false000169001200016900122023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 26, 2023 |

InPoint Commercial Real Estate Income, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-40833 |

32-0506267 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2901 Butterfield Road |

|

Oak Brook, Illinois |

|

60523 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (800) 826-8228 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share |

|

ICR PR A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: Certain statements in this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Words such as “may,” “could,” “should,” “expect,” “intend,” “plan,” “goal,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “variables,” “potential,” “continue,” “expand,” “maintain,” “create,” “strategies,” “likely,” “will,” “would” and variations of these terms and similar expressions indicate forward-looking statements. These forward-looking statements reflect the intent, belief or current expectations of our management based on their knowledge and understanding of the business and industry, the economy and other future conditions. These statements are not factual or guarantees of future performance, and we caution stockholders not to place undue reliance on them. Actual results may differ materially from those expressed or forecasted in forward-looking statements due to a variety of risks, uncertainties and other factors, including but not limited to risks related to blind pool offerings, best efforts offerings, use of short-term financing, borrower defaults, changing interest rates, the effects of the COVID-19 pandemic, particularly on hospitality and retail properties, including our hotel, and on related mortgage loans and securities and other risks detailed in the Risk Factors section in our most recent Annual Report on Form 10-K and in subsequent filings on Form 10-Q as filed with the Securities and Exchange Commission and made available on our website. Forward-looking statements reflect our management’s view only as of the date they are made and may ultimately prove to be incorrect. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results except as required by applicable law. We intend for these forward-looking statements to be covered by the applicable safe harbor provisions created by Section 27A of the Securities Act and Section 21E of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

InPoint Commercial Real Estate Income, Inc. (the “Company”) recorded a webinar for registered representatives to provide an update on the Company’s investment portfolio and to discuss the current economic environment. The webinar will be provided to invited registered representatives on July 27, 2023. A transcript of the webinar is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein solely for purposes of this Item 7.01 disclosure.

Pursuant to the rules and regulations of the U.S. Securities and Exchange Commission, the information in this Item 7.01 disclosure, including Exhibit 99.1 and the information set forth therein, is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. |

|

|

|

|

Date: |

July 26, 2023 |

By: |

/s/ Catherine L. Lynch |

|

|

|

Catherine L. Lynch

Chief Financial Officer |

Exhibit 99.1

Speaker 1 (00:15):

Welcome. My name is Mitchell Sabshon and I'm the Chairman and Chief Executive Officer of InPoint Commercial Real Estate Income, and with me today is Donald McKinnon, president of the company and the head of SoundPoint Commercial Real Estate, the company Subadvisor and Portfolio Manager. Today, Don and I will be providing an update on the REITs mortgage loan portfolio, the macroeconomic environment, and how it impacts commercial real estate overall and commercial real estate lending in particular, and our views on what the future may look like before we go into the macroeconomic environment. Don, can you please provide an update on Sound Point's management of the InPoint portfolio as of June 30th, 2023?

Speaker 2 (01:03):

Absolutely, Mitchell. As of June 30th, the portfolio size was $804 million. The portfolio consists of 40 originated loans, 38 of which are floating rate first mortgage loans. Portfolio is well diversified geographically and from a sector perspective, regional diversification shows 43% of the portfolio in the southeastern United States, 27% of the portfolio in the southwestern part of the United States, 16% in the West, with the remainder across mid-Atlantic Plains and Great Lakes regions sector diversification shows 58% of the portfolio backed by multifamily properties. 22% of the portfolio backed by office properties, 8% of the portfolio backed by industrial properties with the remainder in mixed use retail with one hospitality loan on a property that has been performing very well coming out of Covid.

Speaker 1 (02:11):

Great. Thanks, Don. Now let's turn to the economy. The first half of 2023 had many investors and businesses questioning the state of the US economy and where the commercial real estate industry was heading as we entered the second half of 2023. A variety of factors has led to a unique economic environment. Back in late March, early April, several small to mid-size US banks failed, triggering a brief but sharp decline in stock prices and contributed to the already tightened credit market. However, headline inflation for the month of June was reported at 3% the lowest yield inflation rate since March, 2021. That made it 12 consecutive months of decreasing inflation with the rate now down by more than six percentage points from its peak in June, 2022 of 9.1%. Additionally, in early June, Congress passed the debt ceiling bill, which will suspend the nation's debt limit through January 1st, 2025. These factors collectively influenced the Federal Reserve's decision making process and after 10 consecutive interest rate heights, the Fed took a breather and left the federal fund's target rate unchanged at a range of five to five and a quarter percent.

(03:34):

This pause marked the first policy meeting at which the FOMC has not raised interest rates since it began its monetary policy tightening cycle in March, 2022. Prior to this pause rate hike significantly impacted commercial real estate transaction volumes and property pricing as interest rates rise, of course, borrowing costs increase, which can deter some potential buyers and investors from entering the market, higher financing expenses can make real estate acquisitions less attractive. In fact, deal volume in the first quarter was down 51% year over year, and as of May, commercial property prices declined on average by 15% year over year. Don, can you help us understand Sound Point's view of what that means for commercial real estate?

Speaker 2 (04:27):

Sure. Mitchell. The real answer is it's hard to tell for certain in a rising rate market like this, many prospective investors fear catching the proverbial “falling knife”. Let me explain. If the Fed begins to

raise rates again and it's forecasted that two more rate hikes may take place before year end, commercial real estate prices may continue to be negatively impacted as buyers are unsure that the price they may be paying today will not be even lower six or nine months from now. Hence, catching the falling knife. If the fed halts for the rate increases or ultimately begins to lower rates, we anticipate investors will have a greater degree of confidence in valuations and commercial real estate deal volume will gradually start to recover.

Speaker 1 (05:18):

Great. With that backdrop, Don, what is Sound Point's view of commercial mortgage refinancing today and how do all of these macroeconomic events impact credit markets and commercial real estate lending?

Speaker 2 (05:31):

Well, under current market conditions, certain investors will be impacted by mortgage loan refinancing challenges for perspective new investors or investors with more recent commercial real estate investments. In both cases with longer term investment horizons of five to 10 years, which is typical for commercial real estate investments, current market conditions will not likely be problematic in any material way. On the other hand, for those investors with existing investments that have mortgage loans with near term maturities, those coming due within the next six to 12 months or so, the situation may be more challenging. Industry reports suggest that approximately 1.5 trillion in commercial mortgages will be due for refinancing during the near term. Many, including regulators, are concerned about the increased risk that loans already on bank books will encounter greater difficulty in being repaid through a refinancing with another lender or through proceeds from the sale of the property. As a result, most banks are currently reducing their commercial real estate lending to increased reserves brace for potential of loans not being repaid in full when due along with significantly higher interest rates. Today, this reduced availability of bank lending will make it difficult for real estate borrowers to refinance or repay their maturing loans. Given this challenging environment, there's an accounting issue that likely impacts all mortgage rates, including InPoint. Mitchell, do you want to discuss the current expected credit loss accounting requirement known as “CECL” and how it affects InPoint?

Speaker 1 (07:18):

Don accounting standards require mortgage lenders like InPoint to make quarterly estimates of something called the current expected credit loss, which impacts net income and net asset value – “NAV”. Given the macroeconomic environment, especially interest rates and as a result, the higher yields required to attract new commercial real estate investments, which means lower current commercial real estate values. CECL requires mortgage REITs like InPoint to review the loans in our portfolio, the value of the property securing each of our mortgage loans and our borrower's ability to refinance or otherwise pay off our loans when due. As a result for the second quarter of the year, SoundPoint has determined the change in allowance for our portfolio was a CECL Reserve of approximately $11.6 million, resulting in a decrease in the June 30 NAV per share of approximately $1 and 14 cents. This change in allowance is related to five specific mortgage loans in our portfolio that is scheduled to mature before December 31st of this year. Four of the five mortgages are backed by office properties, a sector which has experienced significant dislocation over the last three years, as we all know. Let me quickly add that each of these five loans is currently performing in accordance with their terms that the CECL loan loss reserve is an estimate required by accounting rules and may or not be realized in the future. I hope that helps.

Speaker 2 (08:54):

Thanks. That's very helpful in understanding how this accounting requirement affects the company's net asset value.

Speaker 1 (09:01):

This concludes our update. We want to thank you for joining us today. Of course, it is important that you be well-informed on the state of the company, and toward that end, we will continue to provide updates pertaining to our portfolio as well as progress related to our process evaluating strategic alternatives. Feel free to reach out to your Inland wholesaler or our investor services team with any questions you may have. Thank you.

v3.23.2

Document And Entity Information

|

Jul. 26, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 26, 2023

|

| Entity Registrant Name |

InPoint Commercial Real Estate Income, Inc.

|

| Entity Central Index Key |

0001690012

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-40833

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

32-0506267

|

| Entity Address, Address Line One |

2901 Butterfield Road

|

| Entity Address, City or Town |

Oak Brook

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60523

|

| City Area Code |

(800)

|

| Local Phone Number |

826-8228

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

ICR PR A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

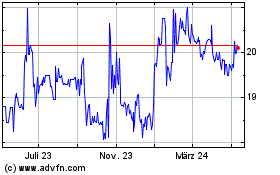

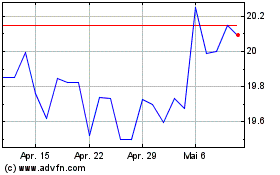

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024