0001526113

false

0001526113

2023-09-06

2023-09-06

0001526113

us-gaap:CommonStockMember

2023-09-06

2023-09-06

0001526113

us-gaap:SeriesAPreferredStockMember

2023-09-06

2023-09-06

0001526113

us-gaap:SeriesBPreferredStockMember

2023-09-06

2023-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 6, 2023

Global Net Lease, Inc.

(Exact Name of Registrant as Specified in Charter)

| Maryland |

|

001-37390 |

|

45-2771978 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 650 Fifth Avenue, 30th Floor |

| New York, New York 10019 |

| (Address, including zip code, of Principal Executive Offices) |

Registrant’s telephone number,

including area code: (212) 415-6500

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange on

which registered |

| Common

Stock, $0.01 par value per share |

|

GNL |

|

New York Stock Exchange |

| 7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value share |

|

GNL PR A |

|

New York Stock Exchange |

| 6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR B |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On September 6, 2023, Global

Net Lease, Inc., a Maryland corporation (“GNL” or the “Company”), Global Net Lease Advisors, LLC , a Maryland

limited liability company (“GNL Advisor”), Global Net Lease Properties, LLC, a Maryland limited liability company (“GNL

Property Manager”), AR Global Investments, LLC, a Delaware limited liability company (“Advisor Parent” and together

with GNL Property Manager, GNL Advisor and GNL, the “GNL Parties,” and Advisor Parent together with GNL Advisor, Necessity

Retail Advisors, LLC (“RTL Advisor”), GNL Property Manager and Necessity Retail Properties, LLC (“RTL Property Manager”),

the “Advisors” and, collectively with GNL and The Necessity Retail REIT, Inc., a Maryland corporation (“RTL”,

and together with GNL, the “Companies”), and any other entities managed or advised by the Advisor Parent or its Affiliates

(whether as of the date hereof or hereafter), the “Group Companies”) and Orange Capital Ventures, LP (together with its Affiliates,

“Orange Capital”) entered into a Settlement and Reimbursement Agreement (the “Agreement”). Each of the GNL Parties

and Orange Capital is referred to therein as a “Party”, and collectively, the “Parties”.

Under

the terms of the Agreement: (i) Orange Capital has agreed to vote in support of GNL’s merger with RTL (the “REIT

Merger”), pursuant to the Agreement and Plan of Merger dated as of May 23, 2023 (the “REIT Merger Agreement”), and GNL’s

agreement to internalize the advisory and property management functions of the combined

company through a series of mergers with the Advisors dated as of May 23, 2023 (the “Internalization

Merger”); (ii) Orange Capital, on behalf of itself and its Affiliates (as defined

therein), released and forever discharged the Group Companies, the Advisor Parent, the Advisors, the Companies, their respective

Affiliates and their respective directors, officers, agents, attorneys and representatives arising from or in relation to or in

connection with the REIT Merger or the Internalization; (iii) each of GNL Advisor, GNL Property Manager, GNL and Advisor Parent, on

behalf of itself and its respective Affiliates, released and forever discharged Orange Capital, from all liabilities and claims

arising from or in relation to or in connection with the REIT Merger or the Internalization; (iv) each Party agreed to not join any

claim or proceeding, arising from or in relation to or in connection with the REIT Merger, the Internalization Merger, any and all

proxy materials, public filings, press releases or other announcements heretofore filed or made in connection with the foregoing;

(v) the Advisor Parent agreed to reimburse Orange Capital for its time and expenses, including legal expenses, depending on the

outcome of the GNL Special Meeting (as defined below); (vi) Orange Capital agreed not to sell or otherwise dispose of any shares of

GNL’s common stock, par value $0.01 per share (“GNL Common Stock”) until the earlier of (x) the time of the

conclusion of GNL’s special meeting of stockholders on September 8, 2023, or any adjournment or postponement thereof, (the

“GNL Special Meeting”), (y) the valid termination of the REIT Merger Agreement in accordance with its terms, (z) or June

1, 2024; (vii) Orange Capital agreed to appear, either in person or by proxy, at the GNL Special Meeting, and vote all shares of GNL

Common Stock in favor of the REIT Merger, Internalization Merger and all matters contemplated therein, in accordance with the GNL

board of directors’ recommendation; (viii) Orange Capital agreed from the date of the Agreement until three years from the

date thereof to customary standstill covenants relating to the Group Companies including, among others, not to nominate or recommend

any person for nomination for election at any annual or special meeting of stockholders of the Group Companies, not to engage in the

solicitation of proxies, not to form or join or knowingly participate in any securities of the group with respect to the Group

Companies.

Forward-Looking Statements

The statements in this communication

that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that

could cause actual results or events to be materially different. In addition, words such as "may," "will," "seeks,"

"anticipates," "believes," "estimates," expects," "plans," "intends," "would,"

or similar expressions indicate a forward-looking statement, although not all forward-looking statements contain these identifying words.

Any statements referring to the future value of an investment in GNL, including the adjustments giving effect to the REIT Merger and the

Internalization Merger (together, the "Proposed Transactions") as described in this current report, as well as the potential

success that GNL may have in executing the REIT Merger and Internalization Merger, are also forward-looking statements. There are a number

of risks, uncertainties and other important factors that could cause GNL's actual results, or GNL's actual results after making adjustments

to give effect to the REIT Merger and the Internalization Merger, to differ materially from those contemplated by such forward-looking

statements, including but not limited to: (i) GNL's ability to complete the proposed REIT Merger and Internalization Merger on the proposed

terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary stockholder approvals

and satisfaction of other closing conditions to consummate the Proposed Transactions, (ii) the occurrence of any event, change or other

circumstance that could give rise to the termination of the Internalization Merger Agreement and REIT Merger Agreement, each dated as

of May 23, 2023 relating to the Proposed Transactions, (iii) the ability of GNL to obtain lender consent to amend its Second Amended and

Restated Credit Facility or any other loan agreement of GNL, if at all, or on terms favorable to GNL, (iv) risks related to the potential

repeal of GNL's Shareholder's Rights Plan; (v) risks related to the decrease in the beneficial ownership requirements of GNL's applicable

classes and series of stock; (vi) risks related to diverting the attention of GNL's management from ongoing business operations, (vii)

failure to realize the expected benefits of the Proposed Transactions, (viii) significant transaction costs or unknown or inestimable

liabilities, (ix) the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay,

(x) the risk that RTL's business will not be integrated successfully or that such integration may be more difficult, time-consuming or

costly than expected, (xi) risks related to future opportunities and plans for GNL post-closing, including the uncertainty of expected

future financial performance and results of GNL post-closing following completion of the Proposed Transactions, (xii) the effect of the

announcement of the proposed transaction on the ability of GNL and RTL to operate their respective businesses and retain and hire key

personnel and to maintain favorable business relationships, (xiii) the effect of any downgrade of GNL's or RTL's corporate rating or to

any of their respective debt or equity securities including the outstanding notes under the RTL Indenture; (xiv) risks related to the

market value of the GNL Common Stock to be issued in the Proposed Transactions; (xv) other risks related to the completion of the Proposed

Transactions, (xvi) potential adverse effects of the ongoing global COVID-19 pandemic, including actions taken to contain or treat COVID-19,

on RTL, RTL's tenants and the global economy and financial market, (xvii) the risk that one or more parties to the Internalization Merger

Agreement and REIT Merger Agreement may not fulfil its obligations under the respective agreement, as well as the additional risks, uncertainties

and other important factors set forth in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition

and Results of Operations" sections of GNL's Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S.

Securities and Exchange Commission (“SEC”) on February 23, 2023, and all other filings with the SEC after that date, as such

risks, uncertainties and other important factors may be updated from time to time in GNL's subsequent reports. Further, forward-looking

statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements

to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required

by law.

Additional Information About the REIT Merger

and Internalization Merger and Where to Find It

In connection with the Proposed Transactions,

on July 6, 2023, GNL filed with the SEC a registration statement on Form S-4 (as amended on July 17, 2023), which includes a document

that serves as a prospectus of GNL and a joint proxy statement of GNL and RTL (the "Joint Proxy Statement/Prospectus"). Each

party also plans to file other relevant documents with the SEC regarding the Proposed Transactions. The Form S-4 became effective on July

18, 2023. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS. GNL and RTL commenced mailing the definitive Joint

Proxy Statement/Prospectus to stockholders on or about July 19, 2023. Investors and securityholders may obtain a free copy of the Joint

Proxy Statement/Prospectus and other relevant documents filed by GNL and RTL with the SEC at the SEC's website at www.sec.gov. Copies

of the documents filed by GNL with the SEC are available free of charge on GNL's website at www.globalnetlease.com or by contacting GNL's

Investor Relations at investorrelations@globalnetlease.com. Copies of the documents filed by RTL with the SEC are available free of charge

on RTL's website at www.necessityretailreit.com or by contacting RTL's Investor Relations at ir@rtlreit.com.

Participants in the Proxy Solicitation

GNL, RTL, and their respective directors, executive

officers and other members of management and employees of their respective advisors and their affiliates may be deemed to be participants

in the solicitation of proxies in respect of the Proposed Transactions. Information about directors and executive officers of GNL is available

in its proxy statement for its 2023 Annual Meeting, as incorporated by reference in the Joint Proxy Statement/Prospectus. Information

about directors and executive officers of RTL is available in its proxy statement for its 2023 Annual Meeting, as incorporated by reference

in the Joint Proxy Statement/Prospectus. Other information regarding the participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant

materials filed with the SEC regarding the Proposed Transactions. Investors should read the Joint Proxy Statement/Prospectus carefully

before making any voting or investment decisions. Investors may obtain free copies of these documents from GNL as indicated above.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GLOBAL NET LEASE, INC. |

| |

|

|

| Date: September 6, 2023 |

By: |

/s/ James L. Nelson |

| |

Name: |

James L. Nelson |

| |

Title: |

Chief Executive Officer |

v3.23.2

Cover

|

Sep. 06, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 06, 2023

|

| Entity File Number |

001-37390

|

| Entity Registrant Name |

Global Net Lease, Inc.

|

| Entity Central Index Key |

0001526113

|

| Entity Tax Identification Number |

45-2771978

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

650 Fifth Avenue

|

| Entity Address, Address Line Two |

30th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

415-6500

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value per share

|

| Trading Symbol |

GNL

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value share

|

| Trading Symbol |

GNL PR A

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR B

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

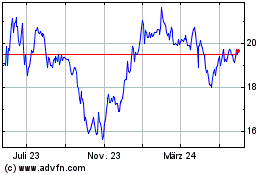

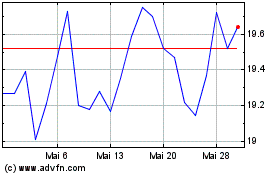

Global Net Lease (NYSE:GNL-B)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Global Net Lease (NYSE:GNL-B)

Historical Stock Chart

Von Mai 2023 bis Mai 2024