(FROM THE WALL STREET JOURNAL 1/13/16)

By Jacob Bunge and Rachel Feintzeig

A feat of corporate and fiscal engineering, Dow Chemical Co. and

DuPont Co.'s planned megamerger hinges on finding the right

chemistry with about 100,000 employees.

Senior leaders who have spent decades at the two giants poised

to be dismantled are coping with upended career prospects and

attempting to keep their staff focused amid the merger of two

companies with a combined value of $103 billion.

At the same time, they could find themselves in line for plum

positions when the new company -- DowDuPont -- eventually separates

the combined businesses into three units focused on agriculture,

industrial materials and specialty products expected within three

years.

Recruiters, coaches and executives who have weathered deals and

integrations say it is a tough process.

"On one side of your mind you're saying, 'Tomorrow will be like

today.' You go about and do your job," says Robert Lynn Oakes, who

worked for Rohm & Haas Co. when Dow acquired the chemical maker

in 2009. He stayed for three years afterward before leaving in

2012. "In the back of your mind, you're looking for opportunities,"

he said.

Executives aim to close the deal by year's end, and staffing

changes are likely to follow. Corporate leaders have said they plan

to eliminate about $3 billion in annual costs before spinning off

the units.

The companies already have taken steps to shed thousands of

jobs, separate from the deal. The moves also could put many

managers in play.

John Touey, a principal with Radnor, Penn.-based executive

search firm Salveson Stetson Group Inc., said executives typically

become more receptive to outside recruiters 90 to 120 days after an

announcement -- a time when leaders are still closing the deal, but

can't yet execute detailed integration planning, he said.

"When an organization can't articulate what this executive's

place is going to be in the new organization, the more of a flight

risk they become," Mr. Touey said.

Edward Breen, DuPont's chairman and chief executive, said in an

interview that he has spoken extensively with senior-level managers

at DuPont since the deal was announced in December, stressing the

scale and heft of the spinoff companies and instructing senior

officials to spread the word among staff in an effort to reassure

and motivate employees.

"The human capital side is the most important part of this,"

said Mr. Breen, who will be the CEO of DowDuPont.

At Dow, managers have grown accustomed to change following a

decade in which the company spun off some businesses and bought

others, said CEO Andrew Liveris.

Still, he acknowledged that portraying deals as "a win-win" for

staff is difficult. "No one wants their cheese moved," said Mr.

Liveris, who will be executive chairman of the combined company.

"No one wants instability."

Privately, some managers at both companies say they are feeling

upbeat about the merger-to-split plan. Yet others have begun

exploring job opportunities elsewhere, say people familiar with the

matter.

Their options appear limited, though. The slumping farm economy

and slowing growth in overseas markets mean competitors are feeling

pain. Monsanto Co. plans to cut 16% of its global workforce, while

3M Co. last year outlined plans to lay off about 1.7% of its

workforce.

Mr. Breen, who separated multiple businesses at Tyco

International Ltd. during his time as CEO there from 2002 until

2012, has said combining the two chemical giants will benefit

managers -- after all, there will be three C-suites to fill, not

one.

Mr. Liveris said he also is preaching focus and calm to keep

workers on task, especially those whose jobs likely won't be

affected by the merger. "The greatest risk during this period of

uncertainty is you drop the ball on existing business," he

said.

To gear up executives to lead the spinoffs, Mr. Breen said he

and Mr. Liveris will include them in investment and strategy

decisions well ahead of the breakup.

At DuPont, Mr. Breen is using uncertainty to motivate his

managers, just as he did at Tyco, telling those in line to lead

spinoffs that their future jobs depend on their teams' performance

during the transition. "When I did this at Tyco, the excitement of

these management teams. . .was so strong, they were working day and

night," he said.

Annual executive turnover at merged companies have averaged

double the normal rate for nearly a decade following deals,

according to research by Jeffrey Krug, dean of the business school

at Bloomsburg University of Pennsylvania.

"The greater degree to which you integrate assets, the higher

the rates of turnover, because integration is disruptive," he

said.

(END) Dow Jones Newswires

January 13, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

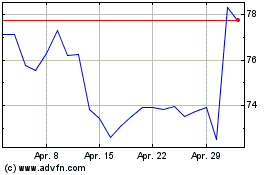

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024