SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

CVM

Official Letter 326 2023 – News published in the media

Rio de Janeiro, November 01, 2023, Centrais

Elétricas Brasileiras S/A – Eletrobras informs that, on October 31, 2023, it received Official Letter No. 326/2023/CVM/SEP/GEA-1

from the Brazilian Securities and Exchange Commission (CVM), attached to this Market Announcement, in which it requests clarification

in relation to the news published on October 31, 2023, under the title: "Eletrobras should announce offer for sale of stake in Cteep

this week".

In this regard, the Company highlights

that it disclosed a relevant fact yesterday, October 31, 2023, informing that the Company's Board of Directors authorized the structuring

of a potential public offering for secondary distribution of preferred shares issued by CTEEP, and there is, to date, no definition of

its terms and conditions, including the number of shares to be offered or the price per share. Until then, as previously disclosed in

a Market Announcement of October 16, 2023, there was no decision related to the sale of CTEEP shares.

The Company reiterates that it is currently

evaluating the potential offer, among several options analyzed to divest its minority interests, such as direct sale on the stock exchange,

“block trade”, exchange of assets, etc. In addition, the potential offer is not material since it would represent approximately

2% of the Company's total assets, as also informed in the Market Announcement of October 16, 2023 and in the Relevant Fact disclosed on

the date of yesterday.

The potential tender offer will be subject

to obtaining the applicable internal approvals of Eletrobras, as well as national and international political and macroeconomic conditions

and the interest of investors, among other factors beyond the control of Eletrobras and, if approved, will be registered and conducted

in accordance with applicable laws and regulations.

Eduardo Haiama

Vice President of Finance and Investor

Relations

|

This document may contain estimates and projections that are not statements of fact that have occurred in the past, but reflect the beliefs and expectations of our management and may constitute estimates and projections about future events within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believes", "may", "may", "estimates", "continues", "anticipates", "intends", "expects" and the like are intended to identify estimates that necessarily involve risks and uncertainties, whether known or not. Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, variations in interest rates, inflation and the value of the Brazilian Real, changes in volumes and patterns of consumer use of electricity, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations, and other risks described in our annual report and other documents filed with the SEC. Estimates and projections speak only as of the date on which they were expressed and we undertake no obligation to update any such estimates or projections due to the occurrence of new information or upcoming events. The future results of the Companies' operations and initiatives may differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect accurate results due to rounding performed. |

ANNEX

Copy of the letter

Subject: Request for clarification on news

Dear Director,

1. We refer to the news published on this date

in the newspaper Valor Econômico, Companies - Infrastructure section, under the title: "Eletrobras should announce an offer

for the sale of a stake in Cteep this week", which contains the following statements:

Continuing the plan to sell non-strategic

assets, Eletrobras plans to announce this week the offer in which it will sell its stake in the transmission company ISA Cteep, a company

in which it has a 35.74% stake in the total capital, according to Valor. The plans are to disclose a material fact with the so-called

'soft launch', which communicates a potential offer to the market.

Citi, Itaú BBA, Santander

and Safra were hired to structure the follow-on offering, according to sources, who spoke on condition of anonymity as the matter is not

yet public. According to the company's investor relations page, Eletrobras holds 9.73% of the common shares and 52.48% of the preferred

shares.

One of the sources said that the

plan is to launch the public offering after the disclosure of the results for the third quarter of ISA Cteep, which took place on Monday

(30) at the end of the day. The former state-owned company's plan is to increase efficiency gains by reducing its ownership structure,

discontinuing or selling assets that are not considered the core of the company's operations.

The

possible sale of Cteep's stakes can be used for new projects that are more aligned with its operations; in the simplification of the company's

structure, which allows for both operational and tax efficiency gains; or even in the payment of dividends to shareholders.

2. In view of the above, we determine that you.

clarify if the news is true, and, if so, explain the reasons why you believe it is not a relevant fact, as well as comment on other information

considered important on the subject.

3. It should be noted that, according to article

3 of CVM Resolution No. 44/21, the Investor Relations Officer is responsible for disclosing and communicating to the CVM and, if applicable,

to the stock exchange and the organized over-the-counter market entity in which the securities issued by the company are admitted to trading,

any material act or fact that occurred or related to its business, as

|

This document may contain estimates and projections that are not statements of fact that have occurred in the past, but reflect the beliefs and expectations of our management and may constitute estimates and projections about future events within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believes", "may", "may", "estimates", "continues", "anticipates", "intends", "expects" and the like are intended to identify estimates that necessarily involve risks and uncertainties, whether known or not. Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, variations in interest rates, inflation and the value of the Brazilian Real, changes in volumes and patterns of consumer use of electricity, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations, and other risks described in our annual report and other documents filed with the SEC. Estimates and projections speak only as of the date on which they were expressed and we undertake no obligation to update any such estimates or projections due to the occurrence of new information or upcoming events. The future results of the Companies' operations and initiatives may differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect accurate results due to rounding performed. |

well as ensuring their wide and immediate dissemination,

simultaneously in all markets in which such securities are admitted to trading.

4. Such manifestation shall occur through the

Empresa.NET System, category: Market Announcement, type: Clarifications on CVM/B3 questions, subject: News Disclosed

in the Media, which shall include the transcription of this letter. The fulfillment of this request for manifestation by means of a Market

Announcement does not exempt the eventual determination of liability for the failure to timely disclose a Relevant Fact, pursuant to CVM

Resolution No. 44/21.

5. We warn that, by order of the Superintendence

of Relations with Companies, in the use of its legal powers and, based on item II, of article 9, of Law No. 6,385/76, and CVM Resolution

No. 47/21, it will be up to the determination of the application of a punitive fine, in the amount of R$ 1,000.00 (one thousand

reais), without prejudice to other administrative sanctions, for non-compliance with the requirement contained in this letter, sent exclusively

by email, until 11.01.2023.

|

This document may contain estimates and projections that are not statements of fact that have occurred in the past, but reflect the beliefs and expectations of our management and may constitute estimates and projections about future events within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believes", "may", "may", "estimates", "continues", "anticipates", "intends", "expects" and the like are intended to identify estimates that necessarily involve risks and uncertainties, whether known or not. Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, variations in interest rates, inflation and the value of the Brazilian Real, changes in volumes and patterns of consumer use of electricity, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations, and other risks described in our annual report and other documents filed with the SEC. Estimates and projections speak only as of the date on which they were expressed and we undertake no obligation to update any such estimates or projections due to the occurrence of new information or upcoming events. The future results of the Companies' operations and initiatives may differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect accurate results due to rounding performed. |

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 1, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Eduardo Haiama

|

|

| |

Eduardo Haiama

Vice-President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

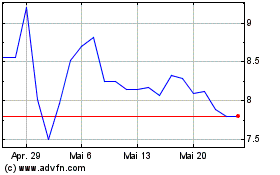

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

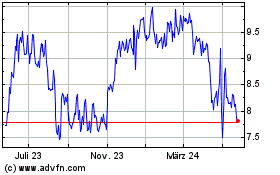

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024