Matador Resources Company (NYSE: MTDR) (“Matador”) today

announced the successful closing of its previously announced

agreement whereby Matador contributed Pronto Midstream, LLC

(“Pronto”), Matador’s wholly-owned midstream subsidiary, to San

Mateo Midstream, LLC, Matador’s 51%-owned midstream joint venture

(“San Mateo”), for a total implied pre-closing valuation of Pronto

of approximately $600 million. Upon completion of the transaction,

San Mateo has a total estimated asset value of more than $1.5

billion net to Matador.1 Please see Matador’s December 5, 2024,

press release for additional details on the transaction.

Joseph Wm. Foran, Matador’s Founder, Chairman and CEO,

commented, “We are excited to have successfully closed the

combination of San Mateo and Pronto. This transaction is expected

to have substantial benefits for Matador and its shareholders,

including:

- Strengthening Matador’s balance sheet with the receipt of

approximately $220 million in upfront cash plus up to $75 million

in performance incentive payments;

- Increasing flow assurance;

- Providing a long-term sour gas solution in northern Lea County,

New Mexico;

- Expediting the expanded Marlan Processing Plant approaching its

designed capacity of 260 million cubic feet as early as 2026;

- Giving San Mateo additional scale and growth opportunities;

and

- Simplifying Matador’s midstream business by combining San Mateo

and Pronto.

“First, we are pleased to have Five Point participating in this

growth opportunity. The transaction increases the ability for San

Mateo, to which Five Point is already a 49% partner, to provide

flow assurance to Matador and San Mateo’s third-party customers.

Notably, after the upcoming Marlan Processing Plant expansion, San

Mateo is expected to be one of the leading natural gas processors

in New Mexico with over 700 million cubic feet of designed inlet

natural gas processing capacity. The expansion of the Marlan

Processing Plant remains on time and on budget and is expected to

come online in the first half of 2025.

“Second, the transaction provides Matador, San Mateo and their

customers with a long-term sour gas solution in northern Lea

County, New Mexico. At the same time, we are looking forward to

working more closely with Northwind Midstream Partners LLC

(“Northwind”), an affiliate of Five Point, through agreements with

San Mateo. As a part of the transaction, Northwind has agreed to

treat sour gas delivered by San Mateo and re-deliver treated gas

back to San Mateo for processing. This sour gas solution is

expected to allow Matador to continue with its development plans in

the Advance acreage it acquired in 2023 as well as on other acreage

Matador and its third-party customers have acquired in northern Lea

County, New Mexico.

“Third, the transaction should expedite the time for San Mateo

to reach designed capacity at the Marlan Processing Plant. As part

of the transaction, Northwind has agreed to deliver treated sour

gas and sweet gas from Northwind’s third-party customers to San

Mateo for processing. We expect that these additional volumes, as

well as other third-party opportunities, will help the expanded

Marlan Processing Plant approach its designed capacity as early as

2026.

“Fourth, the transaction strengthens Matador’s balance sheet. As

part of the transaction, Matador received an up-front cash payment

of approximately $220 million. We are using this amount to repay

outstanding borrowings under our revolving credit facility. We

expect our leverage ratio (net debt divided by adjusted earnings

before interest expense, income taxes, depletion, depreciation,

amortization and other items, or “Adjusted EBITDA”) to be

approximately 1.1 times at December 31, 2024 with plans to continue

reducing our leverage in 2025. In addition, over the next five

years, Matador expects to receive up to $75 million in performance

incentive payments from Five Point as we execute our drilling and

operational plans in northern Lea County, New Mexico.

“Fifth, San Mateo improves its scale and growth opportunities,

which will also allow San Mateo to continue to explore potential

strategic transactions going forward. The midstream team is focused

on enhancing our midstream assets to continue to provide

best-in-class service to Matador, Northwind and San Mateo’s other

third-party customers. San Mateo’s ability to offer midstream

services across all three production streams—crude oil, natural gas

and water—makes it one of the few full-service midstream companies

in the northern Delaware Basin.

“Matador wishes to thank Five Point for their professionalism

throughout this process and for successfully closing the

transaction on time. Five Point’s friendship, expertise and

investment as a partner in San Mateo over the last seven years has

helped build additional shareholder value and confidence in San

Mateo’s system and facilities while growing Matador’s midstream

business.”

About Matador Resources Company

Matador is an independent energy company engaged in the

exploration, development, production and acquisition of oil and

natural gas resources in the United States, with an emphasis on oil

and natural gas shale and other unconventional plays. Its current

operations are focused primarily on the oil and liquids-rich

portion of the Wolfcamp and Bone Spring plays in the Delaware Basin

in Southeast New Mexico and West Texas. Matador also operates in

the Eagle Ford shale play in South Texas and the Haynesville shale

and Cotton Valley plays in Northwest Louisiana. Additionally,

Matador conducts midstream operations in support of its

exploration, development and production operations and provides

natural gas processing, oil transportation services, natural gas,

oil and produced water gathering services and produced water

disposal services to third parties.

For more information, visit Matador Resources Company at

www.matadorresources.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. “Forward-looking statements” are statements related to

future, not past, events. Forward-looking statements are based on

current expectations and include any statement that does not

directly relate to a current or historical fact. In this context,

forward-looking statements often address expected future business

and financial performance, and often contain words such as “could,”

“believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,”

“may,” “should,” “continue,” “plan,” “predict,” “potential,”

“project,” “hypothetical,” “forecasted” and similar expressions

that are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words.

Such forward-looking statements include, but are not limited to,

statements about the anticipated benefits, opportunities and

results with respect to the contribution of Pronto to San Mateo,

guidance, projected or forecasted financial and operating results,

future liquidity, the payment of dividends, results in certain

basins, objectives, project timing, expectations and intentions,

regulatory and governmental actions and other statements that are

not historical facts. Actual results and future events could differ

materially from those anticipated in such statements, and such

forward-looking statements may not prove to be accurate. These

forward-looking statements involve certain risks and uncertainties,

including, but not limited to, disruption from Matador’s

acquisitions or dispositions, including the Pronto contribution,

making it more difficult to maintain business and operational

relationships; significant transaction costs associated with

Matador’s acquisitions or dispositions, including the Pronto

contribution; the risk of litigation and/or regulatory actions

related to Matador’s acquisitions or dispositions, including the

Pronto contribution, as well as the following risks related to

financial and operational performance: general economic conditions;

Matador’s ability to execute its business plan, including whether

its drilling program is successful; changes in oil, natural gas and

natural gas liquids prices and the demand for oil, natural gas and

natural gas liquids; its ability to replace reserves and

efficiently develop current reserves; the operating results of

Matador’s midstream oil, natural gas and water gathering and

transportation systems, pipelines and facilities, the acquiring of

third-party business and the drilling of any additional salt water

disposal wells; costs of operations; delays and other difficulties

related to producing oil, natural gas and natural gas liquids;

delays and other difficulties related to regulatory and

governmental approvals and restrictions; impact on Matador’s

operations due to seismic events; its ability to make acquisitions

on economically acceptable terms; its ability to integrate

acquisitions; availability of sufficient capital to execute its

business plan, including from future cash flows, available

borrowing capacity under its revolving credit facilities and

otherwise; the operating results of and the availability of any

potential distributions from our joint ventures; weather and

environmental conditions; and the other factors that could cause

actual results to differ materially from those anticipated or

implied in the forward-looking statements. For further discussions

of risks and uncertainties, you should refer to Matador’s filings

with the Securities and Exchange Commission (“SEC”), including the

“Risk Factors” section of Matador’s most recent Annual Report on

Form 10-K and any subsequent Quarterly Reports on Form 10-Q.

Matador undertakes no obligation to update these forward-looking

statements to reflect events or circumstances occurring after the

date of this press release, except as required by law, including

the securities laws of the United States and the rules and

regulations of the SEC. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. All forward-looking statements

are qualified in their entirety by this cautionary statement.

Supplemental Non-GAAP Financial Measures

Adjusted EBITDA

This press release includes the non-GAAP financial measure of

Adjusted EBITDA. Adjusted EBITDA is a supplemental non-GAAP

financial measure that is used by management and external users of

Matador’s consolidated financial statements, such as securities

analysts, investors, lenders and rating agencies. “GAAP” means

Generally Accepted Accounting Principles in the United States of

America. Matador believes Adjusted EBITDA helps it evaluate its

operating performance and compare its results of operations from

period to period without regard to its financing methods or capital

structure. Matador defines, on a consolidated basis and for San

Mateo, Adjusted EBITDA as earnings before interest expense, income

taxes, depletion, depreciation and amortization, accretion of asset

retirement obligations, property impairments, unrealized derivative

gains and losses, non-recurring transaction costs for certain

acquisitions, certain other non-cash items and non-cash stock-based

compensation expense and net gain or loss on asset sales and

impairment. Adjusted EBITDA is not a measure of net income or net

cash provided by operating activities as determined by GAAP.

Adjusted EBITDA should not be considered an alternative to, or

more meaningful than, net income or net cash provided by operating

activities as determined in accordance with GAAP or as an indicator

of Matador’s or San Mateo’s operating performance or liquidity.

Certain items excluded from Adjusted EBITDA are significant

components of understanding and assessing a company’s financial

performance, such as a company’s cost of capital and tax structure.

Adjusted EBITDA may not be comparable to similarly titled measures

of another company because all companies may not calculate Adjusted

EBITDA in the same manner. This press release does not provide a

reconciliation with respect to forward-looking Adjusted EBITDA,

which is not based on historical fact. Matador could not provide

such reconciliation without undue hardship because such Adjusted

EBITDA amount is an estimation. In addition, it would be difficult

for Matador to present a detailed reconciliation on account of many

unknown variables for Adjusted EBITDA, including future income

taxes, future interest expense and gains or losses on asset sales

and impairment. For the same reasons, Matador is unable to address

the probable significance of the unavailable information, which

could be material to future results.

1 The $600 million implied valuation is represented by Matador’s

receipt of an up-front cash payment of approximately $220 million

plus up to $75 million in performance incentive payments in

exchange for 49% of Pronto. San Mateo’s total estimated asset value

net to Matador is calculated using Matador’s 51% interest in San

Mateo multiplied by (i) a 10x multiple applied to San Mateo’s 2024

estimated Adjusted EBITDA of $240 to $260 million plus (ii) the

$600 million implied valuation for Pronto.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219080202/en/

Mac Schmitz Senior Vice President - Investor Relations (972)

371-5225 investors@matadorresources.com

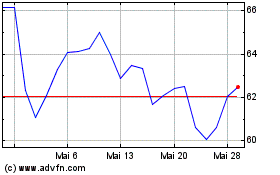

Matador Resources (NYSE:MTDR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Matador Resources (NYSE:MTDR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025