00018353782024Q3False12/31http://www.innovid.com/20240930#WarrantLiabilityNoncurrenthttp://www.innovid.com/20240930#WarrantLiabilityNoncurrent0xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purectv:segmentctv:reportingUnitctv:subsidiary00018353782024-01-012024-09-300001835378us-gaap:CommonStockMember2024-01-012024-09-300001835378us-gaap:WarrantMember2024-01-012024-09-3000018353782024-10-3100018353782024-09-3000018353782023-12-3100018353782024-07-012024-09-3000018353782023-07-012023-09-3000018353782023-01-012023-09-300001835378us-gaap:CommonStockMember2024-06-300001835378us-gaap:AdditionalPaidInCapitalMember2024-06-300001835378us-gaap:RetainedEarningsMember2024-06-3000018353782024-06-300001835378us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001835378us-gaap:CommonStockMember2024-07-012024-09-300001835378us-gaap:RetainedEarningsMember2024-07-012024-09-300001835378us-gaap:CommonStockMember2024-09-300001835378us-gaap:AdditionalPaidInCapitalMember2024-09-300001835378us-gaap:RetainedEarningsMember2024-09-300001835378us-gaap:CommonStockMember2023-06-300001835378us-gaap:AdditionalPaidInCapitalMember2023-06-300001835378us-gaap:RetainedEarningsMember2023-06-3000018353782023-06-300001835378us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001835378us-gaap:CommonStockMember2023-07-012023-09-300001835378us-gaap:RetainedEarningsMember2023-07-012023-09-300001835378us-gaap:CommonStockMember2023-09-300001835378us-gaap:AdditionalPaidInCapitalMember2023-09-300001835378us-gaap:RetainedEarningsMember2023-09-3000018353782023-09-300001835378us-gaap:CommonStockMember2023-12-310001835378us-gaap:AdditionalPaidInCapitalMember2023-12-310001835378us-gaap:RetainedEarningsMember2023-12-310001835378us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001835378us-gaap:CommonStockMember2024-01-012024-09-300001835378us-gaap:RetainedEarningsMember2024-01-012024-09-300001835378us-gaap:CommonStockMember2022-12-310001835378us-gaap:AdditionalPaidInCapitalMember2022-12-310001835378us-gaap:RetainedEarningsMember2022-12-3100018353782022-12-310001835378us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001835378us-gaap:CommonStockMember2023-01-012023-09-300001835378us-gaap:RetainedEarningsMember2023-01-012023-09-300001835378ctv:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001835378ctv:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001835378ctv:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001835378ctv:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001835378us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-09-300001835378us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-07-012024-09-300001835378us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-07-012023-09-300001835378us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-01-012024-09-300001835378us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-09-3000018353782024-04-012024-06-3000018353782023-04-012023-06-300001835378us-gaap:CustomerRelationshipsMember2024-01-012024-09-300001835378us-gaap:TechnologyBasedIntangibleAssetsMember2024-01-012024-09-300001835378us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001835378us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001835378us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001835378us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001835378us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001835378us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-3100018353782024-02-070001835378us-gaap:RealEstateMember2024-09-300001835378us-gaap:RealEstateMember2023-12-310001835378ctv:PublicWarrantsMember2024-09-300001835378ctv:PrivateWarrantsMember2024-09-3000018353782022-08-040001835378us-gaap:RevolvingCreditFacilityMember2022-08-030001835378us-gaap:RevolvingCreditFacilityMember2022-08-040001835378srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2022-08-040001835378us-gaap:RevolvingCreditFacilityMember2022-08-042022-08-040001835378us-gaap:RevolvingCreditFacilityMember2024-09-300001835378srt:SubsidiariesMember2024-09-300001835378ctv:IsraeliSubsidiaryMember2024-09-3000018353782024-04-152024-04-1500018353782024-07-022024-07-020001835378us-gaap:SubsequentEventMember2024-10-232024-10-230001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:CostOfSalesMember2024-07-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:CostOfSalesMember2023-07-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:CostOfSalesMember2024-01-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:CostOfSalesMember2023-01-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:SellingAndMarketingExpenseMember2024-07-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:SellingAndMarketingExpenseMember2024-01-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMemberus-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMember2024-07-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMember2023-07-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMember2024-01-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMemberctv:LegacyPlanAnd2021PlanMember2023-01-012023-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMember2023-12-310001835378us-gaap:ShareBasedPaymentArrangementEmployeeMember2024-01-012024-09-300001835378us-gaap:ShareBasedPaymentArrangementEmployeeMember2024-09-300001835378us-gaap:RestrictedStockUnitsRSUMember2024-09-300001835378us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001835378us-gaap:WarrantMember2024-07-012024-09-300001835378us-gaap:WarrantMember2023-07-012023-09-300001835378us-gaap:WarrantMember2024-01-012024-09-300001835378us-gaap:WarrantMember2023-01-012023-09-300001835378country:US2024-07-012024-09-300001835378country:US2023-07-012023-09-300001835378country:US2024-01-012024-09-300001835378country:US2023-01-012023-09-300001835378country:CA2024-07-012024-09-300001835378country:CA2023-07-012023-09-300001835378country:CA2024-01-012024-09-300001835378country:CA2023-01-012023-09-300001835378srt:AsiaPacificMember2024-07-012024-09-300001835378srt:AsiaPacificMember2023-07-012023-09-300001835378srt:AsiaPacificMember2024-01-012024-09-300001835378srt:AsiaPacificMember2023-01-012023-09-300001835378us-gaap:EMEAMember2024-07-012024-09-300001835378us-gaap:EMEAMember2023-07-012023-09-300001835378us-gaap:EMEAMember2024-01-012024-09-300001835378us-gaap:EMEAMember2023-01-012023-09-300001835378srt:LatinAmericaMember2024-07-012024-09-300001835378srt:LatinAmericaMember2023-07-012023-09-300001835378srt:LatinAmericaMember2024-01-012024-09-300001835378srt:LatinAmericaMember2023-01-012023-09-300001835378country:IL2024-09-300001835378country:IL2023-12-310001835378country:US2024-09-300001835378country:US2023-12-310001835378ctv:RestOfTheWorldMember2024-09-300001835378ctv:RestOfTheWorldMember2023-12-310001835378us-gaap:EmployeeStockOptionMember2024-07-012024-09-300001835378ctv:RestrictedStockUnitsUnvestedMember2024-07-012024-09-300001835378us-gaap:EmployeeStockOptionMember2024-07-012024-09-300001835378us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001835378us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001835378us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001835378us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001835378us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001835378us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001835378us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001835378us-gaap:WarrantMember2024-07-012024-09-300001835378us-gaap:WarrantMember2023-07-012023-09-300001835378us-gaap:WarrantMember2024-01-012024-09-300001835378us-gaap:WarrantMember2023-01-012023-09-300001835378us-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________________________________________________________

FORM 10-Q

____________________________________________________________________________________________________________________________________________

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended September 30, 2024 |

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ____________ to ____________ |

Commission file number 001-40048

____________________________

Innovid Corp.

(Exact name of registrant as specified in its charter)

____________________________

| | | | | | | | |

| Delaware | | 87-3769599 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

30 Irving Place, 12th Floor New York, New York | | 10003 |

(Address of Principal Executive Offices) | | (Zip Code) |

+1(212) 966-7555

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former Fiscal Year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | CTV | New York Stock Exchange |

| Warrants to purchase one share of Common stock, each at an exercise price of $11.50 per share | CTVWS | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large, accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The registrant had outstanding 148,473,428 shares of common stock as of October 31, 2024

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) contains forward-looking statements. These forward-looking statements include, without limitation, statements relating to expectations for future financial performance, business strategies or expectations for our business and the stock repurchase program. These statements are based on the beliefs and assumptions of the management of Innovid. Although Innovid believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, it cannot assure you that it will achieve or realize these plans, intentions or expectations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Quarterly Report, words such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strive,” “target,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Should one or more of a number of known and unknown risks and uncertainties materialize, or should any of our assumptions prove incorrect, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to:

• our public securities’ potential liquidity and trading;

• our ability to raise financing in the future;

• our success in retaining or recruiting, or changes required in, our officers, key employees or directors;

• changes in applicable laws or regulations;

• our ability to maintain and expand relationships with advertisers;

• decreases and/or changes in CTV audience viewership behavior;

• Innovid’s ability to make the right investment decisions and to innovate and develop new solutions;

• the accuracy of Innovid’s estimates of market opportunity, forecasts of market growth and projections of future financial performance;

• the extent of investment required in Innovid’s sales and marketing efforts;

• Innovid’s ability to effectively manage its growth;

• sustained overall demand for advertising;

• actual or potential impacts of international conflicts and humanitarian crises on global markets;

• the continued acceptance of digital advertising by consumers and the impact of opt-in, opt-out or ad-blocking technologies;

• Innovid’s ability to scale its platform and infrastructure to support anticipated growth and transaction volume;

• the impact of increasing competition in the digital advertising space, including with competitors who have significantly more resources; and

• other risks and uncertainties indicated in this report, including those set forth under the section titled “Risk Factors” and those included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Annual Report on Form 10-K”), which was filed with the Securities and Exchange Commission (“SEC”) on February 29, 2024.

These forward-looking statements are based on information available as of the date of this Quarterly Report and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

WHERE TO FIND MORE INFORMATION

Our website address is www.innovid.com. We may use our website as a means of disclosing material non-public information. Such disclosures will be included on our website in the “Investors” section or at investors.innovid.com. We may also use certain social media channels, such as LinkedIn, Facebook or X (formerly Twitter), as a means of disclosing information about us and our business to our colleagues, customers, investors and the public. While not all the information that the Company posts to the Innovid website or to social media accounts is of a material nature, some information could be deemed to be material. Accordingly, investors should monitor our website and certain of our social media channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. However, information contained on, or that can be accessed through, these communications channels do not constitute a part of this Quarterly Report and are not incorporated by reference herein. Our SEC filings are available to you on the SEC’s website at http://www.sec.gov. This site contains reports and other information regarding issuers that file electronically with the SEC. The information on that website is not part of this Quarterly Report and is not incorporated by reference herein.

Part I

Item 1. Financial Statements

INNOVID CORP. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited and in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30, 2024 |

| December 31, 2023 |

Assets |

| |

|

Current assets: | | | |

Cash and cash equivalents | $ | 34,564 | | | $ | 49,585 | |

Trade receivables, net of allowance for credit losses of $292 and $321 at September 30, 2024, and December 31, 2023, respectively | 44,365 | | | 46,420 | |

Prepaid expenses and other current assets | 4,475 | | | 5,615 | |

| Total current assets | 83,404 | | | 101,620 | |

Long-term restricted deposits | 423 | | | 412 | |

Property and equipment, net | 21,006 | | | 18,419 | |

Goodwill | 102,473 | | | 102,473 | |

| Intangible assets, net | 21,305 | | | 24,318 | |

| Operating lease right of use asset | 10,894 | | | 1,435 | |

| Other non-current assets | 903 | | | 1,278 | |

Total assets | $ | 240,408 | | | $ | 249,955 | |

| | | |

Liabilities and Stockholders’ Equity | | | |

Current liabilities: | | | |

| Trade payables | $ | 3,793 | | | $ | 2,810 | |

Employee and payroll accruals | 9,140 | | | 14,060 | |

Lease liabilities—current portion | 1,388 | | | 1,200 | |

| Accrued expenses and other current liabilities | 9,397 | | | 7,426 | |

| Total current liabilities | 23,718 | | | 25,496 | |

| Long-term debt | — | | | 20,000 | |

Lease liabilities—non-current portion | 9,835 | | | 634 | |

| Other non-current liabilities | 6,927 | | | 7,528 | |

| Warrants liability | 411 | | | 307 | |

Commitments and contingencies (Note 6) | | | |

Stockholders’ equity: | | | |

Common stock: $0.0001 par value - Authorized: 500,000,000 at September 30, 2024, and December 31, 2023; Issued and outstanding: 147,773,651 and 141,194,179 at September 30, 2024, and December 31, 2023, respectively | 15 | | | 13 | |

| Additional paid-in capital | 394,410 | | | 378,774 | |

| Accumulated deficit | (194,908) | | | (182,797) | |

Total stockholders’ equity | 199,517 | | | 195,990 | |

Total liabilities and stockholders’ equity | $ | 240,408 | | | $ | 249,955 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

INNOVID CORP. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited and in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

Revenue | $ | 38,251 | | | $ | 36,234 | | | $ | 112,940 | | | $ | 101,265 | | | | | |

Cost of revenue (1) | 8,917 | | | 8,428 | | | 26,746 | | | 25,284 | | | | | |

| Research and development (1) | 7,021 | | | 6,486 | | | 20,646 | | | 20,479 | | | | | |

| Sales and marketing (1) | 11,682 | | | 11,175 | | | 35,523 | | | 34,272 | | | | | |

| General and administrative (1) | 9,238 | | | 9,753 | | | 29,070 | | | 28,327 | | | | | |

| Depreciation, amortization and long-lived assets impairment | 2,836 | | | 4,714 | | | 8,291 | | | 8,808 | | | | | |

| Goodwill impairment | — | | | — | | | — | | | 14,503 | | | | | |

| Operating loss | (1,443) | | | (4,322) | | | (7,336) | | | (30,408) | | | | | |

| Finance income, net | (285) | | | (290) | | | (405) | | | (3,013) | | | | | |

| Loss before taxes | (1,158) | | | (4,032) | | | (6,931) | | | (27,395) | | | | | |

| Taxes on (income) loss | (5,823) | | | (1,301) | | | 5,180 | | | 2,858 | | | | | |

| Net income (loss) | $ | 4,665 | | | $ | (2,731) | | | $ | (12,111) | | | $ | (30,253) | | | | | |

| | | | | | | | | | | |

Net income (loss) per share common share—basic | $ | 0.03 | | | $ | (0.02) | | | $ | (0.08) | | | $ | (0.22) | | | | | |

Net income (loss) per share common share—diluted | $ | 0.03 | | | $ | (0.02) | | | $ | (0.08) | | | $ | (0.22) | | | | | |

| Weighted-average number of shares used in computing net income (loss) per share: | | | | | | | | | | | |

| Basic | 146,822,073 | | | 139,607,389 | | | 144,664,912 | | | 137,826,099 | | | | | |

| Diluted | 152,504,240 | | | 139,607,389 | | | 144,664,912 | | | 137,826,099 | | | | | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

(1) Exclusive of depreciation, amortization, long-lived assets and goodwill impairment presented separately.

INNOVID CORP. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited and in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three months ended September 30, 2024 |

| | | Common stock | | Additional paid-in capital | | Accumulated deficit | | Total stockholders’ equity |

| | | | | Shares | | Amount | | | |

| Balance as of June 30, 2024 | | | | | 145,803,657 | | | $ | 14 | | | $ | 388,467 | | | $ | (199,573) | | | $ | 188,908 | |

| Stock-based compensation | | | | | | | | | 5,710 | | | | | 5,710 | |

Issuance of common stock: | | | | | | | | | | | | | |

| —exercised options and RSUs vested | | | | | 1,969,994 | | | 1 | | | 233 | | | | | 234 | |

Net income | | | | | | | | | | | 4,665 | | | 4,665 | |

Balance as of September 30, 2024 | | | | | 147,773,651 | | | $ | 15 | | | $ | 394,410 | | | $ | (194,908) | | | $ | 199,517 | |

| | | | | | | | | | | | | |

| | | | | Three months ended September 30, 2023 |

| | | | | Common stock | | Additional paid-in capital | | Accumulated deficit | | Total stockholders’ equity |

| | | | | Shares | | Amount | | | |

| Balance as of June 30, 2023 | | | | | 138,737,104 | | | $ | 13 | | | $ | 367,970 | | | $ | (178,408) | | | $ | 189,575 | |

| Stock-based compensation | | | | | | | | | 5,919 | | | | | 5,919 | |

Issuance of common stock: | | | | | | | | | | | | | |

—exercised options and RSUs vested | | | | | 1,399,801 | | | — | | | 158 | | | | | 158 | |

| Net loss | | | | | | | | | | | (2,731) | | | (2,731) | |

Balance as of September 30, 2023 | | | | | 140,136,905 | | | $ | 13 | | | $ | 374,047 | | | $ | (181,139) | | | $ | 192,921 | |

| | | | | | | | | | | | | |

| | | | | Nine months ended September 30, 2024 |

| | | Common stock | | Additional paid-in capital | | Accumulated deficit | | Total stockholders’ equity |

| | | | | Shares | | Amount | | | |

| Balance as of December 31, 2023 | | | | | 141,194,179 | | | $ | 13 | | | $ | 378,774 | | | $ | (182,797) | | | $ | 195,990 | |

| Stock-based compensation | | | | | | | | | 15,324 | | | | | 15,324 | |

Issuance of common stock: | | | | | | | | | | | | | |

| —exercised options and RSUs vested | | | | | 6,579,472 | | | 2 | | | 312 | | | | | 314 | |

| Net loss | | | | | | | | | | | (12,111) | | | (12,111) | |

Balance as of September 30, 2024 | | | | | 147,773,651 | | | 15 | | | $ | 394,410 | | | $ | (194,908) | | | $ | 199,517 | |

| | | | | | | | | | | | | |

| | | | | Nine months ended September 30, 2023 |

| | | | | Common stock | | Additional paid-in capital | | Accumulated deficit | | Total stockholders’ equity |

| | | | | Shares | | Amount | | | |

Balance as of December 31, 2022 | | | | | 133,882,414 | | | $ | 13 | | | $ | 356,801 | | | $ | (150,886) | | | $ | 205,928 | |

| Stock-based compensation | | | | | | | | | 16,474 | | | | | 16,474 | |

Issuance of common stock: | | | | | | | | | | | | | |

—exercised options and RSUs vested | | | | | 6,254,491 | | | — | | | 772 | | | | | 772 | |

| Net loss | | | | | | | | | | | (30,253) | | | (30,253) | |

Balance as of September 30, 2023 | | | | | 140,136,905 | | | $ | 13 | | | $ | 374,047 | | | $ | (181,139) | | | $ | 192,921 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

INNOVID CORP. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited and in thousands)

| | | | | | | | | | | |

| Nine months ended September 30, |

| 2024 |

| 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (12,111) | | | $ | (30,253) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation, amortization and long-lived assets impairment | 8,291 | | | 8,808 | |

| Loss on disposal of property and equipment | 15 | | | — | |

| Goodwill impairment | — | | | 14,503 | |

| Stock-based compensation | 14,526 | | | 15,470 | |

| Change in fair value of warrants | 104 | | | (3,688) | |

Loss on foreign exchange, net | 321 | | | — | |

Changes in operating assets and liabilities: | | | |

| Trade receivables, net | 2,055 | | | 94 | |

Prepaid expenses and other assets | 1,349 | | | (1,167) | |

| Operating lease right of use assets | 438 | | | 1,351 | |

| Trade payables | 984 | | | (36) | |

Employee and payroll accruals | (4,920) | | | 1,770 | |

| Operating lease liabilities | (508) | | | (1,683) | |

Accrued expenses and other liabilities | 1,371 | | | 2,268 | |

Net cash provided by operating activities | 11,915 | | | 7,437 | |

| Cash flows from investing activities: | | | |

| Internal use software capitalization | (6,098) | | | (7,795) | |

Purchases of property and equipment | (983) | | | (395) | |

Withdrawal of short-term bank deposits | 165 | | | 10,000 | |

Decrease in deposits | — | | | 77 | |

Net cash (used in) provided by investing activities | (6,916) | | | 1,887 | |

| Cash flows from financing activities: | | | |

Proceeds from loan | — | | | 20,000 | |

Payment on loan | (20,000) | | | (20,000) | |

| Proceeds from exercise of options | 312 | | | 772 | |

Net cash (used in) provided by financing activities | (19,688) | | | 772 | |

Effect of exchange rates on cash, cash equivalents and restricted cash | (321) | | | — | |

(Decrease) increase in cash, cash equivalents, and restricted cash | (15,010) | | | 10,096 | |

| Cash, cash equivalents, and restricted cash at the beginning of the period | 49,997 | | | 37,971 | |

| Cash, cash equivalents, and restricted cash at the end of the period | $ | 34,987 | | | $ | 48,067 | |

Supplemental disclosures: | | | |

Income taxes paid | $ | 2,990 | | | $ | 1,129 | |

Interest paid | $ | 117 | | | $ | 1,141 | |

Non-cash transactions: | | | |

Right of use assets obtained in exchange for lease liability upon lease modification | $ | 9,897 | | | $ | — | |

Reconciliation of cash, cash equivalents, and restricted cash: | | | |

Cash and cash equivalents | $ | 34,564 | | | $ | 47,680 | |

Long-term restricted deposits | 423 | | | 387 | |

Total cash, cash equivalents, and restricted cash | $ | 34,987 | | | $ | 48,067 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

1. Description of Business

Innovid Corp. together with its consolidated subsidiaries, the “Company” or “Innovid”, is an enterprise software platform for the creation, delivery, measurement, and optimization of advertising across connected TV (“CTV”), mobile TV and desktop environments. We provide critical technology infrastructure for many of the world’s largest brands, agencies, and publishers, and empower them to create ad-supported TV experiences that people love. Our cloud-based platform tightly integrates with the highly fragmented advertising technology and media ecosystems, and includes three key solutions: ad serving, creative personalization, and measurement.

Innovid Corp. was originally incorporated as ION Acquisition Corp. 2 Ltd. (“ION”), a special purpose acquisition company, on November 23, 2020, and Innovid Corp. was the surviving entity following the completion of its merger with ION on November 30, 2021 (the “Transaction”).

On February 28, 2022, the Company completed the acquisition of all the outstanding shares of TV Squared Limited (“TVS”) an independent global measurement and attribution platform for converged TV and a private company limited by shares incorporated under the laws of the Scotland in a combination of cash and stock and stock options issuances.

2. Summary of Significant Accounting Policies

Basis of Presentation

The unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”) for interim reporting and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for Quarterly Reports on Form 10-Q and Article 10 of Regulation S-X. Any reference in these notes to applicable guidance is meant to refer to the authoritative US GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”). Accordingly, such financial statements do not include all the information and footnotes required by US GAAP for complete financial statements. In management’s opinion, these unaudited condensed consolidated interim financial statements contain all adjustments of a normal recurring nature necessary for a fair presentation of the financial statements for the interim period presented.

These unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2023, as reported in the Company’s 2023 Annual Report on Form 10-K. The Company’s significant accounting policies and practices are as described in the Annual Report.

Use of Estimates

The preparation of the condensed consolidated interim financial statements in conformity with US GAAP requires management to make estimates, judgments, and assumptions that affect the amounts reported in the financial statements. The results for interim periods are not necessarily indicative of results to be expected for the year or for any future periods. In management’s opinion, these unaudited condensed consolidated interim financial statements contain all adjustments of a normal recurring nature necessary for a fair presentation of the financial statements for the interim period presented based upon information available at the time they are made. Actual results could differ from those estimates.

Prior Period Reclassification

Certain amounts in prior year’s condensed consolidated balance sheet have been reclassified to conform to current year’s presentation.

Accounting Policies

Trade receivable, net

The Company records trade receivables for amounts invoiced and yet unbilled. The Company’s expected loss allowance methodology for trade receivables is based upon its assessment of various factors, including historical experience, the age of the trade receivable balances, credit quality of its customers, current economic conditions, reasonable and supportable

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

forecasts of future economic conditions, and other factors that may affect its ability to collect from customers. The estimated credit loss allowance is recorded as general and administrative expenses on the Company's condensed consolidated statements of operations.

Concentrations of credit risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents, deposits and trade receivables, net. The majority of the Company’s cash and cash equivalents are invested in deposits with major banks in the US, Israel and the UK. The Company is exposed to credit risk in the event of default by the financial institutions to the extent that amounts recorded on the accompanying consolidated balance sheets exceed insured limits. Generally, these investments may be redeemed upon demand and, therefore, bear minimal risk.

The Company’s trade receivables, net is mainly derived from sales to customers located in the US, APAC, EMEA, and LATAM. The Company mitigates its credit risks by performing ongoing credit evaluations of its customers’ financial conditions. The Company has no off-balance-sheet concentration of credit risk such as foreign exchange contracts, option contracts or other foreign hedging arrangements.

During the three and nine months ended September 30, 2024 and 2023, one customer accounted for more than 10% of the Company’s total revenue as presented below:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | Nine months ended September 30, | | |

| 2024 |

| 2023 | 2024 |

| 2023 | | | | |

Customer A | 15 | % |

| 16 | % | 16 | % | | 16 | % | | | | |

Software development costs

Software development costs, which are included in property and equipment, net, consists of capitalized costs related to the purchase and development of internal-use software. The Company uses such software to provide services to its customers. The costs to purchase and develop internal-use software are capitalized from the time that the preliminary project stage is completed, and it is considered probable that the software will be used to perform the function intended. These costs include personnel and personnel-related employee benefits for employees directly associated with the software development and external costs of the materials or services consumed in developing or obtaining the software.

Any costs incurred for upgrades and functionality enhancements of the software are also capitalized. Once this software is ready for use in providing the Company's services, these costs are amortized on a straight-line basis over the estimated useful life of the software, which is three years. The amortization is presented within depreciation and amortization in the condensed consolidated statements of operations. During the three months ended September 30, 2024 and 2023, the Company capitalized internal-use software cost of $2.0 million and $2.5 million, respectively. During the nine months ended September 30, 2024 and 2023, the Company capitalized internal-use software cost of $6.9 million and $8.8 million, respectively, which represents labor costs including stock based compensation.

Cloud computing arrangements

During nine months ended September 30, 2024, the Company capitalized certain application development phase costs related to hosting arrangements that are service contracts (cloud computing arrangements). Capitalized costs are included in prepaid expenses and other assets in the condensed consolidated balance sheets and will be amortized on a straight-line basis over the estimated useful life, once the modules or components are ready for its intended use. The amount capitalized at September 30, 2024 was immaterial. This amortization will be recorded to software subscription expense within general and administrative expense in the condensed consolidated statements of operations. Cash outflows from cloud computing arrangement implementation costs are classified within operating activities in the consolidated statements of cash flows.

Impairment of long-lived assets

Long-lived assets, including property and equipment and finite-lived intangible assets, are reviewed for impairment whenever facts or circumstances either internally or externally may indicate that the carrying value of an asset may not be recoverable. If there are indications of an impairment, the Company tests for recoverability by comparing the estimated undiscounted future cash flows expected to result from the use of the asset to the carrying amount of the asset or asset

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

group. If the asset or asset group is determined to be impaired, any excess of the carrying value of the asset or asset group over its estimated fair value is recognized as an impairment loss. No impairment was recognized during the three or nine months ended September 30, 2024. In September 2023, the Company identified an impairment indicator for its legacy measurement product and recorded an impairment charge of $2.4 million in the three and nine months ended September 30, 2023.

Goodwill and acquired intangible assets

Goodwill and acquired intangible assets have been recorded in the Company's financial statements resulting from various business combinations. Goodwill represents the excess of the purchase price in a business combination over the fair value of identifiable tangible and intangible assets acquired and liabilities assumed. Goodwill is not amortized as it is estimated to have an indefinite life. As such, goodwill is subject to an annual impairment test.

The Company allocates goodwill to reporting units based on the expected benefit from the business combination. Reporting units are evaluated when changes in the Company’s operating structure occur, and if necessary, goodwill is reassigned using a relative fair value allocation approach. The Company operates in one operating segment and this segment is the only reporting unit.

ASC 350, Intangibles—Goodwill and other (“ASC 350”) requires goodwill to be tested for impairment at least annually and, in certain circumstances, between annual tests. The accounting guidance gives the option to perform a qualitative assessment to determine whether further impairment testing is necessary. The qualitative assessment considers events and circumstances that might indicate that a reporting unit's fair value is less than its carrying amount. If it is determined, as a result of the qualitative assessment, that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, a quantitative test is performed.

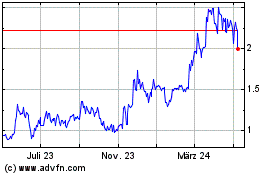

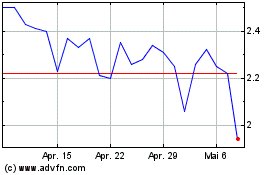

The Company elects to perform an annual impairment test of goodwill as of October 1 of each year, or more frequently if impairment indicators are present. In the second quarter of 2023, the Company experienced a decline in its stock price resulting in its market capitalization being less than the carrying value of its one reporting unit. Thus, the Company performed quantitative assessments of the Company’s reporting unit. The fair value was determined based on the market approach. The market approach utilizes the Company's market capitalization plus an appropriate control premium. Market capitalization is determined by multiplying the number of common stock outstanding by the market price of its common stock. The control premium is determined by utilizing publicly available data from studies for similar transactions of public companies. As a result of this assessment, the Company recorded a goodwill impairment of $14.5 million during the three months ended June 30, 2023. No impairment was recognized during the three or nine months ended September 30, 2024.

Separately acquired intangible assets are measured on initial recognition at cost including directly attributable costs. Intangible assets acquired in a business combination are measured at fair value at the acquisition date.

Customer relationships and acquired technology are amortized on a straight-line basis over the estimated useful life of the assets; approximately 11 years and 6 years, respectively. Amortization of customer relationships and acquired technology is presented within depreciation and amortization in the condensed consolidated statements of operations.

Fair value of financial instruments

The Company applies a fair value framework to measure and disclose its financial assets and liabilities. Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. The fair value hierarchy requires an entity to maximize the use of observable inputs, where available, and minimize the use of unobservable inputs when measuring fair value. There are three levels of inputs that may be used to measure fair value:

Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 - Includes other inputs that are directly or indirectly observable in the marketplace.

Level 3 - Unobservable inputs that are supported by little or no market activity.

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

The Company’s financial instruments consist of cash and cash equivalents, restricted deposits, trade receivables, net, trade payables, employees, payroll accruals, accrued expenses and other current liabilities. Due to the short-term nature of these instruments, historical carrying amounts approximate fair value.

The Company’s investments in money market funds are classified as cash equivalents and measured at fair value. The Company measures its warrant liability at fair value.

The following tables present information about the Company’s financial instruments that are measured at fair value on a recurring basis: | | | | | | | | | | | | | | | | | |

| September 30, 2024 |

| Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | |

| Money market funds | $ | 18,919 | | | $ | — | | | $ | — | |

| | | | | |

Liabilities: | | | | | |

| Warrants liability | 411 | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | |

| Money market funds | $ | 32,264 | | | $ | — | | | $ | — | |

Liabilities: | | | | | |

| Warrants liability | 307 | | | — | | | — | |

As of September 30, 2024, the Company’s warrant liability represents the warrants (refer to Note 4), that were assumed in the Transaction, which were originally issued in connection with ION’s initial public offering. The Company’s warrants are recorded on the balance sheet at fair value with changes in fair value recognized through earnings. The Company’s warrants are within Level 1 of the fair value hierarchy. This valuation is subject to re-measurement at each balance sheet date. The Company determines the fair value of the warrants by using the closing warrant price.

Revenue recognition

Most of the Company’s revenue is derived from digital ad solutions, where the Company provides an ad serving platform for use by advertisers, media agencies and publishers. Standard, interactive and data driven digital video ads are delivered through this ad serving platform. Advertising impressions are served via the Company’s cloud-based ad serving platform to various digital publishers across CTV, mobile TV, desktop TV, display and other channels.

InnovidXP, the Company’s cloud-based cross-platform TV Ad measurement solution, measures the efficiency of CTV advertising and in-flight optimizations for TV marketers. The customers get insights into the effectiveness of their TV and digital advertising.

The Company also provides creative services for the design and development of interactive data-driven and dynamic ad formats by adding data, interactivity and dynamic features to standard ad units.

The Company recognizes revenue when its customer obtains control of promised services in an amount that reflects the consideration that the Company expects to receive in exchange for those services. The Company recognizes revenue in accordance with ASC Topic 606, Revenue from contracts with customers (“ASC 606”) and determines revenue recognition through the following steps: (1) identify the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when a performance obligation is satisfied.

For arrangements with multiple performance obligations, which represent promises within an arrangement that are capable of being distinct and are separately identifiable, the Company allocates the contract consideration to all distinct performance obligations based on their relative standalone selling price (“SSP”). SSP is typically estimated based on observable transactions when these services are sold on a standalone basis.

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

Revenue related to ad serving is recognized when impressions are delivered via the Company’s ad serving platform. The Company recognizes revenue from the display of impression-based ads in the contracted period in which the impressions are delivered. Impressions are considered delivered when an ad is displayed to users.

Revenue related to the InnovidXP solution is recognized over time, since the customer simultaneously receives and consumes the benefits provided by the Company’s performance. Revenues for this measurement subscription is recognized over the service period.

Revenue related to creative projects is recognized when the Company delivers an ad unit. Creative services projects are usually delivered within a week.

The Company’s accounts receivable consists primarily of receivables related to products and services, for which the Company’s contracted performance obligations have been satisfied, the amount has been billed and the Company has an unconditional right to payment. The Company typically bills customers monthly based on actual delivery. Payment terms vary, mainly with terms of 60 days or less.

The typical contract term is twelve months or less for ASC 606 purposes. Most of the Company’s contracts can be cancelled without cause. The Company has the unconditional right to payment for the services provided as of the date of the termination of the contracts.

The Company applies the practical expedient in ASC 606 and does not adjust the promised amount of consideration for the effects of a significant financing component if the Company expects, at contract inception, that the period between when the Company transfers a promised good or service to a customer and when the customer pays for that good or service will be one year or less.

Deferred revenue represents mostly unrecognized fees billed or collected for measurement platform services. Deferred revenue is recognized as (or when) the Company performs under the contract. Revenue recognized during the three and nine months ended September 30, 2024, from amounts included in deferred at the beginning of the period were $0.6 million and $1.7 million, respectively.

Revenue from ad serving solutions via Innovid’s ad serving platform was 74.8% and 73.3% of the Company’s revenue for the three months ended September 30, 2024 and 2023, respectively. Revenue from measurement subscriptions was 22.2% and 23.2% for the three months ended September 30, 2024 and 2023, respectively. Creative services were 3.0% and 3.5% of the Company’s revenue for the three months ended September 30, 2024, and 2023, respectively.

Revenue from ad serving solutions via Innovid’s ad serving platform was 75.2% and 73.4% of the Company’s revenue for the nine months ended September 30, 2024 and 2023, respectively. Revenue from measurement subscriptions was 21.8% and 22.9% for the nine months ended September 30, 2024 and 2023, respectively. Creative services were 3.0% and 3.7% of the Company’s revenue for the nine months ended September 30, 2024 and 2023, respectively.

Costs to obtain a contract

Contract costs include commission programs to compensate sales employees for generating sales orders with new customers or for new services with existing customers. The Company elected to apply the practical expedient and recognize incremental costs of obtaining a contract as an expense when incurred if the amortization period of the asset that the Company otherwise would have recognized is one year or less. Most of the Company’s commissions are commensurate. If commissions are not eligible for the practical expedient, the commissions are capitalized and are amortized over three years. As of both September 30, 2024 and December 31, 2023, capitalized commissions were immaterial.

Recently issued accounting pronouncements not yet adopted

As an “emerging growth company,” the JOBS Act allows the Company to delay adoption of new or revised accounting pronouncements applicable to public companies until such pronouncements are made applicable to private companies. The Company has elected to use this extended transition period under the JOBS Act. The adoption dates discussed below reflect this election.

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

Income taxes

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”). ASU 2023-09 is intended to improve transparency of income tax disclosure by requiring income tax disclosures to contain consistent categories and greater disaggregation of information in the rate reconciliation and income taxes paid, disaggregated by jurisdiction. This standard affects the disclosure of income taxes, not the accounting for income taxes. This standard is effective for the Company for the annual period beginning after December 15, 2025, with early adoption permitted. The Company is evaluating the impact of the adoption of ASU 2023-09.

Segments

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”), which requires public entities to disclose information about their reportable segments’ significant expense and other segment items on an interim and annual basis. Public entities with a single reportable segment are required to apply the disclosure requirements in ASU 2023-07, as well as all existing segment disclosures and reconciliation requirements in ASC 280 on an interim and annual basis. This standard is effective for the Company for annual periods beginning after December 15, 2023, and interim periods beginning after December 15, 2024. The Company is evaluating the impact of the adoption of ASU 2023-07.

3. Leases

Innovid's lease portfolio primarily consists of real estate properties. Short-term leases with a term of 12 months or less are not recorded on the balance sheet. Innovid does not separate lease components from non-lease components.

The Company is a lessee in all its lease agreements. The Company records lease liabilities based on the present value of lease payments over the applicable lease term. Innovid generally uses an incremental borrowing rate to discount its lease liabilities, as the rate implicit in the lease is typically not readily determinable. Certain lease agreements include renewal options that are under the Company's control. Optional renewal periods are included in the lease term when it is reasonably certain that the Company will exercise its option. On February 7, 2024, the Company amended its New York lease agreement extending the term to 2035. The lease contains an option to extend the lease for an additional five-year period and early termination, which are not reasonably certain to be exercised.

Variable lease payments are primarily related to payments to lessors for taxes, maintenance, insurance and other operating costs. The Company's lease agreements do not contain any significant residual value guarantees or restrictive covenants.

The Company has the following operating right-of-use (“ROU”) assets and lease liabilities:

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| ROU assets | | Lease liabilities | | ROU assets | | Lease liabilities |

Real estate | $ | 10,894 | | | $ | 11,223 | | | $ | 1,435 | | | $ | 1,834 | |

| Total operating leases | $ | 10,894 | | | $ | 11,223 | | | $ | 1,435 | | | $ | 1,834 | |

Lease expense components recognized in the interim condensed consolidated statement of operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Operating lease cost | $ | 218 | | | $ | 458 | | | $ | 933 | | | $ | 1,379 | | | | | |

| Short term lease cost | 283 | | | 205 | | | 911 | | | 788 | | | | | |

| Variable lease cost | 58 | | | 31 | | | 142 | | | 77 | | | | | |

| Total lease cost | $ | 559 | | | $ | 694 | | | $ | 1,986 | | | $ | 2,244 | | | | | |

As of September 30, 2024, the weighted-average remaining lease term and weighted-average discount rate for operating leases were 9.8 years and 7.2%, respectively.

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

Supplemental cash flow information regarding the Company's operating leases were as follows: | | | | | | | | | | | | | | |

| | Nine months ended September 30, |

| | 2024 | | 2023 |

| Cash paid for amounts included in the measurement of lease liabilities | | $ | 968 | | | $ | 1,541 | |

Future minimum commitments under the Company’s operating lease were as follows:

| | | | | |

| Twelve months ending September 30, | Nine months ended September 30, 2024 |

| 2025 | $ | 1,263 | |

| 2026 | 1,762 | |

| 2027 | 1,001 | |

| 2028 | 1,523 | |

| 2029 | 1,554 | |

| Thereafter | 9,114 | |

| Total undiscounted lease payments | $ | 16,217 | |

| Less: imputed interest | (4,994) | |

| Total operating lease liabilities | $ | 11,223 | |

4. Warrants

As of September 30, 2024, the Company had 3,162,453 public warrants and 7,060,000 private warrants outstanding. The majority of the private warrant terms are identical to the public warrants resulting in use of the same price for valuation purposes. The Company's warrants do not meet all the conditions to be classified as equity under ASC 815-40 and therefore are classified as a liability measured at fair value through earnings.

See Note 2, Summary of Significant Accounting Policies, for details regarding the fair value of the warrants and see Note 8, Finance (Income) Expenses, Net for details regarding the gains and losses.

5. Long-term Debt

On August 4, 2022, two wholly-owned subsidiaries of the Company, Innovid LLC and TV Squared Inc, entered into an amended and restated loan and security agreement with Silicon Valley Bank (the “2022 A&R Agreement”), to increase the revolving line of credit from $15,000 to $50,000 (the “New Revolving Credit Facility”). The 2022 A&R Agreement and the New Revolving Credit Facility were amended by a First Loan Modification Agreement dated August 2, 2023 (the “2023 Modification Agreement”) and by a Second Loan Modification Agreement dated June 26, 2024 (the “2024 Modification Agreement”). The interest for the New Revolving Credit Facility is payable monthly in arrears. The New Revolving Credit Facility bears interest at an annual rate that is the greater of (a) WSJ Prime Rate plus 0.25% or (b) 4.25%, on the aggregate outstanding balance. Additional fees include fees in an amount of 0.20% per annum of the average unused portion of the New Revolving Credit Facility to be paid quarterly in arrears. The maturity date of the 2022 A&R Agreement, as amended, is June 30, 2027. The New Revolving Credit Facility is subject to certain customary conditions precedent to the credit extension as stated in the 2022 A&R Agreement and is secured by substantially all of the Company’s assets and continues to place limitations on indebtedness, liens, distributions, asset sales, transactions with affiliates and acquisitions, all as defined in the agreement.

The New Revolving Credit Facility requires the Company to comply with all covenants, primarily maintaining an adjusted quick ratio of at least 1.30 to 1.00. As defined in the 2022 A&R Agreement, “adjusted quick ratio” is the ratio of (a) quick assets to (b) current liabilities minus the current portion of deferred revenue. “Quick assets” are determined as the Company’s unrestricted cash plus accounts receivable, net, and is determined according to US GAAP. The Company is also required to maintain the minimum quarterly adjusted EBITDA as defined in the 2022 A&R Agreement, as amended, if the Company does not maintain the quarterly adjusted quick ratio of at least 1.50 to 1.00.

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

At September 30, 2024, there were no amounts outstanding under the New Revolving Credit Facility and the Company was in compliance with all the covenants.

The Company utilizes the credit line on an as needed basis. See Note 8, Finance Income, Net for interest expense.

6. Commitments and Contingent Liabilities

Pledges and bank guarantees

1.Innovid LLC pledged 65,000 shares of common stock of its Israeli Subsidiary, NIS 0.01 par value each, in connection with the line of credit (see Note 5, Long-term Debt).

2.The Israeli Subsidiary pledged bank deposits in an aggregate amount of $0.6 million in connection with an office rent agreement and credit cards.

Legal contingencies

On March 4, 2022, a lawsuit was filed in the United States District Court for the Western District of Texas by the Nielsen Company (US) LLC against TV Squared, alleging infringement of US Patent No. 10.063.078. On June 1, 2022, TV Squared moved to transfer the case to the Southern District of New York, which was granted on January 18, 2023. On March 23, 2023, TV Squared moved for judgment on the pleadings that the asserted claims of the Nielsen patent are invalid because they are patent ineligible under 35 U.S.C. 101. The Court has not yet ruled on TV Squared’s motion. While the motion has remained pending, discovery commenced. The Court also conducted a hearing to construe the patent claims on January 10, 2024, but has not issued a ruling.

On April 15, 2024, the Court issued an order to stay the case for ninety (90) days and to extend various deadlines as set out below, to allow the parties to continue settlement negotiations without incurring the substantial costs associated with the impending close of fact discovery and deadlines for expert reports. The parties agreed that the stay will apply to all interim deadlines, including the service of and responses and objections to written discovery. On July 2, 2024 the Court issued an order to extend the stay for an extra one hundred and twenty (120) days, and on October 23, 2024, the Court extended the stay for an additional eighty (80) days.

In the October 23, 2024 order, the Court set the date for the close of fact discovery as May 2, 2025 and the date for close of expert discovery as September 9, 2025.

No trial date has yet been set and the plaintiff has not specified the amount sought in the litigation. Given the uncertainty of litigation and the preliminary stage of the lawsuit, the Company is unable at this time to give an estimate of the amount or range of potential loss, if any, which might result to the Company if the outcome in such litigation was unfavorable. As of September 30, 2024, the Company has not recorded a loss contingency.

7. Stock-Based Compensation

Stock-based compensation expense under all plans was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Cost of goods sold | $ | 472 | | | $ | 522 | | | $ | 1,332 | | | $ | 1,398 | |

Research and development | 897 | | | 1,249 | | | 2,564 | | | 3,652 | |

Sales and marketing | 1,940 | | | 1,657 | | | 4,632 | | | 4,926 | |

General and administrative | 2,192 | | | 2,177 | | | 5,998 | | | 5,587 | |

Total expensed | $ | 5,501 | | | $ | 5,605 | | | $ | 14,526 | | | $ | 15,563 | |

Internal use software capitalization | 209 | | 314 | | 798 | | 1,004 |

Total stock-based compensation | $ | 5,710 | | | $ | 5,919 | | | $ | 15,324 | | | $ | 16,567 | |

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

Stock Options

Stock option activity under all plans was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2024 |

| Number of options | | Weighted average exercise price | | Weighted average remaining contractual term (in years) | | Aggregate intrinsic value (in thousands) |

Outstanding at December 31, 2023 | 9,526,883 | |

| $ | 1.27 | |

| | | |

| Granted | — | |

| $ | — | | | | | |

| Exercised | (532,089) | |

| $ | 0.59 | | | | | |

| Forfeited | (573,537) | |

| $ | 1.81 | | | | | |

| Expired | (364,341) | | | $ | 1.98 | | | | | |

Outstanding at September 30, 2024 | 8,056,916 | |

| $ | 1.24 | |

| 5.4 | | $ | 6,031 |

Exercisable options at September 30, 2024 | 7,030,893 | | | $ | 1.20 | |

| 5.0 | | $ | 5,545 |

The aggregate intrinsic value of exercised options in the nine months ended September 30, 2024, was $0.8 million.

As of September 30, 2024, the Company had approximately $0.8 million of total unrecognized compensation cost related to non-vested stock options. That cost is expected to be recognized over a weighted-average period of 2.0 years.

Restricted Stock Units

RSU activity under the 2021 Plan was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2024 |

| Number of units | | Weighted average grant date fair value | | Weighted average remaining contractual term (in years) | | Aggregate intrinsic value (in thousands) |

| Outstanding at December 31, 2023 | 13,270,592 | | | $ | 2.07 | |

| | | |

| Granted | 9,837,142 | | | $ | 2.32 | |

|

| | |

| Vested | (6,047,383) | | | $ | 2.29 | |

|

| | |

| Forfeited | (2,887,385) | | | $ | 2.05 | | | | | |

| Outstanding at September 30, 2024 | 14,172,966 | | | $ | 2.15 | |

| 1.1 | | $ | 25,499 | |

| | | | | | | |

The weighted-average grant-date fair value of RSUs generally is determined based on the number of units granted and the quoted price of Innovid’s common stock on the date of grant. The fair value of shares vested during the nine months ended September 30, 2024, was $11.9 million.

As of September 30, 2024, $25.1 million of unrecognized compensation cost related to RSUs is expected to be recognized as expense over the weighted average period of 2.0 years.

8. Finance Income, Net

The Company recognizes the gains and losses from the remeasurement of its warrants liability in “finance income, net” in the condensed consolidated statements of operations. The unrealized (loss)/gain from changes in the fair value of the Company warrants for the three months ended September 30, 2024 and 2023, were gains of $0.3 million and $0.4 million, respectively. The unrealized (loss)/gain from changes in the fair value of the Company warrants for the nine months ended September 30, 2024 and 2023, were gains of $0.1 million and $3.7 million, respectively.

The Company recognizes interest expense and interest income in “finance income, net” in the condensed consolidated statements of operations. Interest expense for the three months ended September 30, 2024 and 2023, was immaterial and $0.4 million, respectively. Interest income for the three months ended September 30, 2024 and 2023, was $0.4 million and

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

$0.4 million, respectively. Interest expense for the nine months ended September 30, 2024 and 2023, was $0.2 million and $1.1 million, respectively. Interest income for the nine months ended September 30, 2024 and 2023, was $1.1 million and $1.0 million, respectively.

9. Income Tax

The Company recorded net benefits for incomes taxes of $5.8 million and $1.3 million for the three months ended September 30, 2024 and 2023, respectively, representing effective tax rates of 502.8% and 32.3%, respectively. The decrease in the third quarter of 2024 tax expense was from a change in the Company’s full year forecast and the effects of using the interim tax reporting methodology provided under ASC 740-270 where the Company uses a forecasted effective tax rate against current year-to-date results.

The Company recorded net provisions for incomes taxes of $5.2 million and $2.9 million for the nine months ended September 30, 2024 and 2023, respectively, representing effective tax rates of (74.7)% and (10.4)%, respectively. The increase in year-to-date 2024 tax expense was from growing profitability of the global business and associated higher current tax expense, non-deductibility of stock compensation expenses in the US and Israel, the recognition of uncertain tax positions that previously offset against unrecognized deferred tax assets, and as discussed above, the effects of using the interim tax reporting methodology provided under ASC 740-270.

10. Segment Reporting

The Company operates and manages its business as one segment, which primarily focuses on the software platform for ad serving, measurement, and creative. Our CEO is the chief operating decision-maker and manages and allocates resources to the operations of the Company on an entity-wide basis.

Revenue by geographic location was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | | |

| 2024 |

| 2023 | | 2024 | | 2023 | | | | |

| US | $ | 35,295 | | | $ | 33,238 | | | $ | 103,417 | | | $ | 92,452 | | | | | |

| Canada | 549 | | | 531 | | | 1,740 | | | 1,385 | | | | | |

| APAC | 706 | | | 723 | | | 2,656 | | | 2,271 | | | | | |

| EMEA | 1,569 | | | 1,542 | | | 4,613 | | | 4,580 | | | | | |

| LATAM | 132 | | | 200 | | | 514 | | | 577 | | | | | |

Total revenue | $ | 38,251 | | | $ | 36,234 | | | $ | 112,940 | | | $ | 101,265 | | | | | |

Property and equipment, net and ROU assets by geographic location was as follows:

| | | | | | | | | | | |

| September 30, 2024 |

| December 31, 2023 |

| Israel | $ | 1,698 | | | $ | 2,154 | |

| US | 29,612 | | | 17,144 | |

Rest of the world | 590 | | | 556 | |

| Total | $ | 31,900 | | | $ | 19,854 | |

INNOVID CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

September 30, 2024

11. Net Income (Loss) Per Share

The following presents a reconciliation of the denominator used in the calculation of diluted net income per share (in thousands, except share and per share data):

| | | | | |

| Three months ended September 30, |

| 2024 |

| Diluted denominator: | |

| Weighted average common shares outstanding | 146,822,073 | |

| Options | 3,242,758 | |

| Unvested restricted stock units | 2,439,409 | |

| Weighted average common shares outstanding - diluted | 152,504,240 | |

The following potential shares of common stock, presented based on amounts outstanding at each period end, have been excluded from the computation of diluted net loss per share attributable to common stockholders for the periods indicated their effect would have been anti-dilutive effect: | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2024 |

| 2023 | | 2024 |

| 2023 |

| Options | 3,396,038 | | | 9,402,442 | | | 6,986,540 | | | 9,402,442 | |

| Unvested restricted stock units | 9,179,898 | | | 14,115,573 | | | 10,654,256 | | | 14,115,573 | |

| Warrants | 10,222,453 | | | 10,222,500 | | | 10,222,453 | | | 10,222,500 | |

12. Subsequent Event

On November 6, 2024, our board of directors authorized the Company to implement a stock repurchase program to purchase up to $20.0 million of our common stock. Subject to the final terms of the program, it is expected that repurchases would be made in the open market, in privately negotiated transactions, or otherwise, with the amount and timing of repurchases determined at the Company’s discretion, depending on market conditions and corporate needs. Open market repurchases will be structured to occur in accordance with applicable federal securities laws, including the pricing and volume requirements of Rule 10b-18 or Rule10b-5-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This program is not expected to obligate us to acquire any particular amount of common stock and may be modified, suspended, or terminated at any time at the discretion of our board of directors and the Company may decline to move forward with the implementation of any repurchase plan.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our interim unaudited condensed consolidated financial statements and related notes appearing elsewhere in this Quarterly Report and our audited financial statements and notes contained in our Annual Report on Form 10-K for the year ended December 31, 2023 (our “2023 Annual Report on Form 10-K”). This discussion contains forward-looking statements reflecting current expectations, estimates and assumptions concerning events and financial trends that may affect our future operating results or financial position. Actual results and timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in our 2023 Annual Report on Form 10-K, which may be updated from time to time in our other filings with the SEC, including elsewhere in this Quarterly Report, including under the heading “Cautionary Statements Regarding Forward-Looking Statements.”

Company Overview

We are an enterprise cloud software platform for the creation, delivery, measurement, and optimization of advertising across connected TV (“CTV”), mobile and desktop environments. We provide critical technology infrastructure for many

of the world’s largest brands, agencies, and publishers, and empower them to create ad-supported TV experiences people love. Our vision, that television should be open for everyone, and controlled by no one, is at the heart of how we operate our business as an independent platform, and as a strategic, trusted partner for our clients.

Our technology is purpose-built for CTV, with a comprehensive view of the full ecosystem, including linear TV, mobile, and desktop channels. Our cloud-based platform tightly integrates with the highly fragmented advertising technology and media ecosystem, and includes three key solutions: Ad Serving, Creative Personalization, and Measurement. We count many of the world’s largest brand advertisers as customers, including Anheuser-Busch InBev, CVS Pharmacy, Kellogg’s, Mercedes-Benz, Target, Sanofi, and more. As of September 30, 2024, over 50% of the top 200 large advertisers, by TV US advertising spend according to MediaRadar leverage our platform. We are also trusted partners of the largest streaming platform providers in the world, including Disney, Hulu, ESPN, NBCU, and Paramount, and we work closely with top advertising agencies and agency holding companies such as WPP, Publicis Groupe, Omnicom Group, Interpublic Group of Cos., Dentsu Inc., Havas Group, Horizon Media, and The Stagwell Group. Our clients are diversified across all major industry verticals, including consumer packaged goods, pharmaceutical and healthcare, retail, financial services, automotive and technology. We serve customers globally across over 50 countries, with most of our customers located in the US.

Our revenue growth closely correlates with the growth of CTV advertising. CTV accounted for 58% and 55% of all video impressions served by Innovid during the three months ended September 30, 2024, and 2023, respectively. During the three months ended September 30, 2024, this represented a year-over-year increase of 13% in CTV video impressions served by Innovid. The balance of video impressions served by Innovid during the third quarter of 2024 and 2023 was attributed to mobile, 32% and 35%, respectively, and PC, 11% and 10%, respectively. In the third quarter of 2024, video impressions volume decreased by 2% for mobile and increased by 5% for desktop as compared to the same period in the prior year.

Transactions

Innovid Corp. was originally incorporated as ION Acquisition Corp. 2 Ltd. (“ION”), a special purpose acquisition company, on November 23, 2020, and Innovid Corp. was the surviving entity following the completion of its merger with ION on November 30, 2021 (the “Transaction”).

On February 28, 2022, the Company completed the acquisition of TV Squared Limited by way of stock purchase agreement (“Stock Purchase Agreement”). The Company acquired all the equity of TVS for an aggregate amount of $100.0 million in cash, 11,549,465 shares of the Company common stock at fair value of $3.80 per share, and the issuance of 949,893 fully vested stock options of the Company at a weighted average fair value of $3.49, subject to certain adjustments as defined in the Stock Purchase Agreement.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States (“US GAAP”) requires us to make estimates, judgments and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Such management estimates and assumptions used are related, but not limited to, income tax uncertainties, deferred taxes, and stock-based compensation, as well as the fair value of assets acquired, and liabilities assumed in business combinations. The Company’s management believes that the estimates, judgments and assumptions used as reasonable based upon information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Global Events