0000799292false00007992922025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

| | |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): January 29, 2025

| | | | | | | | | | | | | | |

| M/I HOMES, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Ohio | | 1-12434 | | 31-1210837 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

4131 Worth Avenue, Suite 500 Columbus, OH 43219

(Address of principal executive offices) (Zip Code)

(614) 418-8000

(Telephone Number)

| | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a.12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $.01 | MHO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2 FINANCIAL INFORMATION

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 29, 2025, M/I Homes, Inc. issued a press release reporting financial results for the three and twelve months ended December 31, 2024. A copy of this press release, including information concerning forward-looking statements and factors that may affect our future results, is attached hereto as Exhibit 99.1. The information in Exhibit 99.1 is furnished pursuant to Item 2.02 on Form 8-K.

SECTION 9 FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description of Exhibit |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document).* |

*Submitted electronically with this Report in accordance with the provisions of Regulation S-T.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 29, 2025

M/I Homes, Inc.

| | | | | |

By: | /s/ Ann Marie W. Hunker |

| Ann Marie W. Hunker |

| VP, Chief Accounting Officer and Controller |

| |

Exhibit 99.1

M/I Homes Reports

Fourth Quarter and Year-End Results

Columbus, Ohio (January 29, 2025) - M/I Homes, Inc. (NYSE:MHO) announced results for its fourth quarter and year ended December 31, 2024.

2024 Fourth Quarter Results:

•Record fourth quarter homes delivered and income

•New contracts increased 11% to 1,759

•Homes delivered increased 19% to 2,402

•Revenue of $1.2 billion, up 24%

•Pre-tax income of $171 million, up 24%

•Net income increased 27% to $133.5 million ($4.71 per diluted share) compared to $105 million ($3.66 per diluted share) in 2023

•Repurchased $50 million of stock

2024 Full Year Results:

•Record homes delivered, revenue and income

•New contracts increased 8% to 8,584

•Homes delivered increased 12% to 9,055

•Revenue increased 12% to $4.5 billion

•Pre-tax income increased 21% to $734 million; 16% of revenue

•Net income increased 21% to $564 million ($19.71 per diluted share)

•Shareholders’ equity reached an all-time record of $2.9 billion, a 17% increase from a year ago,

with book value per share of $109

•Repurchased $176.0 million of stock

•Return on equity of 21%

•Homebuilding debt to capital ratio of 19% compared to 22% at December 31, 2023

For the fourth quarter of 2024, the Company reported net income of $133.5 million, or $4.71 per diluted share, compared to net income of $105.3 million, or $3.66 per diluted share, for the fourth quarter of 2023. For the year ended December 31, 2024, the Company reported net income of $563.7 million, or $19.71 per diluted share, compared to net income of $465.4 million, or $16.21 per diluted share in 2023.

Homes delivered in 2024’s fourth quarter reached an all-time quarterly record of 2,402, a 19% increase compared to 2,019 deliveries in 2023’s fourth quarter. Homes delivered for the twelve months ended December 31, 2024 increased 12% to a record 9,055 from 2023’s deliveries of 8,112. New contracts for 2024’s fourth quarter increased 11% to 1,759 from 1,588 new contracts in 2023’s fourth quarter. For 2024, new contracts were 8,584, an 8% increase from 2023’s 7,977 new contracts. Homes in backlog decreased 16% at December 31, 2024 to 2,531 units, with a sales value of $1.4 billion, an 11% decrease from last year, while the average sales price in

backlog increased 5% to an all-time record $553,000. At December 31, 2023, the sales value of the 3,002 homes in backlog was $1.6 billion, with an average sales price of $525,000. M/I Homes had 220 active communities at December 31, 2024 compared to 213 a year ago. The Company’s cancellation rate was 14% in 2024’s fourth quarter compared to 13% for the prior year’s fourth quarter.

Robert H. Schottenstein, Chief Executive Officer and President, commented, “We had an outstanding 2024 highlighted by all-time records in homes delivered, revenue and income. Our homes delivered increased 12% to 9,055 generating revenue of $4.5 billion - a 12% increase over 2023. Our gross margins were 26.6% compared to 25.3% and pre-tax income was $734 million, a 21% increase over last year. Our pre-tax margin reached 16% and we produced a strong return on equity of 21%.”

Mr. Schottenstein continued, “We are in excellent financial condition. We ended the year with record shareholders’ equity of $2.9 billion, cash of $822 million, zero borrowings under our $650 million credit facility, a homebuilding debt to capital ratio of 19% and a net debt to capital ratio of negative 5%. Our year-end book value was a record $109 per share. As we begin 2025, we believe our industry will continue to benefit from strong fundamentals, including favorable demographic trends and an undersupply of housing.”

The Company will broadcast live its earnings conference call today at 10:30 a.m. Eastern Time. To listen to the call live, log on to the M/I Homes’ website at mihomes.com, click on the “Investors” section of the site, and select “Listen to the Conference Call.” A replay of the call will continue to be available on our website through January 2026.

M/I Homes, Inc. is one of the nation’s leading homebuilders of single-family homes. The Company has homebuilding operations in Columbus and Cincinnati, Ohio; Indianapolis, Indiana; Chicago, Illinois; Minneapolis/St. Paul, Minnesota; Detroit, Michigan; Tampa, Sarasota, Fort Myers/Naples and Orlando, Florida; Austin, Dallas/Fort Worth, Houston and San Antonio, Texas; Charlotte and Raleigh, North Carolina and Nashville, Tennessee.

Certain statements in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “anticipates,” “targets,” “envisions,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. These statements involve a number of risks and uncertainties. Any forward-looking statements that we make herein and in any future reports and statements are not guarantees of future performance, and actual results may differ materially from those in such forward-looking statements as a result of various factors, including, without limitation, factors relating to the economic environment, interest rates, availability of resources, competition, market concentration, land development activities, construction defects, product liability and warranty claims and various governmental rules and regulations, as more fully discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as the same may be updated from time to time in our subsequent filings with the Securities and Exchange Commission. All forward-looking statements made in this press release are made as of the date hereof, and the risk that actual results will differ materially from expectations expressed herein will increase with the passage of time. We undertake no duty to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in our subsequent filings, releases or presentations should be consulted.

Contact M/I Homes, Inc.

Ann Marie W. Hunker, Vice President, Chief Accounting Officer and Controller, (614) 418-8225

Mark Kirkendall, Vice President, Treasurer, (614) 418-8021

M/I Homes, Inc. and Subsidiaries

Summary Statement of Income (Unaudited)

(Dollars and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| New contracts | 1,759 | | | 1,588 | | | 8,584 | | | 7,977 | |

| Average community count | 219 | | | 209 | | | 216 | | | 202 | |

| Cancellation rate | 14 | % | | 13 | % | | 10 | % | | 11 | % |

| Backlog units | 2,531 | | | 3,002 | | | 2,531 | | | 3,002 | |

| Backlog sales value | $ | 1,399,683 | | | $ | 1,575,643 | | | $ | 1,399,683 | | | $ | 1,575,643 | |

| Homes delivered | 2,402 | | | 2,019 | | | 9,055 | | | 8,112 | |

| Average home closing price | $ | 490 | | | $ | 471 | | | $ | 483 | | | $ | 483 | |

| | | | | | | |

| Homebuilding revenue: | | | | | | | |

| Housing revenue | $ | 1,175,883 | | | $ | 950,872 | | | $ | 4,375,829 | | | $ | 3,914,372 | |

| Land revenue | 882 | | | 2,025 | | | 12,635 | | | 25,301 | |

| Total homebuilding revenue | $ | 1,176,765 | | | $ | 952,897 | | | $ | 4,388,464 | | | $ | 3,939,673 | |

| | | | | | | |

| Financial services revenue | 28,512 | | | 19,691 | | | 116,206 | | | 93,829 | |

| | | | | | | |

| Total revenue | $ | 1,205,277 | | | $ | 972,588 | | | $ | 4,504,670 | | | $ | 4,033,502 | |

| | | | | | | |

| Cost of sales - operations | 908,452 | | | 728,202 | | | 3,305,781 | | | 3,014,573 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin | $ | 296,825 | | | $ | 244,386 | | | $ | 1,198,889 | | | $ | 1,018,929 | |

| General and administrative expense | 70,059 | | | 60,284 | | | 258,422 | | | 222,765 | |

| Selling expense | 62,775 | | | 54,256 | | | 234,373 | | | 208,942 | |

| Operating income | $ | 163,991 | | | $ | 129,846 | | | $ | 706,094 | | | $ | 587,222 | |

| | | | | | | |

| Other loss (income) | — | | | 1 | | | — | | | (33) | |

| Interest income, net of interest expense | (6,566) | | | (8,129) | | | (27,514) | | | (20,022) | |

| | | | | | | |

| Income before income taxes | $ | 170,557 | | | $ | 137,974 | | | $ | 733,608 | | | $ | 607,277 | |

| Provision for income taxes | 37,088 | | | 32,692 | | | 169,883 | | | 141,912 | |

| Net income | $ | 133,469 | | | $ | 105,282 | | | $ | 563,725 | | | $ | 465,365 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 4.85 | | | $ | 3.79 | | | $ | 20.29 | | | $ | 16.76 | |

| Diluted | $ | 4.71 | | | $ | 3.66 | | | $ | 19.71 | | | $ | 16.21 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 27,538 | | | 27,769 | | | 27,777 | | | 27,769 | |

| Diluted | 28,308 | | | 28,756 | | | 28,600 | | | 28,716 | |

M/I Homes, Inc. and Subsidiaries

Summary Balance Sheet and Other Information (unaudited)

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | |

| As of |

| December 31, |

| 2024 | | 2023 |

| Assets: | | | |

| Total cash, cash equivalents and restricted cash | $ | 821,570 | | | $ | 732,804 | |

| Mortgage loans held for sale | 283,540 | | | 176,329 | |

| Inventory: | | | |

| Lots, land and land development | 1,630,190 | | | 1,446,576 | |

| Land held for sale | 7,699 | | | 6,932 | |

| Homes under construction | 1,271,626 | | | 1,177,101 | |

| Other inventory | 182,347 | | | 166,542 | |

| Total Inventory | $ | 3,091,862 | | | $ | 2,797,151 | |

| | | |

| Property and equipment - net | 34,513 | | | 34,918 | |

| Operating lease right-of-use assets | 53,895 | | | 56,364 | |

| Goodwill | 16,400 | | | 16,400 | |

| Investments in joint venture arrangements | 65,334 | | | 44,011 | |

| Deferred income tax asset | 13,451 | | | 16,094 | |

| Other assets | 169,231 | | | 148,369 | |

| Total Assets | $ | 4,549,796 | | | $ | 4,022,440 | |

| | | |

| Liabilities: | | | |

| Debt - Homebuilding Operations: | | | |

| | | |

| | | |

| Senior notes due 2028 - net | 397,653 | | | 396,879 | |

| Senior notes due 2030 - net | 297,369 | | | 296,865 | |

| | | |

| | | |

| Total Debt - Homebuilding Operations | $ | 695,022 | | | $ | 693,744 | |

| | | |

| Notes payable bank - financial services operations | 286,159 | | | 165,844 | |

| Total Debt | $ | 981,181 | | | $ | 859,588 | |

| | | |

| Accounts payable | 198,579 | | | 204,678 | |

| Operating lease liabilities | 55,365 | | | 57,566 | |

| Other liabilities | 374,994 | | | 383,669 | |

| Total Liabilities | $ | 1,610,119 | | | $ | 1,505,501 | |

| | | |

| Shareholders’ Equity | 2,939,677 | | | 2,516,939 | |

| Total Liabilities and Shareholders’ Equity | $ | 4,549,796 | | | $ | 4,022,440 | |

| | | |

| Book value per common share | $ | 108.62 | | | $ | 90.66 | |

Homebuilding debt / capital ratio(1) | 19 | % | | 22 | % |

(1)The ratio of homebuilding debt to capital is calculated as the carrying value of our homebuilding debt outstanding divided by the sum of the carrying value of our homebuilding debt outstanding plus shareholders’ equity.

M/I Homes, Inc. and Subsidiaries

Selected Supplemental Financial and Operating Data

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

Cash provided by operating activities | $ | 104,395 | | | $ | 54,901 | | | $ | 179,736 | | | $ | 552,131 | |

| Cash used in investing activities | $ | (9,859) | | | $ | (4,500) | | | $ | (54,896) | | | $ | (18,632) | |

| Cash provided by (used in) financing activities | $ | 7,114 | | | $ | (53,849) | | | $ | (36,074) | | | $ | (112,237) | |

| | | | | | | |

| Land/lot purchases | $ | 107,384 | | | $ | 95,930 | | | $ | 472,937 | | | $ | 343,504 | |

| Land development spending | $ | 201,301 | | | $ | 159,550 | | | $ | 645,960 | | | $ | 512,105 | |

| Land sale revenue | $ | 882 | | | $ | 2,025 | | | $ | 12,635 | | | $ | 25,301 | |

| Land sale gross profit | $ | 391 | | | $ | 356 | | | $ | 3,709 | | | $ | 3,360 | |

| | | | | | | |

| Financial services pre-tax income | $ | 10,034 | | | $ | 4,676 | | | $ | 49,682 | | | $ | 38,354 | |

M/I Homes, Inc. and Subsidiaries

Non-GAAP Financial Results (1)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 133,469 | | | $ | 105,282 | | | $ | 563,725 | | | $ | 465,365 | |

| Add: | | | | | | | |

| Provision for income taxes | 37,088 | | | 32,692 | | | 169,883 | | | 141,912 | |

| Interest income - net | (10,177) | | | (10,908) | | | (40,719) | | | (30,030) | |

| Interest amortized to cost of sales | 8,181 | | | 7,724 | | | 32,053 | | | 33,326 | |

| Depreciation and amortization | 4,810 | | | 4,479 | | | 18,700 | | | 17,369 | |

| Non-cash charges | 9,709 | | | 13,241 | | | 23,808 | | | 20,247 | |

| Adjusted EBITDA | $ | 183,080 | | | $ | 152,510 | | | $ | 767,450 | | | $ | 648,189 | |

(1) We believe these non-GAAP financial measures are relevant and useful to investors in understanding our operations and may be helpful in comparing us with other companies in the homebuilding industry to the extent they provide similar information. These non-GAAP financial measures should be used to supplement our GAAP results in order to provide a greater understanding of the factors and trends affecting our operations.

M/I Homes, Inc. and Subsidiaries

Selected Supplemental Financial and Operating Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NEW CONTRACTS |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| | | | | % | | | | | | | % |

| Region | 2024 | | 2023 | | Change | | | 2024 | | 2023 | | Change |

| Northern | 707 | | | 699 | | | 1 | % | | | 3,761 | | | 3,361 | | | 12 | % |

| Southern | 1,052 | | | 889 | | | 18 | % | | | 4,823 | | | 4,616 | | | 4 | % |

| Total | 1,759 | | | 1,588 | | | 11 | % | | | 8,584 | | | 7,977 | | | 8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOMES DELIVERED |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| | | | | % | | | | | | | % |

| Region | 2024 | | 2023 | | Change | | | 2024 | | 2023 | | Change |

| Northern | 1,064 | | | 848 | | | 25 | % | | | 3,873 | | | 3,169 | | | 22 | % |

| Southern | 1,338 | | | 1,171 | | | 14 | % | | | 5,182 | | | 4,943 | | | 5 | % |

| Total | 2,402 | | | 2,019 | | | 19 | % | | | 9,055 | | | 8,112 | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BACKLOG |

| December 31, 2024 | | | December 31, 2023 |

| | | Dollars | | Average | | | | | Dollars | | Average |

| Region | Units | | (millions) | | Sales Price | | | Units | | (millions) | | Sales Price |

| Northern | 1,136 | | | $ | 637 | | | $ | 561,000 | | | | 1,248 | | | $ | 663 | | | $ | 531,000 | |

| Southern | 1,395 | | | $ | 763 | | | $ | 547,000 | | | | 1,754 | | | $ | 912 | | | $ | 520,000 | |

| Total | 2,531 | | | $ | 1,400 | | | $ | 553,000 | | | | 3,002 | | | $ | 1,576 | | | $ | 525,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| LAND POSITION SUMMARY |

| December 31, 2024 | | | December 31, 2023 |

| Lots | Lots Under | | | | Lots | Lots Under | |

| Region | Owned | Contract | Total | | | Owned | Contract | Total |

| Northern | 6,546 | | 11,076 | | 17,622 | | | | 6,852 | | 8,935 | | 15,787 | |

| Southern | 17,290 | | 17,244 | | 34,534 | | | | 17,522 | | 12,351 | | 29,873 | |

| Total | 23,836 | | 28,320 | | 52,156 | | | | 24,374 | | 21,286 | | 45,660 | |

v3.24.4

Cover Page Cover Page

|

Jan. 29, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

M/I HOMES, INC.

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

1-12434

|

| Entity Tax Identification Number |

31-1210837

|

| Entity Address, Address Line One |

4131 Worth Avenue

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Columbus

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43219

|

| City Area Code |

614

|

| Local Phone Number |

418-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $.01

|

| Trading Symbol |

MHO

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000799292

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

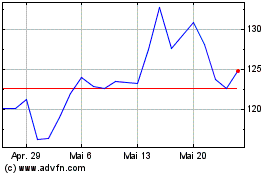

MI Homes (NYSE:MHO)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

MI Homes (NYSE:MHO)

Historical Stock Chart

Von Feb 2024 bis Feb 2025