UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under Rule

14a-12 |

Innovid Corp.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if

other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary

materials. |

| ☐ | Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

This filing relates to the proposed merger involving Innovid Corp.

(“Innovid”) with Mediaocean LLC (“Flashtalking”), pursuant to the terms of that certain Agreement and Plan of

Merger, dated as of November 21, 2024.

The following information was made available to certain employees on

November 21, 2024.

External FAQs

ALL

Q: What’s being announced?

A: Innovid and Flashtalking announced an intent to merge to create

a premier global independent, omnichannel ad tech platform. The merger will take place as part of an agreement for Mediaocean to acquire

Innovid, with an intended close date in 2025 after securing all required regulatory and shareholder approvals.

Q: Who will lead the newly-merged

company?

A: Zvika Netter,

CEO & Founder of Innovid, will lead the combined ad tech organization as CEO reporting to Bill Wise, Co-Founder & CEO of Mediaocean.

Grant Parker, who currently runs Flashtalking, will be President of the combined ad tech organization reporting to Mr. Netter. Mr. Netter

will also join the board of Mediaocean.

Q: What is the focus for the joint company?

A: Together, the newly merged organization will provide the world’s

top advertisers and publishers with ad delivery, creative personalization, measurement, verification, and optimization across channels,

including digital, social, CTV, and linear TV.

Q: Why are Innovid and Flashtalking

merging / why is Mediaocean acquiring Innovid?

A: The companies intend to merge

to create a premier global, independent omnichannel ad tech platform. Together, the combined organization will provide a broad array of

complementary offerings, including ad delivery, creative personalization, measurement, verification, and optimization across channels,

including digital, social, CTV, and linear TV.

A: Brands today often rely on

technology owned by media sellers, resulting in walled off access to inventory and data, less control over where their ads appear, and

higher costs due to media spending being optimized for publisher yield.

A: To level the playing field

and maximize ROI, brands, agencies, and publishers need an independent, neutral technology company operating across all channels.

A: This is especially true in

the emerging area of connected television (CTV) where big tech players have yet to disintermediate the industry. As streaming viewership

continues to rise, ensuring the right foundation is established for the future of TV - across digital and linear channels - is critical.

Q: What are the intended benefits

to the market / customers?

A: Combining two trusted independent

platforms – Innovid and Flashtalking – will empower advertisers with increased control over data and decisions, more choice

in where ad spend goes, and the right tools and workflows to make media investments more effective and efficient.

A: Innovid and Flashtalking are

two of the longest-standing ad tech platforms in the world, with proven solutions proven across brands, agencies, and publishers.

A: Mediaocean, Flashtalking and

Innovid have the independence, data, and technology to help optimize the industry – and make advertising better for all.

Q: When does the deal close and what is the valuation?

A: The merger will take place as part of an agreement for Mediaocean

to acquire Innovid, with an intended close date in 2025.

A: Until that time, both businesses will continue to operate independently.

A: The price per share is $3.15, which implies an enterprise value

of approximately $500 million.

CUSTOMER / PARTNER-CENTRIC (IN ADDITION TO ABOVE)

Organizational/service impacts

Q: How will this acquisition affect my day-to-day team at Innovid

or Flashtalking?

A: Your team at Innovid

or Flashtalking remains the same as we lead up to the formal deal close. Until closing, it’s

business as usual.

Q: Is there any anticipated level of service disruption?

A: No, we do not anticipate any service disruption, and our primary

focus when the deal is closed is to ensure a seamless transition for our clients - with added value of a combined platform over time.

Product and operations

Q: What is the timeline for product integration

roadmap and execution?

A: Integration of product solutions will not start until after the

anticipated deal close set for 2025. We will keep you updated as we get closer to that date and look forward to continuing to innovate

with you.

Q: Are existing product solutions

changing?

A: No, existing product solutions

across ad serving, creative, and measurement are not changing due to the transaction. It is business as usual until the deal closes.

Communication

Q: How will you keep customers updated on the progress of the acquisition?

A: We’ll be operating business as usual until the deal closes

and we’ll provide updates for you at that time. A seamless integration over time is a top priority for us to ensure we can continue

to provide outstanding value for you as a customer / partner.

Objection handling

Q: How will the products fit

together and how will you operate until the deal closes?

A: Mediaocean’s intention

is to provide a broader range of advertising solutions by integrating Innovid’s complementary offerings with Flashtalking’s.

Until the deal closes, we will continue to operate as independent entities, conducting business as usual.

Q: I have an RFP going with both of you - should I wait until this

is done? How should I think about you side-by-side in the meantime?

A: This should not change how you were evaluating a partner. We will

be operating business as usual and as two separate, independent companies until the deal close, anticipated in 2025. At that time, we’ll

be focused on providing seamless integration of our platforms that will produce additional value.

Q: Where can I find additional important information regarding the

merger?

A: In connection with the transaction,

Innovid will file with the SEC a proxy statement on Schedule 14A, the definitive version of which will be sent or provided to Innovid

stockholders. Innovid may also file other documents with the SEC regarding the transaction. This communication is not a substitute for

the proxy statement or any other document which Innovid may file with the SEC. Investors and security holders are urged to read the proxy

statement and any other relevant documents that are filed or will be filed with the SEC, as well as any amendments or supplements to these

documents, carefully and in their entirety because they contain or will contain important information about the transaction and related

matters.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains forward-looking

statements. These forward-looking statements include, without limitation, statements relating to the proposed merger of Innovid with Mediaocean

(the “Transaction”). These statements are based on the beliefs and assumptions of the management of Innovid. Although Innovid

believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, it

cannot assure you that it will achieve or realize these plans, intentions or expectations. These statements constitute projections, forecasts

and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not

relate strictly to historical or current facts. When used in this communication, words such as “anticipate,” “believe,”

“can,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “seek,” “should,” “strive,” “target,” “will,” “would”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. Should one or more of a number of known and unknown risks and uncertainties materialize, or should any of our assumptions

prove incorrect, our actual results or performance may be materially different from those expressed or implied by these forward-looking

statements. Some factors that could cause actual results to differ include, but are not limited to: (i) the completion of the Transaction

on anticipated terms and timing, including obtaining required stockholder and regulatory approvals, and the satisfaction of other conditions

to the completion of the Transaction; (ii) potential litigation relating to the Transaction that could be instituted against Mediaocean,

Innovid or their respective directors, managers or officers, including the effects of any outcomes related thereto; (iii) the risk that

disruptions from the Transaction will harm Innovid’s business, including current plans and operations; (iv) the ability of Innovid

to retain and hire key personnel; (v) potential adverse reactions or changes to business relationships resulting from the announcement

or completion of the Transaction; (vi) continued availability of capital and financing and rating agency actions; (vii) legislative, regulatory

and economic developments affecting Innovid’s business; (vii) general economic and market developments and conditions; (ix) potential

business uncertainty, including changes to existing business relationships, during the pendency of the Transaction that could affect Innovid’s

financial performance; (x) certain restrictions during the pendency of the Transaction that may impact Innovid’s ability to pursue

certain business opportunities or strategic transactions; (xi) unpredictability and severity of catastrophic events, including but not

limited to acts of terrorism, pandemics, outbreaks of war or hostilities, as well as Innovid’s response to any of the aforementioned

factors; (xii) significant transaction costs associated with the Transaction; (xiii) the possibility that the Transaction may be more

expensive to complete than anticipated, including as a result of unexpected factors or events; (xiv) the occurrence of any event, change

or other circumstance that could give rise to the termination of the Transaction, including in circumstances requiring Innovid to pay

a termination fee or other expenses; (xv) competitive responses to the Transaction; (xvi) other risks and uncertainties indicated in this

communication, including those set forth under the section titled “Risk Factors” and those incorporated by reference to our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the Securities and Exchange Commission (“SEC”)

on February 29, 2024; and (xvii) the risks and uncertainties that will be described in the Proxy Statement (as defined herein) available

from the sources indicated below. These risks, as well as other risks associated with the Transaction, will be more fully discussed in

the Proxy Statement. While the list of factors presented here is, and the list of factors to be presented in the Proxy Statement will

be, considered representative, no such list should be considered a complete statement of all potential risks and uncertainties.

These forward-looking statements are based

on information available as of the date of this communication and current expectations, forecasts and assumptions, and involve a number

of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as

of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances

after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws.

As a result of a number of known and unknown

risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking

statements. You should not place undue reliance on these forward-looking statements.

Important Additional Information and

Where to Find It

In connection with the Transaction, Innovid

will file with the SEC a Proxy Statement on Schedule 14A (the “Proxy Statement”), the definitive version of which will be

sent or provided to Innovid stockholders. Innovid may also file other documents with the SEC regarding the Transaction. This communication

is not a substitute for the Proxy Statement or any other document which Innovid may file with the SEC. INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement and other documents (when

they become available) that are filed or will be filed with the SEC by Innovid through the website maintained by the SEC at www.sec.gov,

Innovid’s website at https://investors.innovid.com/ or by contacting Innovid’s Investor Relations Team at ir@innovid.com.

Participants in Solicitation

Mediaocean and Innovid and their respective

directors and officers may be deemed to be participants in the solicitation of proxies from Innovid’s stockholders in connection

with the proposed transaction. Information about Innovid’s directors and executive officers and their ownership of Innovid’s

securities is set forth in Innovid’s filings with the SEC. To the extent that holdings of Innovid’s securities have changed

since the amounts printed in Innovid’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants

in the proposed transaction may be obtained by reading the proxy statement/ prospectus regarding the proposed transaction when it becomes

available. You may obtain free copies of these documents as described in the preceding paragraph.

About Mediaocean

Mediaocean is powering the future of the

advertising ecosystem with technology that empowers brands and agencies to deliver impactful omnichannel marketing experiences. With hundreds

of billions in annualized ad spend running through its software products, Mediaocean deploys AI and automation to optimize investments

and outcomes, with its advertising infrastructure and ad tech tools used by more than 100,000 people across the globe. Mediaocean owns

and operates Prisma, the industry’s trusted system of record for media management and finance, Flashtalking, an innovative

ad server and creative personalization platform, as well as Protected by Mediaocean, an MRC-accredited ad verification solution.

Visit www.mediaocean.com for more information.

About Innovid

Innovid (NYSE:CTV) is an independent software

platform for the creation, delivery, measurement, and optimization of advertising across connected TV (CTV), linear, and digital. Through

a global infrastructure that enables cross-platform ad serving, data-driven creative, and measurement, Innovid offers its clients always-on

intelligence to optimize advertising investment across channels, platforms, screens, and devices. Innovid is an independent platform steering

innovation in converged TV innovation, through proprietary technology and partnerships designed to reimagine TV advertising. Headquartered

in New York City, Innovid serves a global client base through offices across the Americas, Europe, and Asia Pacific. To learn more, visit https://www.innovid.com/ or

follow us on LinkedIn or X.

Contacts

Media

Innovid

Megan Coyle

megan@innovid.com

Mediaocean

Aaron Goldman

press@mediaocean.com

6

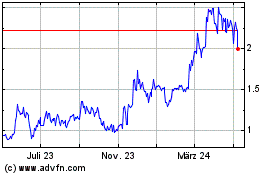

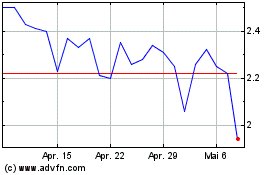

Innovid (NYSE:CTV)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Innovid (NYSE:CTV)

Historical Stock Chart

Von Dez 2023 bis Dez 2024