Earnings Preview: McGraw-Hill - Analyst Blog

19 Oktober 2011 - 2:15PM

Zacks

The McGraw-Hill Companies

Inc (MHP) is slated to report its third-quarter 2011

financial results on Thursday, October 20, 2011. The current Zacks

Consensus Estimate for the quarter is $1.23 a share. For the

quarter to be reported, the Zacks Consensus Estimate for revenue is

$2,041 million.

Second-Quarter 2011, a

Synopsis

McGraw-Hill’s quarterly earnings of

68 cents per share came a penny ahead of the Zacks Consensus

Estimate, and rose 11.9% from 61 cents earned in the prior-year

quarter.

McGraw-Hill’s total revenue of

$1580.8 million handily beats the Zacks Consensus Estimate of

$1,551 million, and jumped 7.2% from the prior-year quarter.

The company registered healthy

performance across McGraw-Hill Financial, Standard & Poor's and

Information & Media, partially offset by a decline in

McGraw-Hill Education resulting from delay in orders. Management

believes that in third-quarter 2011, the elementary and high school

market would gain from delayed orders in the second quarter,

particularly from Texas.

Third-Quarter 2011

Zacks Consensus

The analysts covered by Zacks,

expect McGraw-Hill to post third-quarter 2011 earnings of $1.23 a

share. The current Zacks Consensus Estimate reflects a growth of

0.8% from the prior-year quarter’s earnings. The current Zacks

Consensus Estimate for the quarter ranges between $1.20 and $1.27 a

share.

Zacks Agreement &

Magnitude

The current Zacks Consensus

Estimate came down by a penny over the last 7 days with 2 out of 7

analysts covering the stock, revising their estimate downwards.

With respect to earnings surprises,

McGraw-Hill has topped the Zacks Consensus Estimate over the last

four quarters in the range of 1.5% to 11.9%. The average remained

at 6.2%. This suggests that McGraw-Hill has outperformed the Zacks

Consensus Estimate by an average of 6.2% in the last four

quarters.

What Drives Estimate

Revision

McGraw-Hill has lost a substantial

market value in last 5 years and its rating agency was under fire

for its latest U.S. downgrade.

Further, advertising remains an

important source of revenue for the Information & Media segment

of the company and the slump in advertising revenue rings the alarm

about troubled times ahead in the economy, and its susceptibility

to such conditions.

However, McGraw-Hill, with the

intent of boosting shareholders’ value announced extensive growth

and value measures, including the separation of the company into

two independent companies, McGraw-Hill Markets and McGraw-Hill

Education.

Going with its plan, the company

aims to create two "focused companies” with optimal-size capital

and cost arrangement for amplifying client commitment and improving

strategic and economic suppleness while increasing management’s

focus and responsibility.

Further, the company added that it

will focus on abridging costs drastically to ensure competent

operating channels and will also accelerate the pace of share

buybacks to a total of $1 billion for the fiscal year 2011.

McGraw-Hill expects to complete the

transaction by the end of 2012 through a tax-free spin-off while

the separation plan is subject to the approval by the board of

directors.

Currently, we have a long-term

Neutral rating on McGraw-Hill, which competes with Pearson

plc (PSO). Moreover, the company holds a Zacks #3 Rank,

which translates into a short-term Hold recommendation.

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

Zacks Investment Research

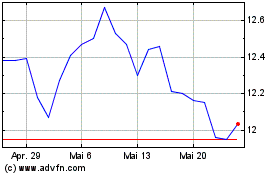

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024