Current Report Filing (8-k)

15 Juni 2020 - 10:34PM

Edgar (US Regulatory)

false0001410384

0001410384

2020-06-09

2020-06-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 9, 2020

Q2 HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36350

|

|

20-2706637

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

13785 Research Blvd, Suite 150

Austin, Texas 78750

(Address of Principal Executive Offices, and Zip Code)

(512) 275-0072

Registrant's Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

QTWO

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e)

On June 9, 2020, the Compensation Committee (the "Committee") of the Board of Directors of Q2 Holdings, Inc. (the "Company") approved an Executive Incentive Compensation Plan (the "Bonus Plan") for the Company's executive officers to be effective for fiscal 2020 and beyond. All executive officers who are not on any other sales or commission-based cash bonus plan are eligible to participate in the Bonus Plan. Participants in the Bonus Plan will be eligible to earn periodic bonuses through achievement of performance targets to be established by the Committee each fiscal year, with the degree of performance achievement determining the bonus amount earned relative to the participant's target bonus amount. Each participant in the Bonus Plan is assigned a target bonus amount, either as a percentage of base salary or as a specified dollar amount. Participants in the Bonus Plan generally must be employed on the date the bonuses are actually paid in order to receive payment. The Company expects to adopt bonus plans under the Bonus Plan for each fiscal year consistent with the terms of the Bonus Plan as described above.

A copy of the Bonus Plan is furnished as Exhibit 10.1 hereto and is incorporated herein by reference. The foregoing description of the Bonus Plan does not purport to be complete and is qualified in its entirety by reference to such exhibit.

On June 9, 2020, pursuant to the Bonus Plan, the Committee also approved the 2020 Bonus Plan (the "2020 Bonus Plan") for the Company's named executive officers to be effective for the fiscal year ending December 31, 2020.

The 2020 base salaries and target bonus payments as a percentage of the base salary for each of the Company's named executive officers are set forth in the following table:

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officer

|

|

2020 Base Salary(1)

|

|

Target Bonus as % of Base Salary

|

|

Matthew P. Flake

President and Chief Executive Officer

|

|

$

|

520,000

|

|

|

57%

|

|

Jennifer N. Harris

Chief Financial Officer

|

|

368,400

|

|

|

55%

|

|

Adam D. Blue

Executive Vice President and Chief Technology Officer

|

|

300,000

|

|

|

55%

|

|

William M. Furrer

Chief Strategy and Marketing Officer

|

|

290,000

|

|

|

55%

|

(1) Base salary amounts reflect no change from 2019.

The 2020 Bonus Plan provides for the payment of cash bonuses based upon achievement of established performance measures and payout formulas determined by the Committee. To the extent earned, bonuses under the 2020 Bonus Plan will be paid in a single annual payout following completion of the 2020 fiscal year.

The 2020 Bonus Plan provides for the bonus amounts to be determined based on the following metrics:

|

|

|

|

|

|

|

Weighting of Performance Measure as % of Potential Bonus Payment

|

|

Non-GAAP Revenue

|

|

Adjusted EBITDA

|

|

50%

|

|

50%

|

The non-GAAP revenue performance measure ("revenue performance measure") consists of GAAP revenue, adjusted to exclude the impact to deferred revenue from purchase accounting. The adjusted EBITDA performance measure ("EBITDA performance measure") consists of adjusted EBITDA, determined by the Company by adjusting GAAP net loss for such items as interest, taxes, depreciation and amortization, stock-based compensation, acquisition-related costs, amortization of technology and intangibles, unoccupied lease charges and the impact to deferred revenue from purchase accounting. The 2020 Bonus Plan provides that the revenue and EBITDA performance measures are to be measured against non-GAAP revenue and adjusted EBITDA targets based on the Company's 2020 internal operating plan.

Potential payouts under the 2020 Bonus Plan with respect to the revenue and EBITDA performance measures are based on performance within a range of each performance measure's target. The targeted range of attainment opportunities for each performance measure are set forth in the following table:

|

|

|

|

|

|

|

|

|

|

|

Achievement Level

|

|

Percentage of Revenue Performance Measure Attained

|

|

Percentage of EBITDA Performance Measure Attained

|

|

Corresponding Weighted Potential Payout Percentage Per Performance Measure

|

|

Minimum

|

|

90%

|

|

80%

|

|

50%

|

|

Target

|

|

100% to 105%

|

|

95% to 105%

|

|

100%

|

|

Maximum

|

|

110%

|

|

110%

|

|

120%

|

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Company held its 2020 annual meeting of stockholders on June 9, 2020. Holders of an aggregate of 48,963,069 shares of the Company’s common stock at the close of business on April 22, 2020 were entitled to vote at the meeting, of which 46,797,900, or 95.6%, of the eligible shares were represented in person or by proxy. The matters voted upon at the meeting and the results of those votes are as follows:

Proposal 1: Election of Directors to hold office for one-year terms or until their respective successors are elected and qualified, or their earlier death, resignation or removal.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Withheld

|

|

Broker Non-votes

|

|

R. Lynn Atchison

|

|

44,593,284

|

|

|

375,104

|

|

|

1,829,512

|

|

|

Charles T. Doyle

|

|

40,153,951

|

|

|

4,814,437

|

|

|

1,829,512

|

|

|

Carl James Schaper

|

|

39,926,910

|

|

|

5,041,478

|

|

|

1,829,512

|

|

Based on the votes set forth above, all of the director nominees were duly elected.

Proposal 2: Ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm for the fiscal year ending December 31, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstaining

|

|

46,537,758

|

|

|

109,726

|

|

|

150,416

|

|

Based on the votes set forth above, the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2020 was ratified.

Proposal 3: Advisory vote to approve the compensation of the Company's named executive officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstaining

|

|

Broker Non-votes

|

|

39,616,509

|

|

|

5,196,093

|

|

|

155,786

|

|

|

1,829,512

|

|

Based on the votes set forth above, the stockholders approved on an advisory basis the compensation of the Company's named executive officers.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Executive Incentive Compensation Plan

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Q2 HOLDINGS, INC.

|

|

|

|

|

June 15, 2020

|

/s/ Jennifer N. Harris

Jennifer N. Harris

Chief Financial Officer

|

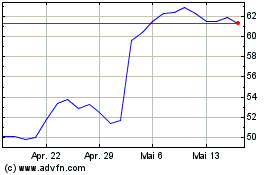

Q2 (NYSE:QTWO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

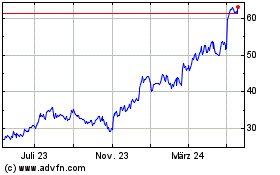

Q2 (NYSE:QTWO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024