Merck Recommends Rejection of TRC Capital’s “Mini-Tender” Offer

22 November 2024 - 10:17PM

Business Wire

Merck (NYSE: MRK), known as MSD outside the United States and

Canada, has been notified that TRC Capital Investment Corporation

(TRC Capital) has commenced an unsolicited “mini-tender” offer,

dated November 12, 2024, to purchase up to 1,000,000 shares of

Merck common stock at $96.38 per share. The offer price is

approximately 4.32% below the closing price of the Merck common

stock on November 11, 2024 ($100.73), the last trading day before

the date of the offer, and approximately 3.48% below the closing

price of the Merck common stock on November 21, 2024 ($99.86), the

day prior to this release.

Merck does not endorse TRC Capital’s offer and recommends that

Merck shareholders reject the offer and not tender their shares in

response to TRC Capital’s unsolicited mini-tender offer. This

mini-tender offer is at a price below the closing price for Merck’s

shares (as of the day prior to this release) and is subject to

numerous conditions, including TRC Capital’s ability to obtain

financing. Merck is not associated in any way with TRC Capital, its

mini-tender offer or the offer documentation.

TRC Capital has made similar unsolicited mini-tender offers for

shares of other publicly traded companies. Mini-tender offers seek

to acquire less than 5% of a company's outstanding shares. This

lets the offering company avoid many of the disclosure and

procedural requirements the U.S. Securities and Exchange Commission

(SEC) requires for tender offers. As a result, mini-tender offers

do not provide investors the same level of protections as provided

by larger tender offers under U.S. federal securities laws.

On its website, the SEC advises that the people behind mini

tender-offers “frequently use mini-tender offers to catch

shareholders off guard” and that investors “may end up selling at

below-market prices.” The SEC's website also contains important

tips for investors regarding mini-tender offers.

Like TRC Capital’s other offers, this one puts individual

investors at risk because they may not realize they are selling

their shares at a discount. Merck urges shareholders to obtain

current stock quotes for their shares of Merck common stock, to

review the terms and conditions of the offer, to consult with their

brokers or financial advisers, and to exercise caution with respect

to TRC Capital’s mini-tender offer.

Merck shareholders who have already tendered are advised they

may withdraw their shares by following the procedures for

withdrawal described in the TRC Capital offer documents prior to

the expiration of the offer, which is currently scheduled for 11:59

a.m. EST on December 11, 2024.

Merck encourages brokers, dealers, and other investors to review

the SEC’s letter regarding broker-dealer mini-tender offer

dissemination and disclosure.

Merck requests that a copy of this news release be included with

all distribution of materials related to TRC Capital’s offer for

shares of Merck common stock.

About Merck At Merck, known as MSD outside of the United

States and Canada, we are unified around our purpose: We use the

power of leading-edge science to save and improve lives around the

world. For more than 130 years, we have brought hope to humanity

through the development of important medicines and vaccines. We

aspire to be the premier research-intensive biopharmaceutical

company in the world – and today, we are at the forefront of

research to deliver innovative health solutions that advance the

prevention and treatment of diseases in people and animals. We

foster a diverse and inclusive global workforce and operate

responsibly every day to enable a safe, sustainable and healthy

future for all people and communities. For more information, visit

www.merck.com and connect with us on X (formerly Twitter),

Facebook, Instagram, YouTube and LinkedIn.

Forward-Looking Statement of Merck & Co., Inc., Rahway,

N.J., USA This news release of Merck & Co., Inc., Rahway,

N.J., USA (the “company”) includes “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These statements

are based upon the current beliefs and expectations of the

company’s management and are subject to significant risks and

uncertainties. If underlying assumptions prove inaccurate or risks

or uncertainties materialize, actual results may differ materially

from those set forth in the forward-looking statements.

Risks and uncertainties include but are not limited to, general

industry conditions and competition; general economic factors,

including interest rate and currency exchange rate fluctuations;

the impact of pharmaceutical industry regulation and health care

legislation in the United States and internationally; global trends

toward health care cost containment; technological advances, new

products and patents attained by competitors; challenges inherent

in new product development, including obtaining regulatory

approval; the company’s ability to accurately predict future market

conditions; manufacturing difficulties or delays; financial

instability of international economies and sovereign risk;

dependence on the effectiveness of the company’s patents and other

protections for innovative products; and the exposure to

litigation, including patent litigation, and/or regulatory

actions.

The company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise. Additional factors that could cause

results to differ materially from those described in the

forward-looking statements can be found in the company’s Annual

Report on Form 10-K for the year ended December 31, 2023 and the

company’s other filings with the Securities and Exchange Commission

(SEC) available at the SEC’s Internet site (www.sec.gov).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241122275388/en/

Media Contacts:

Robert Josephson (203) 914-2372 robert.josephson@merck.com

Michael Levey (215) 872-1462 michael.levey@merck.com

Investor Contacts:

Peter Dannenbaum (732) 594-1579 peter.dannenbaum@merck.com

Steven Graziano (732) 594-1583 steven.graziano@merck.com

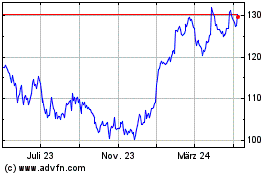

Merck (NYSE:MRK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

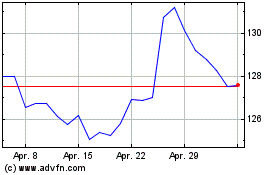

Merck (NYSE:MRK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024