Monsanto Sales Fall; Company Boosts Job Cuts

06 Januar 2016 - 3:20PM

Dow Jones News

Monsanto Co.'s revenue slid 23% in the first quarter as corn

sales weakened, and the biotech seed giant said it would ramp up

its restructuring efforts and cut another 1,000 jobs.

In October, Monsanto unveiled plans to eliminate 2,600 jobs and

streamline its commercial and research efforts. The company said

that it now expects those job cuts to come in at 3,600 and that it

will record $1.1 billion to $1.2 billion in restructuring charges.

It previously expected charges of $850 million to $900 million.

Shares fell 1.3% in premarket trading.

Monsanto is struggling with declining crop prices that have

pinched incomes for farmers, its main customer base.

Those pressures have led Monsanto and other companies in the

agricultural sector to seek deals as a way to expand and slice

costs. Monsanto had pursued rival Syngenta AG but dropped the $46

billion proposal last year after being rejected.

In December, Syngenta's top executive indicated it was open to

combinations with companies including Monsanto. That came after the

merger deal between DuPont Co. and Dow Chemical Co., both major

agricultural suppliers, which eventually could pose a greater

competitive threat in the global seed-and-pesticide industry.

For the quarter ended Nov. 30, corn sales—Monsanto's biggest

source of profit—fell 20% to $745 million.

In all, Monsanto reported a loss of $253 million, or 56 cents a

share, from a year-earlier profit of $243 million, or 50 cents a

share.

Excluding restructuring charges and other items, per-share loss

was 11 cents. Monsanto forecast an adjusted loss of 23 cents to 33

cents a share.

Revenue slid 23% to $2.22 billion, while analysts forecast sales

of $2.39 billion, according to Thomson Reuters.

Monsanto cited weaker foreign currencies and lower corn volumes

in Latin America for the revenue decline.

Soybean sales grew 11% to $438 million. U.S. farmers have

dedicated more fields to soybeans in pursuit of higher profits, and

Monsanto has rolled out new soybean seed varieties in North and

South America.

Sales in the company's agricultural productivity segment, which

includes its Roundup brand weed killer, fell to $820 million from

$1.25 billion a year earlier.

For the year ending in August, the St. Louis company said it

expects to come in at the low end of its adjusted earnings guidance

of $5.10 to $5.60 a share, citing the currency devaluation in

Argentina.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 06, 2016 09:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

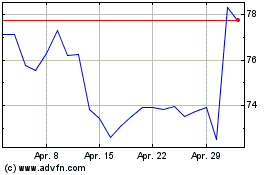

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024