false

0000812074

0000812074

2024-12-12

2024-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

The Securities

Exchange Act of 1934

December 12, 2024

Date of Report (Date of earliest event reported)

O-I

GLASS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-9576 |

|

22-2781933 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

One Michael Owens Way

Perrysburg,

Ohio

(Address

of principal executive offices) |

43551-2999

(Zip

Code) |

(567)

336-5000

(Registrant’s telephone number, including

area code)

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which

registered |

| Common

stock, $.01 par value |

OI |

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 2.05. | COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES. |

On December 12, 2024, O-I Glass, Inc.

(the “Company”) finalized its plans for the closure of two furnaces in its European segment. These closures are part of the

Company’s Fit to Win initiative to reduce redundant capacity and begin to optimize its network. Additional furnace closures and

other restructuring actions are expected in the fourth quarter of 2024 and 2025.

The

furnace closures in the European segment are expected to occur on or after January 15, 2025. The Company intends to facilitate the

closure in a respectful manner for the approximately 100 people impacted. Current customers of the plants impacted by the furnace closure

will be served by other European plants in the Company’s network. Subject to finalization of certain estimates, the Company

expects to record charges associated with these closures of approximately $72 million in the fourth quarter of 2024. Major components

of the charges include approximately $40 million for impairment of plant-related assets, such as the closed furnaces and related machinery,

and $32 million for one-time employee separation benefits and other costs related to the closing (of which approximately $24 million relate

to future cash expenditures).

| ITEM 2.06. | MATERIAL IMPAIRMENTS. |

The disclosures included under Item 2.05 are incorporated

by reference into this Item 2.06.

The Company has also approved a severance program that is expected

to reduce future selling, general and administrative costs in the European segment. The Company expects to record a charge associated

with this program of approximately $18 million in the fourth quarter of 2024, a majority of which relates to cash severance expenditures

expected to be paid in the first six months of 2025.

Forward-Looking Statements

This Current Report on Form 8-K contains

“forward-looking” statements related to the Company within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements reflect the Company’s

current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “expect,”

“intend,” “will,” “anticipate” and other similar expressions generally identify forward-looking statements.

It is possible that the Company’s future

results may differ from expectations due to a variety of factors including, but not limited to: (1) the general political, economic

and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and

social conditions, trade disputes, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, changes in

tax rates and laws, war, civil disturbance or acts of terrorism, natural disasters, public health issues and weather, (2) cost and

availability of raw materials, labor, energy and transportation (including impacts related to the current Ukraine-Russia and Israel-Hamas

conflicts and disruptions in supply of raw materials caused by transportation delays), (3) competitive pressures from other glass

container producers and alternative forms of packaging or consolidation among competitors and customers, (4) changes in consumer

preferences or customer inventory management practices, (5) the continuing consolidation of the Company’s customer base, (6) the

Company’s ability to improve its glass melting

technology, known as the MAGMA program, and implement it in a manner to deliver economic

profit within the timeframe expected, (7) unanticipated supply chain and operational disruptions, including higher capital spending,

(8) the Company’s ability to achieve expected benefits from cost management, efficiency improvements, and profitability initiatives,

such as its Fit to Win program, including expected impacts from production curtailments and furnace closures, (9) seasonality of

customer demand, (10) the failure of the Company’s joint venture partners to meet their obligations or commit additional capital

to the joint venture, (11) labor shortages, labor cost increases or strikes, (12) the Company’s ability to acquire or divest businesses,

acquire and expand plants, integrate operations of acquired businesses and achieve expected benefits from acquisitions, divestitures or

expansions, (13) the Company’s ability to generate sufficient future cash flows to ensure the Company’s goodwill is not impaired,

(14) any increases in the underfunded status of the Company’s pension plans, (15) any failure or disruption of the Company’s

information technology, or those of third parties on which the Company relies, or any cybersecurity or data privacy incidents affecting

the Company or its third-party service providers, (16) risks related to the Company’s indebtedness or changes in capital availability

or cost, including interest rate fluctuations and the ability of the Company to generate cash to service indebtedness and refinance debt

on favorable terms, (17) risks associated with operating in foreign countries, (18) foreign currency fluctuations relative to the U.S.

dollar, (19) changes in tax laws or U.S. trade policies, (20) the Company’s ability to comply with various environmental legal requirements,

(21) risks related to recycling and recycled content laws and regulations, (22) risks related to climate-change and air emissions, and

the other risk factors discussed in the Company’s filings with the Securities and Exchange Commission.

It is not possible to foresee or identify all

such factors. Any forward-looking statements in this Current Report on Form 8-K are based on certain assumptions and analyses made

by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other

factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance, and actual

results or developments may differ materially from expectations. The Company does not assume any obligation to update or supplement any

particular forward-looking statements contained in this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 17, 2024 |

O-I GLASS, INC. |

| |

| |

By: |

/s/ John A. Haudrich |

| |

|

John A. Haudrich |

| |

|

Senior Vice President and Chief Financial Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

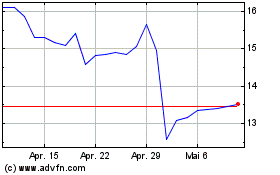

OI Glass (NYSE:OI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

OI Glass (NYSE:OI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025