Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

20 Juni 2023 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of June 2023

Commission File Number: 333-251238

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

COSAN S.A.

Corporate Taxpayer ID (CNPJ): 50.746.577/0001-15

Company Registry (NIRE): 35.300.177.045

Publicly Held Company

CVM 19836

NOTICE TO THE MARKET

COSAN S.A. (B3: CSAN3; NYSE: CSAN) (“Cosan” or “Company”) informs its shareholders and the market in general that its wholly owned subsidiary Cosan Luxembourg S.A., a public limited liability company organized under the laws of Luxembourg (“Cosan Luxembourg”), has launched an offering of senior notes to be guaranteed by Cosan (“Offering”).

Cosan Luxembourg intends to use part of the net proceeds of the Offering to purchase a principal amount of US$250,000,000.00 (two hundred and fifty million American dollars) of the 7.000% senior notes due 2027 of Cosan Luxembourg in a concurrent tender offer. Any remaining funds are expected to be used by us for general corporate purposes.

São Paulo, June 20, 2023.

Ricardo Lewin

Chief Financial and Investor Relations Officer

This notice does not constitute or form part of any offer or invitation to purchase, or any solicitation of any offer to sell, any securities in the United States or any other country, nor shall it or any part of it, or the fact of its release, form the basis of, or be relied on or in connection with, any contract therefor. The tender offer is made only by and pursuant to the terms of the offer to purchase, and the information in this notice is qualified by reference to the offer to purchase.

The senior notes referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws of the United States, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state laws. The senior notes will only be offered in the United States to qualified institutional buyers under Rule 144A under the Securities Act and outside the United States to non-U.S. persons under Regulation S under the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 20, 2023

|

COSAN S.A.

|

|

By:

|

/s/ Ricardo Lewin

|

|

|

Name: Ricardo Lewin

|

|

|

Title: Chief Financial Officer

|

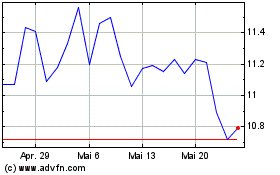

Cosan (NYSE:CSAN)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Cosan (NYSE:CSAN)

Historical Stock Chart

Von Jun 2023 bis Jun 2024