00010198492022FYfalsehttp://fasb.org/us-gaap/2022#AccountingStandardsUpdate201602Memberhttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#Liabilities00010198492022-01-012022-12-3100010198492022-06-30iso4217:USD00010198492023-02-14xbrli:shares00010198492022-12-3100010198492021-12-31iso4217:USDxbrli:shares0001019849us-gaap:NonvotingCommonStockMember2021-12-310001019849us-gaap:NonvotingCommonStockMember2022-12-310001019849us-gaap:CommonClassCMember2021-12-310001019849us-gaap:CommonClassCMember2022-12-310001019849pag:RetailAutomotiveDealershipMember2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMember2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMember2020-01-012020-12-310001019849pag:RetailCommercialTruckDealershipMember2022-01-012022-12-310001019849pag:RetailCommercialTruckDealershipMember2021-01-012021-12-310001019849pag:RetailCommercialTruckDealershipMember2020-01-012020-12-310001019849pag:CommercialVehicleDistributionAndOtherMember2022-01-012022-12-310001019849pag:CommercialVehicleDistributionAndOtherMember2021-01-012021-12-310001019849pag:CommercialVehicleDistributionAndOtherMember2020-01-012020-12-3100010198492021-01-012021-12-3100010198492020-01-012020-12-310001019849pag:SeniorSubordinatedNotes350PercentDue2025Member2022-12-31xbrli:pure0001019849pag:SeniorSubordinatedNotes350PercentDue2025Member2022-01-012022-12-310001019849pag:SeniorSubordinatedNotes350PercentDue2025Member2021-01-012021-12-310001019849pag:SeniorSubordinatedNotes350PercentDue2025Member2020-01-012020-12-310001019849pag:A375SeniorSubordinatedNotesDue2029Member2022-12-310001019849pag:A375SeniorSubordinatedNotesDue2029Member2022-01-012022-12-310001019849pag:A375SeniorSubordinatedNotesDue2029Member2021-01-012021-12-310001019849pag:A375SeniorSubordinatedNotesDue2029Member2020-01-012020-12-310001019849pag:SeniorSubordinatedNotes375PercentDue2020Member2022-12-310001019849pag:SeniorSubordinatedNotes375PercentDue2020Member2022-01-012022-12-310001019849pag:SeniorSubordinatedNotes375PercentDue2020Member2021-01-012021-12-310001019849pag:SeniorSubordinatedNotes375PercentDue2020Member2020-01-012020-12-310001019849pag:SeniorSubordinatedNotes5375PercentDue2024Member2022-12-310001019849pag:SeniorSubordinatedNotes5375PercentDue2024Member2022-01-012022-12-310001019849pag:SeniorSubordinatedNotes5375PercentDue2024Member2021-01-012021-12-310001019849pag:SeniorSubordinatedNotes5375PercentDue2024Member2020-01-012020-12-310001019849pag:SeniorSubordinatedNotes550PercentDue2026Member2022-12-310001019849pag:SeniorSubordinatedNotes550PercentDue2026Member2022-01-012022-12-310001019849pag:SeniorSubordinatedNotes550PercentDue2026Member2021-01-012021-12-310001019849pag:SeniorSubordinatedNotes550PercentDue2026Member2020-01-012020-12-310001019849pag:SeniorSubordinatedNotes575PercentDue2022Member2022-12-310001019849pag:SeniorSubordinatedNotes575PercentDue2022Member2022-01-012022-12-310001019849pag:SeniorSubordinatedNotes575PercentDue2022Member2021-01-012021-12-310001019849pag:SeniorSubordinatedNotes575PercentDue2022Member2020-01-012020-12-3100010198492020-12-3100010198492019-12-310001019849us-gaap:CommonStockMember2019-12-310001019849us-gaap:AdditionalPaidInCapitalMember2019-12-310001019849us-gaap:RetainedEarningsMember2019-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001019849us-gaap:ParentMember2019-12-310001019849us-gaap:NoncontrollingInterestMember2019-12-310001019849us-gaap:CommonStockMember2020-01-012020-12-310001019849us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001019849us-gaap:ParentMember2020-01-012020-12-310001019849us-gaap:RetainedEarningsMember2020-01-012020-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001019849us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001019849us-gaap:CommonStockMember2020-12-310001019849us-gaap:AdditionalPaidInCapitalMember2020-12-310001019849us-gaap:RetainedEarningsMember2020-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001019849us-gaap:ParentMember2020-12-310001019849us-gaap:NoncontrollingInterestMember2020-12-310001019849us-gaap:CommonStockMember2021-01-012021-12-310001019849us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001019849us-gaap:ParentMember2021-01-012021-12-310001019849us-gaap:RetainedEarningsMember2021-01-012021-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001019849us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001019849us-gaap:CommonStockMember2021-12-310001019849us-gaap:AdditionalPaidInCapitalMember2021-12-310001019849us-gaap:RetainedEarningsMember2021-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001019849us-gaap:ParentMember2021-12-310001019849us-gaap:NoncontrollingInterestMember2021-12-310001019849us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001019849us-gaap:ParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001019849srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001019849us-gaap:CommonStockMember2022-01-012022-12-310001019849us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001019849us-gaap:ParentMember2022-01-012022-12-310001019849us-gaap:RetainedEarningsMember2022-01-012022-12-310001019849us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001019849us-gaap:CommonStockMember2022-12-310001019849us-gaap:AdditionalPaidInCapitalMember2022-12-310001019849us-gaap:RetainedEarningsMember2022-12-310001019849us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001019849us-gaap:ParentMember2022-12-310001019849us-gaap:NoncontrollingInterestMember2022-12-31pag:employee0001019849pag:PenskeTruckLeasingCoLPMember2022-12-310001019849pag:PenskeTruckLeasingCoLPMember2022-12-31pag:vehicle0001019849us-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberpag:USAndPRMember2022-01-012022-12-310001019849us-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberpag:OutsideUSMember2022-01-012022-12-31pag:brand0001019849us-gaap:RevenueFromContractWithCustomerMemberpag:RetailAutomotiveDealershipMemberpag:PremiumBrandsConcentrationRiskMember2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMember2022-12-31pag:franchise0001019849pag:RetailAutomotiveDealershipMembercountry:US2022-12-310001019849pag:OutsideUSMemberpag:RetailAutomotiveDealershipMember2022-12-310001019849pag:RetailAutomotiveDealershipMemberpag:UnitedStatesAndUnitedKingdomMember2022-12-31pag:dealership0001019849pag:RetailAutomotiveDealershipMembercountry:US2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMembercountry:GB2022-01-012022-12-310001019849us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberpag:RetailAutomotiveDealershipMemberpag:BmwMiniMember2022-01-012022-12-310001019849us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberpag:RetailAutomotiveDealershipMemberpag:AudiVolkswagenPorscheBentleyMember2022-01-012022-12-310001019849us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberpag:RetailAutomotiveDealershipMemberpag:ToyotaLexusMember2022-01-012022-12-310001019849pag:ManufacturerReceivablesMember2022-12-310001019849pag:ManufacturerReceivablesMember2021-12-310001019849pag:RetailAutomotiveDealershipMemberpag:UnitedStatesAndUnitedKingdomMember2022-01-012022-12-310001019849country:GB2022-01-012022-12-310001019849pag:CarShopSatelliteMembercountry:GB2022-01-012022-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:UnitedStatesAndOntarioCanadaMember2022-12-31pag:state0001019849pag:RetailCommercialTruckDealershipMemberpag:TEAMTruckCentresMember2022-02-012022-02-28pag:location0001019849pag:PenskeCorporationMemberpag:PenskeTruckLeasingCoLPMember2022-01-012022-12-310001019849pag:MitsuiAndCoMemberpag:PenskeTruckLeasingCoLPMember2022-01-012022-12-310001019849pag:ContractsInTransitMember2022-12-310001019849pag:ContractsInTransitMember2021-12-310001019849srt:MinimumMemberpag:PropertyPlantAndEquipmentOtherThanLeaseholdImprovementsMember2022-01-012022-12-310001019849srt:MaximumMemberpag:PropertyPlantAndEquipmentOtherThanLeaseholdImprovementsMember2022-01-012022-12-310001019849us-gaap:LeaseholdsAndLeaseholdImprovementsMember2022-01-012022-12-31pag:segmentpag:reporting0001019849pag:NonAutomotiveInvestmentsMember2022-12-310001019849pag:PenskeTruckLeasingCoLPMember2021-12-310001019849pag:SeniorSubordinatedNotes550PercentDue2025Member2022-12-310001019849pag:SeniorSubordinatedNotes550PercentDue2025Member2021-12-310001019849pag:A375SeniorSubordinatedNotesDue2029Member2021-12-310001019849us-gaap:MortgagesMember2022-12-310001019849us-gaap:MortgagesMember2021-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailAutomotiveAndRetailCommercialTruckDealershipMember2022-01-012022-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailAutomotiveAndRetailCommercialTruckDealershipMember2022-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailAutomotiveAndRetailCommercialTruckDealershipMember2021-12-310001019849us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberpag:PenskeTruckLeasingCoLPMember2022-12-310001019849pag:VehicleSalesMemberpag:RetailAutomotiveAndRetailCommercialTruckDealershipMember2022-01-012022-12-310001019849pag:RetailAutomotiveAndRetailCommercialTruckDealershipMemberpag:ServiceAndPartsMember2022-01-012022-12-310001019849pag:PenskeCommercialVehiclesAustraliaMemberpag:CommercialVehicleDistributionAndOtherMember2022-01-012022-12-310001019849pag:PenskeCommercialVehiclesAustraliaMemberpag:ServiceAndPartsMemberpag:CommercialVehicleDistributionAndOtherMember2022-01-012022-12-310001019849pag:PenskeCommercialVehiclesAustraliaMemberpag:ServiceAndPartsMemberpag:CommercialVehicleDistributionAndOtherMember2021-01-012021-12-310001019849pag:PenskeCommercialVehiclesAustraliaMemberpag:ServiceAndPartsMemberpag:CommercialVehicleDistributionAndOtherMember2020-01-012020-12-310001019849pag:RetailAutomotiveDealershipMemberpag:NewVehicleMember2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMemberpag:NewVehicleMember2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMemberpag:NewVehicleMember2020-01-012020-12-310001019849pag:RetailAutomotiveDealershipMemberpag:UsedVehicleMember2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMemberpag:UsedVehicleMember2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMemberpag:UsedVehicleMember2020-01-012020-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailAutomotiveDealershipMember2022-01-012022-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailAutomotiveDealershipMember2021-01-012021-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailAutomotiveDealershipMember2020-01-012020-12-310001019849pag:RetailAutomotiveDealershipMemberpag:ServiceAndPartsMember2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMemberpag:ServiceAndPartsMember2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMemberpag:ServiceAndPartsMember2020-01-012020-12-310001019849pag:FleetAndWholesaleMemberpag:RetailAutomotiveDealershipMember2022-01-012022-12-310001019849pag:FleetAndWholesaleMemberpag:RetailAutomotiveDealershipMember2021-01-012021-12-310001019849pag:FleetAndWholesaleMemberpag:RetailAutomotiveDealershipMember2020-01-012020-12-310001019849pag:RetailAutomotiveDealershipMembercountry:US2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMembercountry:US2020-01-012020-12-310001019849pag:RetailAutomotiveDealershipMembercountry:GB2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMembercountry:GB2020-01-012020-12-310001019849pag:RetailAutomotiveDealershipMemberpag:GermanyItalyAndJapanMember2022-01-012022-12-310001019849pag:RetailAutomotiveDealershipMemberpag:GermanyItalyAndJapanMember2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMemberpag:GermanyItalyAndJapanMember2020-01-012020-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:NewVehicleMember2022-01-012022-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:NewVehicleMember2021-01-012021-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:NewVehicleMember2020-01-012020-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:UsedVehicleMember2022-01-012022-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:UsedVehicleMember2021-01-012021-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:UsedVehicleMember2020-01-012020-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailCommercialTruckDealershipMember2022-01-012022-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailCommercialTruckDealershipMember2021-01-012021-12-310001019849pag:FinanceAndInsuranceNetMemberpag:RetailCommercialTruckDealershipMember2020-01-012020-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:ServiceAndPartsMember2022-01-012022-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:ServiceAndPartsMember2021-01-012021-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:ServiceAndPartsMember2020-01-012020-12-310001019849pag:OtherProductMemberpag:RetailCommercialTruckDealershipMember2022-01-012022-12-310001019849pag:OtherProductMemberpag:RetailCommercialTruckDealershipMember2021-01-012021-12-310001019849pag:OtherProductMemberpag:RetailCommercialTruckDealershipMember2020-01-012020-12-310001019849pag:VehicleReceivablesMember2022-12-310001019849pag:VehicleReceivablesMember2021-12-310001019849us-gaap:TradeAccountsReceivableMember2022-12-310001019849us-gaap:TradeAccountsReceivableMember2021-12-310001019849srt:MinimumMemberpag:OperatingLeasesPropertyLeasesMember2022-12-310001019849srt:MaximumMemberpag:OperatingLeasesPropertyLeasesMember2022-12-310001019849pag:OperatingLeasesEquipmentLeasesMembersrt:MaximumMember2022-12-310001019849pag:TheNixGroupMember2022-12-310001019849pag:BarcelonaPremiumSlMember2022-12-310001019849pag:PenskeCommercialLeasingAustraliaMember2022-12-310001019849us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-01-012022-12-310001019849us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-01-012021-12-310001019849us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-01-012020-12-310001019849us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-12-310001019849us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-12-310001019849pag:NicoleGroupMemberpag:RetailAutomotiveDealershipMemberpag:TokyoJapanMember2021-01-012021-12-310001019849pag:NicoleGroupMemberpag:RetailAutomotiveDealershipMember2021-01-012021-12-310001019849pag:RetailCommercialTruckDealershipMemberpag:KansasCityFreightlinerMember2021-01-012021-12-310001019849pag:McCoyFreightlinerMemberpag:RetailCommercialTruckDealershipMember2021-01-012021-12-310001019849pag:AutomotiveInventoryNewVehiclesNetMember2022-12-310001019849pag:AutomotiveInventoryNewVehiclesNetMember2021-12-310001019849pag:AutomotiveInventoryUsedVehiclesNetMember2022-12-310001019849pag:AutomotiveInventoryUsedVehiclesNetMember2021-12-310001019849pag:AutomotiveInventoryPartsAccessoriesAndOtherNetMember2022-12-310001019849pag:AutomotiveInventoryPartsAccessoriesAndOtherNetMember2021-12-310001019849pag:AutomotiveInventoryCommercialVehiclesNetMember2022-12-310001019849pag:AutomotiveInventoryCommercialVehiclesNetMember2021-12-310001019849pag:AutomotiveInventoryCommercialDistributionVehiclesNetMember2022-12-310001019849pag:AutomotiveInventoryCommercialDistributionVehiclesNetMember2021-12-310001019849pag:BuildingsAndLeaseholdImprovementsMember2022-12-310001019849pag:BuildingsAndLeaseholdImprovementsMember2021-12-310001019849pag:FurnitureFixturesAndEquipmentMember2022-12-310001019849pag:FurnitureFixturesAndEquipmentMember2021-12-3100010198492014-12-310001019849pag:RetailAutomotiveDealershipMember2020-12-310001019849pag:RetailCommercialTruckDealershipMember2020-12-310001019849us-gaap:AllOtherSegmentsMember2020-12-310001019849us-gaap:AllOtherSegmentsMember2021-01-012021-12-310001019849pag:RetailAutomotiveDealershipMember2021-12-310001019849pag:RetailCommercialTruckDealershipMember2021-12-310001019849us-gaap:AllOtherSegmentsMember2021-12-310001019849us-gaap:AllOtherSegmentsMember2022-01-012022-12-310001019849pag:RetailCommercialTruckDealershipMember2022-12-310001019849us-gaap:AllOtherSegmentsMember2022-12-310001019849pag:UsCreditAgreementRevolvingCreditLineMember2022-12-310001019849pag:UsCreditAgreementRevolvingCreditLineMember2021-12-310001019849pag:UkCreditAgreementRevolvingCreditLineMember2022-12-310001019849pag:UkCreditAgreementRevolvingCreditLineMember2021-12-310001019849pag:UkCreditAgreementOverdraftLineOfCreditMember2022-12-310001019849pag:UkCreditAgreementOverdraftLineOfCreditMember2021-12-310001019849pag:SeniorSubordinatedNotes350PercentDue2025Member2021-12-310001019849pag:AustraliaCapitalLoanMember2022-12-310001019849pag:AustraliaCapitalLoanMember2021-12-310001019849pag:AustraliaWorkingCapitalLoanMember2022-12-310001019849pag:AustraliaWorkingCapitalLoanMember2021-12-310001019849pag:AustraliaCreditAgreementMember2022-12-310001019849pag:AustraliaCreditAgreementMember2021-12-310001019849pag:OtherDebtMember2022-12-310001019849pag:OtherDebtMember2021-12-310001019849pag:UsCreditAgreementRevolvingCreditLineMember2022-02-152022-02-15iso4217:GBP0001019849pag:UkCreditAgreementRevolvingCreditLineMemberus-gaap:SubsequentEventMember2023-01-310001019849pag:SterlingOvernightIndexAverageSONIAMemberpag:UkCreditAgreementRevolvingCreditLineMembersrt:MinimumMember2022-01-012022-12-310001019849pag:SterlingOvernightIndexAverageSONIAMemberpag:UkCreditAgreementRevolvingCreditLineMembersrt:MaximumMember2022-01-012022-12-310001019849us-gaap:SeniorSubordinatedNotesMember2022-12-310001019849us-gaap:SeniorSubordinatedNotesMember2022-01-012022-12-310001019849pag:A375SeniorSubordinatedNotesDue2029Memberpag:DebtRedemptionPriorToJune122024Member2022-01-012022-12-310001019849srt:MaximumMemberpag:DebtInstrumentRedemptionPeriodPriorToSeptember2022Memberpag:A375SeniorSubordinatedNotesDue2029Member2022-01-012022-12-310001019849pag:DebtInstrumentRedemptionPeriodPriorToMay2021Memberpag:A375SeniorSubordinatedNotesDue2029Member2022-01-012022-12-310001019849pag:AustraliaCapitalLoanMember2022-01-012022-12-31pag:facilityiso4217:AUD0001019849pag:AustraliaWorkingCapitalLoanMember2022-01-012022-12-310001019849pag:AustraliaCreditAgreementMemberpag:AustralianBBSW30DayBillRateMember2022-01-012022-12-310001019849pag:AustraliaCreditAgreementMember2022-01-012022-12-310001019849pag:RevolvingMortgageFacilityMember2022-12-310001019849pag:RevolvingMortgageFacilityMember2022-01-012022-12-310001019849pag:PenskeCorporationAndAffiliatesMember2022-01-012022-12-310001019849pag:PenskeCorporationAndAffiliatesMember2021-01-012021-12-310001019849pag:PenskeCorporationAndAffiliatesMember2020-01-012020-12-310001019849pag:PenskeCorporationAndAffiliatesMember2022-12-310001019849pag:PenskeCorporationAndAffiliatesMember2021-12-310001019849pag:PenskeTruckLeasingCoLPMember2022-12-31pag:individual0001019849pag:PenskeTruckLeasingCoLPMemberus-gaap:SubsequentEventMember2023-02-012023-02-280001019849pag:PenskeTruckLeasingCoLPMember2022-01-012022-12-310001019849pag:PenskeTruckLeasingCoLPMember2021-01-012021-12-310001019849pag:PenskeTruckLeasingCoLPMember2020-01-012020-12-310001019849pag:AudiMercedesBenzSprinterPorscheMemberpag:FairfieldConnecticutMember2022-12-310001019849pag:GreenwichConnecticutMemberpag:MercedesBenzMember2022-12-310001019849pag:BmwMiniMaseratiPorscheAudiLandRoverVolvoMercedesBenzSmartAndLamborghiniMemberpag:NorthernItalyMember2022-12-310001019849pag:LexusToyotaVolkswagenMemberpag:FrankfurtGermanyMember2022-12-310001019849pag:BmwMiniMemberpag:BarcelonaSpainMember2022-12-310001019849pag:Plan2015Member2022-12-310001019849us-gaap:RestrictedStockMember2022-01-012022-12-310001019849us-gaap:RestrictedStockMember2021-01-012021-12-310001019849us-gaap:RestrictedStockMember2020-01-012020-12-310001019849us-gaap:RestrictedStockMember2022-12-310001019849us-gaap:RestrictedStockMember2020-12-310001019849us-gaap:RestrictedStockMember2021-12-310001019849pag:BoardAuthorizedRepurchaseProgramMember2022-01-012022-12-310001019849pag:BoardAuthorizedRepurchaseProgramMember2021-01-012021-12-310001019849pag:BoardAuthorizedRepurchaseProgramMember2020-01-012020-12-310001019849pag:ShareRepurchaseEmployeeEquityAwardsMember2022-01-012022-12-310001019849pag:ShareRepurchaseEmployeeEquityAwardsMember2021-01-012021-12-310001019849pag:ShareRepurchaseEmployeeEquityAwardsMember2020-01-012020-12-310001019849pag:BoardAuthorizedRepurchaseProgramMember2022-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2019-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2020-01-012020-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2020-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2021-01-012021-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2021-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2022-01-012022-12-310001019849us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001019849us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001019849pag:AccumulatedOtherComprehensiveIncomeOtherAdjustmentAttributableToParentMember2022-12-310001019849us-gaap:StateAndLocalJurisdictionMember2022-12-310001019849us-gaap:DomesticCountryMemberpag:ForeignCarryforwardMember2022-12-310001019849us-gaap:CapitalLossCarryforwardMemberpag:UKTaxAuthorityMember2022-12-310001019849pag:GermanyTaxAuthorityMember2022-12-310001019849pag:ItalyTaxAuthorityMember2022-12-310001019849pag:JapanTaxAuthorityMember2022-12-310001019849us-gaap:StateAndLocalJurisdictionMember2022-01-012022-12-310001019849us-gaap:DomesticCountryMember2022-12-310001019849pag:UKTaxAuthorityMember2022-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailAutomotiveDealershipMember2022-01-012022-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailCommercialTruckDealershipMember2022-01-012022-12-310001019849us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310001019849pag:NonAutomotiveInvestmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailAutomotiveDealershipMember2021-01-012021-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailCommercialTruckDealershipMember2021-01-012021-12-310001019849us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-01-012021-12-310001019849pag:NonAutomotiveInvestmentsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailAutomotiveDealershipMember2020-01-012020-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailCommercialTruckDealershipMember2020-01-012020-12-310001019849us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2020-01-012020-12-310001019849pag:NonAutomotiveInvestmentsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailAutomotiveDealershipMember2022-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailCommercialTruckDealershipMember2022-12-310001019849us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-12-310001019849pag:NonAutomotiveInvestmentsMemberus-gaap:OperatingSegmentsMember2022-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailAutomotiveDealershipMember2021-12-310001019849us-gaap:OperatingSegmentsMemberpag:RetailCommercialTruckDealershipMember2021-12-310001019849us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-12-310001019849pag:NonAutomotiveInvestmentsMemberus-gaap:OperatingSegmentsMember2021-12-310001019849country:US2022-01-012022-12-310001019849country:US2021-01-012021-12-310001019849country:US2020-01-012020-12-310001019849us-gaap:NonUsMember2022-01-012022-12-310001019849us-gaap:NonUsMember2021-01-012021-12-310001019849us-gaap:NonUsMember2020-01-012020-12-310001019849country:US2022-12-310001019849country:US2021-12-310001019849us-gaap:NonUsMember2022-12-310001019849us-gaap:NonUsMember2021-12-310001019849us-gaap:AllowanceForCreditLossMember2021-12-310001019849us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001019849us-gaap:AllowanceForCreditLossMember2022-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001019849us-gaap:AllowanceForCreditLossMember2020-12-310001019849us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001019849us-gaap:AllowanceForCreditLossMember2019-12-310001019849us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310001019849us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-12297

Penske Automotive Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 22-3086739 (I.R.S. Employer Identification No.) |

| |

2555 Telegraph Road Bloomfield Hills Michigan (Address of principal executive offices) | 48302-0954 (Zip Code) |

(248) 648-2500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Voting Common Stock, par value $0.0001 per share | PAG | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large Accelerated Filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company ☐ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting common stock held by non-affiliates as of June 30, 2022, was $2,729,130,423. As of February 14, 2023, there were 69,072,203 shares of voting common stock outstanding.

Documents Incorporated by Reference

Certain portions, as expressly described in this report, of the registrant's proxy statement for the 2023 Annual Meeting of the Stockholders to be held May 11, 2023, are incorporated by reference into Part III, Items 10-14.

TABLE OF CONTENTS

PART I

Item 1. Business

We are a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers. We operate dealerships in the United States, the United Kingdom, Canada, Germany, Italy, and Japan, and we are one of the largest retailers of commercial trucks in North America for Freightliner. We also distribute and retail commercial vehicles, diesel and gas engines, power systems, and related parts and services principally in Australia and New Zealand. We employ over 26,500 people worldwide. Additionally, we own 28.9% of Penske Transportation Solutions, a business that employs over 41,500 people worldwide, manages one of the largest, most comprehensive and modern trucking fleets in North America with over 414,500 trucks, tractors, and trailers under lease, rental, and/or maintenance contracts, and provides innovative transportation, supply chain, and technology solutions to its customers.

Business Overview

In 2022, our business generated $27.8 billion in total revenue, which is comprised of approximately $23.7 billion from retail automotive dealerships, $3.5 billion from retail commercial truck dealerships, and $578.8 million from commercial vehicle distribution and other operations. We generated $4.8 billion in gross profit, which is comprised of $4.1 billion from retail automotive dealerships, $555.1 million from retail commercial truck dealerships, and $157.3 million from commercial vehicle distribution and other operations.

Retail Automotive. We are one of the largest global automotive retailers as measured by the $23.7 billion in total retail automotive dealership revenue we generated in 2022. We are diversified geographically with 58% of our total retail automotive dealership revenues in 2022 generated in the U.S. and Puerto Rico and 42% generated outside of the U.S. We offer over 35 vehicle brands with 71% of our retail automotive franchised dealership revenue in 2022 generated from premium brands, such as Audi, BMW, Land Rover, Mercedes-Benz, and Porsche. As of December 31, 2022, we operated 338 retail automotive franchised dealerships, of which 151 are located in the U.S. and 187 are located outside of the U.S. The franchised dealerships outside of the U.S. are located primarily in the U.K. As of December 31, 2022, we also operated 21 used vehicle dealerships, with eight dealerships in the U.S. and 13 dealerships in the U.K., which retailed used vehicles under a one price, "no-haggle" methodology under the CarShop brand. We retailed and wholesaled more than 539,000 vehicles in 2022.

Each of our franchised dealerships offers a wide selection of new and used vehicles for sale. In addition to selling new and used vehicles, we generate higher-margin revenue at each of our dealerships through maintenance and repair services, the sale and placement of third-party finance and insurance products, third-party extended service and maintenance contracts, replacement and aftermarket automotive products, and at certain of our locations, collision repair services. We operate our franchised dealerships under franchise agreements with a number of automotive manufacturers and distributors that are subject to certain rights and restrictions typical of the industry. Beginning in 2023, we transitioned our Mercedes-Benz U.K. dealerships to an agency model. Under an agency model, our Mercedes-Benz U.K. dealerships receive a fee for facilitating the sale by the manufacturer of a new vehicle but do not hold the vehicle in inventory. We continue to provide new vehicle customer service at our Mercedes-Benz U.K. dealerships, and the Mercedes-Benz U.K. agency model is not expected to structurally change our used vehicle sales operations or service and parts operations, although the impact of the agency model at these dealerships as well as other agency models proposed by our manufacturer partners is uncertain. See Item 1A. Risk Factors for a discussion of agency.

During 2022, we acquired 19 retail automotive franchises, consisting of 15 franchises in the U.K. and four franchises in the U.S., and we opened two retail automotive franchises that we were awarded in the U.S. We sold one retail automotive franchise in the U.S., and we closed four locations in the U.K., consisting of two retail automotive franchises and two CarShop satellite locations. Retail automotive dealerships represented 85.2% of our total revenues and 85.3% of our total gross profit in 2022.

We believe our diversified retail automotive income streams help to mitigate the historical cyclicality found in some elements of the automotive sector. Revenues from higher margin service and parts sales include warranty work, customer paid work, rapid repair, collision repair services, and wholesale parts sales. Service and parts sales are typically less cyclical than retail vehicle sales and generate the largest part of our retail automotive gross profit.

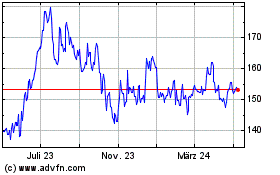

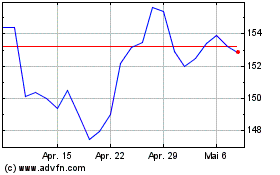

The following graphics show the percentage of our total retail automotive dealership revenues by product type and their respective contribution to our retail automotive gross profit:

Retail Commercial Truck Dealership. We operate Premier Truck Group (“PTG”), a heavy- and medium-duty truck dealership group offering primarily Freightliner and Western Star trucks (both Daimler brands), with locations across nine U.S. states and Ontario, Canada. During February 2022, we acquired four full-service dealerships in Ontario, Canada. As of December 31, 2022, PTG operated 39 locations selling new and used trucks, parts and service, and offering collision repair services. We retailed and wholesaled 21,002 new and used trucks in 2022. This business represented 12.7% of our total revenues and 11.5% of our total gross profit in 2022.

While our retail commercial truck business benefits from diversified income streams similar to those of the retail automotive sector, there are several key differences. As exhibited in the following table, a greater part of our gross profit is derived from the sale of service and parts in the retail truck business given the large volume of parts business, in many cases, to fleet customers, as well as historically lower selling, general, and administrative expense as a percentage of gross profit as compared to retail automotive due to lower sales compensation and advertising expenses. The following graphics show the percentage of our total retail commercial truck dealership revenues by product type and their respective contribution to our retail commercial truck gross profit:

Penske Australia. Penske Australia is the exclusive importer and distributor of Western Star heavy-duty trucks (a Daimler brand), MAN heavy- and medium-duty trucks and buses (a VW Group brand), and Dennis Eagle refuse collection vehicles, together with associated parts, across Australia, New Zealand, and portions of the Pacific. In most of these same markets, we are also a leading distributor of diesel and gas engines and power systems, principally representing MTU (a

Rolls-Royce solution), Detroit Diesel, Allison Transmission, and Bergen Engines. Penske Australia offers products across the on- and off-highway markets, including in the trucking, mining, power generation, defense, marine, rail, and construction sectors and supports full parts and aftersales service through a network of branches, field service locations, and dealers across the region. These businesses represented 2.1% of our total revenues and 3.2% of our total gross profit in 2022.

Penske Transportation Solutions. We hold a 28.9% ownership interest in Penske Truck Leasing Co., L.P. (“PTL”). PTL is owned 41.1% by Penske Corporation, 28.9% by us, and 30.0% by Mitsui & Co., Ltd. (“Mitsui”). We account for our investment in PTL under the equity method, and we therefore record our share of PTL's earnings on our statements of income under the caption “Equity in earnings of affiliates,” which also includes the results of our other equity method investments. Penske Transportation Solutions (“PTS”) is the universal brand name for PTL's various business lines through which it is capable of meeting customers' needs across the supply chain with a broad product offering that includes full-service truck leasing, truck rental, and contract maintenance along with logistic services, such as dedicated contract carriage, distribution center management, transportation management, lead logistics provider services, and dry van truckload carrier services. We recorded $490.0 million and $365.8 million in equity earnings from this investment in 2022 and 2021, respectively.

Outlook

Retail Automotive. In 2022, U.S. industry new light vehicle sales decreased 7.9%, as compared to 2021, to 13.9 million units, and U.K. new vehicle registrations decreased 2.0%, as compared to 2021, to 1.6 million registrations. We believe the year over year decrease in new vehicle sales and registrations is primarily attributable to a lower supply of new vehicles available for sale due to disruptions in the supply chain limiting the availability of microchips and other components, the war in Ukraine, and challenges in sourcing labor, coupled with higher interest rates and inflation, impacting the affordability of vehicles for customers. Our new vehicle days' supply is 25 as of December 31, 2022, compared to 17 as of December 31, 2021, and 50 as of December 31, 2020. Our used vehicle days' supply has proved to be more resilient with a 53 days' supply as of December 31, 2022, compared to 60 as of December 31, 2021, and 48 as of December 31, 2020. While we expect increased new vehicle availability in 2023, continued production disruptions and supply shortages could result in suppressed new and used vehicle sales volumes which would impact the availability and affordability of new and used vehicles. When the supply of new vehicles improves, we may experience reduced new and used vehicle gross profit together with higher sales volumes.

During 2022, our premium/luxury unit sales increased 4.6% as compared to 2021. In the U.K., premium/luxury unit sales, which account for over 93% of our new unit sales, decreased 6.9%, and the overall U.K. market decreased 2.0% as compared to 2021. Many of the premium brands we represent in the U.K. market were also impacted by production disruptions from the supply chain challenges.

Representatives of the U.K. government have proposed a ban on the sale of gasoline engines in new cars and new vans that would take effect as early as 2030 and a ban on the sale of gasoline hybrid engines in new cars and new vans as early as 2035 while also providing government incentives on certain electric vehicles to entice consumers to transition from internal combustion vehicles to electric vehicles. During 2022, sales of diesel-powered vehicles decreased 33.8%, petrol-powered vehicles decreased 6.0%, and non-diesel/petrol vehicles increased 23.0%, as compared to 2021. In the U.K., new registrations of electric vehicles, including Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), and Hybrid Electric Vehicle (HEV), represented 34.5% of the overall market for 2022, compared to 27.5% for 2021, and represented 24.6% of our U.K. new unit sales, compared with 18.6% for 2021.

Retail Commercial Truck Dealership. In 2022, North American sales of Class 6-8 medium- and heavy-duty trucks, the vehicles sold by our PTG business, increased 12.1% from last year to 448,723 units. The Class 6-7 medium-duty truck market increased 7.4% from last year to 139,108 units, and Class 8 heavy-duty trucks, the largest North American market, increased 14.4% from last year to 309,615 units. The truck market is experiencing the same production and supply issues noted above, and the Class 6-8 medium- and heavy-duty truck backlog is 357,414 units according to data published by ACT Research. We expect lower inventories of new commercial trucks and parts disruptions to continue until the supply of certain components used to manufacture commercial trucks improves and manufacturers work through backlogs. As a result of the supply constraints, we expect demand for Class 8 commercial trucks to remain strong, driven by replacement demand. When the supply of commercial trucks improves, we may experience reduced new and used commercial truck gross profit per unit together with higher sales volumes.

Commercial Vehicle Distribution and Other. In 2022, the Australian heavy-duty truck market reported sales of 14,966 units, representing an increase of 15.1% from last year, while the New Zealand market reported sales of 3,587 units, representing an increase of 15.0% from last year.

Penske Transportation Solutions. A majority of PTS' revenue is generated by multi-year contracts for full-service leasing, contract maintenance, and logistics services. During 2022, PTS continued to expand its managed fleet with over 414,500 trucks, tractors, and trailers under lease, rental, and/or maintenance contracts. PTS continues to expect strong demand for commercial rental trucks and full-service leasing.

As described in Item 1A. Risk Factors, there are a number of factors that could cause actual results to differ materially from our expectations. For a detailed discussion of our financial and operating results, see Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Business Strategy

We aim to deliver excellence to our customers, value to our stakeholders, and opportunity to our team members to be the best international transportation services company everywhere we operate. This mission is supported by a set of values embedded in our philosophy to exceed, excel, and encourage.

•Exceed: Provide a superior customer experience that exceeds expectations, and establishes trust and loyalty through honesty, transparency, and accountability

•Excel: Deliver long-term value for our stakeholders through continuous improvement, organic growth, and strategic acquisitions

•Encourage: Provide opportunities for team members to succeed in our organization by cultivating talent, rewarding achievement, and maintaining the highest standards of respect for each other

We employ the following set of strategies to achieve these objectives:

Growing our Business

We operate in the highly fragmented automotive retail and commercial truck dealership markets and believe there are attractive opportunities to grow our business, both organically and by acquisition. During 2022, in our retail automotive business, we acquired or were granted open points (new franchises awarded from the automotive manufacturer) representing 21 dealerships, 15 located in the U.K. representing BMW, MINI, Mercedes-Benz, and smart brands, and six located in the U.S., representing BMW, MINI, Honda, Hyundai, Genesis, and Audi brands. In our retail truck business, we acquired four full-service dealerships in Ontario, Canada. In 2023, we expect to continue to devote capital resources to acquire and build premium retail automotive and commercial truck dealerships.

Returning Value to Shareholders

We believe in returning value to our shareholders through a combination of dividends and share repurchases. We increased our quarterly stock dividend four times in 2022 from $0.46 per share to $0.57 per share. Our latest declared dividend is $0.61 per share payable on March 1, 2023. We also repurchased 8,214,147 shares of our common stock in 2022 for $886.5 million, which, together with quarterly dividends, represents a return to stockholders of approximately $1.0 billion.

On February 16, 2023, our Board of Directors delegated to management an additional $250 million in authority to repurchase our outstanding securities, resulting in $253.6 million of authority outstanding and available for repurchases. This authority has no expiration.

Human Capital

We believe that our Human Capital is our greatest asset and is an integral component of our growth and value creation strategy. We understand that exceptional customer service can only be consistently delivered by attracting, motivating, training, and retaining the very best team members. We are committed to building a diverse and skilled workforce while providing a work environment that promotes equity and is free from any form of discrimination. With this in mind, we put our employees at the heart of everything that we do by developing their talent and enabling them to build long-term careers.

In recognition of our people-first philosophy, in 2022, 46 of our dealerships were named to the "Automotive News Best Dealerships To Work For" which ranks the top 100 dealerships in the United States, including seven of the top ten spots and 17 of the top 25 spots nationally in 2022's rankings. Seven of our dealerships were ranked in the top ten nationally for their efforts to promote Diversity, Equity & Inclusion. In 2022, we were ranked in the top ten by Forbes as one of "America's Best Employers for Veterans" which ranks the top 200 companies in the United States.

Customer Satisfaction

Maintaining high levels of superior customer service is key to our business model. We strive to deliver a positive, valuable experience at every touchpoint to ensure the highest level of customer satisfaction. By offering outstanding brands in premium facilities, “one-stop” shopping convenience in our aggregated facilities, and a well-trained and knowledgeable staff, we aim to forge lasting relationships with our customers throughout their entire ownership journey.

Reputation management is one of our most powerful marketing tools. We proactively monitor online reputation management sites, including Google, Facebook, Yelp, among others, to enhance our online presence, build loyalty, gain a better understanding of our customers' needs, attract top talent, and generate business. Our reputation management strategy of actively monitoring and responding quickly to customer reviews is crucial for maintaining a positive online reputation.

Diversification

Our business benefits from a diversified revenue and gross profit mix, including multiple revenue and gross profit streams in our traditional vehicle and commercial truck dealerships (new vehicles, used vehicles, finance and insurance, and service and parts operations) across many geographies, our commercial vehicle distribution and power systems operations, and returns relating to our joint venture investments, which we believe helps to mitigate the cyclicality that has historically impacted some elements of the automotive sector. Our CarShop used vehicle dealerships in the U.S. and U.K. complement and provide more diversification to our retail automotive operations and provide scalable opportunities across our market areas. Furthermore, PTG provides diversification both by business line and by its business being represented across the U.S. and in Canada. Finally, our ownership interest in PTS provides us additional diversification as well as equity earnings, cash dividends, and significant cash savings on taxes.

We are also diversified geographically as established by the following table, which shows our consolidated revenue and gross profit by country as a percentage of our total revenue and total gross profit:

| | | | | | | | | | | | | | |

| Country | | % of Total 2022 Revenue | | % of Total 2022 Gross Profit |

| United States | | 60 | % | | 66 | % |

| United Kingdom | | 30 | % | | 25 | % |

| Germany/Italy | | 5 | % | | 4 | % |

| Japan | | 1 | % | | 1 | % |

| Canada | | 2 | % | | 1 | % |

| Australia/New Zealand | | 2 | % | | 3 | % |

We are also diversified within our automotive retail operations by brand. We represent over 35 brands in our markets and our automotive dealership revenue mix consists of 71% related to premium brands, 21% related to volume non-U.S.

brands, 1% related to brands of U.S. based manufacturers, and 7% related to our CarShop used vehicle dealerships as further detailed in the chart below:

Digital Strategy/Omnichannel

We are focused on executing a comprehensive omnichannel digital strategy with emphasis on customization, personalization, and creating a connection with our customers. We endeavor to build and optimize our presence across all digital platforms and deliver a seamless, convenient, and transparent experience that gives customers the ability to purchase, sell, or schedule service for their vehicles on their terms.

To stay at the forefront of technological innovations, we continue to develop and test platforms for end-to-end digital retailing through our industry and OEM relationships. Fully online retailing includes features like personalized monthly payments across all inventories, accurate trade-in capabilities, financing, digital contracting, and digital signatures. We are actively testing these technologies at both our franchise and U.S. CarShop locations to ensure we are gaining an understanding of best practices and customer adoption of these initiatives. In addition, we have implemented AI-driven technologies at certain of our dealerships, including a voice assistant to answer and appoint inbound service calls and an engagement system to address customer lead inquiries and schedule sales and service appointments. These technologies are designed to improve our customer experience and are available 24/7.

For U.S. customers who wish for a hybrid online/in-person transaction at our franchise locations, we offer the respective OEM provided digital solution or our own "Preferred Purchase" as our digital retailing solutions. These tools provide a digital buying process including trade-value, pricing, leasing, and financing options with customized payments. Customers can add insurance and protection products to their purchase, evaluate manufacturer and lender incentive programs, and pre-qualify for credit all online or in combination with an in-store experience. These tools are designed to serve a customer wherever they are at in their buying journey, whether they want to evaluate payment options or complete their purchase online through a secure link where they can sign documents digitally and arrange for curbside or home delivery.

Similarly, in the U.K., we offer online resources that enhance customers’ overall dealership experience. Customers can reserve a vehicle for up to three days with a fully refundable £99 deposit and complete their finance application entirely online with instant acceptance for qualified buyers. With our internally developed digital retailing program called “Click & Collect”, customers can fully pay for a vehicle online with a debit or credit card and request vehicles be transferred between dealerships by paying a transfer fee online. CarShop U.K. customers can access a bespoke finance eligibility tool which helps them gauge their likelihood for financial acceptance.

We also promote our U.S. and U.K. automotive retail new and pre-owned vehicle inventory online through PenskeCars.com, Agnewcars.com, CarShop.com, Sytner.co.uk, and CarShop.co.uk (the latter two built in-house and hosted on a proprietary technology platform). These websites are designed to streamline the car-buying process and allow consumers to view and compare new, certified, and pre-owned vehicles. Along with our dealership websites, these sites provide consumers a simple way to view extensive vehicle information, including photos, prices, promotions, videos, and third-party vehicle history reports for pre-owned vehicles, schedule service appointments online 24/7, and use our digital tools to customize their vehicle purchase. These websites also support our “Sell Us Your Car” initiative, offered in the U.S. and U.K., which allows customers to sell their vehicles to us without a requirement to purchase a vehicle.

ESG Highlights

As a leading international, diversified transportation services company, we recognize it is our responsibility to ensure we manage our environmental impact and promote economic opportunity and social equity in the communities where we operate around the world. We recognize we are accountable to key stakeholders and the communities in which we do business. We are committed to responsible business practices, continuous improvement of our operations and strengthening relationships with our stakeholders. We focus our Environmental, Social, and Governance (ESG) efforts where we can have the most positive impact on our business and society, including issues related to:

■Community Participation

■Environmental Sustainability

■Human Capital

This important work is driven by our core values and ensures that we enrich our communities, minimize our environmental impact, protect the health and safety of our team members and customers, and provide a diverse and inclusive workplace – all while creating value for our stakeholders. The most important investments we make are in our people. Everything we aspire to be as a company builds on our ability to come together as one team. We provide our team members a supportive work environment that empowers them to do meaningful work while fulfilling their passions and balancing work goals with life goals.

We are pleased to have published our 2022 ESG Report last fall which highlights our ESG strategies, activities, progress, metrics, and performance for 2021, which is available on our website under the tab "ESG". The report aligns with the Sustainability Accounting Standards Board (SASB) Multiline & Specialty Distributors sector standard and includes additional disclosures responsive to the framework established by the Task Force on Climate-Related Financial Disclosures. We are committed to regular, transparent communication of our progress and look forward to bringing our stakeholders along with us on this journey.

We encourage you to review our 2022 ESG Report, which includes additional detail in regard to certain of our key efforts highlighted below.

Community Participation. We believe community participation and charitable giving enrich the neighborhoods where we work, live, and play. We are proud of these efforts and we encourage participation by all dealerships and employees, including through our commitment to the Paralyzed Veterans of America ("PVA"). Since 2015, our dealerships have supported the PVA, an organization working to ensure paralyzed and disabled veterans receive the care, benefits, and job opportunities they deserve. Each year, we match certain donations from our customers and team members to the PVA and have contributed more than $8.5 million to the group. As a company with a presence spanning four continents, we are able to make positive impacts well beyond the borders of the communities where our dealerships are located. After the outbreak of the war in Ukraine, we and our affiliate Penske Transportation Solutions made a $1 million contribution to World Central Kitchen, an organization working to supply meals to those in need at the front lines of humanitarian, climate, and community crises. We encouraged team members to also donate to this cause, raising over $150,000 from employees of both Penske Automotive and PTS.

Environmental Sustainability — Electric Vehicles. Our dealerships sell and service vehicles that are engineered and manufactured by over 35 of the world's automotive OEMs, including hybrid, plug-in hybrid, and pure electric vehicles (“EVs”). EVs can reduce the emissions that contribute to climate change and smog, improve public health, and reduce ecological damage.

We are committed to encouraging the sale and use of EVs and, as part of that commitment, are actively placing charging stations across our network to facilitate a reliable infrastructure for their use. We estimate that approximately 23.4% of our new vehicles sold in the U.S. and U.K. for 2022 were either pure electric or hybrid electric vehicles.

Managing our Energy Use and Reducing Waste. We are committed to monitoring and managing our energy use and the environmental impacts of our business. We recognize our responsibility to advocate for a cleaner environment through self-awareness, leveraging our global partnerships, promoting cleaner driving vehicles through our dealerships, and reducing pollution and waste. We have deployed several strategies for reducing or optimizing our energy use, such as installing LED lighting, occupancy sensors, energy-efficient glass, and high-efficiency heating, ventilation, and air conditioning (HVAC) systems.

We are committed to reducing the environmental impact of waste produced at our facilities. We deploy several strategies to ensure the efficient use of resources and responsible disposal of waste, including hazardous waste, and use third parties to manage, collect and process recycling for many of the materials that go through our service departments. Other strategies to reduce pollution and waste include recycling worn-out tires collected from participating U.S. retail dealerships and eliminating the use of paper for internal communications and customer documentation.

Human Capital — Diversity, Equity, and Inclusion. We believe that our employees are our greatest asset. We understand that exceptional customer service can only be consistently delivered by attracting, motivating, training, and retaining the very best team members. With this in mind, we put our employees at the heart of everything that we do by developing their talent and enabling them to build long-term careers. We are committed to building a diverse and skilled workforce while providing a work environment that promotes equity and is free from any form of prohibited discrimination.

Retail Automotive Dealership Operations

Retail Automotive Franchises. We routinely acquire and dispose of retail automotive franchises. The following table exhibits our retail automotive franchises by location and manufacturer as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location | | Franchises | | Franchises | | U.S. | | Non-U.S. | | Total |

| Arizona | | 26 | | BMW/MINI | | 25 | | 54 | | 79 |

| Arkansas | | 4 | | Toyota/Lexus | | 24 | | — | | 24 |

| California | | 30 | | Mercedes-Benz/Sprinter/smart | | 18 | | 31 | | 49 |

| Connecticut | | 9 | | Audi/Volkswagen/Bentley | | 17 | | 38 | | 55 |

| Florida | | 3 | | Chrysler/Jeep/Dodge | | 3 | | — | | 3 |

| Georgia | | 4 | | Honda/Acura | | 19 | | — | | 19 |

| Indiana | | 4 | | Ferrari/Maserati | | 2 | | 13 | | 15 |

| Maryland | | 2 | | Porsche | | 9 | | 11 | | 20 |

| Michigan | | 1 | | Jaguar/Land Rover | | 14 | | 18 | | 32 |

| Minnesota | | 2 | | Lamborghini | | 1 | | 5 | | 6 |

| New Jersey | | 24 | | Nissan/Infiniti | | 3 | | — | | 3 |

| North Carolina | | 2 | | Cadillac/Chevrolet | | 4 | | — | | 4 |

| Ohio | | 7 | | Others | | 12 | | 17 | | 29 |

| Puerto Rico | | 4 | | Total | | 151 | | 187 | | 338 |

| Rhode Island | | 8 | | | | | | | | |

| Tennessee | | 1 | | | | | | | | |

| Texas | | 11 | | | | | | | | |

| Virginia | | 7 | | | | | | | | |

| Wisconsin | | 2 | | | | | | | | |

| Total U.S. | | 151 | | | | | | | | |

| U.K. | | 135 | | | | | | | | |

| Germany | | 21 | | | | | | | | |

| Italy | | 21 | | | | | | | | |

| Japan | | 10 | | | | | | | | |

| Total Non-U.S. | | 187 | | | | | | | | |

| Total Worldwide | | 338 | | | | | | | | |

Retail Automotive CarShop Used Vehicle Dealerships. The following table exhibits the CarShop used vehicle dealerships we currently operate by geographic location as of December 31, 2022:

| | | | | | | | |

| Location | | Number of Dealerships |

| U.S. | | |

| Arizona | | 1 | |

| Pennsylvania | | 5 | |

| New Jersey | | 2 | |

| Total U.S. | | 8 | |

| U.K. | | 13 | |

| Total | | 21 | |

New Vehicle Retail Sales. In 2022, we retailed 185,831 new vehicles which generated 42.4% of our retail automotive dealership revenue and 30.2% of our retail automotive dealership gross profit. New vehicles are typically acquired by dealerships directly from the manufacturer. We strive to maintain outstanding relationships with the automotive manufacturers based in part on our long-term presence in the retail automotive market, our commitment to providing premium facilities, our commitment to drive customer satisfaction, the reputation of our management team, and the consistent sales volume at our dealerships. Our dealerships finance the purchase of most new vehicles from the manufacturers through floor plan financing provided primarily by various manufacturers' captive finance companies.

Used Vehicle Retail Sales. In 2022, we retailed 261,739 used vehicles, including 71,242 from our CarShop used vehicle dealerships, which generated 38.0% of our retail automotive dealership revenue and 13.2% of our retail automotive dealership gross profit. We acquire used vehicles from various sources, including trade-ins from consumers in connection with their purchase of a new or used vehicle from us, purchases of used vehicles directly from consumers, lease expirations, public auctions, and auctions open only to authorized new vehicle dealers. To improve customer confidence in our used vehicle inventory, we provide vehicle history reports for all used vehicles, and virtually all of our franchised new vehicle dealerships participate in manufacturer certification processes for used vehicles. If certification is obtained, the used vehicle owner is typically provided benefits and warranties similar to those offered to new vehicle owners by the applicable manufacturer.

Vehicle Finance and Insurance Sales. Finance and insurance sales represented 3.6% of our retail automotive dealership revenue and 20.6% of our retail automotive dealership gross profit in 2022. At our customers' option, our dealerships can arrange third-party financing or leasing in connection with vehicle purchases. We typically receive a flat fee or a portion of the cost of the financing or leasing paid by the customer for each transaction. While these services are generally non-recourse to us, we are subject to chargebacks in certain circumstances, such as default under a financing arrangement or pre-payment. These chargebacks vary by finance product but typically are limited to the fee we receive.

We also offer our customers various vehicle warranty and extended protection products, including extended service contracts, maintenance programs, voluntary vehicle protection products, and theft protection products. The extended service contracts and other products that our dealerships currently offer to customers are underwritten by independent third parties, including the vehicle manufacturers' captive finance companies. Similar to finance transactions, we are subject to chargebacks relating to fees earned in connection with the sale of certain protection products. We also offer for sale other aftermarket products, including security systems and protective coatings.

We offer finance and insurance products using a “menu” process, which is designed to ensure that we offer our customers a complete range of finance, insurance, protection, and other aftermarket products in a transparent manner. We utilize docuPAD® at our U.S. dealerships, an interactive electronic interface designed to improve document processing and menu presentation of finance and insurance options during the purchase or lease transaction.

Service and Parts Sales. Service and parts sales represented 10.2% of our retail automotive dealership revenue and 34.9% of our retail automotive dealership gross profit in 2022. We generate service and parts sales in connection with warranty work performed at each of our franchised dealerships and non-warranty work. We believe our service and parts revenues benefit from the increasingly complex technology used in vehicles that makes it difficult for independent repair facilities or vehicle owners to maintain and repair today's automobiles.

A goal of each of our dealerships is to make each vehicle purchaser a customer of our service and parts department. Our dealerships keep records of our customers' maintenance and service histories, and many dealerships send reminders to

customers when vehicles are due for periodic maintenance or service. We also offer rapid repair services, such as paintless dent repair, tire sales, and windshield replacement at most of our facilities in order to offer our customers the convenience of one-stop shopping for all of their automotive requirements. We also operate 33 automotive collision repair centers, each of which is operated as an integral part of our dealership operations.

Fleet and Wholesale Sales. Fleet and wholesale sales represented 5.8% of our retail automotive dealership revenue and 1.1% of our retail automotive dealership gross profit in 2022. Fleet activities represent the sale of new units to customers that are deemed to not be retail customers, such as cities, municipalities, or rental car companies and are generally sold at contracted amounts. Wholesale activities relate to the sale of used vehicles generally to other dealers and occur at auction. Vehicles sold through this channel generally include units acquired by trade-in that do not meet certain standards or aged units. In the U.K., we offer used vehicles to wholesalers and other dealers via a proprietary online auction.

Retail Commercial Truck Dealership Operations

Premier Truck Group (“PTG”) is a heavy- and medium-duty truck dealership group offering primarily Freightliner and Western Star trucks (both Daimler brands) with 39 locations across nine U.S. states and in Ontario, Canada. PTG dealerships provide a similar suite of services as our automotive dealerships, offering new trucks and a large selection of used trucks for sale, a full range of parts, maintenance and repair services, collision centers, and finance and insurance options by facilitating truck and trailer financing and leasing, extended maintenance plans, physical damage insurance, voluntary vehicle protection products, roadside relief, and other programs.

The maintenance and repair of commercial trucks is an essential service and a key area of differentiation for our business. We offer “Elite Support” certified locations to help maximize vehicle uptime. Elite Support certified locations provide an express assessment whereby we communicate a primary diagnosis, check parts availability, and provide an estimate of cost and repair time within a few hours of service write-up. As part of this service, many of our locations offer a comfortable environment for customers with amenities such as customer lounges, lockers, showers, and laundry facilities. We also offer roadside remote service for certain repairs and provide 24/7 technician support for breakdown/emergency service.

The collision centers at PTG are full-service, heavy-duty paint and collision repair facilities with certified professionals that can handle everything from light cosmetic issues to complete vehicle reconstruction, including mechanical engine repairs. PTG also carries an extensive inventory of parts for the new and used trucks they sell and service. The service and parts business of our PTG commercial truck dealerships represents approximately 65% of our retail commercial truck dealership gross profit.

Commercial Vehicle Distribution and Other Operations

Penske Australia. Penske Australia is the exclusive importer and distributor of Western Star heavy-duty trucks (a Daimler brand), MAN heavy- and medium-duty trucks and buses (a VW Group brand), and Dennis Eagle refuse collection vehicles, together with associated parts, across Australia, New Zealand, and portions of the Pacific. In most of these same markets, we are also a leading distributor of diesel and gas engines and power systems, principally representing MTU (a Rolls-Royce solution), Detroit Diesel, Allison Transmission, and Bergen Engines. Penske Australia offers products across the on- and off-highway markets, including in the trucking, mining, power generation, defense, marine, rail, and construction sectors and supports full parts and aftersales service through a network of branches, field service locations, and dealers across the region.

Penske Australia distributes commercial vehicles and parts for Western Star, MAN, and Dennis Eagle to a network which comprises on average of more than 70 dealership locations across Australia, New Zealand, and portions of the Pacific. Of these dealership locations, ten are company-owned retail commercial vehicle and/or service and parts dealerships in Australia and three are company-owned retail commercial vehicle dealerships in New Zealand. Our dealership in Brisbane, Australia is the largest retailer of Western Star Trucks in Australia by volume, and our dealership in Perth, Australia is the largest retailer of MAN Trucks in Australia by volume. We finance our purchases of these vehicles under floor plan agreements with a local Daimler affiliate and a local Volkswagen affiliate with terms similar to our other floor plan agreements.

Western Star trucks are manufactured by Daimler Trucks North America in Portland, Oregon. These technologically advanced, custom-built vehicles are ordered by customers to meet their particular needs for line haul, long distance road train, mining, logging, and other heavy-duty applications. We are also the exclusive importer of MAN trucks and buses. MAN Truck and Bus, a VW Group company, is a leading producer of medium- and heavy-duty trucks as well as city and coach buses. These cab-forward, fuel efficient vehicles are principally produced in several sites in Germany and are

ordered by customers for line haul, local distribution, mining, and other off-road applications. Dennis Eagle refuse collection vehicles are manufactured by Ros Roca in Warwick, England. These brands represented 3.8% of heavy-duty truck units sold in Australia and 3.2% in New Zealand during 2022.

We also distribute diesel gas engines and power systems to over 100 dealer locations that are strategically located throughout Australia, New Zealand, and portions of the Pacific. Most of the dealers represent the Detroit Diesel brand, with the majority aligned to Western Star and/or Freightliner truck manufacturers. The remaining dealers represent the MTU and Allison Transmission brands. The “off-highway” business principally includes the sale and servicing of power systems directly to customers in the commercial, defense, mining, maritime, and power generation sectors from 20 facilities we operate across Australia and New Zealand. We also utilize mobile remote field service units to travel directly to customer premises.

Penske Transportation Solutions

We hold a 28.9% ownership interest in Penske Truck Leasing Co., L.P. (“PTL”). Penske Transportation Solutions (“PTS”) is the universal brand name for PTL's various business lines through which it is capable of meeting customers' needs across the supply chain with a broad product offering that includes full-service truck leasing, truck rental, and contract maintenance along with logistic services, such as dedicated contract carriage, distribution center management, transportation management, lead logistics provider services, and dry van truckload carrier services. PTS has a highly diversified customer base ranging from multi-national corporations across industries, such as food and beverage, transportation, manufacturing, automotive, retail, and healthcare, with whom they have long-term contracts to individual consumers who rent a single truck on a daily basis.

PTS operates two principal businesses: (i) one of the leading full-service truck leasing, truck rental, and contract maintenance businesses in North America and (ii) an international logistics business in North America, South America, and Europe. PTS also operates a truck leasing and truck rental business in Australia through a joint venture with us.

Full-service truck leasing, truck rental, and contract maintenance. Full-service truck leasing, truck rental, and contract maintenance of commercial trucks, tractors, and trailers constitutes PTS' largest business. PTS manages a fleet of over 414,500 trucks, tractors, and trailers, consisting of over 271,300 vehicles owned by PTS and leased to customers under full-service lease or rental agreements and over 143,200 customer-owned and -operated vehicles for which they provided contract maintenance services. Lease terms under its full-service leases generally range from four to seven years for tractors and trucks and six to ten years for trailers. Its commercial and consumer rental fleet as of December 31, 2022, consisted of approximately 109,000 vehicles for use by its full-service truck leasing, small business, and consumer customers for periods generally ranging from less than a day to 12 months. Most of its leased vehicles are configured according to customer specifications, including custom painting and lettering, while its rental trucks bear Penske branding.

Commercial customers often outsource to PTS to reduce the complexity, cost, and total capital associated with vehicle ownership. Under a full-service lease, PTS provides and fully maintains the vehicle, which is generally configured for the customer. The services provided under full-service lease and contract maintenance agreements generally include preventive and regular maintenance, advanced diagnostics, emergency road service, fleet services, safety programs, and fuel services through PTS' network of company-operated facilities and a nationwide network of independent truck stops. In addition, PTS makes available to its full-service leasing and contract maintenance customers additional vehicles on a rental basis. PTS' commercial rental operations offer short-term availability of tractors, trucks, and trailers typically to accommodate seasonal, emergency, and other temporary needs. A significant portion of these rentals are to existing full-service leasing and contract maintenance customers who are seeking flexibility in their fleet management. PTS has established a network of approximately 850 locations to provide full-service truck leasing, truck rental, and contract maintenance services to customers. This network enables PTS to meet multi-location customer requirements. PTS' commercial rental business generated 24% of its revenue for 2022 and its full-service lease and contract maintenance business generated 43% of its revenue in 2022.

For consumer customers, PTS provides short-term rental of light- and medium-duty vehicles on a one-way and local basis, typically to transport household goods. Customers typically include local small businesses and individuals seeking a do-it-yourself solution to their moving needs. PTS' consumer fleet generally consists of late model vehicles ranging in size from small vans to 26-foot trucks, and its consumer rentals are conducted through approximately 1,930 independent rental agents and approximately 410 of its company-operated leasing and rental facilities. PTS' consumer business generated 5% of its revenue for 2022.

Logistics. PTS' logistics business offers an extensive variety of services, including dedicated contract carriage, distribution center management, freight management, lead logistics provider, and dry van truckload carrier services. PTS

coordinates services for its customers across the supply chain, including inbound material flow, handling and packaging, inventory management, distribution and technologies, and sourcing of third-party carriers. These services are available individually or on a combined basis and often involve its associates performing services at the customer's location. By offering a scalable series of services to its customers, PTS can manage the customer's entire supply chain or any stand-alone service. PTS also utilizes specialized software that enables real-time fleet visibility and provides reporting metrics, giving customers detailed information on fuel economy and other critical supply chain costs. PTS' international logistics business has approximately 525 locations in North America, South America, and Europe. PTS' logistics business generated 28% of its revenue for 2022.

Industry Information