Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

24 Mai 2024 - 8:29PM

Edgar (US Regulatory)

First Trust Enhanced Equity Income Fund (FFA)

Portfolio of Investments

March 31, 2024 (Unaudited)

|

|

|

|

|

|

|

|

Air Freight & Logistics – 1.5%

|

|

|

|

|

|

|

|

|

|

|

|

General Motors Co. (a) (b)

|

|

|

|

|

|

|

|

Huntington Bancshares, Inc. (a)

|

|

|

|

|

|

|

|

PNC Financial Services Group (The), Inc. (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Constellation Brands, Inc., Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs Group (The), Inc. (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Air Products and Chemicals, Inc.

|

|

|

|

Sherwin-Williams (The) Co.

|

|

|

|

|

|

|

|

Communications Equipment – 1.5%

|

|

|

|

|

|

|

|

Consumer Staples Distribution & Retail – 1.6%

|

|

|

|

Costco Wholesale Corp. (b)

|

|

|

|

Diversified Telecommunication Services – 1.3%

|

|

|

|

Verizon Communications, Inc.

|

|

|

|

Electric Utilities – 2.0%

|

|

|

|

American Electric Power Co., Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinemark Holdings, Inc. (a) (c)

|

|

|

|

|

|

|

|

Lions Gate Entertainment Corp., Class B (a) (c)

|

|

|

|

Take-Two Interactive Software, Inc. (c)

|

|

|

|

|

|

|

|

Financial Services – 0.4%

|

|

|

|

PayPal Holdings, Inc. (a) (c)

|

|

|

|

Ground Transportation – 1.3%

|

|

|

|

Canadian Pacific Kansas City Limited (a)

|

|

First Trust Enhanced Equity Income Fund (FFA)

Portfolio of Investments (Continued)

March 31, 2024 (Unaudited)

|

|

|

|

COMMON STOCKS (Continued)

|

|

|

Health Care Equipment & Supplies – 1.3%

|

|

|

|

Boston Scientific Corp. (a) (b) (c)

|

|

|

|

Health Care Providers & Services – 2.1%

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure – 3.6%

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant Brands International, Inc. (a)

|

|

|

|

Six Flags Entertainment Corp. (c)

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Conglomerates – 1.5%

|

|

|

|

Honeywell International, Inc. (a)

|

|

|

|

|

|

|

|

Arthur J. Gallagher & Co. (a)

|

|

|

|

|

|

|

|

|

|

|

|

Interactive Media & Services – 3.8%

|

|

|

|

Alphabet, Inc., Class C (a) (c)

|

|

|

|

|

|

|

|

International Business Machines Corp. (a)

|

|

|

|

Life Sciences Tools & Services – 3.6%

|

|

|

|

|

|

|

|

Thermo Fisher Scientific, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Freeport-McMoRan, Inc. (b)

|

|

|

|

Oil, Gas & Consumable Fuels – 4.6%

|

|

|

|

Diamondback Energy, Inc. (b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment – 8.9%

|

|

|

|

|

|

|

|

|

|

|

|

Marvell Technology, Inc. (b)

|

|

|

|

Micron Technology, Inc. (b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Trust Enhanced Equity Income Fund (FFA)

Portfolio of Investments (Continued)

March 31, 2024 (Unaudited)

|

|

|

|

COMMON STOCKS (Continued)

|

|

|

|

|

|

|

|

|

|

|

Synopsys, Inc. (a) (b) (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gaming and Leisure Properties, Inc.

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals – 7.6%

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods – 1.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip Morris International, Inc. (a)

|

|

|

|

Wireless Telecommunication Services – 1.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCKS – BUSINESS DEVELOPMENT COMPANIES – 1.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments – 99.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Call Options Written – (0.2)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Trust Enhanced Equity Income Fund (FFA)

Portfolio of Investments (Continued)

March 31, 2024 (Unaudited)

|

|

|

|

|

|

|

WRITTEN OPTIONS (Continued)

|

|

|

Call Options Written (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Premiums received $717,038)

|

|

|

|

|

|

|

Net Other Assets and Liabilities – 0.7%

|

|

|

|

|

|

|

|

All or a portion of these securities are pledged to cover index call options written.

At March 31, 2024, the segregated value of

these securities amounts to $194,521,002.

|

|

|

All or a portion of this security’s position represents cover for outstanding options written.

|

|

|

Non-income producing security.

|

|

|

Call options on securities indices were written on a portion of the common stock positions

that were not used to cover call options

written on individual equity securities held in the Fund’s portfolio.

|

Abbreviations throughout the Portfolio of Investments:

|

|

|

– Real Estate Investment Trusts

|

Valuation Inputs

The Fund is subject to fair value accounting standards that define fair value, establish

the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation

as of the measurement date. The three levels of the fair value hierarchy are as follows:

•

Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

•

Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived from observable market

data.)

•

Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the investment.

The inputs or methodologies used for valuing investments are not necessarily an indication

of the risk associated with investing in those investments.

A summary of the inputs used to value the Fund’s investments as of March 31, 2024 is as follows:

|

|

|

|

|

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

|

|

|

|

|

Common Stocks - Business Development Companies*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

|

|

|

|

|

|

|

See Portfolio of Investments for industry breakout.

|

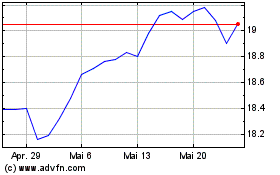

First Trust Enhanced Equ... (NYSE:FFA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

First Trust Enhanced Equ... (NYSE:FFA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024