Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

07 Oktober 2024 - 12:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of October, 2024

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: October 03, 2024 |

|

|

|

By: |

|

/s/ Ajay Agarwal |

|

|

|

|

Name: Ajay Agarwal |

|

|

|

|

Title: Company Secretary and Head – Group

Oversight |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Incorporation of HDFC Securities IFSC

Limited, a wholly owned subsidiary of HDFC Securities Limited, (subsidiary of HDFC Bank Limited)

Exhibit 99

October 03, 2024

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir/ Madam,

Sub: Incorporation of HDFC Securities IFSC

Limited, a wholly owned subsidiary of HDFC Securities Limited, (subsidiary of HDFC Bank Limited)

We refer to our earlier intimation dated

May 14, 2022 wherein we had informed that the Reserve Bank of India vide its letter dated May 13, 2022, had conveyed its approval to the Bank for setting up a step-down subsidiary through HDFC Securities Limited, for offering broking and

clearing services in International Financial Services Centre (IFSC) at GIFT City.

In this regard, we wish to inform you that a wholly owned subsidiary of

HDFC Securities Limited namely “HDFC Securities IFSC Limited” has been incorporated effective October 1, 2024. Accordingly, HDFC Securities IFSC Limited has become a subsidiary of the Bank with effect from October 1, 2024.

The details required are enclosed as Annexure A.

You

are requested to take note of the above.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Ajay Agarwal

Company Secretary and Head – Group

Oversight

Annexure A

|

|

|

|

|

|

Sr. No |

|

Particulars |

|

Details |

|

1. |

|

Name of the target entity, details in brief such as size, turnover etc.; |

|

Name: HDFC Securities IFSC Limited is incorporated

as a wholly owned subsidiary of HDFC Securities Limited on October 1, 2024. Authorised Capital: ₹ 30,00,00,000/- (Rupees Thirty Crore only) Paid up Capital: ₹ 15,00,00,000/- (Rupees Fifteen Crore only) Other details (size and turnover): Nil (yet to commence business

operations) |

|

2. |

|

Whether the acquisition would fall within related party transaction(s) and whether the promoter/ promoter group/ group companies have any interest in the entity being acquired? If yes, nature

of interest and details thereof and whether the same is done at “arm’s length”; |

|

There is no acquisition or any transaction by the

Bank and accordingly, this is not a related party transaction. HDFC Securities IFSC Limited is a wholly owned subsidiary of HDFC Securities Limited, which

is a subsidiary and a related party of the Bank. Accordingly, by the virtue of HDFC Securities IFSC Limited being a step-down subsidiary of the Bank, it is

a related party of the Bank with effect from October 1, 2024. Save and except as mentioned above, the group companies of the Bank are not interested

in the incorporation of the HDFC Securities IFSC Limited. |

|

3. |

|

Industry to which the entity being acquired belongs; |

|

Financial/Advisory services |

|

|

|

|

|

|

4. |

|

Objects and impact of acquisition (including but not limited to, disclosure of reasons for acquisition of target entity, if its business is outside the main line

of business of the listed entity); |

|

There is no

investment/acquisition by the Bank in HDFC Securities IFSC Limited. The objective behind incorporation of the entity is for it to become member of NSE IX,

INDIA INX and IIBX at GIFT city SEZ and offer broking services to eligible clients in various financial products like GIFT Derivatives, Unsponsored Depository Receipts (UDRs) & Global investing and Gold Bullion/Bullion Depository

Receipts. |

|

5. |

|

Brief details of any governmental or regulatory approvals required for the acquisition; |

|

Approvals from SEBI, RBI, IFSCA were required and procured prior to incorporation of HDFC Securities IFSC Limited |

|

6. |

|

Indicative time period for completion of the acquisition; |

|

Not Applicable |

|

7. |

|

Consideration - whether cash consideration or share swap or any other form and details of the same; |

|

Not Applicable |

|

8. |

|

Cost of acquisition and/or the price at which the shares are acquired; |

|

Not Applicable |

|

9. |

|

Percentage of shareholding / control acquired and / or number of shares acquired; |

|

The Bank does not hold any share in HDFC Securities IFSC Limited. However, by virtue of the Bank’s shareholding in HDFC Securities

Limited, the indirect holding in HDFC Securities IFSC Limited is 94.89% as on date. |

|

10. |

|

Brief background about the entity acquired in terms of products/line of business acquired, date of incorporation, history of last 3 years turnover, country in which the acquired entity has

presence and any other significant information (in brief); |

|

HDFC Securities IFSC Limited is subsidiary company

of HDFC Securities Ltd and step down subsidiary of HDFC Bank Limited. It will offer broking services to eligible clients like residents, NRIs FPIs etc. listed on NSE IX, INDIA INX and IIBX at GIFT city SEZ.

Date of incorporation: October 1, 2024 History / turnover:

Not Applicable Country: India |

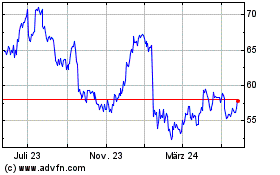

HDFC Bank (NYSE:HDB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

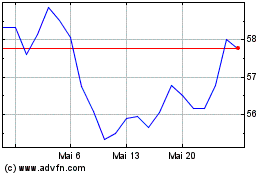

HDFC Bank (NYSE:HDB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024