- Third quarter revenue totaled $430.1 million, representing an

increase of 28% year-over-year

- GAAP loss from operations of $30.8 million, or 7% of revenue,

and non-GAAP income from operations of $63.5 million, or 15% of

revenue

- Operating cash flow of $104.7 million, or 24% of revenue, and

free cash flow of $45.3 million, or 11% of revenue

Cloudflare, Inc. (NYSE: NET), the leading connectivity cloud

company, today announced financial results for its third quarter

ended September 30, 2024.

"I am pleased with our results for the third quarter—exceeding

expectations for revenue, operating margin, and free cash flow

while also reaching a key inflection point in the transformation of

our go-to-market organization. In addition, we added a record 219

large customers and achieved a new milestone—35% of the Fortune 500

are now paying Cloudflare customers,” said Matthew Prince,

co-founder & CEO of Cloudflare. “I’m also proud of what we did

to support causes even bigger than ourselves—helping to ensure

cyber attacks did not play a role in impacting the outcome of the

United States 2024 election. We exceeded financial, customer, and

innovation milestones, all while protecting both presidential

candidates and providing our services, at no cost, to hundreds of

government websites in more than half of U.S. states. I want to

thank our team for coming to the aid of election officials and

campaigns whenever they had a need and for playing a vital role in

upholding the democratic process."

Third Quarter Fiscal 2024 Financial Highlights

- Revenue: Total revenue of $430.1 million, representing

an increase of 28% year-over-year.

- Gross Profit: GAAP gross profit was $334.1 million, or

77.7% gross margin, compared to $257.5 million, or 76.7%, in the

third quarter of 2023. Non-GAAP gross profit was $339.1 million, or

78.8% gross margin, compared to $264.2 million, or 78.7%, in the

third quarter of 2023.

- Operating Income (Loss): GAAP loss from operations was

$30.8 million, or 7.2% of revenue, compared to $39.2 million, or

11.7% of revenue, in the third quarter of 2023. Non-GAAP income

from operations was $63.5 million, or 14.8% of revenue, compared to

$42.5 million, or 12.7% of revenue, in the third quarter of

2023.

- Net Income (Loss): GAAP net loss was $15.3 million,

compared to $23.5 million in the third quarter of 2023. GAAP net

loss per basic and diluted share was $0.04, compared to $0.07 in

the third quarter of 2023. Non-GAAP net income was $72.6 million,

compared to $55.3 million in the third quarter of 2023. Non-GAAP

net income per diluted share was $0.20, compared to $0.16 in the

third quarter of 2023.

- Cash Flow: Net cash flow from operating activities was

$104.7 million, compared to $68.1 million for the third quarter of

2023. Free cash flow was $45.3 million, or 11% of revenue, compared

to $34.9 million, or 10% of revenue, in the third quarter of

2023.

- Cash, cash equivalents, and available-for-sale

securities were $1,823.8 million as of September 30, 2024.

The section titled "Non-GAAP Financial Information" below

describes our usage of non-GAAP financial measures. Reconciliations

between historical GAAP and non-GAAP information are contained at

the end of this press release following the accompanying financial

data.

Financial Outlook

For the fourth quarter of fiscal 2024, we expect:

- Total revenue of $451.0 to $452.0 million

- Non-GAAP income from operations of $57.0 to $58.0 million

- Non-GAAP net income per share of $0.18, utilizing weighted

average common shares outstanding of approximately 360 million

For the full year fiscal 2024, we expect:

- Total revenue of $1,661.0 to $1,662.0 million

- Non-GAAP income from operations of $220.0 to $221.0

million

- Non-GAAP net income per share of $0.74, utilizing weighted

average common shares outstanding of approximately 357 million

These statements are forward-looking and actual results may

differ materially. Refer to the Forward-Looking Statements safe

harbor below for information on the factors that could cause our

actual results to differ materially from these forward-looking

statements.

Conference Call Information

Cloudflare will host an investor conference call to discuss its

third quarter ended September 30, 2024 earnings results today at

2:00 p.m. Pacific time (5:00 p.m. Eastern time). Interested parties

can access the call by dialing (877) 400-4517 from the United

States or (332) 251-2620 internationally with conference ID

3723782. A live webcast of the conference call will be accessible

from the investor relations website at https://cloudflare.NET. A

replay will be available approximately two hours after the

conclusion of the live event and will remain available for

approximately one year.

Supplemental Financial and Other Information

Supplemental financial and other information can be accessed

through the Company’s investor relations website at

https://cloudflare.NET.

Non-GAAP Financial Information

Cloudflare believes that the presentation of non-GAAP financial

information provides important supplemental information to

management and investors regarding financial and business trends

relating to the Company’s financial condition and results of

operations. Reconciliations of non-GAAP financial measures to the

most directly comparable financial results as determined in

accordance with GAAP are included at the end of this press release

following the accompanying financial data. A reconciliation of

non-GAAP guidance measures to corresponding GAAP measures is not

available on a forward-looking basis without unreasonable effort

due to the uncertainty of expenses that may be incurred in the

future. For further information regarding why Cloudflare believes

that these non-GAAP measures provide useful information to

investors, the specific manner in which management uses these

measures, and some of the limitations associated with the use of

these measures, please refer to the “Explanation of Non-GAAP

Financial Measures” section at the end of this press release.

Available Information

Cloudflare intends to use its press releases, website, investor

relations website, news site, blog, X account, Facebook account,

and Instagram account, in addition to filings made with the

Securities and Exchange Commission (SEC) and public conference

calls, as a means of disclosing material non-public information and

for complying with its disclosure obligations under Regulation

FD.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which statements involve substantial risks and

uncertainties. In some cases, you can identify forward-looking

statements because they contain words such as “may,” “will,”

“should,” “expect,” “explore,” “plan,” “anticipate,” “could,”

“intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential,” or “continue,” or the negative

of these words, or other similar terms or expressions that concern

our expectations, strategy, plans, or intentions. However, not all

forward-looking statements contain these identifying words.

Forward-looking statements expressed or implied in this press

release include, but are not limited to, statements regarding our

future financial and operating performance, our reputation and

performance in the market, general market trends, our estimated and

projected revenue, non-GAAP income from operations and non-GAAP net

income per share, shares outstanding, the benefits to customers

from using our products, the expected functionality and performance

of our products, the demand by customers for our products, our

plans and objectives for future operations, growth, initiatives, or

strategies, our market opportunity, and comments made by our CEO

and others. There are a significant number of factors that could

cause actual results to differ materially from statements made in

this press release, including: the impact of adverse macroeconomic

conditions, such as inflation, high interest rates, actual or

potential bank failures and recessionary concerns, on our and our

customers’, vendors’, and partners’ operations and future financial

performance; the impact of the conflicts in the Middle East and

Ukraine and other areas of geopolitical tension around the world,

or any potential worsening or expansion of those conflicts or

geopolitical tensions and other geopolitical events such as

elections and other governmental changes; our history of net

losses; risks associated with managing our rapid growth; our

ability to attract and retain new customers (including new large

customers); our ability to retain and upgrade paying customers and

convert free customers to paying customers; our ability to expand

the number of products we sell to paying customers; our ability to

effectively increase sales to large customers; our ability to

increase brand awareness; our ability to continue to innovate and

develop new products and product features; our ability to generate

demand for our products; our ability to effectively attract, train,

and retain our sales force to be able to sell our existing and new

products and product features; our sales team’s productivity; our

ability to effectively attract, integrate and retain key personnel;

problems with our internal systems, network, or data, including

actual or perceived breaches or failures; rapidly evolving

technological developments in the market, including advancements in

AI; length of our sales cycles and the timing of payments by our

customers; activities of our paying and free customers or the

content of their websites and other Internet properties that use

our network and products; foreign currency fluctuations; changes in

the legal, tax, and regulatory environment applicable to our

business; and other general market, political, economic, and

business conditions. Our actual results could differ materially

from those stated or implied in forward-looking statements due to a

number of factors, including but not limited to, risks detailed in

our filings with the SEC, including our Quarterly Report on Form

10-Q filed on August 1, 2024, as well as other filings that we may

make from time to time with the SEC.

The forward-looking statements made in this press release relate

only to events as of the date on which the statements are made. We

undertake no obligation to update any forward-looking statements

made in this press release to reflect events or circumstances after

the date of this press release or to reflect new information or the

occurrence of unanticipated events, except as required by law. We

may not actually achieve the plans, intentions, or expectations

disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements.

About Cloudflare

Cloudflare, Inc. (NYSE: NET) is the leading connectivity cloud

company on a mission to help build a better Internet. It empowers

organizations to make their employees, applications and networks

faster and more secure everywhere, while reducing complexity and

cost. Cloudflare’s connectivity cloud delivers the most

full-featured, unified platform of cloud-native products and

developer tools, so any organization can gain the control they need

to work, develop, and accelerate their business.

Powered by one of the world’s largest and most interconnected

networks, Cloudflare blocks billions of threats online for its

customers every day. It is trusted by millions of organizations –

from the largest brands to entrepreneurs and small businesses to

nonprofits, humanitarian groups, and governments across the

globe.

Learn more about Cloudflare’s connectivity cloud at

cloudflare.com/connectivity-cloud. Learn more about the latest

Internet trends and insights at radar.cloudflare.com.

CLOUDFLARE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

430,082

$

335,603

$

1,209,680

$

934,272

Cost of revenue(1)(2)

95,967

78,069

270,016

223,722

Gross profit

334,115

257,534

939,664

710,550

Operating expenses:

Sales and marketing(1)(2)(4)

185,221

150,214

553,824

433,903

Research and development(1)

110,911

90,593

301,161

261,742

General and administrative(1)(3)

68,777

55,939

204,721

157,561

Total operating expenses

364,909

296,746

1,059,706

853,206

Loss from operations

(30,794

)

(39,212

)

(120,042

)

(142,656

)

Non-operating income (expense):

Interest income

22,471

17,954

65,438

47,977

Interest expense(5)

(1,433

)

(1,138

)

(3,751

)

(4,803

)

Loss on extinguishment of debt

—

—

—

(50,300

)

Other income (expense), net

(3,066

)

115

(1,673

)

(2,269

)

Total non-operating income (expense),

net

17,972

16,931

60,014

(9,395

)

Loss before income taxes

(12,822

)

(22,281

)

(60,028

)

(152,051

)

Provision for income taxes

2,509

1,254

5,924

4,033

Net loss

$

(15,331

)

$

(23,535

)

$

(65,952

)

$

(156,084

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.04

)

$

(0.07

)

$

(0.19

)

$

(0.47

)

Weighted-average shares used in computing

net loss per share attributable to common stockholders, basic and

diluted

342,356

334,666

340,539

332,600

____________

(1) Includes stock-based compensation and

related employer payroll taxes as follows:

Cost of revenue

$

2,943

$

2,367

$

8,776

$

6,296

Sales and marketing

24,677

20,674

71,081

57,276

Research and development

40,459

36,353

106,545

103,142

General and administrative

23,688

17,463

71,599

43,482

Total stock-based compensation and related

employer payroll taxes

$

91,767

$

76,857

$

258,001

$

210,196

(2) Includes amortization of acquired

intangible assets as follows:

Cost of revenue

$

2,054

$

4,313

$

8,364

$

12,938

Sales and marketing

363

575

1,301

1,725

Total amortization of acquired intangible

assets

$

2,417

$

4,888

$

9,665

$

14,663

(3) Includes acquisition-related and other

expenses as follows:

General and administrative

$

78

$

—

$

240

$

—

Total acquisition-related and other

expenses

$

78

$

—

$

240

$

—

(4) Includes one-time compensation charge

as follows:

Sales and marketing

$

—

$

—

$

15,000

$

—

Total one-time compensation charge

$

—

$

—

$

15,000

$

—

(5) Includes amortization of debt issuance

costs as follows:

Interest expense

$

990

$

1,059

$

2,970

$

3,529

Total amortization of debt issuance

costs

$

990

$

1,059

$

2,970

$

3,529

CLOUDFLARE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value)

(unaudited)

September 30,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

182,883

$

86,864

Available-for-sale securities

1,640,963

1,586,880

Accounts receivable, net

252,927

248,268

Contract assets

13,458

11,041

Restricted cash short-term

1,000

2,522

Prepaid expenses and other current

assets

72,647

47,502

Total current assets

2,163,878

1,983,077

Property and equipment, net

396,552

322,813

Goodwill

157,200

148,047

Acquired intangible assets, net

19,247

19,564

Operating lease right-of-use assets

151,513

138,556

Deferred contract acquisition costs,

noncurrent

152,380

133,236

Restricted cash

2,023

1,838

Other noncurrent assets

19,953

12,636

Total assets

$

3,062,746

$

2,759,767

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

74,110

$

53,727

Accrued expenses and other current

liabilities

68,885

63,597

Accrued compensation

65,797

63,801

Operating lease liabilities

43,028

38,351

Deferred revenue

389,795

347,608

Total current liabilities

641,615

567,084

Convertible senior notes, net

1,286,332

1,283,362

Operating lease liabilities,

noncurrent

121,374

113,490

Deferred revenue, noncurrent

21,990

17,244

Other noncurrent liabilities

18,345

15,540

Total liabilities

2,089,656

1,996,720

Stockholders’ Equity

Class A common stock; $0.001 par value;

2,250,000 shares authorized as of September 30, 2024 and December

31, 2023; 305,386 and 298,089 shares issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively

305

297

Class B common stock; $0.001 par value;

315,000 shares authorized as of September 30, 2024 and December 31,

2023; 37,661 and 39,443 shares issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively

37

40

Additional paid-in capital

2,046,593

1,784,566

Accumulated deficit

(1,089,792

)

(1,023,840

)

Accumulated other comprehensive income

15,947

1,984

Total stockholders’ equity

973,090

763,047

Total liabilities and stockholders’

equity

$

3,062,746

$

2,759,767

CLOUDFLARE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September

30,

2024

2023

Cash Flows from Operating

Activities

Net loss

$

(65,952

)

$

(156,084

)

Adjustments to reconcile net loss to cash

provided by operating activities:

Depreciation and amortization expense

91,476

99,640

Non-cash operating lease costs

35,624

32,899

Amortization of deferred contract

acquisition costs

56,707

44,757

Stock-based compensation expense

243,969

199,565

Amortization of debt issuance costs

2,970

3,529

Net accretion of discounts and

amortization of premiums on available-for-sale securities

(33,980

)

(31,039

)

Deferred income taxes

(1,338

)

(588

)

Provision for bad debt

7,357

9,527

Loss on extinguishment of debt

—

50,300

Other

361

713

Changes in operating assets and

liabilities, net of effect of acquisitions:

Accounts receivable, net

(12,016

)

(60,451

)

Contract assets

(2,417

)

(3,397

)

Deferred contract acquisition costs

(75,851

)

(66,766

)

Prepaid expenses and other current

assets

(25,313

)

(17,115

)

Other noncurrent assets

621

(1,189

)

Accounts payable

7,817

5,252

Accrued expenses and other current

liabilities

11,316

8,378

Operating lease liabilities

(36,020

)

(31,096

)

Deferred revenue

46,933

81,075

Other noncurrent liabilities

857

1,055

Net cash provided by operating

activities

253,121

168,965

Cash Flows from Investing

Activities

Purchases of property and equipment

(111,884

)

(83,580

)

Capitalized internal-use software

(22,076

)

(16,637

)

Asset acquisitions and business

combinations, net of cash acquired

(15,015

)

—

Purchases of available-for-sale

securities

(1,187,287

)

(1,293,014

)

Sales of available-for-sale securities

—

20,248

Maturities of available-for-sale

securities

1,173,041

1,288,364

Other investing activities

29

65

Net cash used in investing

activities

(163,192

)

(84,554

)

Cash Flows from Financing

Activities

Repayments of convertible senior notes

—

(207,649

)

Cash paid for issuance costs on revolving

credit facility

(2,148

)

—

Proceeds from the exercise of stock

options

9,031

11,384

Proceeds from the early exercise of stock

options

6

—

Repurchases of unvested common stock

—

(34

)

Proceeds from the issuance of common stock

for employee stock purchase plan

10,455

10,450

Payment of tax withholding obligation on

RSU settlement

(12,591

)

(5,643

)

Payment of indemnity holdback

—

(10,483

)

Net cash provided by (used in)

financing activities

4,753

(201,975

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

94,682

(117,564

)

Cash, cash equivalents, and restricted

cash, beginning of period

91,224

215,204

Cash, cash equivalents, and restricted

cash, end of period

$

185,906

$

97,640

CLOUDFLARE, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Reconciliation of cost of

revenue:

GAAP cost of revenue

$

95,967

$

78,069

$

270,016

$

223,722

Less: Stock-based compensation and related

employer payroll taxes

(2,943

)

(2,367

)

(8,776

)

(6,296

)

Less: Amortization of acquired intangible

assets

(2,054

)

(4,313

)

(8,364

)

(12,938

)

Non-GAAP cost of revenue

$

90,970

$

71,389

$

252,876

$

204,488

Reconciliation of gross profit:

GAAP gross profit

$

334,115

$

257,534

$

939,664

$

710,550

Add: Stock-based compensation and related

employer payroll taxes

2,943

2,367

8,776

6,296

Add: Amortization of acquired intangible

assets

2,054

4,313

8,364

12,938

Non-GAAP gross profit

$

339,112

$

264,214

$

956,804

$

729,784

GAAP gross margin

77.7

%

76.7

%

77.7

%

76.1

%

Non-GAAP gross margin

78.8

%

78.7

%

79.1

%

78.1

%

Reconciliation of operating

expenses:

GAAP sales and marketing

$

185,221

$

150,214

$

553,824

$

433,903

Less: Stock-based compensation and related

employer payroll taxes

(24,677

)

(20,674

)

(71,081

)

(57,276

)

Less: Amortization of acquired intangible

assets

(363

)

(575

)

(1,301

)

(1,725

)

Less: One-time compensation charge

—

—

(15,000

)

—

Non-GAAP sales and marketing

$

160,181

$

128,965

$

466,442

$

374,902

GAAP research and development

$

110,911

$

90,593

$

301,161

$

261,742

Less: Stock-based compensation and related

employer payroll taxes

(40,459

)

(36,353

)

(106,545

)

(103,142

)

Non-GAAP research and development

$

70,452

$

54,240

$

194,616

$

158,600

GAAP general and administrative

$

68,777

$

55,939

$

204,721

$

157,561

Less: Stock-based compensation and related

employer payroll taxes

(23,688

)

(17,463

)

(71,599

)

(43,482

)

Less: Acquisition-related and other

expenses

(78

)

—

(240

)

—

Non-GAAP general and administrative

$

45,011

$

38,476

$

132,882

$

114,079

Reconciliation of income (loss) from

operations:

GAAP loss from operations

$

(30,794

)

$

(39,212

)

$

(120,042

)

$

(142,656

)

Add: Stock-based compensation and related

employer payroll taxes

91,767

76,857

258,001

210,196

Add: Amortization of acquired intangible

assets

2,417

4,888

9,665

14,663

Add: Acquisition-related and other

expenses

78

—

240

—

Add: One-time compensation charge

—

—

15,000

—

Non-GAAP income from operations

$

63,468

$

42,533

$

162,864

$

82,203

GAAP operating margin

(7.2

)%

(11.7

)%

(9.9

)%

(15.3

)%

Non-GAAP operating margin

14.8

%

12.7

%

13.5

%

8.8

%

CLOUDFLARE, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Reconciliation of interest

expense:

GAAP interest expense

$

(1,433

)

$

(1,138

)

$

(3,751

)

$

(4,803

)

Add: Amortization of debt issuance

costs

990

1,059

2,970

3,529

Non-GAAP interest expense

$

(443

)

$

(79

)

$

(781

)

$

(1,274

)

Reconciliation of loss on

extinguishment of debt:

GAAP loss on extinguishment of debt

$

—

$

—

$

—

$

(50,300

)

Add: Loss on extinguishment of debt

—

—

—

50,300

Non-GAAP loss on extinguishment of

debt

$

—

$

—

$

—

$

—

Reconciliation of provision for income

taxes:

GAAP provision for income taxes

$

2,509

$

1,254

$

5,924

$

4,033

Income tax effect of non-GAAP

adjustments

7,346

4,005

19,718

6,454

Non-GAAP provision for income taxes

$

9,855

$

5,259

$

25,642

$

10,487

Reconciliation of net income (loss) and

net income (loss) per share:

GAAP net loss attributable to common

stockholders

$

(15,331

)

$

(23,535

)

$

(65,952

)

$

(156,084

)

Add: Stock-based compensation and related

employer payroll taxes

91,767

76,857

258,001

210,196

Add: Amortization of acquired intangible

assets

2,417

4,888

9,665

14,663

Add: Acquisition-related and other

expenses

78

—

240

—

Add: One-time compensation charge

—

—

15,000

—

Add: Amortization of debt issuance

costs

990

1,059

2,970

3,529

Add: Loss on extinguishment of debt

—

—

—

50,300

Income tax effect of non-GAAP

adjustments

(7,346

)

(4,005

)

(19,718

)

(6,454

)

Non-GAAP net income

$

72,575

$

55,264

$

200,206

$

116,150

GAAP net loss per share, basic

$

(0.04

)

$

(0.07

)

$

(0.19

)

$

(0.47

)

GAAP net loss per share, diluted

$

(0.04

)

$

(0.07

)

$

(0.19

)

$

(0.47

)

Add: Stock-based compensation and related

employer payroll taxes

0.27

0.23

0.76

0.63

Add: Amortization of acquired intangible

assets

0.01

0.01

0.03

0.04

Add: Acquisition-related and other

expenses

—

—

—

—

Add: One-time compensation charge

—

—

0.04

—

Add: Amortization of debt issuance

costs

—

—

0.01

0.01

Add: Loss on extinguishment of debt

—

—

—

0.15

Income tax effect of non-GAAP

adjustment

(0.02

)

(0.01

)

(0.06

)

(0.02

)

Effect of dilutive shares

(0.02

)

—

(0.03

)

—

Non-GAAP net income per share,

diluted(1)(2)

$

0.20

$

0.16

$

0.56

$

0.34

Weighted-average shares used in computing

net loss per share attributable to common stockholders, basic

342,356

334,666

340,539

332,600

Weighted-average shares used in computing

non-GAAP net income per share attributable to common stockholders,

diluted(2)

356,855

351,709

356,789

343,432

____________

(1)

Totals may not sum due to rounding.

Figures are calculated based upon the respective underlying

non-rounded data.

(2)

For the period in which we had non-GAAP

net income, diluted non-GAAP net income per share is calculated

using weighted-average shares, adjusted for dilutive potential

shares that were assumed outstanding during period.

CLOUDFLARE, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Free cash flow

Net cash provided by operating

activities

$

104,727

$

68,100

$

253,121

$

168,965

Less: Purchases of property and

equipment

(50,203

)

(27,291

)

(111,884

)

(83,580

)

Less: Capitalized internal-use

software

(9,245

)

(5,934

)

(22,076

)

(16,637

)

Free cash flow

$

45,279

$

34,875

$

119,161

$

68,748

Net cash used in investing activities

$

(76,400

)

$

(100,229

)

$

(163,192

)

$

(84,554

)

Net cash provided by (used in) financing

activities

$

(2,411

)

$

(34,610

)

$

4,753

$

(201,975

)

Net cash provided by operating

activities

(percentage of revenue)

24

%

20

%

21

%

18

%

Less: Purchases of property and

equipment

(percentage of revenue)

(11

)%

(8

)%

(9

)%

(9

)%

Less: Capitalized internal-use

software

(percentage of revenue)

(2

)%

(2

)%

(2

)%

(2

)%

Free cash flow margin(1)

11

%

10

%

10

%

7

%

____________

(1)

Totals may not sum due to rounding.

Figures are calculated based upon the respective underlying

non-rounded data.

Explanation of Non-GAAP Financial Measures

In addition to our results determined in accordance with

generally accepted accounting principles in the United States (U.S.

GAAP), we believe the following non-GAAP measures are useful in

evaluating our operating performance. We use the following non-GAAP

financial information to evaluate our ongoing operations and for

internal planning and forecasting purposes. We believe that

non-GAAP financial information, when taken collectively, may be

helpful to investors because it provides consistency and

comparability with past financial performance. However, non-GAAP

financial information is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not

be considered in isolation or as a substitute for financial

information presented in accordance with U.S. GAAP. In particular,

free cash flow is not a substitute for cash provided by operating

activities. Additionally, the utility of free cash flow as a

measure of our liquidity is further limited as it does not

represent the total increase or decrease in our cash balance for a

given period. In addition, other companies, including companies in

our industry, may calculate similarly-titled non-GAAP measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison. A

reconciliation is provided above for each non-GAAP financial

measure to the most directly comparable financial measure stated in

accordance with U.S. GAAP. Investors are encouraged to review the

related U.S. GAAP financial measures and the reconciliation of

these non-GAAP financial measures to their most directly comparable

U.S. GAAP financial measures, and not to rely on any single

financial measure to evaluate our business.

Items Excluded from Non-GAAP Measures. We exclude

stock-based compensation expense, which is a non-cash expense, from

certain of our non-GAAP financial measures because we believe that

excluding this item provides meaningful supplemental information

regarding operational performance. We exclude employer payroll tax

expenses related to stock-based compensation, which is a cash

expense, from certain of our non-GAAP financial measures because

such expenses are dependent on the price of our Class A common

stock and other factors that are beyond our control and do not

correlate to the operation of our business. We exclude amortization

of acquired intangible assets, which is a non-cash expense, related

to business combinations from certain of our non-GAAP financial

measures because such expenses are related to business combinations

and have no direct correlation to the operation of our business. We

exclude acquisition-related and other expenses from certain of our

non-GAAP financial measures because such expenses are related to

business combinations and have no direct correlation to the

operation of our business. Acquisition-related and other expenses

can be cash or non-cash expenses and include third-party

transaction costs and compensation expense for key acquired

personnel. We also excluded the one-time cash compensation charge

incurred during the three months ended March 31, 2024 from certain

of our non-GAAP financial measures because it was not attributable

to services provided and did not correlate to the ongoing operation

of our business. We exclude amortization of debt issuance costs and

loss on extinguishment of debt, which are non-cash expenses, from

certain of our non-GAAP financial measures because such expenses

have no direct correlation to the operation of our business.

Non-GAAP Gross Profit and Non-GAAP Gross Margin. We

define non-GAAP gross profit and non-GAAP gross margin as U.S. GAAP

gross profit and U.S. GAAP gross margin, respectively, excluding

stock-based compensation and related employer payroll taxes and

amortization of acquired intangible assets.

Non-GAAP Income from Operations and Non-GAAP Operating

Margin. We define non-GAAP income from operations and non-GAAP

operating margin as U.S. GAAP loss from operations and U.S. GAAP

operating margin, respectively, excluding stock-based compensation

expense and its related employer payroll taxes, amortization of

acquired intangible assets, acquisition-related and other

expenses.

Non-GAAP Net Income and Non-GAAP Net Income per Share,

Diluted. We define non-GAAP net income as GAAP net income

(loss) adjusted for stock-based compensation expense and its

related employer payroll taxes, amortization of acquired intangible

assets, acquisition-related and other expenses, amortization of

issuance costs, loss on extinguishment of debt, and a non-GAAP

provision for (benefit from) income taxes. Generally, the

difference between our GAAP and non-GAAP income tax expense

(benefit) is primarily due to adjustments in stock-based

compensation and related employer payroll taxes, amortization of

acquired intangibles associated with business combinations,

acquisition-related and other expenses, and amortization of

issuance costs. We define non-GAAP net income per share, diluted,

as non-GAAP net income divided by the weighted-average common

shares outstanding, adjusted for dilutive potential shares that

were assumed outstanding during period. Currently, potential

dilutive effect mainly consists of employee equity incentive plans

and convertible senior notes. We believe that excluding these items

from non-GAAP net income per share, diluted, provides management

and investors with greater visibility into the underlying

performance of our core business operating results.

Free Cash Flow and Free Cash Flow Margin. Free cash flow

is a non-GAAP financial measure that we calculate as net cash

provided by operating activities less cash used for purchases of

property and equipment and capitalized internal-use software. Free

cash flow margin is calculated as free cash flow divided by

revenue. We believe that free cash flow and free cash flow margin

are useful indicators of liquidity that provide information to

management and investors about the amount of cash generated from

our operations that, after the investments in property and

equipment and capitalized internal-use software, can be used for

strategic initiatives, including investing in our business, and

strengthening our financial position. We believe that historical

and future trends in free cash flow and free cash flow margin, even

if negative, provide useful information about the amount of cash

generated by our operating activities that is available (or not

available) to be used for strategic initiatives. For example, if

free cash flow is negative, we may need to access cash reserves or

other sources of capital to invest in strategic initiatives. One

limitation of free cash flow and free cash flow margin is that they

do not reflect our future contractual commitments. Additionally,

free cash flow does not represent the total increase or decrease in

our cash balance for a given period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107791655/en/

Investor Relations Information Phil Winslow

ir@cloudflare.com

Press Contact Information Daniella Vallurupalli

press@cloudflare.com

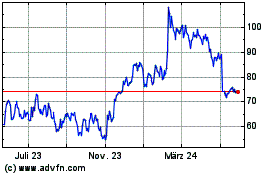

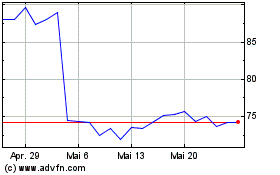

Cloudflare (NYSE:NET)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Cloudflare (NYSE:NET)

Historical Stock Chart

Von Nov 2023 bis Nov 2024