The Board of Trustees of First Trust Enhanced Equity Income Fund

(the "Fund") (NYSE: FFA), CUSIP 337318109, previously approved a

managed distribution policy for the Fund (the "Managed Distribution

Plan") in reliance on exemptive relief received from the Securities

and Exchange Commission which permits the Fund to make periodic

distributions of long-term capital gains more frequently than

otherwise permitted with respect to its common shares subject to

certain conditions.

The Fund has declared a distribution payable on June 28, 2024,

to shareholders of record as of June 21, 2024, with an ex-dividend

date of June 21, 2024. This Notice is meant to provide you

information about the sources of your Fund’s distributions. You

should not draw any conclusions about the Fund's investment

performance from the amount of its distribution or from the terms

of its Managed Distribution Plan.

The following tables set forth the estimated amounts of the

current distribution and the cumulative distributions paid this

fiscal year to date for the Fund from the following sources: net

investment income ("NII"); net realized short-term capital gains

("STCG"); net realized long-term capital gains ("LTCG"); and return

of capital ("ROC"). These estimates are based upon information

projected through June 30, 2024, are calculated based on a

generally accepted accounting principles ("GAAP") basis and include

the prior fiscal year-end undistributed net investment income. The

amounts and sources of distributions are expressed per common

share.

5 Yr. Avg.

Annualized Current

Annual Total

Fund

Fund

Fiscal

Total Current

Current Distribution

($)

Current Distribution

(%)

Dist. Rate as a

Return

Ticker

Cusip

Year

End

Distribution

NII

STCG

LTCG

ROC

(2)

NII

STCG

LTCG

ROC(2)

% of

NAV(3)

on

NAV(4)

FFA

337318109

12/31/2024

$0.35000

$0.03640

-

-

$0.31360

10.40%

-

-

89.60%

6.97%

13.48%

Total

Cumulative

Cumulative Fiscal

Fund

Fund

Fiscal

Cumulative Fiscal YTD

Cumulative Distributions

Fiscal YTD ($)

Cumulative Distributions

Fiscal YTD (%)

Fiscal YTD Distributions

as

YTD Total Return

Ticker

Cusip

Year

End

Distributions(1)

NII

STCG

LTCG

ROC

(2)

NII

STCG

LTCG

ROC(2)

a % of

NAV(3)

on

NAV(4)

FFA

337318109

12/31/2024

$0.66500

$0.06916

-

-

$0.59584

10.40%

-

-

89.60%

3.31%

8.99%

(1) Includes the most recent quarterly distribution paid on June

28, 2024. (2) The Fund estimates that it has distributed more than

its income and net realized capital gains; therefore, a portion of

your distribution may be a return of capital. A return of capital

may occur, for example, when some or all of the money that you

invested in the Fund is paid back to you. A return of capital

distribution does not necessarily reflect the Fund's investment

performance and should not be confused with "yield" or "income."

(3) Based on Net Asset Value ("NAV") as of May 31, 2024. (4) Total

Returns are through May 31, 2024.

The amounts and sources of distributions reported in this Notice

are only estimates and are not being provided for tax reporting

purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon the Fund's investment

experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. The Fund will send you

a Form 1099-DIV for the calendar year that will tell you how to

report these distributions for federal income tax purposes. You

should not use this Notice as a substitute for your Form

1099-DIV.

First Trust Advisors L.P. ("FTA") is a federally registered

investment advisor and serves as the Fund's investment advisor. FTA

and its affiliate First Trust Portfolios L.P. ("FTP"), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $226 billion as of May

31, 2024 through unit investment trusts, exchange-traded funds,

closed-end funds, mutual funds and separate managed accounts. FTA

is the supervisor of the First Trust unit investment trusts, while

FTP is the sponsor. FTP is also a distributor of mutual fund shares

and exchange-traded fund creation units. FTA and FTP are based in

Wheaton, Illinois.

Chartwell Investment Partners, LLC ("Chartwell") serves as the

Fund's investment sub-advisor and is an investment firm focusing on

institutional, sub-advisory, and private client relationships. The

firm is a research-based equity and fixed-income manager with a

disciplined, team-oriented investment process. As of May 31, 2024,

Chartwell had approximately $11.8 billion in assets under

management.

Principal Risk Factors: Risks are inherent in all investing.

Certain risks applicable to the Fund are identified below, which

includes the risk that you could lose some or all of your

investment in the Fund. The principal risks of investing in the

Fund are spelled out in the Fund's annual shareholder reports. The

order of the below risk factors does not indicate the significance

of any particular risk factor. The Fund also files reports, proxy

statements and other information that is available for

review.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost. There can be no assurance that the Fund's investment

objectives will be achieved. The Fund may not be appropriate for

all investors.

Market risk is the risk that a particular security, or shares of

a fund in general may fall in value. Securities are subject to

market fluctuations caused by such factors as general economic

conditions, political events, regulatory or market developments,

changes in interest rates and perceived trends in securities

prices. Shares of a fund could decline in value or underperform

other investments as a result. In addition, local, regional or

global events such as war, acts of terrorism, spread of infectious

disease or other public health issues, recessions, natural

disasters or other events could have significant negative impact on

a fund.

Current market conditions risk is the risk that a particular

investment, or shares of the fund in general, may fall in value due

to current market conditions. As a means to fight inflation, the

Federal Reserve and certain foreign central banks have raised

interest rates and expect to continue to do so, and the Federal

Reserve has announced that it intends to reverse previously

implemented quantitative easing. Recent and potential future bank

failures could result in disruption to the broader banking industry

or markets generally and reduce confidence in financial

institutions and the economy as a whole, which may also heighten

market volatility and reduce liquidity. Ongoing armed conflicts

between Russia and Ukraine in Europe and among Israel, Hamas and

other militant groups in the Middle East, have caused and could

continue to cause significant market disruptions and volatility

within the markets in Russia, Europe, the Middle East and the

United States. The hostilities and sanctions resulting from those

hostilities have and could continue to have a significant impact on

certain fund investments as well as fund performance and liquidity.

The COVID-19 global pandemic, or any future public health crisis,

and the ensuing policies enacted by governments and central banks

have caused and may continue to cause significant volatility and

uncertainty in global financial markets, negatively impacting

global growth prospects.

Shares of closed-end investment companies such as the Fund

frequently trade at a discount from their net asset value. The Fund

cannot predict whether its common shares will trade at, below or

above net asset value.

The Fund may write (sell) covered call options on all or a

portion of the equity securities held in the Fund's portfolio. The

use of options may require the Fund to sell portfolio securities at

inopportune times or for prices other than current market values,

may limit the amount of appreciation the Fund can realize on an

investment, or may cause the Fund to hold an equity security that

it might otherwise sell.

Premiums from writing (selling) call options and dividends and

interest payments made by the securities in the Fund's portfolio

can vary widely over time.

An adverse event affecting an issuer of equity securities, such

as an unfavorable earnings report, may depress the value of a

particular equity security held by the Fund. Also, the prices of

equity securities are sensitive to general movements in the stock

market and a drop in the stock market may depress the prices of

equity securities to which the Fund has exposure. There is no

guarantee that the issuers of the equity securities in which the

Fund invests will declare dividends in the future or that if

declared they will remain at current levels. There can be no

assurance as to what portion of the distributions paid to the

Fund's Common Shareholders will consist of tax-advantaged qualified

dividend income.

Investment in non-U.S. securities is subject to the risk of

currency fluctuations and to economic and political risks

associated with such foreign countries.

The Fund may not invest 25% or more of its total assets in

securities of issuers in any single industry. If the Fund is

focused in an industry, it may present more risks than if it were

broadly diversified over numerous industries of the economy.

The risks of investing in the Fund are spelled out in the

shareholder report and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

Forward-Looking Statements

Certain statements made in this press release that are not

historical facts are referred to as "forward‑looking statements"

under the U.S. federal securities laws. Actual future results or

occurrences may differ significantly from those anticipated in any

forward‑looking statements due to numerous factors. Generally, the

words "believe," "expect," "intend," "estimate," "anticipate,"

"project," "will" and similar expressions identify forward‑looking

statements, which generally are not historical in nature.

Forward‑looking statements are subject to certain risks and

uncertainties that could cause actual results to differ from those

anticipated in any forward-looking statements. You should not place

undue reliance on forward‑looking statements, which speak only as

of the date they are made. The Fund undertakes no responsibility to

update publicly or revise any forward‑looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628329070/en/

Inquiries: Derek Maltbie (630) 765-8499

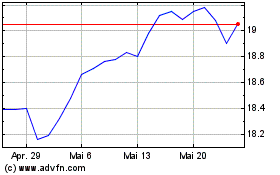

First Trust Enhanced Equ... (NYSE:FFA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

First Trust Enhanced Equ... (NYSE:FFA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024