described above were transferred into such counterparty’s custody. |

S-6

| Risk Factors |

Investing in our common shares involves risks. You should carefully consider the risks discussed under the caption “Risk

Factors” beginning on page S-8 of this prospectus supplement, on page 9 of the accompanying base prospectus in our Registration Statement on Form F-3ASR, effective

April 28, 2023, in our Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Commission on March 14, 2024, and under the caption “Risk Factors” or any similar

caption in the documents that we subsequently file with the Commission that are incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying base prospectus, and in any free writing prospectus that you

may be provided in connection with the offering of common shares pursuant to this prospectus supplement and the accompanying base prospectus. |

S-7

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks and the discussion of

risks in this prospectus supplement, the accompanying base prospectus, and the documents incorporated into each by reference, including those in our Annual Report on Form 20-F for the year ended

December 31, 2023, filed with the Commission on March 14, 2024, and the documents we have incorporated by reference in this prospectus supplement, including the section entitled “Risk Factors” in future annual reports that

summarize the risks that may materially affect our business before making an investment in our securities. Please see the section in this prospectus supplement entitled “Where You Can Find Additional Information.”

Management will have broad discretion as to the use of the proceeds from this offering and may not use the proceeds effectively.

Because we have not designated the amount of net proceeds from this offering to be used for any particular purpose, our

management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering. Our management may use the net proceeds for corporate

purposes that may not improve our financial condition or the market value of our common shares.

The price of our common shares after this offering may

be volatile.

The price of our common shares may fluctuate due to factors such as:

| |

• |

|

actual or anticipated fluctuations in our quarterly and annual results and those of other public companies in

our industry; |

| |

• |

|

changes in key management personnel; |

| |

• |

|

any reductions in the payment of our dividends or changes in our dividend policy; |

| |

• |

|

mergers and strategic alliances in the shipping and offshore industries, including the crude oil tanker, dry

bulk carrier, container vessel, car carrier, jack-up drilling rig, ultra-deepwater drilling, chemical tanker and oil product tanker industries; |

| |

• |

|

market conditions in the shipping and offshore industries; |

| |

• |

|

changes in government regulation; |

| |

• |

|

the failure of securities analysts to publish research about us after this offering, or shortfalls in our

operating results from levels forecast by securities analysts; |

| |

• |

|

perceived or actual inability by our chartering counterparts to fully perform under the charter parties,

including the charterers of our drilling units; and |

| |

• |

|

third party announcements concerning us or our competitors. |

The shipping and offshore industries have been highly unpredictable and volatile. The market for our common shares in this

industry may be equally volatile. Consequently, you may not be able to sell the common shares at prices equal to or greater than those paid by you in this offering.

We may issue additional common shares or other equity securities without your approval, which would dilute your ownership

interests and may depress the market price of our common shares.

Changes in our dividend policy could adversely affect holders of our common shares.

Any dividend on our common shares that we declare is at the discretion of our Board of Directors and subject to the

requirements of Bermuda law. We cannot assure you that our dividend will not be reduced or

S-8

eliminated in the future, and changes in our dividend policy could adversely affect the market price of our common shares. Our profitability and corresponding ability to pay dividends is

substantially affected by amounts we receive through charter hire and profit-sharing payments from our charterers. Our entitlement to profit sharing payments, if any, is based on the financial performance of our vessels which is outside of our

control. If our charter hire and profit-sharing payments decrease substantially, we may not be able to continue to pay dividends at present levels, or at all. We are also subject to contractual limitations on our ability to pay dividends pursuant to

certain debt agreements, and we may agree to additional limitations in the future. Additional factors that could affect our ability to pay dividends include statutory and contractual limitations on the ability of our subsidiaries to pay dividends to

us, including under current or future debt arrangements, economic conditions, and macroeconomic impacts on our business and financial condition, such as inflationary pressure, and other factors the Board of Directors may deem relevant.

We will need to procure significant additional financing, which may be difficult to obtain on acceptable terms or at all, in order to take delivery of our

Newbuilding Containership Vessels.

The Company has entered into newbuilding contracts to build the Newbuilding

Containership Vessels with scheduled deliveries in 2028 and an aggregate contract cost of approximately $1 billion.

In order to complete the construction of our Newbuilding Containership Vessels, we will need to procure additional financing.

We cannot be certain that additional financing will be available on acceptable terms or at all. If additional financing is not available when needed, or is available only on unfavorable terms, we may be unable to take delivery of one or more of our

Newbuilding Containership Vessels, in which case we would be prevented from realizing revenues from the Newbuilding Containership Vessels and we could lose the portion of the purchase price that has already been and will be paid during construction.

We may also incur additional costs and liability to the shipyards, which may pursue claims against us under our newbuilding construction contracts and retain and sell our Newbuilding Containership Vessels and other newbuilding vessels to third

parties.

We may become subject to corporate income tax in Bermuda in the future.

As discussed further in the section of this Prospectus Supplement entitled “Taxation—Bermuda Taxation,” in

December 2023, Bermuda passed into law the Corporate Income Tax 2023 in response to the Organisation for Economic Co-operation and Development’s (the “OECD”) Pillar Two global minimum tax

initiative to impose a 15% corporate income tax that will be effective for fiscal years beginning on or after January 1, 2025, and which may apply to us.

S-9

USE OF PROCEEDS

We estimate that we will receive net proceeds of approximately $96.0 million from this offering assuming the

underwriters’ over-allotment option to purchase additional shares is not exercised, and approximately $110.4 million if the underwriters’ over-allotment option to purchase additional shares is exercised in full, in each case after

deducting underwriting discounts and estimated offering expenses payable by us.

We intend to use the net proceeds from

any sales of common shares from this offering, after deducting the underwriters’ commissions and our offering expenses, for general corporate purposes, including but not limited to vessel acquisitions. We continuously evaluate potential

transactions that we believe will be accretive to earnings, enhance shareholder value or are in the best interests of the Company, which may include pursuit of other business combinations, the acquisition of vessels or related businesses, the

expansion of our operations, repayment of existing debt, share repurchases, short term investments, other equity or debt offerings or other transactions.

S-10

CAPITALIZATION

The following table sets forth our cash and capitalization as of March 31, 2024, on an:

| |

• |

|

as adjusted basis to give effect to the following: |

| |

• |

|

the issuance of $150 million 8.25% senior unsecured sustainability linked bonds due 2028;

|

| |

• |

|

the redemption at maturity of the NOK700 million senior unsecured floating rate bonds due 2027; and

|

| |

• |

|

as further adjusted basis to give effect to this offering and the use of proceeds and assuming the

underwriters’ over-allotment option to purchase additional shares is not exercised. |

Other than

these adjustments, there have been no material changes to our capitalization since March 31, 2024.

You should read

the information below in conjunction with the section of this prospectus supplement entitled “Use of Proceeds” and the consolidated financial statements and related notes included in our Annual Report on Form

20-F for the year ended December 31, 2023 and the consolidated financial statements and related notes included in our Quarterly Report on Form 6-K for the quarter

ended March 31, 2024, filed with the Commission on March 14, 2024 and May 28, 2024, respectively, and incorporated by reference herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2024 |

|

| (in thousands of $) |

|

Actual |

|

|

As adjusted |

|

|

As further

adjusted(1) |

|

| Cash and cash equivalents |

|

$ |

168,153 |

|

|

$ |

154,058 |

|

|

$ |

250,308 |

|

| Debt |

|

|

|

|

|

|

|

|

|

|

|

|

| Secured bank debt |

|

$ |

933,808 |

|

|

$ |

933,808 |

|

|

$ |

933,808 |

|

| NOK700 million senior unsecured floating rate bonds due 2024 |

|

$ |

64,095 |

|

|

|

— |

|

|

$ |

— |

|

| NOK600 million senior unsecured floating rate bonds due 2025 |

|

$ |

54,411 |

|

|

$ |

54,411 |

|

|

$ |

54,411 |

|

| 7.25% senior unsecured sustainability-linked bonds due 2026 |

|

$ |

150,000 |

|

|

$ |

150,000 |

|

|

$ |

150,000 |

|

| U.S. dollar denominated fixed-rate debt due 2026 |

|

$ |

148,500 |

|

|

$ |

148,500 |

|

|

$ |

148,500 |

|

| 8.875% senior unsecured sustainability-linked bonds due 2027 |

|

$ |

150,000 |

|

|

$ |

150,000 |

|

|

$ |

150,000 |

|

| 8.250% senior unsecured sustainability-linked bonds due 2028 |

|

|

— |

|

|

$ |

150,000 |

|

|

$ |

150,000 |

|

| Lease debt financing |

|

$ |

714,052 |

|

|

$ |

714,052 |

|

|

$ |

714,052 |

|

| $8.4 million senior unsecured term loan facility |

|

$ |

8,440 |

|

|

$ |

8,440 |

|

|

$ |

8,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total debt |

|

$ |

2,223,306 |

|

|

$ |

2,309,211 |

|

|

$ |

2,309,211 |

|

| Finance lease liability |

|

$ |

405,486 |

|

|

$ |

405,486 |

|

|

$ |

405,486 |

|

| Share capital |

|

$ |

1,388 |

|

|

$ |

1,388 |

|

|

$ |

1,468 |

|

| Additional paid in capital |

|

$ |

618,587 |

|

|

$ |

618,587 |

|

|

$ |

714,757 |

|

| Other equity |

|

$ |

430,382 |

|

|

$ |

430,382 |

|

|

$ |

430,382 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’

equity(2) |

|

$ |

1,050,357 |

|

|

$ |

1,050,357 |

|

|

$ |

1,146,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capitalization(3) |

|

$ |

3,679,149 |

|

|

$ |

3,765,054 |

|

|

$ |

3,861,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Cash and cash equivalents includes a total cash outlay of approximately $104 million.

|

| (2) |

300,000,000 common shares authorized, par value $0.01 per share; as of the date of this prospectus

supplement, there were a total of 137,708,524 common shares were outstanding, which includes (i) 8,000,000 shares issued as part of a share lending arrangement relating to the Company’s issuance of 5.75% senior unsecured convertible notes

in October 2016 and 3,765,842 shares issued as a part of a share lending arrangement relating to the Company’s issuance of 4.875% senior unsecured convertible notes in April and May 2018; and excludes (ii) 1,095,095 shares repurchased by

the Company under its Share Repurchase |

S-11

| |

Program and held as treasury stock as at March 31, 2024. The Company entered into a general share lending agreement with another counterparty and after the maturity of the bonds, 8,000,000

shares and 3,765,142 shares (as reduced by 700 shares which were cancelled), respectively, from each issuance under the two initial share lending arrangements described above were transferred into such counterparty’s custody.

|

| (3) |

Total amount excludes deferred charges equal to approximately $16 million. |

S-12

DIVIDEND POLICY

Our Board of Directors adopted a policy in May 2004 in connection with our public listing, whereby we seek to pay a regular

quarterly dividend, the amount of which is based on our contracted revenues and growth prospects. Our goal is to increase our quarterly dividend as we grow the business, but the timing and amount of dividends, if any, is at the sole discretion of

our Board of Directors and will depend upon, among other things, our operating results, financial condition, cash requirements, restrictions in terms of financing arrangements and other relevant factors.

We have paid dividends for 81 consecutive quarters. Our ability to pay dividends is always subject to the discretion of

our Board of Directors, the requirements of Bermuda law and the limitations contained in our bond and debt facilities and there can be no assurance we will continue to pay dividends in similar amounts, if at all. Please see “Risk

Factors—Changes in our dividend policy could adversely affect holders of our common shares.”

We have paid the

following cash dividends in 2021, 2022, 2023 and 2024:

|

|

|

|

|

|

|

| Period |

|

Payment Date |

|

Amount

Per Share |

|

| 2021 |

|

|

|

|

|

|

| Q1 2021 |

|

June 29, 2021 |

|

$ |

0.15 |

|

| Q2 2021 |

|

September 29, 2021 |

|

$ |

0.15 |

|

| Q3 2021 |

|

December 29, 2021 |

|

$ |

0.18 |

|

| Q4 2021 |

|

March 29, 2022 |

|

$ |

0.20 |

|

| 2022 |

|

|

|

|

|

|

| Q1 2022 |

|

June 29, 2022 |

|

$ |

0.22 |

|

| Q2 2022 |

|

September 29, 2022 |

|

$ |

0.23 |

|

| Q3 2022 |

|

December 29, 2022 |

|

$ |

0.23 |

|

| Q4 2022 |

|

March 30, 2023 |

|

$ |

0.24 |

|

| 2023 |

|

|

|

|

|

|

| Q1 2023 |

|

June 30, 2023 |

|

$ |

0.24 |

|

| Q2 2023 |

|

September 29, 2023 |

|

$ |

0.24 |

|

| Q3 2023 |

|

December 28, 2023 |

|

$ |

0.25 |

|

| Q4 2023 |

|

March 28, 2024 |

|

$ |

0.26 |

|

| 2024 |

|

|

|

|

|

|

| Q1 2024 |

|

June 26, 2024 |

|

$ |

0.27 |

|

S-13

DESCRIPTION OF SHARE CAPITAL

The following is a summary of the description of our share capital and the material terms of our amended Memorandum of

Association and Bye-laws. Because the following is a summary, it does not contain all of the information that you may find useful. For more complete information, you should read the description of share

capital and the material terms of our amended Memorandum of Association and Bye-laws contained in our Annual Report on Form 20-F for the year ended December 31,

2023, filed with the Commission on March 14, 2024, as updated by annual, quarterly and other reports and documents we file with the Commission after the date of this prospectus supplement and that are incorporated by reference herein, together

with our amended Memorandum of Association and Bye-laws, copies of which have been filed as exhibits thereto. Please see the section of this prospectus supplement entitled “Where You Can Find Additional

Information.”

Purpose

The Memorandum of Association of the Company was previously filed on May 21, 2004 as Exhibit 3.1 to its Registration

Statement on Form F-4 (File No. 333-115705) and is incorporated by reference herein.

The purposes and powers of the Company are set forth in Items 6(1) and 7(a) through (h) of its Memorandum of Association

and in the Second Schedule of the Companies Act of 1981 of Bermuda. These purposes include exploring, drilling, moving, transporting and refining petroleum and hydro-carbon products, including oil and oil products; acquiring, owning,

chartering, selling, managing and operating ships and aircraft; the entering into of any guarantee, contract, indemnity or suretyship to assure, support, secure, with or without the consideration or benefit, the performance of any obligations of any

person or persons; and the borrowing and raising of money in any currency or currencies to secure or discharge any debt or obligation in any manner.

The Company’s Bye-laws

At the 2007 Annual General Meeting of the Company, the shareholders voted to amend the Company’s Bye-laws to ensure conformity with recent revisions to the Companies Act 1981 of Bermuda, as amended. These amended Bye-laws of the Company, as adopted by the Company’s

shareholders on September 28, 2007, and as further amended on September 20, 2013, September 23, 2016 and September 30, 2022 are hereby incorporated by reference into this prospectus supplement.

Bermuda law permits the Bye-laws of a Bermuda company to contain provisions exempting

(except in relation to an allegation of fraud or dishonesty proved against them) from personal liability a director, alternate director, officer, member of a committee authorized under Bye-law 98, resident

representative or their respective heirs, executors or administrators to the company from any loss arising or liability attaching to him by virtue of any rule of law in respect of any negligence, default, breach of duty or breach of trust of which

the officer or person may be guilty in relation to the company or any subsidiary thereof. Bermuda law also grants companies the power generally to indemnify directors, alternate directors and officers of the company and any members authorized

under Bye-law 98, resident representatives or their respective heirs, executors or administrators if any such person was or is a party or threatened to be made a party to a threatened, pending or completed

action, suit or proceeding by reason of the fact that he or she is or was a director, alternate director or officer of the company or member of a committee authorized under Bye-law 98, resident representative

or their respective heirs, executors or administrators or was serving in a similar capacity for another entity at the company’s request.

The Company’s shareholders have no pre-emptive, subscription, redemption,