Turkish lender achieves one of the best fraud

ratios among Turkish banks by incorporating custom machine learning

scores with FICO® Falcon® Fraud Manager

FICO (NYSE: FICO)

Highlights:

- Yapı Kredi reduced fraud losses by 98.7% over seven years,

using FICO® Falcon® Fraud Manager.

- The bank maintains Turkiye’s lowest card fraud basis point

ratio—50% lower than peers.

- Yapı Kredi analyzes 40 million transactions each day, detecting

500 potential fraud cases.

- Yapı Kredi has won a 2025 FICO® Decision Award for Fraud

Management.

Turkiye’s Yapı Kredi (YKB) has harnessed the power of FICO’s

advanced fraud detection technologies including FICO® Falcon® Fraud

Manager to achieve a remarkable 98.7% reduction in fraud losses

over seven years. Despite doubling its banking transaction volumes,

YKB has maintained one of Turkiye’s lowest fraud ratios among top

banks. This success stems from integrating custom data and scores

alongside the machine learning models within FICO Falcon Fraud

Manager.

More information:

https://www.fico.com/en/products/fico-falcon-fraud-manager

“The global economic slowdown and Turkiye's recent earthquake

significantly increased transaction volumes and fraud risks,” said

Halis K�seoğlu, fraud prevention director at Yapı Kredi. “We

expanded our analytics team, developed new fraud detection rules,

and leveraged FICO Falcon Fraud Manager’s capabilities to deliver

real-time fraud prevention with exceptional accuracy and

efficiency.”

Adapting Fraud Prevention to Emerging Payment

Channels

The biggest challenge Yapı Kredi faced in evolving its fraud

system was monitoring anomalies across existing and new service

channels, including cryptocurrency transfers, open banking,

card-to-card transfers, and request-to-pay. With 50% of Turkiye’s

adult population investing in cryptocurrencies, these new payment

patterns posed significant risks. To address this, Yapı Kredi

extended FICO Falcon Fraud Manager’s capabilities by providing more

detailed and comprehensive data inputs.

YKB’s new analytics, driven by both machine learning algorithms

and precalculated enriched data, underpin more than 1,000 fraud

detection rules in FICO Falcon Fraud Manager, which protects Yapı

Kredi’s demand deposit accounts, credit cards, debit cards and

merchants. Every day, more than 40 million monetary and

non-monetary transactions are processed, with FICO Falcon Fraud

Manager detecting approximately 500 potentially fraudulent

activities daily. Each transaction is analyzed with remarkable

efficiency, boasting an average response time of just 4

milliseconds.

Smarter Analytics, Faster Detection

“It is crucial that our systems scale effectively to meet

increasing demand,” said K�seoğlu. “FICO Falcon Fraud

Manager can handle our volume growth, and now processes more than

40 million transactions daily. Our overall fraud system operates

with a 99.98% success rate, without timeouts.”

Since implementing FICO Falcon Fraud Manager in 2017, YKB’s

approach has resulted in a false positive ratio of approximately

10:1— a substantial enhancement compared to the previous ratio of

30:1 and the pre-Falcon ratio of over 200:1.

According to data from the Turkish Interbank Card Centre, Yapı

Kredi has one of Turkiye’s best card fraud basis point ratios,

standing at less than 0.6.

“A key factor in these successes is our ability to detect and

block 98% of fraud attempts using FICO Falcon Fraud Manager before

any damage can occur,” added K�seoğlu. “FICO’s enterprise

fraud monitoring solution enables accurate, consistent decisions by

analyzing customer behavior across channels and tailoring responses

to transaction risks.”

Yapı Kredi leverages FICO Falcon Fraud Manager to streamline

fraud management across channels, including phone (IVR), SMS,

email, push notifications, and mobile banking. “These integrations

allow us to quickly confirm transactions based on their risk level,

ensuring real-time fraud prevention and seamless customer

communication,” added K�seoğlu.

For its achievements, Yapı Kredi won the 2025 FICO® Decision

Award for Fraud Management.

“Criminals worldwide have accelerated the evolution of their

technology to commit fraud at an unprecedented scale,” said

Nikhil Behl, executive vice president for software at FICO.

“Yapı Kredi sets a global benchmark for financial institutions with

their leadership in synthesizing FICO Falcon Fraud Manager with

models, custom data, and advanced analytics.”

“Yapı Kredi’s achievement goes beyond fighting fraud—it’s about

creating a banking environment where security enhances trust and

convenience for customers," said risk analytics senior manager

Regan Goble at Westpac NZ, one of the FICO Decision Awards judges

and one of last year’s winners. "Their innovative use of AI and

data-driven insights shows how fraud prevention can evolve into a

competitive advantage."

FICO® Falcon® Fraud Manager is the world’s leading payments

fraud solution, protecting some 4 billion payment accounts

worldwide. It was the first fraud system to deploy AI and has

evolved through dozens of patents in machine learning and other

technologies.

To see the full list of 2025 FICO Decisions Awards winners,

check out: https://www.fico.com/en/decisionawards

About Yapı Kredi

Yapı Kredi has been sustainably strengthening its market

positioning in the sector since its establishment in 1944, through

a customer-centric approach and focus on innovation. Yapı Kredi

achieved total assets worth TL 2.5 trillion as of the first nine

months of 2024. Constantly seeking to increase its contribution to

the financing of the Turkish economy with its customer-centric

approach, Yapı Kredi enlarged the volume of its total cash and

non-cash loans by 52% y-o-y in the first nine months of 2024 to TL

1.7 trillion.

Learn more at https://www.yapikredi.com.tr/.

About the FICO® Decisions Awards

The FICO Decisions Awards recognize organizations that are

achieving remarkable success using FICO solutions. A panel of

independent judges with deep industry expertise evaluates

nominations based upon measurable improvement in key metrics;

demonstrated use of best practices; project scale, depth and

breadth; and innovative uses of technology. The 2025 judges

are:

- Regan Goble, risk analytics senior manager at Westpac NZ

(Previous Winner)

- Megha Kumar, research vice president at IDC

- Joe McKendrick, analyst and senior contributor at

Forbes

- Luiz Pacete, technology and marketing industry

influencer

- Ali Paterson, founder and editor-in-chief at Fintech

Finance

- Mike Roberts, head of unsecured retail risk at HSBC UK

bank (Previous Winner)

- Erin Stillwell, head of strategic partnerships and

engagements at TSYS (Previous Winner)

- Allan Tan, group editor-in-chief at Cxociety

The winners of the FICO Decisions Awards will be spotlighted at

and win tickets to FICO® World 2025, May 6-9, 2025, at

the Diplomat Hotel in Hollywood, Florida.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 80 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at https://www.fico.com

FICO and Falcon are registered trademarks of Fair Isaac

Corporation in the U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130240001/en/

For further comment contact: FICO UK PR Team Wendy

Harrison/Parm Heer ficoteam@harrisonsadler.com 0208 977 9132

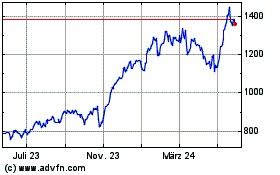

Fair Isaac (NYSE:FICO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

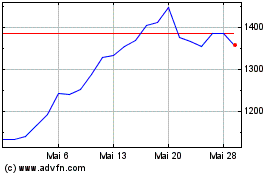

Fair Isaac (NYSE:FICO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025