Total first quarter revenue of $54.8 million,

up 23 percent year-over-year, and up 6 percent from the previous

quarter

Q2 Holdings, Inc. (NYSE:QTWO), a leading provider of secure,

experience-driven digital banking solutions, today announced

results for its first quarter ending March 31, 2018.

First Quarter 2018 Results

Please note these results reflect the impact from the adoption

of ASC 606, Contracts with Customers, effective Jan. 1, 2018.

- Revenue for the first quarter of $54.8

million, up 23 percent year-over-year and up 6 percent from the

previous quarter.

- GAAP gross margin for the first quarter

of 50.8 percent, up from 48.9 percent one year ago. Non-GAAP gross

margin for the first quarter of 54.3 percent, up from 52.5 percent

one year ago.

- GAAP net loss for the first quarter of

$6.0 million, which compares to a GAAP net loss of $7.0 million for

the first quarter of 2017, and $5.5 million for the fourth quarter

of 2017. Adjusted EBITDA for the first quarter of positive $5.0

million, an improvement from positive $1.1 million one year ago and

positive $4.1 million for the fourth quarter of 2017.

“We had a strong start to 2018, sustaining our bookings momentum

in what is typically a seasonally slower quarter,” said Matt Flake,

CEO of Q2. “Having just wrapped up our annual client conference, I

believe our customers are generally optimistic about their

improving operating environments. When you combine this with three

consecutive quarters of positive bookings momentum, I believe we

are well positioned for solid growth in 2018.”

First Quarter 2018 Highlights.

- Signed a Top 50 credit union and two

Tier 1 banks in the first quarter, including a $10 billion bank in

the Southeast and a $7 billion bank in the West.

- Exited the first quarter with

approximately 10.9 million registered users on the Q2 platform,

representing 22 percent year-over-year growth and up 5 percent

sequentially.

- Continued Q2 Open momentum, signing

MoneyLion, a savings and investment platform with two million

customers.

Financial Outlook

Q2 Holdings is providing guidance for its second quarter 2018 as

follows:

- Total revenue of $57.9 million to $58.5

million, which would represent year-over-year growth of 22 percent

to 23 percent.

- Adjusted EBITDA of $4.7 million to $5.3

million. GAAP net loss is the most comparable GAAP measure to

adjusted EBITDA. Adjusted EBITDA differs from GAAP net loss in that

it excludes things such as depreciation and amortization,

stock-based compensation, acquisition-related costs, interest,

income taxes and unoccupied lease charges. Q2 Holdings is unable to

predict with reasonable certainty the ultimate outcome of these

exclusions without unreasonable effort. Therefore, Q2 Holdings has

not provided guidance for GAAP net loss or a reconciliation of the

foregoing forward-looking adjusted EBITDA guidance to GAAP net

loss.

Q2 Holdings is providing guidance for the full-year 2018 as

follows:

- Total revenue of $236.5 million to

$238.5 million, which would represent year-over-year growth of 22

percent to 23 percent.

- Adjusted EBITDA of $21 million to $23

million. Adjusted EBITDA differs from GAAP net loss in that it

excludes things such as depreciation and amortization, stock-based

compensation, acquisition-related costs, interest, income taxes and

unoccupied lease charges. Q2 Holdings is unable to predict with

reasonable certainty the ultimate outcome of these exclusions

without unreasonable effort. Therefore, Q2 Holdings has not

provided guidance for GAAP net loss or a reconciliation of the

foregoing forward-looking adjusted EBITDA guidance to GAAP net

loss.

Conference Call Details

Date:

May 3, 2018

Time:

8:30 a.m. EDT

Hosts:

Matt Flake, CEO / Jennifer Harris, CFO

Dial in:

US toll free: 1-833-241-4254

International: 1-647-689-4205

Conference ID:

2697347

Please join the conference call at least 10 minutes before start

time to ensure the line is connected. A live webcast of the

conference call will be accessible from the investor services

section of the Q2 Holdings, Inc. website at

http://investors.q2ebanking.com/.

A replay of the webcast will also be available at this website

on a temporary basis shortly after the call.

About Q2 Holdings, Inc.

Q2 is a leading provider of secure, experience-driven digital

banking solutions headquartered in Austin, Texas. We are

driven by a mission to build stronger communities by strengthening

their financial institutions. Q2 provides the industry’s

most comprehensive digital banking platform, enriched through

actionable data insights, open development tools and an evolving

fintech ecosystem. We help clients elevate the experience,

drive efficiency and grow faster. To learn more about Q2,

visit www.q2ebanking.com.

Use of Non-GAAP Measures

Q2 uses the following non-GAAP financial measures: adjusted

EBITDA; non-GAAP gross margin; non-GAAP gross profit; non-GAAP

sales and marketing expense; non-GAAP research and development

expense; non-GAAP general and administrative expense; non-GAAP

operating loss; and, non-GAAP net loss. Management believes that

these non-GAAP financial measures are useful measures of operating

performance because they exclude items that Q2 does not consider

indicative of its core performance.

In the case of adjusted EBITDA, Q2 adjusts net loss for such

things as interest, taxes, depreciation and amortization,

stock-based compensation, acquisition-related costs, amortization

of technology and intangibles, and unoccupied lease charges. In the

case of non-GAAP gross margin and non-GAAP gross profit, Q2 adjusts

gross profit and gross margin for stock-based compensation and

amortization of acquired technology. In the case of non-GAAP sales

and marketing expense, non-GAAP research and development expense,

and non-GAAP general and administrative expense, Q2 adjusts the

corresponding GAAP expense to exclude stock-based compensation. In

the case of non-GAAP operating loss and non-GAAP net loss, Q2

adjusts operating loss and net loss, respectively, for stock-based

compensation, acquisition related-costs, amortization of acquired

technology, amortization of acquired intangibles, and unoccupied

lease charges.

These non-GAAP measures should be considered in addition to, not

as a substitute for or superior to, the closest GAAP measures, or

other financial measures prepared in accordance with GAAP. A

reconciliation to the closest GAAP measures of these non-GAAP

measures is contained in tabular form on the attached unaudited

condensed consolidated financial statements.

Q2’s management uses these non-GAAP measures as measures of

operating performance; to prepare Q2’s annual operating budget; to

allocate resources to enhance the financial performance of Q2’s

business; to evaluate the effectiveness of Q2’s business

strategies; to provide consistency and comparability with past

financial performance; to facilitate a comparison of Q2’s results

with those of other companies, many of which use similar non-GAAP

financial measures to supplement their GAAP results; and in

communication with our board of directors concerning Q2’s financial

performance.

Forward-looking Statements

This press release contains forward-looking statements,

including statements about positive sales and bookings momentum,

increased activity in the bank market and the effects of the

improved economic environment on banks’ decision-making, optimism

about our pipeline and Q2’s performance in 2018, and Q2’s quarterly

and annual financial guidance. The forward-looking statements

contained in this press release are based upon Q2’s historical

performance and its current plans, estimates and expectations and

are not a representation that such plans, estimates or expectations

will be achieved. Factors that could cause actual results to differ

materially from those described herein include risks related to:

(a) the risk of increased competition in its existing markets and

as it enters new sections of the market with Tier 1 customers and

new products and services; (b) the risk that the market for Q2’s

solutions does not grow as anticipated, in particular with respect

to Tier 1 customers; (c) the risk that Q2’s increased focus on

selling to larger Tier 1 customers may result in greater

uncertainty and variability in Q2’s business and sales results; (d)

the risk that changes in Q2’s market, business or sales

organization negatively impacts its ability to sell its products

and services; (e) the challenges and costs associated with selling,

implementing and supporting Q2’s solutions, particularly for larger

customers with more complex requirements and longer implementation

processes; (f) the risk that errors, interruptions or delays in

Q2’s products or services or Web hosting negatively impacts Q2’s

business and sales; (g) risks associated with data breaches and

breaches of security measures within Q2’s products, systems and

infrastructure and the resultant harm to Q2’s business and its

ability to sell its products and services; (h) the impact that a

slowdown in the economy, financial markets, and credit markets has

on Q2’s customers and Q2’s business sales cycles, prospects and

customers’ spending decisions and timing of implementation

decisions, particularly in regions where a significant number of

Q2’s customers are concentrated; (i) the difficulties and risks

associated with developing and selling complex new solutions and

enhancements with the technical and regulatory specifications and

functionality required by customers and governmental authorities;

(j) the risks inherent in technology and implementation

partnerships that could cause harm to Q2’s business; (k) the

difficulties and costs Q2 may encounter with complex

implementations of its solutions and the resulting impact on

reputation and the timing of its revenue from any delayed

implementations; (l) the risk that Q2 will not be able to maintain

historical contract terms such as pricing and duration; (m) the

risks associated with managing growth and the challenges associated

with improving operations and hiring, retaining and motivating

employees to support such growth; (n) the risk that modifications

or negotiations of contractual arrangements will be necessary

during Q2’s implementations of its solutions or the general risks

associated with the complexity of Q2’s customer arrangements; (o)

the risks associated with integrating acquired companies and

successfully selling and maintaining their solutions; (p)

litigation related to intellectual property and other matters and

any related claims, negotiations and settlements; and (q) the risks

associated with further consolidation in the financial services

industry.

Additional information relating to the uncertainty affecting the

Q2 business are contained in Q2’s filings with the Securities and

Exchange Commission. These documents are available on the SEC

Filings section of the Investor Services section of Q2’s website at

http://investors.q2ebanking.com/. These forward-looking statements

represent Q2’s expectations as of the date of this press release.

Subsequent events may cause these expectations to change, and Q2

disclaims any obligations to update or alter these forward-looking

statements in the future, whether as a result of new information,

future events or otherwise.

Q2 Holdings, Inc. Condensed

Consolidated Balance Sheets (in thousands)

March

31, December 31, 2018 2017 (unaudited)

(unaudited) Assets Current assets: Cash and cash equivalents $

255,411 $ 57,961 Restricted cash 2,315 2,315 Investments 38,704

41,685 Accounts receivable, net 16,897 13,203 Contract assets,

current portion 336 - Prepaid expenses and other current assets

4,699 3,115 Deferred solution and other costs, current portion

8,392 9,246 Deferred implementation costs, current portion

3,740 3,562 Total current assets 330,494

131,087 Property and equipment, net 36,592 34,544 Deferred solution

and other costs, net of current portion 16,333 12,973 Deferred

implementation costs, net of current portion 8,374 8,295 Intangible

assets, net 10,556 12,034 Goodwill 12,876 12,876 Contract assets,

net of current portion 5,539 - Other long-term assets 1,090

1,006 Total assets $ 421,854 $ 212,815

Liabilities and stockholders' equity Current

liabilities:

Accounts payable and accrued

liabilities

$

23,451

$ 29,694 Deferred revenues, current portion 38,344

38,379 Total current liabilities 63,305 68,073

Convertible notes, net of current portion

175,170

- Deferred revenues, net of current portion 20,599 28,289 Deferred

rent, net of current portion 9,075 9,393 Other long-term

liabilities

360

438 Total liabilities 266,999 106,193

Stockholders' equity: Common stock 4 4 Treasury stock - (855 )

Additional paid-in capital 298,087 259,726 Accumulated other

comprehensive loss (163 ) (139 ) Accumulated deficit

(143,073 ) (152,114 ) Total stockholders' equity

154,855 106,622 Total liabilities and

stockholders' equity $ 421,854 $ 212,815

Q2 Holdings, Inc. Condensed

Consolidated Statements of Comprehensive Loss (in thousands,

except per share data)

Three Months Ended March 31,

2018 2017 (unaudited) (unaudited) Revenues $

54,808 $ 44,534

Cost of revenues (1) (2)

26,977 22,772 Gross profit 27,831

21,762 Operating expenses: Sales and marketing (1) 10,966

9,878 Research and development (1) 11,157 9,651 General and

administrative (1) 10,296 8,452 Acquisition related costs 256 348

Amortization of acquired intangibles 368 371

Total operating expenses 33,043 28,700

Loss from operations (5,212 ) (6,938 ) Other income

(expense), net (1,023 ) 34 Loss before income

taxes (6,235 ) (6,904 ) Benefit from (provision for) income taxes

187 (136 ) Net loss $ (6,048 ) $ (7,040 )

Other comprehensive loss Unrealized loss on available-for-sale

investments (24 ) (1 ) Comprehensive loss $ (6,072 )

$ (7,041 ) Net loss per common share: Net loss per common share,

basic and diluted $ (0.14 ) $ (0.17 ) Weighted average common

shares outstanding, basic and diluted 42,170

40,630 (1) Includes stock-based compensation

expenses as follows:

Three Months Ended March 31,

2018 2017 Cost of revenues $

1,015 $ 724 Sales and marketing 1,226 631 Research and development

1,356 945 General and administrative 2,498

1,897 Total stock-based compensation expenses $ 6,095

$ 4,197 (2) Includes amortization of acquired

technology of $0.9 million for each of the three months ended March

31, 2018 and 2017.

Q2 Holdings, Inc.

Condensed Consolidated Statements of Cash Flows (in

thousands)

Three Months Ended March

31, 2018 2017 (unaudited) (unaudited) Cash flows

from operating activities: Net loss $ (6,048 ) $ (7,040 )

Adjustments to reconcile net loss to net

cash used in operating activities:

Amortization of deferred implementation, solution and other costs

2,218 1,719 Depreciation and amortization 3,878 3,525 Amortization

of debt issuance costs 123 24 Amortization of premiums on

investments 56 69

Amortization of debt discount

1,099 - Stock-based compensation expenses 6,095 4,197 Deferred

income taxes 36 117 Other non-cash charges 22 (6 ) Changes in

operating assets and liabilities (14,582 ) (13,273 )

Cash used in operating activities (7,103 ) (10,668 ) Cash flows

from investing activities: Net redemptions of investments 2,901

2,770 Purchases of property and equipment (5,396 ) (5,361 )

Business combinations and asset acquisitions, net of cash acquired

(150 ) (1,316 ) Capitalization of software development costs

- (532 ) Cash used in investing activities (2,645 )

(4,439 ) Cash flows from financing activities: Proceeds from

issuance of convertible notes, net of issuance costs 223,675 -

Purchase of convertible notes bond hedge (41,699 ) - Proceeds from

issuance of warrants 22,379 - Proceeds from issuance of common

stock 2,843 2,990 Net cash provided by

financing activities 207,198 2,990 Net

increase (decrease) in cash and cash equivalents 197,450 (12,117 )

Cash, cash equivalents, and restricted cash beginning of period

60,276 56,188 Cash, cash equivalents,

and restricted cash end of period $ 257,726 $ 44,071

Reconciliation of cash, cash equivalents,

and restricted cash as shown in the statements of cash flows:

Cash and cash equivalents $ 255,411 $ 42,756 Restricted cash

2,315 1,315 Total cash, cash equivalents, and

restricted cash $ 257,726 $ 44,071

Q2 Holdings, Inc. Reconciliation of

GAAP to Non-GAAP Measures (in thousands, except per share data)

Three Months Ended March 31, 2018 2017

(unaudited) (unaudited) GAAP gross profit $ 27,831 $ 21,762

Stock-based compensation 1,015 724 Amortization of acquired

technology 912 885 Non-GAAP gross

profit $ 29,758 $ 23,371 Non-GAAP gross

margin: Non-GAAP gross profit $ 29,758 $ 23,371 GAAP revenue

54,808 44,534 Non-GAAP gross margin

54.3 % 52.5 % GAAP sales and marketing expense $

10,966 $ 9,878 Stock-based compensation (1,226 ) (631

) Non-GAAP sales and marketing expense $ 9,740 $ 9,247

GAAP research and development expense $ 11,157 $

9,651 Stock-based compensation (1,356 ) (945 )

Non-GAAP research and development expense $ 9,801 $ 8,706

GAAP general and administrative expense $ 10,296 $

8,452 Stock-based compensation (2,498 ) (1,897 )

Non-GAAP general and administrative expense $ 7,798 $ 6,555

GAAP operating loss $ (5,212 ) $ (6,938 ) Stock-based

compensation 6,095 4,197 Acquisition related costs 256 348

Amortization of acquired technology 912 885 Amortization of

acquired intangibles 368 371 Non-GAAP

operating income (loss) $ 2,419 $ (1,137 ) GAAP net

loss $ (6,048 ) $ (7,040 ) Stock-based compensation 6,095 4,197

Acquisition related costs 256 348 Amortization of acquired

technology 912 885 Amortization of acquired intangibles 368

371 Non-GAAP net income (loss) $ 1,583

$ (1,239 )

Reconciliation from diluted

weighted-average number of common shares as reported to pro forma

diluted weighted average number of common shares

Diluted weighted-average number of common shares, as reported

42,170 40,630 Weighted-average effect of potentially dilutive

shares 1,970 - Pro forma diluted

weighted-average number of common shares 44,140 40,630

Calculation of non-GAAP income (loss) per share: Non-GAAP net

income (loss) $ 1,583 $ (1,239 )

Diluted weighted-average number of common

shares (pro forma for three months ended March 31, 2018)

44,140 40,630 Non-GAAP net income

(loss) per share $ 0.04 $ (0.03 ) Reconciliation of

GAAP net loss to adjusted EBITDA: GAAP net loss $ (6,048 ) $ (7,040

) Depreciation and amortization 3,878 3,525 Stock-based

compensation 6,095 4,197 (Benefit from) provision for income taxes

(187 ) 136 Interest (income) expense, net 1,023 (34 ) Acquisition

related costs 256 348 Adjusted EBITDA $

5,017 $ 1,132

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180502006462/en/

MEDIA CONTACT:Red Fan CommunicationsEmma ChaseO: (512)

551-9253 / C: (512)

917-4319emma@redfancommunications.comorINVESTOR CONTACT:Q2

Holdings, Inc.Bob GujavartyO: (512)

439-3447bobby.gujavarty@q2ebanking.com

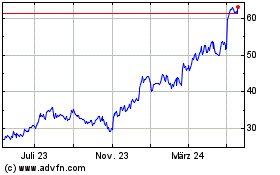

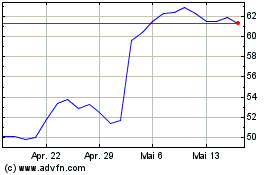

Q2 (NYSE:QTWO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Q2 (NYSE:QTWO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024