AM Best Revises Outlooks to Positive for CNA Financial Corporation and Its Subsidiaries

05 Dezember 2024 - 5:22PM

Business Wire

AM Best has revised the outlooks to positive from stable

and affirmed the Financial Strength Rating (FSR) of A (Excellent)

and the Long-Term Issuer Credit Ratings (Long-Term ICRs) of “a+”

(Excellent) of the property/casualty (P/C) subsidiaries of CNA

Financial Corporation (CNAF) [NYSE: CNA], collectively known as CNA

Insurance Companies (CNA) and the members of Western Surety Group.

Concurrently, AM Best has revised the outlook to positive from

stable and affirmed the Long-Term ICR of “bbb+” (Good) and all

existing Long-Term Issue Credit Ratings (Long-Term IRs) of CNAF.

All above named companies are headquartered in Chicago, IL. (See

below for a detailed listing of the companies and ratings.)

The positive outlooks are reflective of the consistently

positive operating performance of CNA underpinned by its positive

underwriting and investment metrics, which compare favorably to its

commercial casualty peers. Additionally, the outlooks reflect the

supportive ownership of CNAF.

CNA, along with its Credit Ratings (ratings), is considered the

lead rating unit in the CNAF enterprise. CNA’s credit ratings

reflect its balance sheet strength, which AM Best assesses as very

strong, as well as its adequate operating performance, favorable

business profile and appropriate enterprise risk management (ERM).

The ratings also acknowledge the historical financial support

provided by CNA’s diversified 92%-shareholder ultimate parent,

Loews Corporation.

The ratings of CNA—whose lead member is Continental Casualty

Company—recognize the strongest level of risk-adjusted

capitalization, as measured by Best’s Capital Adequacy Ratio

(BCAR), the group’s consistently profitable operating results, as

well as its well established position as a leading U.S. writer of

commercial and specialty lines. Additionally, the ratings recognize

CNA’s favorable operating platform, which demonstrates considerable

geographic and product line scope, strong service capabilities and

its diversified distribution channel with well-established agency

relationships. The group’s specialty insurance segment remains the

primary engine of profitability and internal capital generation,

but its commercial insurance operations have demonstrated steady

improvement as significant underwriting and expense management

initiatives have taken hold. The ratings also consider CNA’s ERM

structure, and the implicit and explicit financial and

organizational support provided by the Loews Corporation.

Partially offsetting these positive factors are the intermittent

adverse impacts of CNA’s discontinued long-term care program, which

has at times served as a drag on CNA’s overall profitability and

has exposed its surplus and risk-adjusted capitalization to

potential volatility. Additional factors affecting the group’s

credit profile are its moderate underwriting exposures to

catastrophe losses associated with its commercial property product

lines, reserve uncertainties, which generally affect

litigation-sensitive casualty lines, as well as cyber-related and

other underwriting exposures.

The ratings of the Western Surety Group reflect its balance

sheet strength, which AM Best assesses as strongest, as well as its

strong operating performance, neutral business profile and

appropriate ERM.

Additionally, Western Surety Group’s ratings reflect its

strongest risk-adjusted capitalization, as measured by BCAR, its

consistently favorable loss reserve position and its modest level

of underwriting leverage. Western Surety Group maintains a strong

market position in contract and miscellaneous surety bond markets

and has consistently reported profitable underwriting and operating

performance. Partially offsetting these positive factors are

Western Surety Group’s narrow product focus in a highly competitive

surety market, which may put pressure on underwriting margins over

the near term.

The outlooks have been revised to positive from stable and the

FSR of A (Excellent) and the Long-Term ICRs of “a+” (Excellent)

have been affirmed for the following members of CNA Insurance

Companies:

- American Casualty Company of Reading, Pennsylvania

- Columbia Casualty Company

- Continental Casualty Company

- The Continental Insurance Company of New Jersey

- The Continental Insurance Company

- National Fire Insurance Company of Hartford

- North Rock Insurance Company Limited

- Transportation Insurance Company

- Valley Forge Insurance Company

The outlooks have been revised to positive from stable and the

FSR of A (Excellent) and the Long-Term ICRs of “a+” (Excellent)

have been affirmed for the following members of Western Surety

Group:

- Surety Bonding Company of America

- Universal Surety of America

- Western Surety Company

The following Long-Term IRs have been affirmed with the outlooks

revised to positive from stable:

CNA Financial Corporation — -- “bbb+” (Good) on $500 million

4.5% senior unsecured notes, due 2026 -- “bbb+” (Good) on $500

million 3.45% senior unsecured notes, due 2027 -- “bbb+” (Good) on

$500 million 3.9% senior unsecured notes, due 2029 -- “bbb+” (Good)

on $500 million 2.05% senior unsecured notes, due 2030 -- “bbb+”

(Good) on $500 million 5.50% senior unsecured notes, due 2033 --

“bbb+” (Good) on $500 million 5.125% senior unsecured notes, due

2034

The following indicative Long-Term IRs on securities available

under the shelf registration have been affirmed with the outlooks

revised to positive from stable:

CNA Financial Corporation — -- “bbb+” (Good) on senior unsecured

debt -- “bbb” (Good) on senior subordinated debt -- “bbb-” (Good)

on junior subordinated debt -- “bbb-” (Good) on preferred stock

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s

Performance Assessments, Best’s Preliminary Credit Assessments and

AM Best press releases, please view Guide to Proper Use of

Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205207858/en/

Elizabeth Blamble Senior Financial Analyst +1

908 882 1661 elizabeth.blamble@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Alan Murray Director +1 908 882 2195

alan.murray@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

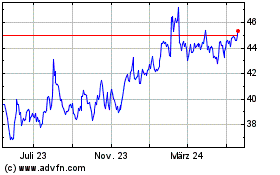

CNA Financial (NYSE:CNA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

CNA Financial (NYSE:CNA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025