0001526113

false

true

0001526113

2023-08-03

2023-08-03

0001526113

gnl:PreferredStockPurchaseRightsMember

2023-08-03

2023-08-03

0001526113

us-gaap:CommonStockMember

2023-08-03

2023-08-03

0001526113

us-gaap:SeriesAPreferredStockMember

2023-08-03

2023-08-03

0001526113

us-gaap:SeriesBPreferredStockMember

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

true

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 3, 2023

Global Net Lease, Inc.

(Exact Name of Registrant as Specified in Charter)

| Maryland |

|

001-37390 |

|

45-2771978 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 650 Fifth Avenue, 30th Floor |

| New York, New York 10019 |

| (Address, including zip code, of Principal Executive Offices) |

Registrant’s telephone number,

including area code: (212) 415-6500

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| Title of each class |

|

Trading

Symbols |

|

Name of each

exchange on which

registered |

| Common

Stock, $0.01 par value per share |

|

GNL |

|

New York Stock Exchange |

| 7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value share |

|

GNL PR A |

|

New York Stock Exchange |

| 6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR B |

|

New York Stock Exchange |

| Preferred Stock Purchase Rights |

|

|

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

Earnings Call Script

On August 3, 2023, Global Net Lease, Inc. (the

“Company”) hosted a conference call to discuss its financial and operating results for the quarter ended June 30, 2023. A

transcript of the pre-recorded portion of the conference call is furnished as Exhibit 99.1 to this Current Report on Form 8-K. As previously

disclosed, a replay of the entire conference call is available through November 3, 2023 by telephone as follows:

Domestic Dial-In (Toll Free): 1-844-512-2921

International Dial-In: 1-412-317-6671

Conference Number: 10176723

The information set forth in Item 7.01 of this

Current Report on Form 8-K and in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that Section. The information set forth in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall

not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of

any general incorporation language in such filing.

The statements in this Current Report on

Form 8-K that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and

uncertainties that could cause actual results or events to be materially different. In addition, words such as “may,”

“will,” “seeks,” “anticipates,” “believes,” “estimates,” expects,”

“plans,” “intends,” “would,” or similar expressions indicate a forward-looking statement,

although not all forward-looking statements contain these identifying words. Any statements referring to the future value of an

investment in the Company, including the adjustments giving effect to RTL merging with and into Osmosis Sub I, LLC, with Osmosis Sub

I continuing as the surviving entity and wholly-owned subsidiary of GNL (the “REIT Merger”) and GNL and RTL becoming

internally managed (the “Internalization Merger”) as described in this communication, as well as the potential success

that the Company may have in executing the REIT Merger and Internalization Merger, are also forward-looking statements. There are a

number of risks, uncertainties and other important factors that could cause the Company’s actual results, or the

Company’s actual results after making adjustments to give effect to the REIT Merger and the Internalization Merger, to differ

materially from those contemplated by such forward-looking statements, including but not limited to: (i) the Company’s ability

to complete the proposed REIT Merger and Internalization Merger on the proposed terms or on the anticipated timeline, or at all,

including risks and uncertainties related to securing the necessary stockholder approvals and satisfaction of other closing

conditions to consummate the proposed transaction, (ii) the occurrence of any event, change or other circumstance that could give

rise to the termination of the Internalization Merger Agreement and REIT Merger Agreement, each dated as of May 23, 2023 relating to

the proposed transactions, (iii) ability of the Company to obtain lender consent to amend its Second Amended and Restated Credit

Facility or any other loan agreement of the Company, if at all, or on terms favorable to the Company, (iv) risks related to the

potential repeal of the Company’s Shareholder’s Rights Plan; (v) risks related to the decrease in the beneficial

ownership requirements of the Company’s applicable classes and series of stock; (vi) risks related to diverting the attention

of the Company’s management from ongoing business operations, (vii) failure to realize the expected benefits of the proposed

transactions, (viii) significant transaction costs or unknown or inestimable liabilities, (ix) the risk of shareholder litigation in

connection with the proposed transaction, including resulting expense or delay, (x) the risk that RTL’s business will not be

integrated successfully or that such integration may be more difficult, time-consuming or costly than expected, (xi) risks related

to future opportunities and plans for the Company post-closing, including the uncertainty of expected future financial performance

and results of the Company post-closing following completion of the proposed transactions, (xii) the effect of the announcement of

the proposed transaction on the ability of the Company and RTL to operate their respective businesses and retain and hire key

personnel and to maintain favorable business relationships, (xiii) the effect of any downgrade of the Company’s or RTL’s

corporate rating or to any of their respective debt or equity securities including the outstanding notes under the RTL Indenture;

(xiv) risks related to the market value of the GNL Common Stock to be issued in the proposed transactions; (xv) other risks related

to the completion of the proposed transactions, (xvi) the risk that one or more parties to the Internalization Merger Agreement and

REIT Merger Agreement may not fulfil its obligations under the respective agreement, as well as the additional risks, uncertainties

and other important factors set forth in the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the Company’s Annual Report on Form 10-K for the year ended

December 31, 2022 filed with the SEC on February 23, 2023, and all other filings with the SEC after that date, as such risks,

uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further,

forward-looking statements speak only as of the date they are made, and Company undertakes no obligation to update or revise

forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating

results over time, except as required by law.

| Item 9.01. |

Financial Statements and Exhibits. |

| Exhibit No |

|

Description |

| 99.1 |

|

Transcript |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GLOBAL NET LEASE, INC. |

| |

|

|

| Date: August 3, 2023 |

By: |

/s/ James L. Nelson |

| |

Name: |

James L. Nelson |

| |

Title: |

Chief Executive Officer and President |

Exhibit 99.1

Operator

Good afternoon and welcome to the Global Net Lease Second Quarter 2023

Earnings Call. [Operator Instructions]. I would now like to turn the conference over to Curtis Parker, Senior Vice President. Please go

ahead.

Curtis Parker

Thank you. Good afternoon, everyone and thank you for joining us for

GNL's second quarter 2023 Earnings Call. This call is being webcast in the Investor Relations section of GNL's website at www.globalnetlease.com.

Joining me today on the call to discuss this quarter’s results are Jim Nelson, GNL’s Chief Executive Officer and Chris Masterson,

GNL’s Chief Financial Officer. Mike Weil, CEO of The Necessity Retail REIT, Inc. will also be joining us for the question and answer

session.

The following information contains forward-looking statements, which

are subject to risks and uncertainties. Should one or more of these risks or uncertainties materialize, actual results may differ materially

from those expressed or implied by the forward-looking statements. We refer all of you to our SEC filings including the Form 10-K for

the year ended December 31, 2022 filed on February 23, 2023 and all other filings with the SEC after that date for a more detailed discussion

of the risk factors that could cause these differences.

Any forward-looking statements provided during this conference call

are only made as of the date of this call. As stated in our SEC filings, GNL disclaims any intent or obligation to update or revise these

forward-looking statements except as required by law. Also, during today's call, we will discuss non-GAAP financial measures, which we

believe can be useful in evaluating the company's financial performance. These measures should not be considered in isolation or as a

substitute for our financial results prepared in accordance with GAAP. A reconciliation of these measures to the most directly comparable

GAAP measure is available in our earnings release and supplement which are posted to our website. Please also refer to our earnings release

for more information about what we consider to be implied investment grade tenants, a term we will use throughout today's call.

I'll now turn the call over to our CEO, Jim Nelson. Jim?

James Nelson

Thanks, Curtis, and thank you to everyone for joining us on today’s

call.

Before we get into our results I will provide a brief update on the

proposed merger with the Necessity Retail REIT which was announced in May and is expected to close this September. We believe that the

merger with RTL - and the simultaneous internalization of GNL's management and operations, paired with numerous governance enhancements

- will establish GNL as a sector-leading net-lease REIT with a global presence, uniquely positioned for long-term growth.

We expect that in the first full quarter after closing, the transactions

will be 9% accretive to annualized AFFO per share, relative to the quarter ended March 31, 2023, and will reduce leverage for the combined

company, driving net debt to adjusted EBITDA to 7.6x in the fourth quarter. Annual cost savings are expected to be approximately $75 million.

The SEC declared the registration statement for the merger effective in July, and we have set a record date of August 8, 2023, for the

special meeting of stockholders to vote on the proposed mergers, which will be on September 8, 2023.

Beyond the merger, the GNL team continued to make great progress on

our key strategic objectives during the second quarter. We completed eleven lease renewals and one tenant expansion project, resulting

in nearly $20.2 million of net new straight-line rent over a weighted-average lease term of 6.0 years. Occupancy was 98% across the portfolio.

Subsequent to quarter end, we signed three additional lease renewals, bringing us to fourteen lease renewals since the end of the first

quarter. Nearly 60% of our long-term leases are with Investment Grade Tenants, and industrial or distribution assets comprised 55% of

our portfolio as of the end of the second quarter, both based on annualized straight-line rent. Among our office properties, 68% are mission

critical facilities, which is defined as a headquarters, lab or R&D facility, and 71% are leased to investment grade or implied investment

grade tenants. We believe GNL is well positioned for meaningful capital appreciation with our strong portfolio and the upcoming corporate

enhancements.

We continue to be substantially insulated from the rising interest

rate environment, as we benefit from our predominately fixed rate debt which minimizes the impact of rate increases, as well as a sophisticated

hedging program designed to minimize negative impact to our cash flow from foreign exchange volatility and a stronger US dollar.

In the second quarter, our AFFO was $41.4 million or $0.40 per share,

compared to $0.43 in the second quarter of 2022 but an increase from $0.38 per share in the first quarter of 2023. Revenue increased over

$1.5 million compared to the first quarter of 2023, which also helped drive Adjusted EBITDA and NOI higher quarter over quarter.

Our performance was driven by ongoing strong leasing activity which

totaled 1.7 million square feet of lease renewals and expansions through July 20, 2023. These leases added $64.1 million of net new straight-line

rent over the new lease terms at a positive 0.7% spread compared to the prior leases.

Leases signed during the second quarter included six leases with XPO

Logistics in the US for over 77,000 square feet, a lease with ID Logistics in France for approximately 566,000 square feet, and an 86,000

square foot lease with PFB Canada in Alberta. Thanks to our leasing efforts, our portfolio only has 1% of leases expiring during the balance

of this year, with 73% of our leases not expiring until 2028 or later.

At quarter end, our $4.6 billion, 317 property portfolio had a weighted

average remaining lease term of 7.6 years. Geographically, 236 of our properties are located in the U.S. and Canada, representing 60%

of annualized straight-line rent revenue. We own 81 properties in the U.K. and Western Europe, which generate 40% of annualized straight-line

rent. Our portfolio is well-diversified with 139 tenants in 51 industries, with no single industry representing more than 12% of the entire

portfolio and no tenant exceeding 5% of the portfolio, based on annual straight-line rent.

Approximately 95% of our leases feature annual rent increases which

increase the cash rent that is due over time from these leases. Based on straight-line rent, approximately 60.1% of our leases feature

fixed-rate escalations, 27.5% have escalations that are based on the Consumer Price Index, and 7.1% have escalations based on other measures.

Subsequent to the end of the second quarter we announced that we had

entered into a definitive agreement to sell a vacant office property in San Jose, California for $50 million. We bought this property

for $52.5 million in 2014 with a long-term lease in place. Negotiating the sale of this vacant property for nearly the same price we paid

for it showcases the value of our diligent underwriting standards that favors properties with high reuse potential.

Our differentiated investment strategy continues to deliver value and

we remain focused on growing our portfolio. Our successful lease renewals speak to the mission-critical nature of the properties that

we own, where the weighted-average remaining lease term is nearly eight years. We are well-positioned for the future, and I look forward

to building on our progress through the merger and the many strategic objectives we are pursuing.

I'll turn the call over to Chris to walk through the financial results

in more detail before I follow up with some closing remarks. Chris?

Chris Masterson

Thanks, Jim.

For the second quarter 2023 we recorded revenue of $95.8 million, with

a net loss attributable to common stockholders of $31.4 million. FFO was $5.9 million, or $0.06 per share, and AFFO was $41.4 million,

respectively, or $0.40 per share. FFO was impacted by $15.1 million of settlement costs, $7.4 million of proxy related expenses, and $6.3

million of merger and transaction costs that are added back to AFFO. On a constant currency basis, (applying the average monthly currency

rates from the second quarter 2022), revenues in the second quarter of 2023 would have been up by $0.2 million year-over-year to $96.0

million. As always, a reconciliation of GAAP net income to the non-GAAP measures can be found in our earnings release, which is posted

on our website.

On the balance sheet, we ended the quarter with net debt of $2.4 billion

at a weighted-average interest rate of 4.8% and had liquidity of $374.1 million, including $100.9 million of cash and cash equivalents

and $273.2 million of availability under the Company's revolving credit facility. Our net debt to trailing twelve

month adjusted EBITDA ratio was 8.3x at the end of the quarter. The weighted-average debt maturity at the end of the second quarter 2023

was 3.7 years.

Our debt includes $500.0 million in senior notes, $1.0 billion on the

multi-currency revolving credit facility and $1.0 billion of outstanding gross mortgage debt. This debt was approximately 72% fixed rate,

which includes floating rate debt with in-place interest rate swaps, and our interest coverage ratio was 2.9x. The Company distributed

$41.7 million in dividends to common shareholders in the quarter, at a rate of $0.40 per share.

Our net debt to enterprise value was 65.2% with an enterprise value

of $3.7 billion. I'll now turn the call back to Jim for some closing remarks.

James Nelson

Thanks, Chris.

We are continuing to execute lease renewals and tenant expansions across

our portfolio, locking in credit-worthy tenants with long-term leases. Our success is the natural outcome of the deliberate underwriting

process we have applied over many years. In a similar way, as we continue to move toward the proposed transformative merger with the Necessity

Retail REIT, we believe that it's similarly constructed portfolio of primarily retail net-lease and open-air shopping centers will complement

our current assets. We expect that the diversification, scale, and savings that we anticipate realizing through the merger, internalization

of management, and governance enhancements will unlock value for GNL shareholders and create a strong foundation for GNL to continue growing

in the future.

We are pleased that Mike Weil, CEO of RTL who will join me as co-CEO

of GNL pending completion of the merger, will participate in the Q&A session. We look forward to answering any questions you may have.

Operator, please open the line for questions.

Question-and-Answer Session

Operator

[Operator Instructions]

v3.23.2

Cover

|

Aug. 03, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity File Number |

001-37390

|

| Entity Registrant Name |

Global Net Lease, Inc.

|

| Entity Central Index Key |

0001526113

|

| Entity Tax Identification Number |

45-2771978

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

650 Fifth Avenue

|

| Entity Address, Address Line Two |

30th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

415-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Preferred Stock Purchase Rights [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value per share

|

| Trading Symbol |

GNL

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value share

|

| Trading Symbol |

GNL PR A

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR B

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gnl_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

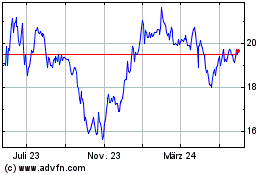

Global Net Lease (NYSE:GNL-B)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

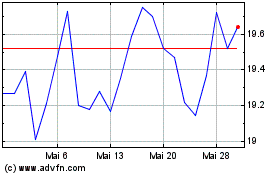

Global Net Lease (NYSE:GNL-B)

Historical Stock Chart

Von Mai 2023 bis Mai 2024