CTO Realty Growth Announces Chief Financial Officer Transition

28 Februar 2024 - 10:15PM

CTO Realty Growth, Inc. (NYSE: CTO) (the “Company” or “CTO”)

announced today that its Senior Vice President, Chief Financial

Officer and Treasurer, Matthew M. Partridge, has resigned from the

Company, effective as of April 1, 2024 (the “Effective Date”), to

pursue another opportunity with a new venture not in the REIT

industry. Following the Effective Date, Mr. Partridge intends to

provide further assistance with certain needs of the Company during

the Company’s first quarter reporting period in order to ensure a

successful transition. The Company has begun its search for a new

Chief Financial Officer.

“Both personally and on behalf of the board of

directors, I want to wish Matt great success in his new endeavor,”

said John P. Albright, President and Chief Executive Officer of CTO

Realty Growth, Inc. “Matt has been an important part of the

Company’s evolution during his three and a half years, helping to

shape the Company’s balance sheet, financial reporting, and asset

management strategies. He has developed a strong finance and

accounting team, now led by Lisa Vorakoun, our Vice President and

Chief Accounting Officer who has been with CTO for over 11 years,

to provide stability and to support the long-term growth of the

Company.”

Mr. Partridge said, “I am proud of all that we

have accomplished during my time with the Company, and I can’t

thank them enough for the opportunity they’ve provided me. CTO has

an incredibly talented team and I’m grateful to have worked

alongside each of them to help the Company achieve its strategic

and financial goals.”

About CTO Realty Growth,

Inc.

CTO Realty Growth, Inc. is a publicly traded

real estate investment trust that owns and operates a portfolio of

high-quality, retail-based properties located primarily in higher

growth markets in the United States. CTO also externally manages

and owns a meaningful interest in Alpine Income Property Trust,

Inc. (NYSE: PINE), a publicly traded net lease REIT.

We encourage you to review our most recent

investor presentation and supplemental financial information, which

is available on our website at www.ctoreit.com.

Safe Harbor

Certain statements contained in this press

release (other than statements of historical fact) are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements can typically be identified by words such as “believe,”

“estimate,” “expect,” “intend,” “anticipate,” “will,” “could,”

“may,” “should,” “plan,” “potential,” “predict,” “forecast,”

“project,” and similar expressions, as well as variations or

negatives of these words.

Although forward-looking statements are made

based upon management’s present expectations and reasonable beliefs

concerning future developments and their potential effect upon the

Company, a number of factors could cause the Company’s actual

results to differ materially from those set forth in the

forward-looking statements. Such factors may include, but are not

limited to: the Company’s ability to remain qualified as a REIT;

the Company’s exposure to U.S. federal and state income tax law

changes, including changes to the REIT requirements; general

adverse economic and real estate conditions; macroeconomic and

geopolitical factors, including but not limited to inflationary

pressures, interest rate volatility, distress in the banking

sector, global supply chain disruptions, and ongoing geopolitical

war; credit risk associated with the Company investing in

structured investments; the ultimate geographic spread, severity

and duration of pandemics such as the COVID-19 pandemic and its

variants, actions that may be taken by governmental authorities to

contain or address the impact of such pandemics, and the potential

negative impacts of such pandemics on the global economy and the

Company’s financial condition and results of operations; the

inability of major tenants to continue paying their rent or

obligations due to bankruptcy, insolvency or a general downturn in

their business; the loss or failure, or decline in the business or

assets of PINE; the completion of 1031 exchange transactions; the

availability of investment properties that meet the Company’s

investment goals and criteria; the uncertainties associated with

obtaining required governmental permits and satisfying other

closing conditions for planned acquisitions and sales; and the

uncertainties and risk factors discussed in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

other risks and uncertainties discussed from time to time in the

Company’s filings with the U.S. Securities and Exchange

Commission.

There can be no assurance that future

developments will be in accordance with management’s expectations

or that the effect of future developments on the Company will be

those anticipated by management. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

| Contact: |

Matthew M. PartridgeSenior Vice

President, Chief Financial Officer, and Treasurer(407)

904-3324mpartridge@ctoreit.com |

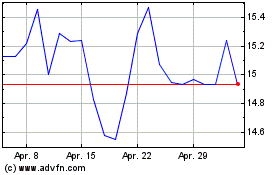

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024