0001777393false240 East Hacienda AvenueCampbellCA00017773932024-07-092024-07-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): July 9, 2024

ChargePoint Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39004 | | 84-1747686 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

240 East Hacienda Avenue Campbell, CA | | 95008 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 841-4500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 | | CHPT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Director Appointment

On July 9, 2024, the board of directors (the “Board”) of ChargePoint Holdings, Inc. (the “Company”) appointed Mr. Mitesh Dhruv, 47, as a Class II director and a member of the Company’s Audit Committee, effective immediately. Mr. Dhruv will serve until the Company’s 2025 Annual Meeting of Stockholders and until his successor is elected and qualified, or sooner in the event of his death, resignation or removal. The Board has determined that Mr. Dhruv meets the requirements for independence under the applicable listing standards of the New York Stock Exchange and the Securities Exchange Act of 1934, as amended.

Mr. Dhruv most recently served as Chief Financial Officer of RingCentral, Inc., a cloud-based communications and collaboration solutions provider, from May 2017 until December 2021. Prior to serving as Chief Financial Officer of RingCentral, Inc., Mr. Dhruv held other positions with RingCentral in the accounting and finance department, including as Senior Vice President, Finance and Strategy from October 2015 to May 2017, as Vice President, Finance and Corporate Controller from September 2014 to October 2015 and as Vice President, Finance from April 2012 to September 2014. Mr. Dhruv also previously worked at Bank of America-Merrill Lynch from December 2005 to March 2012 as an equity analyst, covering software and cloud companies and prior to that, worked in various accounting firms from February 2000 to December 2005, including PricewaterhouseCoopers. Mr. Dhruv served as a member of the Board of Directors of ZoomInfo Technologies Inc. from February 2020 until May 2024. Mr. Dhruv is a Certified Public Accountant, Chartered Accountant, and CFA Charterholder, and holds an undergraduate degree in accounting from the University of Mumbai, India. The Board believes that Mr. Dhruv is qualified to serve as a director due to his extensive financial and accounting experience, including as the Chief Financial Officer of RingCentral, his accounting and financial certifications, his knowledge and experience with global software companies, and his experience in management of a public company.

Mr. Dhruv will be entitled to receive compensation in accordance with the ChargePoint Holdings, Inc. Compensation Program for Non-Employee Directors, which was filed with the Securities and Exchange Commission on September 11, 2023, as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q. Mr. Dhruv will also enter into the Company’s standard form of indemnification agreement.

There are no arrangements or understandings between Mr. Dhruv and any other persons pursuant to which he was elected as a member of the Board. Mr. Dhruv is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

Chief Financial Officer Appointment

Also, on July 9, 2024, the Board appointed Ms. Mansi Khetani, 49, currently the Company’s interim Chief Financial Officer, to serve as the Company’s Chief Financial Officer on a permanent basis. Ms. Khetani has served as the Company’s interim Chief Financial Officer since November 16, 2023.

Information regarding Ms. Khetani’s previous positions with the Company and business experience is disclosed under Item 5.02 of the Company’s Current Report on Form 8-K, which was filed with the Securities and Exchange Commission on November 16, 2023. There is no arrangement or understanding between Ms. Khetani and any other person pursuant to which Ms. Khetani was selected as Chief Financial Officer, and there are no family relationships between Ms. Khetani and any of the Company’s directors or other executive officers. Ms. Khetani is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K

Ms. Khetani will continue to participate in the Company’s employee benefit plans and existing compensation arrangements, as described under “Executive Compensation - Compensation Discussion and Analysis” in the Company’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders (the “2024 Proxy Statement”), which was filed with the Securities and Exchange Commission on May 24, 2024, provided however, that Ms. Khetani will now be eligible to participate in the Company’s Fiscal 2025 Severance Plan, as described in the 2024 Proxy Statement and her target fiscal 2025 executive bonus percentage was increased to 60% of her annual base salary.

Further, Ms. Khetani will be eligible to receive time-based and performance-based restricted stock unit (“RSU”) awards in connection with her appointment as Chief Financial Officer. The time-based RSU award will be with respect to 200,000 shares of the Company’s common stock and will vest in equal quarterly installments for four years from the date of grant subject to her

continued service. The performance-based RSU award will be with respect to 270,000 shares of the Company’s common stock and will have service-based and performance-based vesting criteria. The performance-based RSU is subject to service-based vesting occurring quarterly in equal installments for four years from the date of grant. The performance-based conditions will be achieved if the average closing price of the Company’s common stock is greater than or equal to four respective stock price appreciation targets for at least 90 consecutive trading days at any time during the five-year performance period with 25% of the shares underlying the performance-based RSU award eligible to vest upon achievement of stock price appreciation targets at $3.00 per share, $5.00 per share, $7.50 per share and $10.00 per share. Each of the time-based and performance-based RSU awards shall be subject to accelerated vesting pursuant to the terms of the Fiscal 2025 Severance Plan, as described in the 2024 Proxy Statement.

On July 11, 2024, the Company issued a press release announcing the appointment of Mr. Dhruv as a member of the Board and of Ms. Khetani as the Company’s Chief Financial Officer. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On July 9, 2024, the Company held its 2024 Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, 251,189,502 shares of the Company’s common stock, or approximately 59.1% of the total shares entitled to vote, were represented in person or by proxy. The matters before the Annual Meeting were described in more detail in the Company’s definitive 2024 Proxy Statement filed with the United States Securities and Exchange Commission on May 24, 2024. The vote results detailed below represent final results as certified by the Inspector of Election.

Proposal One--Election of Directors. The stockholders elected the following nominees as Class I directors to serve until the 2027 Annual Meeting of Stockholders and until the election and qualification of their respective successors or their earlier death, disqualification, resignation or removal.

| | | | | | | | | | | |

| Nominee | Votes For | Votes Withheld | Broker Non-Votes |

Roxanne Bowman | 73,652,261 | 23,273,431 | 154,263,810 |

| Axel Harries | 91,304,139 | 5,621,553 | 154,263,810 |

Mark Leschly | 68,236,117 | 28,689,575 | 154,263,810 |

Ekta Singh-Bushell | 90,998,068 | 5,927,624 | 154,263,810 |

Proposal Two--Ratification of Selection of Independent Registered Public Accounting Firm. The stockholders ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the Company's fiscal year ending January 31, 2025.

| | | | | | | | |

| Votes For | Votes Against | Abstentions |

| 246,468,857 | 3,465,001 | 1,255,644 |

Proposal Three--Advisory Vote to Approve the Compensation of the Company's Named Executive Officers. The stockholders approved, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the 2024 Proxy Statement.

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 84,720,232 | 9,440,339 | 2,765,121 | 154,263,810 |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 99.1 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| CHARGEPOINT HOLDINGS, INC. |

| |

| By: | | /s/ Rebecca Chavez |

| | Name: Rebecca Chavez |

| | Title: Chief Legal Officer & Corporate Secretary |

Date: July 11, 2024

Exhibit 99.1

ChargePoint Announces Executive and Board Appointments to Bolster Expertise in Software-Led EV Charging

Campbell, Calif., July 11, 2024—ChargePoint (NYSE: CHPT), a leading provider of networked charging solutions for electric vehicles (EVs), announced today the appointment of a Chief Financial Officer, Chief Development Officer for Software, and a new member of the Board of Directors (the “Board”). All three individuals join ChargePoint with the skillset, passion, and experience to continue accelerating ChargePoint’s leadership position in the electrification of transportation.

“I am thrilled to have this trio of potent leaders as part of the ChargePoint team. Each brings unique capabilities that will help us continue to make ChargePoint the platform of choice for everyone who wants to offer EV charging and they share a deep passion to build something that is better than all other alternatives. There is almost no limit to the potential of a company that recruits great people, and these three additions to our team are as great as they get,” said Rick Wilmer CEO of ChargePoint.

Mansi Khetani has been appointed Chief Financial Officer, effective July 9, 2024. Ms. Khetani has been with ChargePoint since 2018, previously leading Financial Planning and Analysis efforts before becoming interim CFO in November 2023. She has extensive experience spanning financial planning, corporate development, M&A, and investment banking. Ms. Khetani previously held senior corporate positions at Gainsight and Rocket Fuel, and senior investment banking positions at Piper Jaffray and Merrill Lynch. Mansi holds an M.B.A. and is a Chartered Accountant.

Ash Chowdappa has joined ChargePoint as Chief Development Officer for Software, where he will lead the Software team across all regions, products, and segments. Mr. Chowdappa is a seasoned technology veteran that has been in customer and field facing business leadership roles for nearly 25 years. He has a proven track record of formulating product strategy from inception to launch. He most recently served as SVP of Software at HPE Aruba Networks for the Cloud, Security & Network infrastructure portfolio, where he led R&D. His leadership experience combined with deep technical knowledge makes him the ideal executive to lead the software business at ChargePoint.

Mitesh Dhruv has joined ChargePoint’s Board and will serve as a member of the Audit Committee. Mr. Dhruv has close to 25 years of experience in accounting and finance, including a career on Wall Street as an equity analyst. Previously Mr. Dhruv served as Audit Committee Chair on the Board of ZoomInfo Technologies Inc., and as Chief Financial Officer of RingCentral, Inc., a cloud-based communications and collaboration solutions provider. Highly regarded in the software community, he has been ranked in the All-America Best Software CFO category by Institutional Investor for three years in a row. He is a CPA, Chartered Accountant, CFA Charterholder and has an undergraduate degree in Accounting.

About ChargePoint Holdings, Inc.

ChargePoint has been an innovator of all things EV charging since 2007, before the first mass market electric vehicle was on the road. ChargePoint offers solutions for the entire EV ecosystem including drivers, charging station owners, vehicle manufacturers and others. Accessible and reliable, ChargePoint’s portfolio of software, hardware, and services enables a seamless experience for drivers across North America and Europe. With ChargePoint, every driver who needs to charge can do so, accessing more than 1 million places to charge globally. ChargePoint has powered more than 10 billion electric miles and will continue to innovate as part of a mission to lower global emissions while improving the future of transportation. For more information, visit the ChargePoint pressroom, the ChargePoint Investor Relations site, or contact the ChargePoint North American or European press offices or Investor Relations.

CHPT-IR

ChargePoint

John Paolo Canton

Vice President, Communications

JP.Canton@chargepoint.com

AJ Gosselin

Director, Corporate Communications

AJ.Gosselin@chargepoint.com

media@chargepoint.com

Patrick Hamer

Vice President, Capital Markets and Investor Relations

Patrick.Hamer@chargepoint.com

investors@chargepoint.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

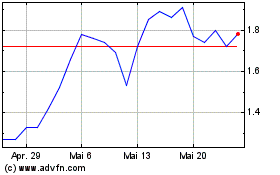

ChargePoint (NYSE:CHPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

ChargePoint (NYSE:CHPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024