Morgan Stanley Bank, N.A. Receives Outstanding Rating for Community Reinvestment Initiatives

02 Oktober 2023 - 7:00PM

Business Wire

Rating given by the Office of the Comptroller of the

Currency

Morgan Stanley Bank, N.A. (MSBNA), a national bank subsidiary of

Morgan Stanley (NYSE: MS), has been recognized with the highest

rating from the Office of the Comptroller of the Currency (OCC) for

its work meeting the credit needs of the communities it serves. The

Bank received a rating of “Outstanding” for the Bank’s community

reinvestment activities. Both of the Firm’s national bank

subsidiaries have achieved consistent “Outstanding” ratings based

on the OCC’s review of community reinvestment activities.

The OCC report for MSBNA highlights several initiatives that

contributed to the “Outstanding” rating including nearly $6 billion

in combined community development loans and investments that

addressed the need of affordable housing, resident services to

strengthen communities, and capital for small businesses over the

three-year exam period.

“Morgan Stanley is very proud to have received, for the eighth

time in a row, an “Outstanding” rating from the OCC for our

community reinvestment work,” said Michael Pizzi, Head of U.S.

Banks and Head of Technology. "Our program’s continued focus on

affordable housing and economic development remains our priority in

the communities we serve.”

The evaluation noted that the Bank’s community development

lending and investment performance was “excellent” and “the Bank

was responsive to identified community needs and supports services

that targeted affordable housing, financial education, social

services for low- and moderate-income (LMI) individuals, and

services for small businesses.”

“Morgan Stanley continues to leverage our capital markets

expertise to support affordable housing and economic development,

which contribute to thriving communities,” continued Mr. Pizzi.

The Performance Evaluation highlighted several transactions,

including:

More than $375 million in loans to community development

financial institutions (CDFIs) in the Bank’s local, regional, and

national areas over the three-year exam period (2020-2022). MSBNA

recognized the critical role that CDFIs played in stabilizing and

revitalizing communities, particularly those with considerable

needs exacerbated by the pandemic. One example included a $9

million revolving line of credit to a CDFI to fund affordable

housing projects and working capital for distressed neighborhoods.

The CDFI builds new single- and multi-family housing, rehabilitates

existing housing stock and works to revitalize neighborhoods in

Salt Lake City and around the state of Utah.

Due to the unique nature of MSBNA’s Wholesale Bank designation

for Community Reinvestment Act (CRA), the Bank is able to leverage

its expertise to meet community needs across the nation in addition

to serving its local assessment area. This regional and national

focus allowed the Bank to respond to disaster areas, invest in

rural CRA “deserts,” and preserve affordable housing nationwide at

a time when the country faces a severe affordable housing

crisis.

One of the projects that helped rebuild in the wake of a natural

disaster was Phase I and II of Laurel at Perennial Park in Santa

Rosa, California. Working with Burbank Housing Development

Corporation (BHDC), the Bank provided both affordable housing

construction loans and Low-Income Housing Tax Credit (LIHTC) equity

to the redevelopment project. The Bank’s financing created 132

units of affordable housing for seniors 62+. The site, formerly the

Journey’s End Mobile Home Park, was destroyed by the Tubbs wildfire

in 2017.

“Morgan Stanley has served as a trusted advisor throughout the

life cycle of the redevelopment at 3575 Mendocino Avenue, now

Laurel at Perennial Park,” says Larry Florin, CEO of Burbank

Housing. “Morgan Stanley was a key first responder to the natural

disaster and was able to creatively and flexibly design their

response by listening to the needs of the community first, and then

bring capital to the table based on those identified needs. They

have made responding to disaster areas one of their priorities,

which really sets them apart as a partner.”

The Bank also offered SBA 504 loans for small businesses,

financing for the construction and preservation of affordable

housing, and LIHTC investments across rural areas where capital is

often more sparse than urban markets. For example, projects in

Fresno and Mineral Wells, Texas and Los Alamos, New Mexico received

a variety of community development funding.

Mike Mantle, Head of Community Development Finance at Morgan

Stanley said, “Morgan Stanley continually looks for ways to make an

impact in the communities we serve. Affordable housing is a major

focus given the critical need we see across the country. However,

the capital we deploy through the SBA 504 program, particularly in

rural markets, helps provide critically needed loans for small

businesses. These businesses in turn create or retain local jobs.

We are proud of our track record.”

About Morgan Stanley

Morgan Stanley (NYSE: MS) is a leading global financial services

firm providing a wide range of investment banking, securities,

wealth management and investment management services. With offices

in 42 countries, the Firm’s employees serve clients worldwide

including corporations, governments, institutions and individuals.

For further information about Morgan Stanley, please visit

www.morganstanley.com.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231002873917/en/

Media Relations Contact: mediainquiries@morganstanley.com

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

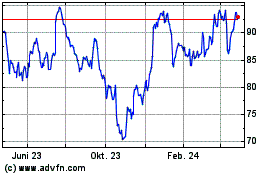

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024