Second highest revenues, silver reserves and

production; Expecting silver production growth

For The Period Ended: December 31, 2023

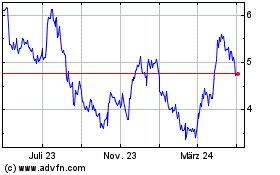

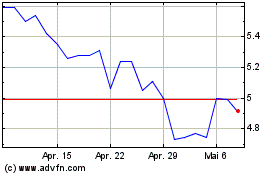

Hecla Mining Company (NYSE:HL) ("Hecla" or the "Company") today

announced fourth quarter 2023 financial and operating results.

HIGHLIGHTS

- Silver reserves of 238 million ounces, silver production of

14.3 million ounces, and total sales of $720.2 million, all are the

second highest in Company history.

- Lucky Friday restarted production on January 9th, with first

insurance proceeds received in February.

- Hecla received a U.S. patent for the Underhand Closed Bench

("UCB") mining method.

- Greens Creek achieved record throughput and generated $157.3

million in cash flow from operations and free cash flow of $121.6

million.2

- Casa Berardi began the transition to surface only mining with

results exceeding expectations.

- Keno Hill began silver production in the second half of the

year, focusing on improving safety and environmental performance

while completing major infrastructure projects.

- Completed Technical Report Summary for Keno Hill and Casa

Berardi demonstrating the value of the assets.

- All-Injury Frequency Rate ("AIFR") of 1.45, lower than the

national average, Greens Creek and Lucky Friday recorded their

lowest AIFR of 0.29 and 0.66, respectively.

"Hecla reported the second largest silver reserves, largest gold

resource, and second highest silver production and revenues in our

history despite the Lucky Friday losing five months of production

due to a fire," said Phillips S. Baker Jr, President and CEO.

"Greens Creek delivered another year of strong and consistent

performance as we increased throughput. Casa Berardi exceeded our

expectations for tons and cost per ton from operating our own

surface fleet, and this strong performance is reflected in the

updated technical report. At Keno Hill, we slowed the ramp-up of

the mine due to the safety and environmental performance; however,

with the silver grade over twice the grade of our other mines, it

still contributed significantly to our silver production and, as

the technical report shows, it will contribute even more in the

future."

Baker continued, "Because of the suspension of production at

Lucky Friday due to the fire and continued investment in ramp-up at

Keno Hill, we have drawn on our revolving credit facility which we

expect to pay down in 2024 with all four mines in operation and

anticipated receipt of approximately $50 million of insurance

proceeds. With Lucky Friday back in production and Keno Hill's

continued ramp-up, we expect silver production to increase by

15-20% this year, and 30% by 2026, making Hecla one of the world’s

fastest growing silver companies."

Baker concluded, "2023 was also a significant year in the energy

transition as 75% of the world’s new renewable electric power

generation capacity was solar, requiring 500,000 ounces per

gigawatt of new installed capacity, which equates to as much as 190

million ounces of silver in solar demand. China alone installed as

much solar as the entire world did in 2022, and significant new

solar facilities are now planned for the United States. As the

demand for silver in solar continues to rise, Hecla, the largest

silver producer in the U.S., and soon Canada, is well positioned to

leverage higher expected silver prices driven by increasing

demand."

FINANCIAL OVERVIEW

In the following table and throughout this release, "total cost

of sales" is comprised of cost of sales and other direct production

costs and depreciation, depletion and amortization; "prior year"

refers to 2022, and "prior quarter" refers to the third quarter of

2023. In section ‘Operations Overview’, free cash flow for

operations excludes hedging adjustments.2

In Thousands unless stated otherwise

4Q-2023

3Q-2023

2Q-2023

1Q-2023

4Q-2022

FY-2023

FY-2022

FINANCIAL AND PRODUCTION

SUMMARY

Sales

$

160,690

$

181,906

$

178,131

$

199,500

$

194,825

$

720,227

$

718,905

Total cost of sales

$

153,825

$

148,429

$

140,472

$

164,552

$

169,807

$

607,278

$

602,749

Gross profit

$

6,865

$

33,477

$

37,659

$

34,948

$

25,018

$

112,949

$

116,156

Net loss applicable to common

stockholders

$

(43,073

)

$

(22,553

)

$

(15,832

)

$

(3,311

)

$

(4,590

)

$

(84,769

)

$

(37,900

)

Basic loss per common share (in

dollars)

$

(0.07

)

$

(0.04

)

$

(0.03

)

$

(0.01

)

$

(0.01

)

$

(0.14

)

$

(0.07

)

Adjusted EBITDA1

$

36,661

$

46,251

$

67,740

$

61,901

$

62,261

$

212,553

$

217,492

Total Debt

$

662,815

$

551,841

Net Debt to Adjusted EBITDA1

2.6

1.9

Cash provided by operating activities

$

884

$

10,235

$

23,777

$

40,603

$

36,120

$

75,499

$

89,890

Capital Expenditures

$

(62,622

)

$

(55,354

)

$

(51,468

)

$

(54,443

)

$

(56,140

)

$

(223,887

)

$

(149,378

)

Free Cash Flow2

$

(61,738

)

$

(45,119

)

$

(27,691

)

$

(13,840

)

$

(20,020

)

$

(148,388

)

$

(59,488

)

Silver ounces produced

2,935,631

3,533,704

3,832,559

4,040,969

3,663,433

14,342,863

14,182,987

Silver payable ounces sold

2,847,591

3,142,227

3,360,694

3,604,494

3,756,701

12,955,006

12,311,595

Gold ounces produced

37,168

39,269

35,251

39,571

43,634

151,259

175,807

Gold payable ounces sold

33,230

36,792

31,961

39,619

40,097

141,602

165,818

Cash Costs and AISC, each after

by-product credits

Silver cash costs per ounce 4

$

4.94

$

3.31

$

3.32

$

2.14

$

4.79

$

3.23

$

2.06

Silver AISC per ounce 4

$

17.48

$

11.39

$

11.63

$

8.96

$

13.98

$

11.76

$

10.66

Gold cash costs per ounce 4

$

1,702

$

1,475

$

1,658

$

1,775

$

1,696

$

1,652

$

1,478

Gold AISC per ounce 4

$

1,969

$

1,695

$

2,147

$

2,392

$

2,075

$

2,048

$

1,773

Realized Prices

Silver, $/ounce

$

23.47

$

23.71

$

23.67

$

22.62

$

22.03

$

23.33

$

21.53

Gold, $/ounce

$

1,998

$

1,908

$

1,969

$

1,902

$

1,757

$

1,939

$

1,803

Lead, $/pound

$

1.09

$

1.07

$

0.99

$

1.02

$

1.05

$

1.03

$

1.01

Zinc, $/pound

$

1.39

$

1.52

$

1.13

$

1.39

$

1.24

$

1.35

$

1.41

Sales in 2023 increased to $720.2 million as higher realized

prices for silver and gold offset lower gold and lead sales

volumes. Gold production declined due to Casa Berardi reducing

underground production as it transitions to a surface only

operation by mid-2024. Lead production declined due to the

temporary suspension of production at the Lucky Friday.

Gross profit in 2023 was $112.9 million, a decrease of 3% over

the prior year. The decrease is attributable to (i) lower gross

profit at Casa Berardi due to lower sales volumes and accelerated

depreciation, depletion, and amortization based on the shorter

underground mine life, and (ii) only seven months of production at

Lucky Friday partially offset by higher gross profit realized at

Greens Creek.

Net loss applicable to common stockholders for the year was

$84.8 million, an increase over the prior year primarily related

to:

- Ramp-up and suspension costs increased by $52.1 million,

reflecting the impact of the Lucky Friday suspension, and the

ramp-up of production at Keno Hill.

- A foreign exchange loss of $3.8 million, compared to a gain of

$7.2 million in the prior year, reflecting the impact of the U.S.

dollar appreciation on Canadian dollar denominated monetary assets

and liabilities.

- An income tax provision of $1.2 million, compared to a benefit

of $7.6 million due to an increase in the valuation allowance for

losses incurred by Keno Hill during the year.

The above items were partly offset by:

- A decrease in exploration and pre-development expense of $13.5

million due to lower spend at Casa Berardi, Mexico, and Nevada

sites, partially offset by higher spend at Greens Creek and Keno

Hill.

- Fair value adjustments, net, changed from a loss to a gain,

increasing by $7.6 million, reflecting unrealized gains on our

marketable securities portfolio and de-designated hedging

contracts.

- Other operating income of $1.4 million, compared to other

operating expense of $6.3 million, reflecting the receipt of $5.9

million from an insurance settlement (unrelated to Lucky

Friday).

Consolidated silver total cost of sales in 2023 was $379.6

million and increased by 9% from the prior year, primarily due to

the temporary suspension of production at Lucky Friday during the

year offset by higher labor and maintenance costs at Greens Creek.

Cash costs and AISC per silver ounce, each after by-product

credits, were $3.23 and $11.76, respectively, and increased over

the prior year primarily due to lower by-product credits (primarily

lower lead and zinc production and lower realized prices for zinc)

and lower silver production.3,4

Consolidated gold total cost of sales decreased by 10% to $227.7

million primarily due to lower production costs at Casa Berardi as

the underground East Mine ceased production given the strategic

change announced in August to transition to a surface only

operation with underground operations expected to be completed in

mid-2024. Cash costs and AISC per gold ounce, each after by-product

credits, were $1,652 and $2,048, respectively and increased over

the prior year as lower gold production offset lower production

costs and sustaining capital investment.3,4

Adjusted EBITDA for the year was $212.6 million, in line with

the prior year. The ratio of net debt to adjusted EBITDA increased

to 2.6 due to higher net debt attributable to draws on the credit

facility and the use of cash reflecting the Company's investment in

Keno Hill's development, and the temporary suspension of operations

at the Lucky Friday.1 Cash and cash equivalents at the end of the

fourth quarter were $106.4 million and included $128 million drawn

on the revolving credit facility.

Cash provided by operating activities was $75.5 million and

decreased by $14.4 million from the prior year primarily due to

higher ramp-up and suspension costs and unfavorable working capital

changes.

Capital expenditures, net of finance leases, were $223.9 million

in 2023, compared to $149.4 million in 2022. The increase was due

to (i) higher capital investment at Casa Berardi, primarily for

tailings construction activities and mobile equipment purchases for

the open pit operations, (ii) mine development and infrastructure

projects at Keno Hill, (iii) restart plans to establish an

alternative secondary escapeway as a result of the fire and

completion of the service hoist and the coarse ore bunker at Lucky

Friday and (iv) other sustaining capital projects at Greens

Creek.

Free cash flow for the year was negative $148.4 million,

compared to negative $59.5 million in the prior year, with the

decrease primarily due to higher capital expenditures.2

Forward Sales Contracts for Base Metals and Foreign

Currency

The Company uses financially settled forward sales contracts to

manage exposures to zinc and lead price changes in forecasted

concentrate shipments. On December 31, 2023, the Company had

contracts covering approximately 50% of the forecasted payable lead

production from 2024 - 2025 at an average price of $0.98 per

pound.

The Company also manages Canadian dollar ("CAD") exposure

through forward contracts. At December 31, 2023, the Company had

hedged approximately 60% of forecasted Casa Berardi and Keno Hill

CAD denominated direct production costs through 2026 at an average

CAD/USD rate of 1.32. The Company has also hedged approximately 26%

of Casa Berardi and Keno Hill CAD denominated total capital

expenditures through 2026 at 1.35.

OPERATIONS OVERVIEW

Greens Creek Mine - Alaska

Dollars are in thousands except cost per

ton

4Q-2023

3Q-2023

2Q-2023

1Q-2023

4Q-2022

FY-2023

FY-2022

GREENS CREEK

Tons of ore processed

220,186

228,978

232,465

233,167

230,225

914,796

881,445

Total production cost per ton

$

223.98

$

200.30

$

194.94

$

198.60

$

211.29

$

204.20

$

196.73

Ore grade milled - Silver (oz./ton)

12.9

13.1

12.8

14.4

13.1

13.3

13.6

Ore grade milled - Gold (oz./ton)

0.09

0.09

0.10

0.08

0.08

0.09

0.08

Ore grade milled - Lead (%)

2.8

2.5

2.5

2.6

2.6

2.6

2.7

Ore grade milled - Zinc (%)

6.5

6.5

6.5

6.0

6.7

6.4

6.7

Silver produced (oz.)

2,260,027

2,343,192

2,355,674

2,772,859

2,433,275

9,731,752

9,741,935

Gold produced (oz.)

14,651

15,010

16,351

14,884

12,989

60,896

48,216

Lead produced (tons)

4,910

4,740

4,726

5,202

4,985

19,578

19,480

Zinc produced (tons)

12,535

13,224

13,255

12,482

13,842

51,496

52,312

Sales

$

93,543

$

96,459

$

95,891

$

98,611

$

95,374

$

384,504

$

335,062

Total cost of sales

$

(70,231

)

$

(60,322

)

$

(63,054

)

$

(66,288

)

$

(70,075

)

$

(259,895

)

$

(232,718

)

Gross profit

$

23,312

$

36,137

$

32,837

$

32,323

$

25,299

$

124,609

$

102,344

Cash flow from operations

$

34,576

$

36,101

$

43,302

$

43,346

$

44,769

$

157,325

$

150,621

Exploration

$

1,324

$

4,283

$

1,760

$

448

$

1,050

$

7,815

$

5,920

Capital additions

$

(15,996

)

$

(12,060

)

$

(8,828

)

$

(6,658

)

$

(12,150

)

$

(43,542

)

$

(36,898

)

Free cash flow 2

$

19,904

$

28,324

$

36,234

$

37,136

$

33,669

$

121,598

$

119,643

Cash cost per ounce, after by-product

credits 3

$

4.94

$

3.04

$

1.33

$

1.16

$

4.26

$

2.53

$

0.70

AISC per ounce, after by-product credits

4

$

12.00

$

8.18

$

5.34

$

3.82

$

8.61

$

7.14

$

5.17

Greens Creek produced 9.7 million ounces of silver in 2023, in

line with the prior year. Gold production increased 26% to 60,896

ounces due to higher throughput and grades. Lead production was

consistent with the prior year while zinc production declined 2%

due to lower grades. The mine achieved record throughput, which has

increased 25% since the Company became the operator in 2008.

Sales in the fourth quarter were $93.5 million, a decrease of 3%

over the prior quarter, as higher realized gold prices and higher

silver and lead sales volumes were offset by lower gold and zinc

sales volumes and lower realized silver prices. Total cost of sales

was $70.2 million, an increase of 16% over the prior quarter

primarily due to higher production costs attributable to higher

labor costs, increased fuel usage following three significant

weather events that resulted in twelve days of lost production

during the fourth quarter, and higher maintenance costs. Cash costs

and AISC per silver ounce, each after by-product credits, were

$4.94 and $12.00 and increased over the prior quarter primarily due

to lower base metal by-product credits (primarily zinc due to lower

production), higher production costs and lower silver production.

Increased AISC per silver ounce after by-product credits was

attributable to higher sustaining capital investment of $15.2

million ($11.3 million in the prior quarter) due to the timing of

equipment purchases and surface projects.3,4 Cash flow from

operations was $34.6 million, in line with the prior quarter.

Capital investment was $16.0 million during the quarter, an

increase of $3.9 million over the prior quarter due to the timing

of equipment purchases and planned construction projects. Free cash

flow for the quarter was $19.9 million, a decrease over the prior

quarter due to higher capital investment.

Sales in 2023 were $384.5 million, an increase of 15% compared

to the prior year as higher realized precious metals prices and

higher gold volumes were partially offset by lower silver and zinc

sales volumes. Total cost of sales increased 12% to $259.9 million

due to higher labor costs, higher consumable volumes to support

record throughput in 2023, and related higher mill and equipment

maintenance costs. Cash costs and AISC per silver ounce (each after

by-product credits) were $2.53 and $7.14, respectively, higher than

the prior year due to the abovementioned reasons.3,4 The increase

in AISC was also impacted by higher planned sustaining capital

investments during the year. Cash flow from operations for the year

was $157.3 million and increased 4% over the prior year. Free cash

flow generation for the year was $121.6 million and increased 2%

over the prior year as higher sales were partially offset by higher

costs and capital investment. 2

Lucky Friday Mine - Idaho

Dollars are in thousands except cost per

ton

4Q-2023

3Q-2023

2Q-2023

1Q-2023

4Q-2022

FY-2023

FY-2022

LUCKY FRIDAY

Tons of ore processed

5,164

36,619

94,043

95,303

90,935

231,129

356,907

Total production cost per ton

$

201.42

$

191.81

$

248.65

$

210.72

$

232.73

$

218.45

$

223.55

Ore grade milled - Silver (oz./ton)

12.7

13.6

14.3

13.8

14.0

14.0

13.0

Ore grade milled - Lead (%)

8.0

8.6

9.1

8.8

9.1

8.9

8.7

Ore grade milled - Zinc (%)

3.5

3.5

4.2

4.1

4.1

4.1

3.9

Silver produced (oz.)

61,575

475,414

1,286,666

1,262,464

1,224,199

3,086,119

4,412,764

Lead produced (tons)

372

2,957

8,180

8,034

7,934

19,543

29,233

Zinc produced (tons)

134

1,159

3,338

3,313

3,335

7,944

12,436

Sales

$

3,117

$

21,409

$

42,648

$

49,110

$

45,434

$

116,284

$

147,814

Total cost of sales

$

(3,117

)

$

(14,344

)

$

(32,190

)

$

(34,534

)

$

(32,819

)

$

(84,185

)

$

(116,598

)

Gross profit

$

—

$

7,065

$

10,458

$

14,576

$

12,615

$

32,099

$

31,216

Cash flow from operations

$

(7,982

)

$

515

$

18,893

$

46,132

$

(7,437

)

$

57,558

$

37,813

Capital additions

$

(18,819

)

$

(15,494

)

$

(16,317

)

$

(14,707

)

$

(13,714

)

$

(65,337

)

$

(50,992

)

Free cash flow 2

$

(26,801

)

$

(14,979

)

$

2,576

$

31,425

$

(21,151

)

$

(7,779

)

$

(13,179

)

Cash cost per ounce, after by-product

credits 3

N/A

$

4.74

$

6.96

$

4.30

$

5.82

$

5.51

$

5.06

AISC per ounce, after by-product credits

4

N/A

$

10.63

$

14.24

$

10.69

$

12.88

$

12.21

$

12.86

Lucky Friday produced 3.1 million ounces of silver for the year,

a decrease of 30% over the prior year due to the suspension of

production beginning in August through the end of the year due to a

fire in the secondary escapeway (#2 shaft).

The mine restarted production on January 9, 2024 and is expected

to ramp-up to full production in the first quarter of 2024. The

work executed to resume production was completed on schedule and

within cost expectations (approximately $12 million). This work

involved developing a new secondary egress consisting of a ramp of

1,600 feet and a 290-foot vertical escapeway. The Company has

property and business interruption insurance, with an applicable

underground sublimit coverage of $50 million, which is expected to

cover a majority of the expenses and business interruption (net of

the deductibles). The first insurance payment has been received and

the Company expects to receive remaining insurance payments through

the year.

Sales in 2023 were $116.3 million, a decrease of 21% over the

prior year due to lower production and sales volumes. Gross profit

in 2023 was $32.1 million, an increase of 3% over 2022, due to

higher realized silver and lead prices and higher production prior

to the suspension of production. Cash flow from operations for the

year was $57.6 million, an increase of 52% over the prior year due

to favorable working capital changes, which included a $31 million

reduction in accounts receivable. Capital investment, net of

leases, for the year was $65.3 million, compared to $50.9 million

in the prior year with the increase attributable to production

restart work to reestablish the secondary egress, construction of

the coarse ore bunker, which allows a stockpile of ore to be stored

on surface, and the service hoist project. Free cash flow was

negative $7.8 million due to increased capital investment for the

year that offset higher cash flow from operations.2

Casa Berardi - Quebec

Dollars are in thousands except cost per

ton

4Q-2023

3Q-2023

2Q-2023

1Q-2023

4Q-2022

FY-2023

FY-2022

CASA BERARDI

Tons of ore processed - underground

104,002

112,544

94,124

110,245

160,150

420,915

660,550

Tons of ore processed - open pit

251,009

231,075

224,580

318,909

250,883

1,025,573

928,189

Tons of ore processed - total

355,011

343,619

318,704

429,154

411,033

1,446,488

1,588,739

Surface tons mined - ore and waste

4,639,770

3,574,391

2,461,196

2,136,993

2,657,638

12,812,350

9,522,295

Total production cost per ton

$

108.20

$

103.75

$

97.69

$

107.95

$

125.75

$

104.75

$

117.89

Ore grade milled - Gold (oz./ton) -

underground

0.11

0.13

0.14

0.13

0.15

0.11

0.16

Ore grade milled - Gold (oz./ton) - open

pit

0.05

0.06

0.04

0.05

0.05

0.04

0.05

Ore grade milled - Gold (oz./ton) -

combined

0.07

0.08

0.07

0.07

0.09

0.07

0.09

Gold produced (oz.) - underground

11,206

12,416

10,226

11,788

20,365

45,636

84,786

Gold produced (oz.) - open pit

11,311

11,843

8,675

12,898

10,344

44,727

42,804

Gold produced (oz.) - total

22,517

24,259

18,901

24,686

30,709

90,363

127,590

Silver produced (oz.) - total

5,730

5,084

5,956

5,645

5,960

22,415

28,289

Sales

$

42,822

$

46,912

$

36,946

$

50,998

$

53,458

$

177,678

$

235,136

Total cost of sales

$

(58,945

)

$

(56,822

)

$

(42,576

)

$

(62,998

)

$

(65,328

)

$

(221,341

)

$

(248,898

)

Gross (loss) profit

$

(16,123

)

$

(9,910

)

$

(5,630

)

$

(12,000

)

$

(11,870

)

$

(43,663

)

$

(13,762

)

Cash flow from (used in) operations

$

3,136

$

7,877

$

(8,148

)

$

(684

)

$

10,188

$

2,181

$

34,415

Exploration

$

635

$

1,482

$

1,107

$

1,054

$

1,637

$

4,278

$

8,237

Capital additions

$

(15,929

)

$

(16,225

)

$

(20,816

)

$

(17,086

)

$

(12,995

)

$

(70,056

)

$

(39,667

)

Free cash flow 2

$

(12,158

)

$

(6,866

)

$

(27,857

)

$

(16,716

)

$

(1,170

)

$

(63,597

)

$

2,985

Cash cost per ounce, after by-product

credits 3

$

1,702

$

1,475

$

1,658

$

1,775

$

1,696

$

1,652

$

1,478

AISC per ounce, after by-product credits

4

$

1,969

$

1,695

$

2,147

$

2,392

$

2,075

$

2,048

$

1,773

Casa Berardi produced 90,363 ounces of gold in 2023, a decrease

of 29% over the prior year due to wildfire-related closures in June

and lower underground tonnage mined, reflecting the decision to

halt underground mining in the East Mine as part of the strategic

change announced in August to transition to a surface operation by

mid-2024. Open pit tons moved during the year set a record as the

first phase of the in-house equipment fleet was commissioned.

Sales in the fourth quarter were $42.8 million, a 9% decrease

over the prior quarter due to lower gold sales volumes. Total cost

of sales was $58.9 million, an increase of 4% over the prior

quarter, attributable to higher production costs and an increase in

non-cash depreciation, depletion, and amortization expense due to

amortizing the underground mine assets over a shorter useful life

as the mine transitions to a surface only operation. Cash costs and

AISC per gold ounce, each after by-product credits, were $1,702 and

$1,969, respectively, and increased over the prior quarter due to

higher production costs attributable to higher ore and waste tons

mined and milled during the quarter and lower gold production.3,4

Cash flow from operations was $3.1 million and decreased over the

prior quarter due to lower sales and higher costs. Capital

investment for the quarter was $15.9 million, with $5.8 million and

$10.1 million in sustaining and non-sustaining capital investment,

respectively. Non-sustaining capital was primarily related to

construction costs for tailings facilities. Free cash flow for the

quarter was negative $12.2 million and decreased over the prior

quarter due to lower cash flow from operations.2

Sales for 2023 were $177.7 million and decreased 24% over the

prior year due to lower gold production partially offset by higher

gold prices. Full-year total cost of sales was $221.3 million and

decreased 11% year over year due to lower production costs

attributable to lower underground production. Cash costs and AISC

per gold ounce, each after by-product credits, were $1,652 and

$2,048, respectively.3,4 The year over year increase in cash costs

and AISC per gold ounce was primarily attributable to lower gold

production in 2023. Cash flow from operations for the year was $2.2

million. Capital investment increased to $70.1 million primarily

due to purchases of new surface fleet equipment as the mine

transitions from an underground to an open pit operation and the

construction of tailings storage facilities.

The Company expects to file a revised Technical Report Summary

for Casa Berardi with its Annual Report on Form 10-K on February

15, 2024. The Technical Report Summary projects (1) a 14-year open

pit mine life, (2) life of mine gold production of 1.27 million

ounces at an average grade of 0.08 opt (2.75 grams per tonne), and

(3) capital of $498 million. The mine's after-tax NPV (5%) is

estimated at $347 million at a gold price assumption of

$1,950/oz.

Keno Hill - Yukon Territory

Dollars are in thousands except cost per

ton

4Q-2023

3Q-2023

2Q-2023

1Q-2023

FY-2023

KENO HILL

Tons of ore processed

19,651

24,616

12,064

—

56,331

Total production cost per ton

$

145.36

$

88.97

$

202.66

$

—

$

153.64

Ore grade milled - Silver (oz./ton)

31.7

33.0

20.2

—

27.7

Ore grade milled - Lead (%)

2.6

2.4

2.5

—

2.3

Ore grade milled - Zinc (%)

1.6

2.5

4.1

—

2.5

Silver produced (oz.)

608,301

710,012

184,264

—

1,502,577

Lead produced (tons)

481

327

417

—

1,225

Zinc produced (tons)

396

252

691

—

1,339

Sales

$

17,936

$

16,001

$

1,581

—

$

35,518

Total cost of sales

$

(17,936

)

$

(16,001

)

$

(1,581

)

—

$

(35,518

)

Gross profit

$

—

$

—

$

—

$

—

$

—

Cash flow from operations

$

1,181

$

(6,200

)

$

(12,900

)

$

(6,324

)

$

(24,243

)

Exploration

$

1,548

$

1,653

$

1,039

$

437

$

4,677

Capital additions

$

(12,549

)

$

(11,498

)

$

(3,505

)

$

(17,120

)

$

(44,672

)

Free cash flow 2

$

(9,820

)

$

(16,045

)

$

(15,366

)

$

(23,007

)

$

(64,238

)

Keno Hill continued ramping up production and produced 1.5

million ounces of silver in 2023. Tonnage mined was constrained

during the year by delays in infrastructure construction which

impacted development rates and resulted in a slower ramp-up.

Capital investment in 2023 totaled $44.7 million and comprised key

infrastructure projects, including the shotcrete plant, cemented

rock fill plant, and upgrades to mill infrastructure, including the

secondary crushing circuit. The Company has executed a safety

action plan, which will be executed over the year and will focus on

training, supervision, mining practices, and implementation of

safety processes.

The Company expects to file its initial Technical Report Summary

for Keno Hill with its Annual Report on Form 10-K on February 15,

2024. The Technical Report Summary projects an 11-year reserve mine

life and life of mine silver production of 53 million ounces at an

average grade of 26.6 ounces per ton. 5-year average silver

production is expected to be 4.4 million ounces as throughput is

expected to increase to 600 tpd in 2028. The mine's after-tax NPV

(5%) is estimated at $305 million at a silver price assumption of

$22/oz.

Keno Hill is expected to produce 2.7-3.0 million ounces of

silver in 2024 as the mine ramps up production. Expenditures on

production costs, excluding depreciation, are expected to be

$15-$17 million per quarter. The Company will provide guidance for

cash costs and AISC per silver ounce, each after by-product

credits, once the mine reaches commercial production which is

expected during the year.

Keno Hill's silver reserves at year-end 2023 were 55 million

ounces and have increased by 45% over the reserves identified at

the time of acquisition in September 2022. In addition, measured

and indicated resources increased by 5%, and inferred resources

increased by 25% over the prior year.

EXPLORATION AND PRE-DEVELOPMENT

Exploration and pre-development expenses totaled $7.0 million

for the fourth quarter and $32.5 million for the entire year.

During the fourth quarter, exploration activities focused on

targets at Keno Hill, Greens Creek, and Casa Berardi.

For the year ended 2023, the Company reported silver reserves of

238 million ounces, the second highest in the Company's history and

1% lower than 2022. A breakdown of the Company's reserves and

resources is located in Table A at the end of this news

release.

For further details on the Company's 2023 exploration and

pre-development program and 2024 planned expenditures as well as

reserves and resources at year-end 2023, please refer to the news

release entitled "Hecla Reports Exploration Results and Reserves"

released on February 13, 2024.

DIVIDENDS

Common Stock

The Board of Directors declared a quarterly cash dividend of

$0.00625 per share of common stock, consisting of $0.00375 per

share for the minimum dividend component and $0.0025 per share for

the silver-linked component. The common stock dividend is payable

on or about March 25, 2024, to stockholders of record on March 12,

2024. The fourth quarter realized silver price was $23.47,

satisfying the criterion for the Company’s common stock

silver-linked dividend policy component.

Preferred Stock

The Board of Directors declared a quarterly cash dividend of

$0.875 per share of preferred stock, payable on or about April 1,

2024, to stockholders of record on March 15, 2024.

2024 GUIDANCE 6

The Company is providing a three-year production outlook and

2024 estimates of costs, capital and exploration, and

pre-development expenses.

Consolidated silver production is expected to increase to

16.5-17.5 million ounces in 2024 and increase by 30% (compared to

2023) to 18.0-20.0 million ounces by 2026. Greens Creek's silver

production is expected to decrease in 2024 due to expected lower

silver mined grades attributable to mine sequencing, which is also

expected to result in lower gold and higher zinc production. Lucky

Friday's silver production guidance is 5.0-5.3 million ounces, with

the ramp up to full production expected to be complete in the first

quarter. Silver production from Keno Hill is forecasted to be

2.7-3.0 million ounces as the mine ramps up production during the

year.

Consolidated gold production is expected to decrease to 121-133

thousand ounces, primarily due to Casa Berardi as the mine

transitions to a surface only operation during the year.

2024 and Three Year Production Outlook

Silver Production

(Moz)

Gold Production (Koz)

Silver Equivalent

(Moz)

Gold Equivalent (Koz)

2024 Greens Creek *

8.8 - 9.2

46.0 - 51.0

21.0 - 21.5

235 - 245

2024 Lucky Friday *

5.0 - 5.3

N/A

9.5 - 10.0

110 - 115

2024 Casa Berardi

N/A

75.0 - 82.0

6.5 - 7.2

75 - 82

2024 Keno Hill*

2.7 - 3.0

N/A

3.0 - 3.5

36 - 40

2024 Total

16.5 - 17.5

121.0 - 133.0

40.0 - 42.2

455 - 482

2025 Total

17.0 - 18.5

110.0 - 125.0

39.0 - 42.0

445 - 485

2026 Total

18.0 - 20.0

110.0 - 120.0

40.0 - 43.0

465 - 495

* Equivalent ounces include Lead and Zinc

production

2024 Cost Guidance

At Greens Creek, guidance for cash costs per silver ounce (after

by-product credits) is higher compared to 2023 due to expected

lower silver production year over year. The increase in guidance

for AISC for the mine per silver ounce (after by-product credits)

is attributable to planned higher capital investment. At Lucky

Friday, cost guidance reflects a full year of production. At Keno

Hill, expenditures on production costs, excluding depreciation, are

expected to be $15-$17 million per quarter. The Company will

provide guidance for cash costs and AISC per silver ounce, each

after by-product credits, once the mine reaches commercial

production, which is expected to occur during the year.

At Casa Berardi, guidance for cash costs and AISC per gold

ounce, each after by-product credits, reflects the closure of

underground operations in mid-2024 and transition to an open-pit

only operation.

Total costs of Sales

(million)

Cash cost, after by-product

credits, per silver/gold ounce3

AISC, after by-product

credits, per produced silver/gold ounce4

Greens Creek

252

$3.50 - $4.00

$9.50 - $10.25

Lucky Friday

130

$2.50 - $3.25

$10.50 - 12.25

Total Silver

382

$3.00 - $3.75

$13.00 - $14.50

Casa Berardi

200

$1,500 - $1,700

$1,750 - $1,975

2024 Capital and Exploration Guidance

Consolidated capital investment is expected to trend lower in

2024 at all operations except Greens Creek. Greens Creek's

increased capital investment is primarily attributable to increased

capital development and mobile equipment purchases. Expected

capital investment at Keno Hill comprises mine development, mobile

equipment, and mine infrastructure projects, including a paste

backfill plant. Capital investment at Lucky Friday is expected to

decrease as a result of the completion of critical projects (coarse

ore bunker to increase stockpile capacity, service hoist to

increase mine throughput, and establishment of an alternative

secondary escapeway for production restart) in 2023. Casa Berardi's

growth capital investment includes capitalization of certain

tailings construction costs.

Guidance for 2024 exploration is $25 million with Greens Creek

and Keno Hill expected to account for 35% and 25% of the expected

spend, respectively.

(millions)

Total

Sustaining

Growth

2024 Total Capital expenditures

$190 - $210

$122 - $132

$68 - $78

Greens Creek

$59 - $63

$56 - $58

$3 - $5

Lucky Friday

$45 - $50

$42 - $45

$3 - $5

Casa Berardi

$56 - $63

$14 - $17

$42 - $46

Keno Hill

$30 - $34

$10 - $12

$20 - $22

2024 Exploration

$25

2024 Pre-Development

$6.5

CONFERENCE CALL AND WEBCAST

A conference call and webcast will be held on Thursday, February

15, at 10:00 a.m. Eastern Time to discuss these results. We

recommend that you dial in at least 10 minutes before the call

commencement. You may join the conference call by dialing toll-free

1-888-330-2391 or for international dialing 1-240-789-2702. The

Conference ID is 4812168 and must be provided when dialing in.

Hecla's live and archived webcast can be accessed at

https://events.q4inc.com/attendee/758455261 or www.hecla.com under

Investors.

VIRTUAL INVESTOR EVENT

Hecla will be holding a Virtual Investor Event on Thursday,

February 15, from 12:00 p.m. to 1:30 p.m. Eastern Time.

Hecla invites shareholders, investors, and other interested

parties to schedule a personal, 30-minute virtual meeting (video or

telephone) with a member of senior management to discuss Financial,

Exploration, Operations, ESG or general matters. Click on the link

below to schedule a call (or copy and paste the link into your web

browser). You can select a topic once you have entered the meeting

calendar. If you are unable to book a time, either due to high

demand or for other reasons, please reach out to Anvita M. Patil,

Vice President, Investor Relations and Treasurer at

hmc-info@hecla.com or 208-769-4100.

One-on-One meeting URL: https://calendly.com/2024-feb-vie

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest

silver producer in the United States. In addition to operating

mines in Alaska, Idaho, and Quebec, Canada, the Company is

developing a mine in the Yukon, Canada, and owns a number of

exploration and pre-development projects in world-class silver and

gold mining districts throughout North America.

NOTES

Non-GAAP Financial Measures

Non-GAAP financial measures are intended to provide additional

information only and do not have any standard meaning prescribed by

United States generally accepted accounting principles ("GAAP").

These measures should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP. The non-GAAP financial measures cited in this release and

listed below are reconciled to their most comparable GAAP measure

at the end of this release.

(1) Adjusted EBITDA is a non-GAAP measurement, a reconciliation

of which to net income, the most comparable GAAP measure, can be

found at the end of the release. Adjusted EBITDA is a measure used

by management to evaluate the Company's operating performance but

should not be considered an alternative to net income, or cash

provided by operating activities as those terms are defined by

GAAP, and does not necessarily indicate whether cash flows will be

sufficient to fund cash needs. In addition, the Company may use it

when formulating performance goals and targets under its incentive

program. Net debt to adjusted EBITDA is a non-GAAP measurement, a

reconciliation of which to debt and net income (loss), the most

comparable GAAP measurements, can be found at the end of the

release. It is an important measure for management to measure

relative indebtedness and the ability to service the debt relative

to its peers. It is calculated as total debt outstanding less total

cash on hand divided by adjusted EBITDA.

(2) Free cash flow is a non-GAAP measure calculated as cash

provided by operating activities less capital expenditures. Cash

provided by operating activities for the Greens Creek, Lucky

Friday, and Casa Berardi operating segments excludes exploration

and pre-development expense, as it is a discretionary expenditure

and not a component of the mines’ operating performance. Capital

expenditures refers to Additions to properties, plants and

equipment from the Consolidated Statements of Cash Flows, net of

finance leases.

(3) Cash cost, after by-product credits, per silver and gold

ounce is a non-GAAP measurement, a reconciliation of total cost of

sales, can be found at the end of the release. It is an important

operating statistic that management utilizes to measure each mine's

operating performance. It also allows the benchmarking of

performance of each mine versus those of our competitors. As a

primary silver mining company, management also uses the statistic

on an aggregate basis - aggregating the Greens Creek and Lucky

Friday mines - to compare performance with that of other silver

mining companies and aggregating Casa Berardi and the Nevada

operations, to compare its performance with other gold mining

companies. Similarly, the statistic is useful in identifying

acquisition and investment opportunities as it provides a common

tool for measuring the financial performance of other mines with

varying geologic, metallurgical and operating characteristics. In

addition, the Company may use it when formulating performance goals

and targets under its incentive program.

(4) All-in sustaining cost (AISC), after by-product credits, is

a non-GAAP measurement, a reconciliation of which to total cost of

sales, the closest GAAP measurement, can be found in the end of the

release. AISC, after by-product credits, includes total cost of

sales and other direct production costs, expenses for reclamation

at the mine sites and all site sustaining capital costs. AISC,

after by-product credits, is calculated net of depreciation,

depletion, and amortization and by-product credits. Prior year

presentation has been adjusted to conform with current year

presentation. Management believes this measurement provides an

indication of economic performance and efficiency at each location

and on a consolidated basis, as well as providing a meaningful

basis to compare Company results to those of other mining companies

and other operating mining properties.

(5) Adjusted net income (loss) applicable to common stockholders

is a non-GAAP measurement, a reconciliation of which to net income

(loss) applicable to common stockholders, the most comparable GAAP

measure, can be found at the end of the release. Adjusted net

income (loss) applicable to common stockholders is a measure used

by management to evaluate the Company's operating performance but

should not be considered an alternative to net income (loss)

applicable to common stockholders as defined by GAAP. They exclude

certain impacts which are of a nature which we believe are not

reflective of our underlying performance. Management believes that

adjusted net income (loss) applicable to common stockholders per

common share provides investors with the ability to better evaluate

our underlying operating performance.

Current GAAP measures used in the mining industry, such as total

cost of goods sold, do not capture all the expenditures incurred to

discover, develop and sustain silver and gold production.

Management believes that AISC is a non-GAAP measure that provides

additional information to management, investors and analysts to

help (i) in the understanding of the economics of our operations

and performance compared to other producers and (ii) in the

transparency by better defining the total costs associated with

production. Similarly, the statistic is useful in identifying

acquisition and investment opportunities as it provides a common

tool for measuring the financial performance of other mines with

varying geologic, metallurgical and operating characteristics. In

addition, the Company may use it when formulating performance goals

and targets under its incentive program.

Other

(6) Expectations for 2024 include silver, gold, lead and zinc

production from Greens Creek, Lucky Friday, Keno Hill, and Casa

Berardi converted using Au $1,950/oz, Ag $22.50/oz, Zn $1.20/lb,

and Pb 0.95$/lb. Numbers are rounded.

Cautionary Statement Regarding Forward

Looking Statements, Including 2024 Outlook

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, including

Canadian securities laws. Words such as “may”, “will”, “should”,

“expects”, “intends”, “projects”, “believes”, “estimates”,

“targets”, “anticipates” and similar expressions are used to

identify these forward-looking statements. Such forward-looking

statements may include, without limitation: (i) the projections

contained in the Technical Report Summary for each of Casa Berardi

and Keno Hill; (ii) Lucky Friday is expected to ramp-up to full

production in the first quarter of 2024; (iii) approximately $50

million in proceeds from the Company's property insurance policy

will be collected in 2024; (iv) Keno Hill's production will

increase over time; (v) the Company expects to pay down on its

revolving credit facility in 2024; (vi) the Company expects all

four of its mines to be in operation in 2024; (vii) the Company

expects silver production to increase by 15-20% in 2024, and by 30%

by 2026; (viii) Casa Berardi will be a full surface operation by

mid-2024; (ix) the Company will soon be Canada's largest silver

producer; (x) mine-specific and Company-wide 2024 estimates of

future production, and 2025 and 2026 estimates of future production

Company-wide; (xi)total cost of sales, as well as cash cost and

AISC per ounce (in each case after by-product credits) for Greens

Creek, Lucky Friday and Casa Berardi; and (xii) Company-wide

estimated spending on capital, exploration and pre-development for

2024. The material factors or assumptions used to develop such

forward-looking statements or forward-looking information include

that the Company’s plans for development and production will

proceed as expected and will not require revision as a result of

risks or uncertainties, whether known, unknown or unanticipated, to

which the Company’s operations are subject.

Estimates or expectations of future events or results are based

upon certain assumptions, which may prove to be incorrect, which

could cause actual results to differ from forward-looking

statements. Such assumptions, include, but are not limited to: (i)

there being no significant change to current geotechnical,

metallurgical, hydrological and other physical conditions; (ii)

permitting, development, operations and expansion of the Company’s

projects being consistent with current expectations and mine plans;

(iii) political/regulatory developments in any jurisdiction in

which the Company operates being consistent with its current

expectations; (iv) the exchange rate for the USD/CAD being

approximately consistent with current levels; (v) certain price

assumptions for gold, silver, lead and zinc; (vi) prices for key

supplies being approximately consistent with current levels; (vii)

the accuracy of our current mineral reserve and mineral resource

estimates; (viii) there being no significant changes to the

availability of employees, vendors and equipment; (ix) the

Company’s plans for development and production will proceed as

expected and will not require revision as a result of risks or

uncertainties, whether known, unknown or unanticipated; (x)

counterparties performing their obligations under hedging

instruments and put option contracts; (xi) sufficient workforce is

available and trained to perform assigned tasks; (xii) weather

patterns and rain/snowfall within normal seasonal ranges so as not

to impact operations; (xiii) relations with interested parties,

including First Nations and Native Americans, remain productive;

(xiv) maintaining availability of water rights; (xv) factors do not

arise that reduce available cash balances; and (xvi) there being no

material increases in our current requirements to post or maintain

reclamation and performance bonds or collateral related

thereto.

In addition, material risks that could cause actual results to

differ from forward-looking statements include, but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; (vi)

conflict resolution and outcome of projects or oppositions; (vii)

litigation, political, regulatory, labor and environmental risks;

(viii) exploration risks and results, including that mineral

resources are not mineral reserves, they do not have demonstrated

economic viability and there is no certainty that they can be

upgraded to mineral reserves through continued exploration; (ix)

the failure of counterparties to perform their obligations under

hedging instruments; (x) we take a material impairment charge on

any of our assets; and (xi) inflation causes our costs to rise more

than we currently expect. For a more detailed discussion of such

risks and other factors, see the Company’s 2023 Annual Report on

Form 10-K, filed with the Securities and Exchange Commission

(“SEC”) on February 15, 2024. The Company does not undertake any

obligation to release publicly, revisions to any “forward-looking

statement,” including, without limitation, outlook, to reflect

events or circumstances after the date of this presentation, or to

reflect the occurrence of unanticipated events, except as may be

required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that

statement. Continued reliance on “forward-looking statements” is at

investors’ own risk.

Cautionary Statements to Investors on

Reserves and Resources

This news release uses the terms “mineral resources”, “measured

mineral resources”, “indicated mineral resources” and “inferred

mineral resources.” Mineral resources that are not mineral reserves

do not have demonstrated economic viability. You should not assume

that all or any part of measured or indicated mineral resources

will ever be converted into mineral reserves. Further, inferred

mineral resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically, and an inferred mineral resource may not be

considered when assessing the economic viability of a mining

project, and may not be converted to a mineral reserve. We report

reserves and resources under the SEC’s mining disclosure rules

(“S-K 1300”) and Canada’s National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) because we are a

“reporting issuer” under Canadian securities laws. Unless otherwise

indicated, all resource and reserve estimates contained in this

press release have been prepared in accordance with S-K 1300 as

well as NI 43-101.

Qualified Person (QP)

Kurt D. Allen, MSc., CPG, VP - Exploration of Hecla Mining

Company and Keith Blair, MSc., CPG, Chief Geologist of Hecla

Limited, who serve as a Qualified Person under S-K 1300 and NI

43-101, supervised the preparation of the scientific and technical

information concerning Hecla’s mineral projects in this news

release. Technical Report Summaries for each of the Company’s

Greens Creek and Lucky Friday properties are filed as exhibits 96.1

and 96.2 respectively, to the Company’s Annual Report on Form 10-K

for the year ended December 31, 2022 and are available at

www.sec.gov. A Technical Report Summary for each of the Company’s

Casa Berardi and Keno Hill properties will be filed as exhibits

96.3 and 96.4, respectively, to the Company’s Annual Report on Form

10-K for the year ended December 31, 2023 to be filed on February

15, 2024 and will then be available at www.sec.gov. Information

regarding data verification, surveys and investigations, quality

assurance program and quality control measures and a summary of

analytical or testing procedures for (i) the Greens Creek Mine are

contained in its Technical Report Summary and in a NI 43-101

technical report titled “Technical Report for the Greens Creek

Mine” effective date December 31, 2018, (ii) the Lucky Friday Mine

are contained in its Technical Report Summary and in its technical

report titled “Technical Report for the Lucky Friday Mine Shoshone

County, Idaho, USA” effective date April 2, 2014, (iii) Casa

Berardi will be contained in its Technical Report Summary titled

“Technical Report Summary on the Casa Berardi Mine, Northwestern

Quebec, Canada” effective date December 31, 2023 and are contained

in its NI 43-101 technical report titled “Technical Report on the

mineral resource and mineral reserve estimate for Casa Berardi

Mine, Northwestern Quebec, Canada” effective date December 31,

2018, (iv) Keno Hill will be contained in its Technical Report

Summary titled “S-K 1300 Technical Report Summary on the Keno Hill

Mine, Yukon, Canada” and are contained its NI 43-101 technical

report titled “Technical Report on Updated Mineral Resource and

Reserve Estimate of the Keno Hill Silver District” effective date

April 1, 2021, and (v) the San Sebastian Mine, Mexico, are

contained in a technical report prepared for Hecla titled

“Technical Report for the San Sebastian Ag-Au Property, Durango,

Mexico” effective date September 8, 2015. Also included or to be

included in each technical reports is a description of the key

assumptions, parameters and methods used to estimate mineral

reserves and resources and a general discussion of the extent to

which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other relevant factors. Information regarding data verification,

surveys and investigations, quality assurance program and quality

control measures and a summary of sample, analytical or testing

procedures are contained in technical reports prepared for Klondex

Mines Ltd. for (i) the Fire Creek Mine (technical report dated

March 31, 2018), (ii) the Hollister Mine (technical report dated

May 31, 2017, amended August 9, 2017), and (iii) the Midas Mine

(technical report dated August 31, 2014, amended April 2, 2015).

Information regarding data verification, surveys and

investigations, quality assurance program and quality control

measures and a summary of sample, analytical or testing procedures

are contained in technical reports prepared for ATAC Resources Ltd.

for (i) the Osiris Project (technical report dated July 28, 2022)

and (ii) the Tiger Project (technical report dated February 27,

2020). Copies of these technical reports are available under the

SEDAR profiles of Klondex Mines Unlimited Liability Company and

ATAC Resources Ltd., respectively, at www.sedar.com (the Fire Creek

technical report is also available under Hecla’s profile on SEDAR).

Mr. Allen and Mr. Blair reviewed and verified information regarding

drill sampling, data verification of all digitally collected data,

drill surveys and specific gravity determinations relating to all

the mines. The review encompassed quality assurance programs and

quality control measures including analytical or testing practice,

chain-of-custody procedures, sample storage procedures and included

independent sample collection and analysis. This review found the

information and procedures meet industry standards and are adequate

for Mineral Resource and Mineral Reserve estimation and mine

planning purposes.

HECLA MINING COMPANY

Consolidated Statements of

Loss

(dollars and shares in thousands,

except per share amounts - unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2023

September 30, 2023

December 31, 2023

December 31, 2022

Sales

$

160,690

$

181,906

$

720,227

$

718,905

Cost of sales and other direct production

costs

112,988

112,212

458,504

458,811

Depreciation, depletion and

amortization

40,837

36,217

148,774

143,938

Total cost of sales

153,825

148,429

607,278

602,749

Gross profit

6,865

33,477

112,949

116,156

Other operating expenses:

General and administrative

12,273

7,596

42,722

43,384

Exploration and pre-development

6,966

13,686

32,512

46,041

Ramp-up and suspension costs

27,568

21,025

76,252

24,114

Provision for closed operations and

environmental matters

1,164

2,256

7,575

8,793

Other operating (income) expense

1,291

1,555

(1,438

)

6,262

49,262

46,118

157,623

128,594

Loss from operations

(42,397

)

(12,641

)

(44,674

)

(12,438

)

Other (expense) income:

Interest expense

(12,133

)

(10,710

)

(43,319

)

(42,793

)

Fair value adjustments, net

8,699

(6,397

)

2,925

(4,723

)

Foreign exchange (loss) gain

(4,244

)

4,176

(3,810

)

7,211

Other income

1,458

1,657

5,883

7,829

(6,220

)

(11,274

)

(38,321

)

(32,476

)

Loss before income and mining taxes

(48,617

)

(23,915

)

(82,995

)

(44,914

)

Income and mining tax benefit

(provision)

5,682

1,500

(1,222

)

7,566

Net loss

(42,935

)

(22,415

)

(84,217

)

(37,348

)

Preferred stock dividends

(138

)

(138

)

(552

)

(552

)

Net loss applicable to common

stockholders

$

(43,073

)

$

(22,553

)

$

(84,769

)

$

(37,900

)

Basic and diluted loss per common share

after preferred dividends

$

(0.07

)

$

(0.04

)

$

(0.14

)

$

(0.07

)

Weighted average number of common shares

outstanding basic

610,547

607,896

605,668

557,344

Weighted average number of common shares

outstanding diluted

610,547

607,896

605,668

557,344

HECLA MINING COMPANY

Consolidated Statements of Cash

Flows

(dollars in thousands -

unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2023

September 30, 2023

December 31, 2023

December 31, 2022

OPERATING ACTIVITIES

Net loss

$

(42,935

)

$

(22,415

)

$

(84,217

)

$

(37,348

)

Non-cash elements included in net income

(loss):

Depreciation, depletion and

amortization

51,967

37,095

163,672

145,147

Inventory adjustments

4,487

8,814

20,819

2,646

Fair value adjustments, net

(8,699

)

6,397

(2,925

)

24,182

Provision for reclamation and closure

costs

1,853

2,477

9,658

9,572

Stock-based compensation

1,476

2,434

6,598

6,012

Deferred income taxes

(6,910

)

(3,790

)

(6,115

)

(25,546

)

Foreign exchange loss (gain)

4,244

(4,241

)

3,810

(9,210

)

Other non-cash items, net

1,470

50

3,094

3,736

Change in assets and liabilities:

Accounts receivable

113

(3,544

)

25,133

8,669

Inventories

304

(6,218

)

(24,035

)

(18,230

)

Other current and non-current assets

(17,411

)

18

(32,456

)

(12,388

)

Accounts payable, accrued and other

current liabilities

2,987

(2,532

)

598

(24,981

)

Accrued payroll and related benefits

6,262

(1,701

)

(4,982

)

13,732

Accrued taxes

437

(923

)

(571

)

(7,927

)

Accrued reclamation and closure costs and

other non-current liabilities

1,239

(1,686

)

(2,582

)

11,824

Cash provided by operating

activities

884

10,235

75,499

89,890

INVESTING ACTIVITIES

Additions to properties, plants, equipment

and mineral interests

(62,622

)

(55,354

)

(223,887

)

(149,378

)

Proceeds from sale or exchange of

investments

—

—

—

9,375

Proceeds from disposition of properties,

plants, equipment and mineral interests

1,169

80

1,329

748

Purchases of investments

(7,209

)

(1,753

)

(8,962

)

(31,971

)

Acquisition, net

228

—

228

8,953

Pre-acquisition advance to Alexco

—

—

—

(25,000

)

Net cash used in investing

activities

(68,434

)

(57,027

)

(231,292

)

(187,273

)

FINANCING ACTIVITIES

Proceeds from issuance of stock, net of

related costs

30,796

—

56,684

17,278

Acquisition of treasury shares

—

—

(2,036

)

(3,677

)

Borrowing of debt

120,000

63,000

239,000

25,000

Repayment of debt

(72,000

)

(14,000

)

(111,000

)

(25,000

)

Dividends paid to common and preferred

stockholders

(3,958

)

(3,947

)

(15,713

)

(12,932

)

Credit facility feed paid

—

—

—

(536

)

Repayments of finance leases

(2,615

)

(3,225

)

(10,605

)

(7,633

)

Net cash provided by (used in)

financing activities

72,223

41,828

156,330

(7,500

)

Effect of exchange rates on cash

1,018

(1,140

)

1,095

(273

)

Net increase (decrease) in cash, cash

equivalents and restricted cash and cash equivalents

5,691

(6,104

)

1,632

(105,156

)

Cash, cash equivalents and restricted

cash and cash equivalents at beginning of period

101,848

107,952

105,907

211,063

Cash, cash equivalents and restricted

cash and cash equivalents at end of period

$

107,539

$

101,848

$

107,539

$

105,907

HECLA MINING COMPANY

Consolidated Balance Sheets

(dollars and shares in thousands

- unaudited)

December 31, 2023

December 31, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

106,374

$

104,743

Accounts receivable

33,116

55,841

Inventories

93,647

90,672

Other current assets

27,125

16,471

Total current assets

260,262

267,727

Investments

33,724

24,018

Restricted cash and cash equivalents

1,165

1,164

Properties, plants, equipment and mineral

interests, net

2,666,250

2,569,790

Operating lease right-of-use assets

8,349

11,064

Deferred tax assets

2,883

21,105

Other non-current assets

38,471

32,304

Total assets

$

3,011,104

$

2,927,172

LIABILITIES

Current liabilities:

Accounts payable and accrued

liabilities

$

81,737

$

84,747

Accrued payroll and related benefits

28,240

37,579

Accrued taxes

3,501

4,030

Finance leases

9,752

9,483

Accrued reclamation and closure costs

9,660

8,591

Accrued interest

14,405

14,454

Derivative liabilities

1,144

16,125

Other current liabilities

9,021

3,457

Total current liabilities

157,460

178,466

Accrued reclamation and closure costs

110,797

108,408

Long-term debt including finance

leases

653,063

517,742

Deferred tax liability

104,835

125,846

Derivatives liabilities

364

6,066

Other non-current liabilities

16,481

11,677

Total liabilities

1,043,000

948,205

STOCKHOLDERS’ EQUITY

Preferred stock

39

39

Common stock

156,076

151,819

Capital surplus

2,343,747

2,260,290

Accumulated deficit

(503,861

)

(403,931

)

Accumulated other comprehensive income,

net

5,837

2,448

Treasury stock

(33,734

)

(31,698

)

Total stockholders’ equity

1,968,104

1,978,967

Total liabilities and stockholders’

equity

$

3,011,104

$

2,927,172

Common shares outstanding

624,647

607,620

Non-GAAP Measures (Unaudited)

Reconciliation of Total Cost of Sales to Cash Cost, Before

By-product Credits and Cash Cost, After By-product Credits

(non-GAAP) and All-In Sustaining Cost, Before By-product Credits

and All-In Sustaining Cost, After By-product Credits

(non-GAAP)

The tables below present reconciliations between the most

comparable GAAP measure of total cost of sales to the non-GAAP

measures of (i) Cash Cost, Before By-product Credits, (ii) Cash

Cost, After By-product Credits, (iii) AISC, Before By-product

Credits and (iv) AISC, After By-product Credits for our operations

and for the Company for the three and twelve month periods ended

December 31, 2023 and 2022, the three month periods ended March 31,

2023, June 30, 2023 and September 30, 2023 and for estimated

amounts for the twelve months ended December 31, 2024.

Cash Cost, After By-product Credits, per Ounce and AISC, After

By-product Credits, per Ounce are measures developed by precious

metals companies (including the Silver Institute and the World Gold

Council) in an effort to provide a uniform standard for comparison

purposes. There can be no assurance, however, that these non-GAAP

measures as we report them are the same as those reported by other

mining companies.

Cash Cost, After By-product Credits, per Ounce is an important

operating statistic that we utilize to measure each mine's

operating performance. We use AISC, After By-product Credits, per

Ounce as a measure of our mines' net cash flow after costs for

reclamation and sustaining capital. This is similar to the Cash

Cost, After By-product Credits, per Ounce non-GAAP measure we

report, but also includes reclamation and sustaining capital costs.

Current GAAP measures used in the mining industry, such as cost of

goods sold, do not capture all the expenditures incurred to

discover, develop and sustain silver and gold production. Cash

Cost, After By-product Credits, per Ounce and AISC, After

By-product Credits, per Ounce also allow us to benchmark the

performance of each of our mines versus those of our competitors.

As a silver and gold mining company, we also use these statistics

on an aggregate basis - aggregating the Greens Creek and Lucky

Friday mines to compare our performance with that of other silver

mining companies, and aggregating Casa Berardi and Nevada

Operations for comparison with other gold mining companies.

Similarly, these statistics are useful in identifying acquisition

and investment opportunities as they provide a common tool for

measuring the financial performance of other mines with varying

geologic, metallurgical and operating characteristics.

Cash Cost, Before By-product Credits and AISC, Before By-product

Credits include all direct and indirect operating cash costs

related directly to the physical activities of producing metals,

including mining, processing and other plant costs, third-party

refining expense, on-site general and administrative costs,

royalties and mining production taxes. AISC, Before By-product

Credits for each mine also includes reclamation and sustaining

capital costs. AISC, Before By-product Credits for our consolidated

silver properties also includes corporate costs for general and

administrative expense and sustaining capital costs. By-product

credits include revenues earned from all metals other than the

primary metal produced at each unit. As depicted in the tables

below, by-product credits comprise an essential element of our

silver unit cost structure, distinguishing our silver operations

due to the polymetallic nature of their orebodies.

In addition to the uses described above, Cash Cost, After

By-product Credits, per Ounce and AISC, After By-product Credits,

per Ounce provide management and investors an indication of

operating cash flow, after consideration of the average price,

received from production. We also use these measurements for the